Please help me i will give good rating

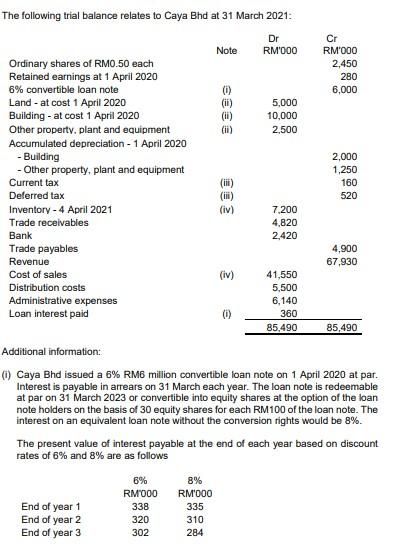

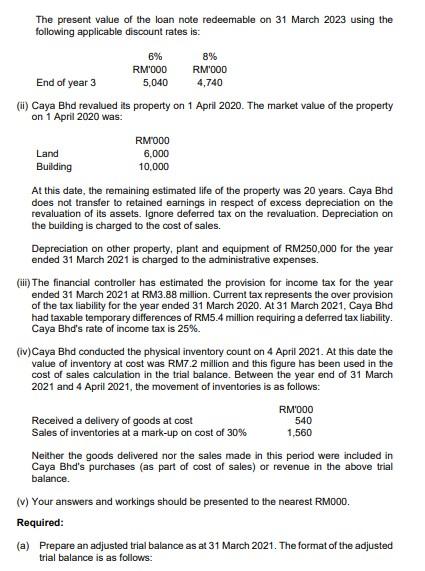

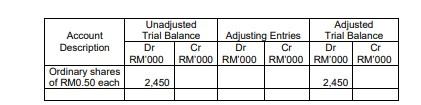

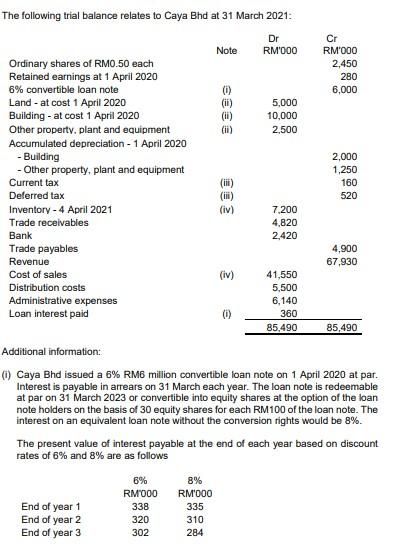

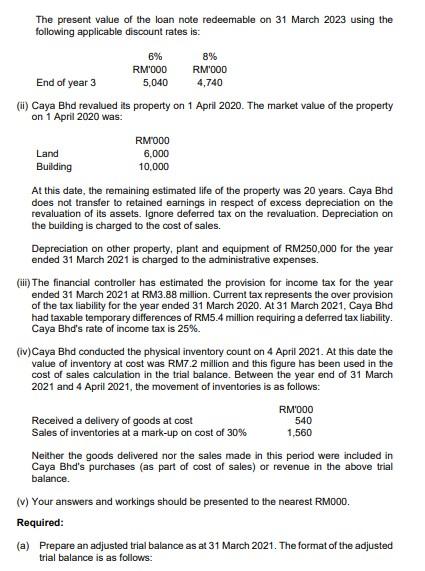

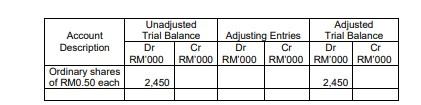

The following trial balance relates to Caya Bhd at 31 March 2021: Additional information: (i) Caya Bhd issued a 6\% RM6 million convertible loan note on 1 April 2020 at par. Interest is payable in arrears on 31 March each year. The loan note is redeemable at par on 31 March 2023 or convertible into equity shares at the option of the loan note holders on the basis of 30 equity shares for each RM100 of the loan note. The interest on an equivalent loan note without the conversion rights would be 8%. The present value of interest payable at the end of each year based on discount. rates of 6% and 8% are as follows The present value of the loan note redeemable on 31 March 2023 using the following applicable discount rates is: (ii) Caya Bhd revalued its property on 1 April 2020 . The market value of the property on 1 April 2020 was: At this date, the remaining estimated life of the property was 20 years. Caya Bhd does not transfer to retained earnings in respect of excess depreciation on the revaluation of its assets. Ignore deferred tax on the revaluation. Depreciation on the building is charged to the cost of sales. Depreciation on other property, plant and equipment of RM250,000 for the year ended 31 March 2021 is charged to the administrative expenses. (iii) The financial controller has estimated the provision for income tax for the year ended 31 March 2021 at RM3.88 million. Current tax represents the over provision of the tax liability for the year ended 31 March 2020. At 31 March 2021, Caya Bhd had taxable temporary differences of RM5.4 million requiring a deferred tax liability. Caya Bhd's rate of income tax is 25%. (iv) Caya Bhd conducted the physical inventory count on 4 April 2021. At this date the value of inventory at cost was RM7.2 million and this figure has been used in the cost of sales calculation in the trial balance. Between the year end of 31 March 2021 and 4 April 2021 , the movement of inventories is as follows: Neither the goods delivered nor the sales made in this period were included in Caya Bhd's purchases (as part of cost of sales) or revenue in the above trial balance. (v) Your answers and workings should be presented to the nearest RMO0O. Required: (a) Prepare an adjusted trial balance as at 31 March 2021 . The format of the adjusted trial balance is as follows: The following trial balance relates to Caya Bhd at 31 March 2021: Additional information: (i) Caya Bhd issued a 6\% RM6 million convertible loan note on 1 April 2020 at par. Interest is payable in arrears on 31 March each year. The loan note is redeemable at par on 31 March 2023 or convertible into equity shares at the option of the loan note holders on the basis of 30 equity shares for each RM100 of the loan note. The interest on an equivalent loan note without the conversion rights would be 8%. The present value of interest payable at the end of each year based on discount. rates of 6% and 8% are as follows The present value of the loan note redeemable on 31 March 2023 using the following applicable discount rates is: (ii) Caya Bhd revalued its property on 1 April 2020 . The market value of the property on 1 April 2020 was: At this date, the remaining estimated life of the property was 20 years. Caya Bhd does not transfer to retained earnings in respect of excess depreciation on the revaluation of its assets. Ignore deferred tax on the revaluation. Depreciation on the building is charged to the cost of sales. Depreciation on other property, plant and equipment of RM250,000 for the year ended 31 March 2021 is charged to the administrative expenses. (iii) The financial controller has estimated the provision for income tax for the year ended 31 March 2021 at RM3.88 million. Current tax represents the over provision of the tax liability for the year ended 31 March 2020. At 31 March 2021, Caya Bhd had taxable temporary differences of RM5.4 million requiring a deferred tax liability. Caya Bhd's rate of income tax is 25%. (iv) Caya Bhd conducted the physical inventory count on 4 April 2021. At this date the value of inventory at cost was RM7.2 million and this figure has been used in the cost of sales calculation in the trial balance. Between the year end of 31 March 2021 and 4 April 2021 , the movement of inventories is as follows: Neither the goods delivered nor the sales made in this period were included in Caya Bhd's purchases (as part of cost of sales) or revenue in the above trial balance. (v) Your answers and workings should be presented to the nearest RMO0O. Required: (a) Prepare an adjusted trial balance as at 31 March 2021 . The format of the adjusted trial balance is as follows