Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me how to understand how to fill the form out. also to check if i got the correct answer Use Worksheet 7.2. Matilda

Please help me how to understand how to fill the form out. also to check if i got the correct answer

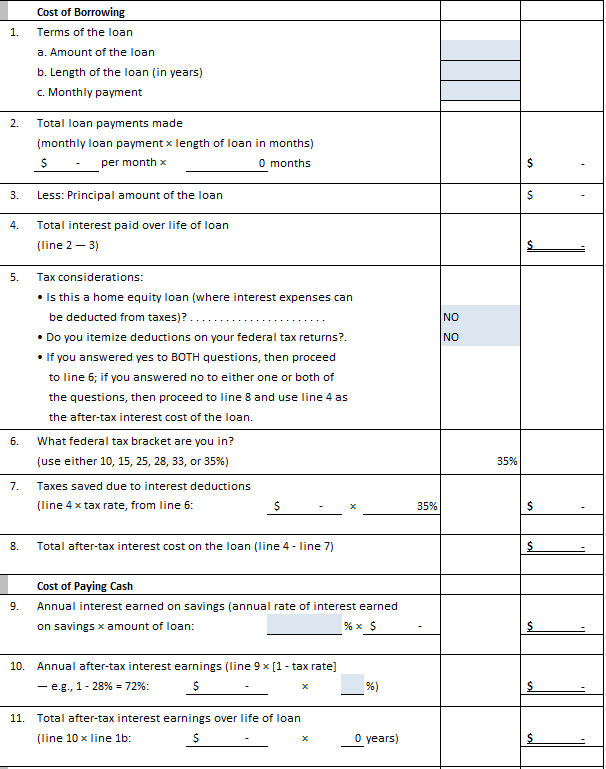

Use Worksheet 7.2. Matilda Edwards wants to buy a home entertainment center. Complete with a big-screen TV, DVD, and sound system, the unit would cost $3,500. Matilda has over $15,000 in a money fund, so she can easily afford to pay cash for the whole thing (the fund is currently paying 4.6 percent interest, and Matilda expects that yield to hold for the foreseeable future). To stimulate sales, the dealer is offering to finance the full cost of the unit with a 36-month, simple interest installment loan at 9 percent, simple. (Note: Assume Matilda is in the 28 percent tax bracket and that she itemizes deductions on her tax returns.) a. Should she pay cash for the home entertainment center or buy it on time? pay cash 1. Cost of Borrowing Terms of the loan a. Amount of the loan b. Length of the loan in years) c. Monthly payment 2. Total loan payments made (monthly loan payment x length of loan in months) $ - per month 0 months 3. Less: Principal amount of the loan 4. Total interest paid over life of loan (line 2-3) 5. Tax considerations: Is this a home equity loan (where interest expenses can be deducted from taxes)?. Do you itemize deductions on your federal tax returns? If you answered yes to BOTH questions, then proceed to line 6; if you answered no to either one or both of the questions, then proceed to line 8 and use line 4 as the after-tax interest cost of the loan. 6. What federal tax bracket are you in? (use either 10, 15, 25, 28, 33, or 35%) 35% 7. Taxes saved due to interest deductions (line 4x tax rate, from line 6: $ - *_ 8. Total after-tax interest cost on the loan (line 4 - line 7) 9. Cost of Paying Cash Annual interest earned on savings (annual rate of interest earned on savings x amount of loan: _%* $ 10. Annual after-tax interest earnings (line 9x[1 - tax rate] - e.g., 1-28% = 72%: $ . * %) 11. Total after-tax interest earnings over life of loan (line 10 x line 1b: $ . * O years) Use Worksheet 7.2. Matilda Edwards wants to buy a home entertainment center. Complete with a big-screen TV, DVD, and sound system, the unit would cost $3,500. Matilda has over $15,000 in a money fund, so she can easily afford to pay cash for the whole thing (the fund is currently paying 4.6 percent interest, and Matilda expects that yield to hold for the foreseeable future). To stimulate sales, the dealer is offering to finance the full cost of the unit with a 36-month, simple interest installment loan at 9 percent, simple. (Note: Assume Matilda is in the 28 percent tax bracket and that she itemizes deductions on her tax returns.) a. Should she pay cash for the home entertainment center or buy it on time? pay cash 1. Cost of Borrowing Terms of the loan a. Amount of the loan b. Length of the loan in years) c. Monthly payment 2. Total loan payments made (monthly loan payment x length of loan in months) $ - per month 0 months 3. Less: Principal amount of the loan 4. Total interest paid over life of loan (line 2-3) 5. Tax considerations: Is this a home equity loan (where interest expenses can be deducted from taxes)?. Do you itemize deductions on your federal tax returns? If you answered yes to BOTH questions, then proceed to line 6; if you answered no to either one or both of the questions, then proceed to line 8 and use line 4 as the after-tax interest cost of the loan. 6. What federal tax bracket are you in? (use either 10, 15, 25, 28, 33, or 35%) 35% 7. Taxes saved due to interest deductions (line 4x tax rate, from line 6: $ - *_ 8. Total after-tax interest cost on the loan (line 4 - line 7) 9. Cost of Paying Cash Annual interest earned on savings (annual rate of interest earned on savings x amount of loan: _%* $ 10. Annual after-tax interest earnings (line 9x[1 - tax rate] - e.g., 1-28% = 72%: $ . * %) 11. Total after-tax interest earnings over life of loan (line 10 x line 1b: $ . * O years)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started