Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me I am struggling On December 31,2021, BH Enterprises, Inc. had current earnings and profits of $8,000 and a deficit in accumulated earnings

Please help me I am struggling

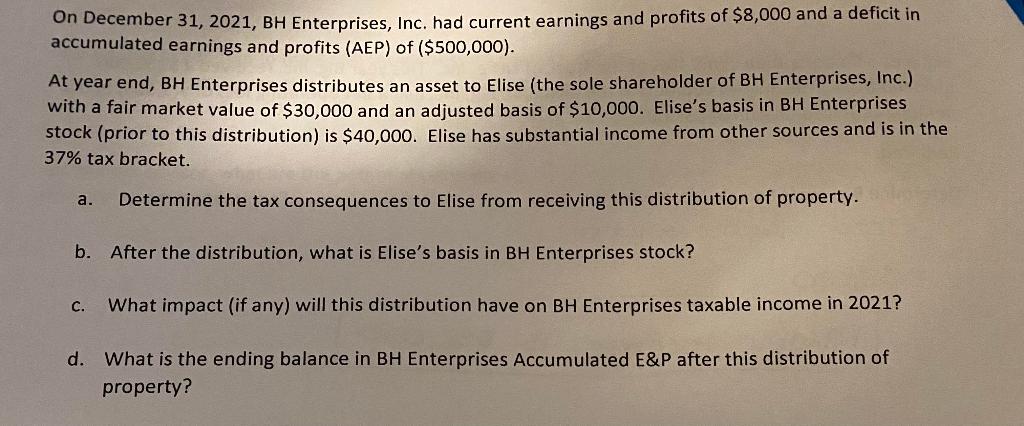

On December 31,2021, BH Enterprises, Inc. had current earnings and profits of $8,000 and a deficit in accumulated earnings and profits (AEP) of ($500,000). At year end, BH Enterprises distributes an asset to Elise (the sole shareholder of BH Enterprises, Inc.) with a fair market value of $30,000 and an adjusted basis of $10,000. Elise's basis in BH Enterprises stock (prior to this distribution) is $40,000. Elise has substantial income from other sources and is in the 37% tax bracket. a. Determine the tax consequences to Elise from receiving this distribution of property. b. After the distribution, what is Elise's basis in BH Enterprises stock? c. What impact (if any) will this distribution have on BH Enterprises taxable income in 2021? d. What is the ending balance in BH Enterprises Accumulated E\&P after this distribution of propertyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started