please help me. ill give a great raring and review

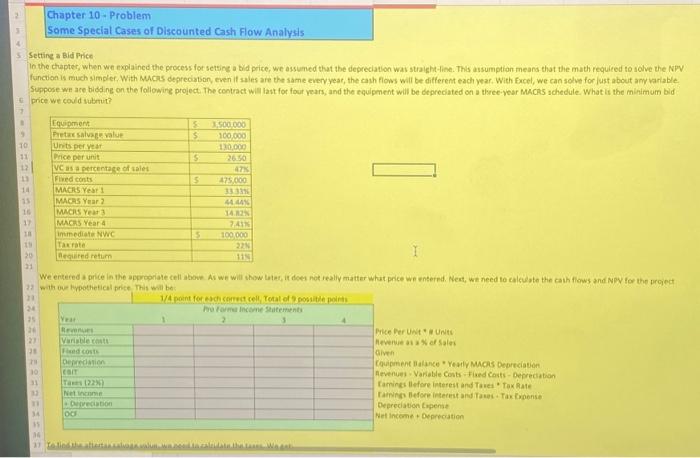

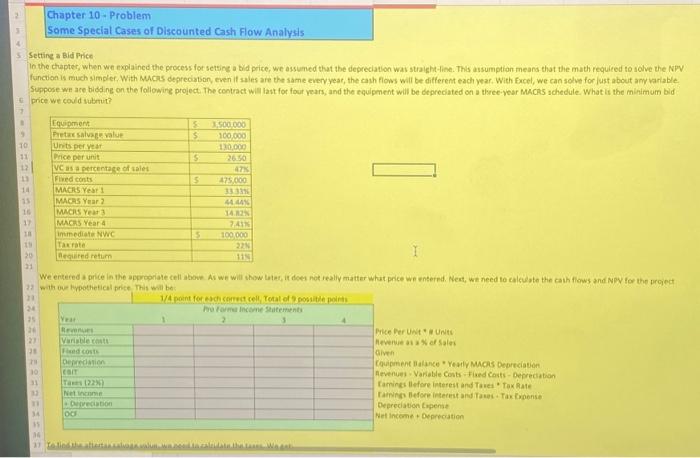

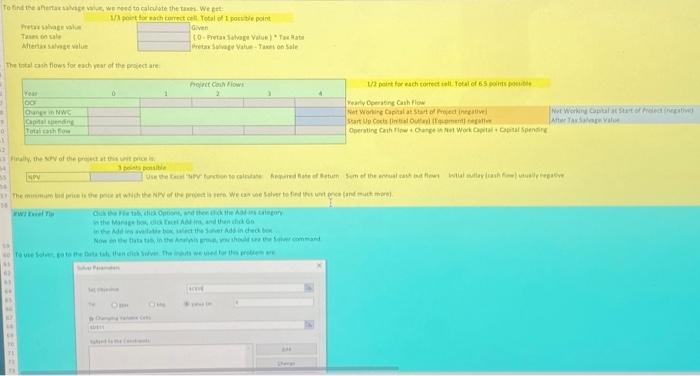

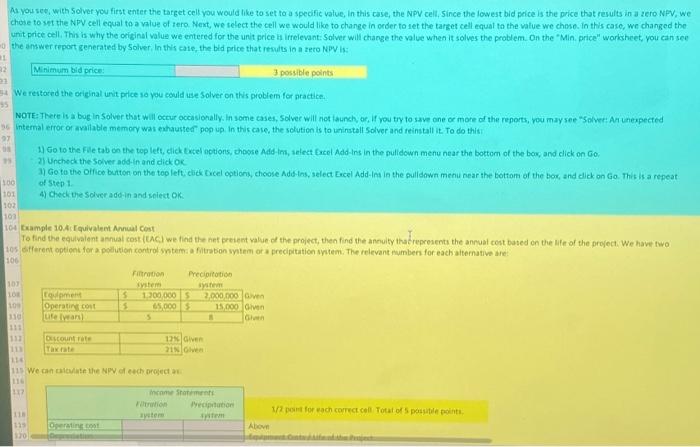

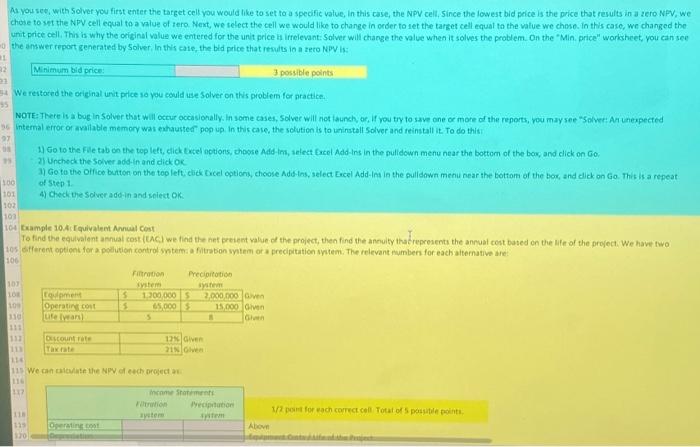

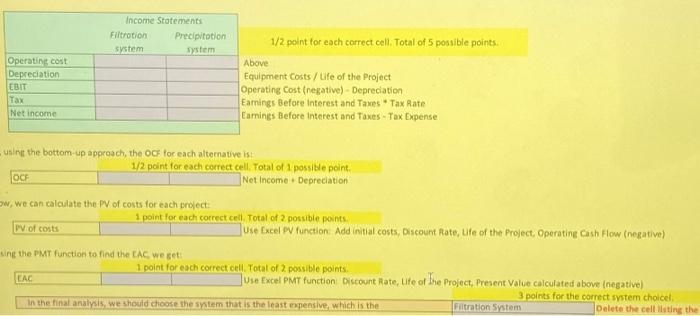

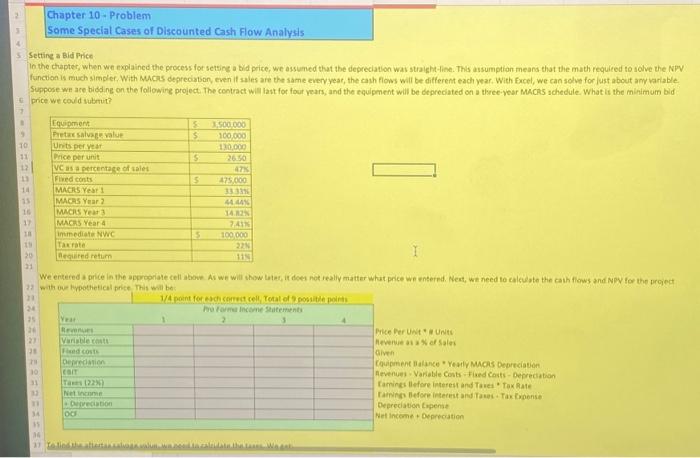

2) Chapter 10-Problem Some Special Cases of Discounted Cash Flow Analysis 5. Settine a Bid Price In the chapter, when we explained the process for setsine a Bid price, we assumed that the depreciation wav straight-fine. This assumption means that the math requiced to solve the NFV functon is much simpler, With Mucas depreciasony even if sales are the same evervyeat, the cash flows will be different each year. With fecel, we can solve for just about amy varlable. Suppose we ace bidding on the followire project. The contract will last for fout vears, and the equipment will be depreciated on a three-vear Macks achedule. What is the minimum bid. ic. price we covld submut? 2) with oue typothetical price This will be: Netar whaen wik Fines on sale Qiven Mhenw solves value The tical canh flows for each rear of the priect are: Vearty operasing Cah flow Wet Wonire Comalat stat of Myed inreativel After Taksidam valise At you see, with Solver you first enter the target cell you would like to set to a specific value, in this case, the NPV cell, since the lowest bid peice is the price that results in a zero NPV, we chose to st the NPV cell equal to a value of iera. Next, we select the cell we would like to change in order to set the target cell equal to the value we chese. In this case, we changed the unit price cell. This is why the original value we entered for the unit price it irfelevant: Solver will charge the value when it solves the problem. On the "Min. price" worksheet, you can see the answer report generated by Solver, In this caie, the bid price that results io a zero NPV Is: Minimum bid price: 3 possible points We restored the orieinal unit price so you could use Solver on this probien for practice. NOTE: There is a bug in Solver that will octur occasionally. in some cases, Solver will not isunch or, if you try to save one oc more of the reports, rou may see "Solver: Arinexpected intemal erroc of wailable memory was echaustef pop up. In this case, the solution is to uninstall Solver and reinstall it. To do this: 1) Go to the File tab on the top left, click Cxtel ootions, choose Add-in, select fxcel Add-ins in the pulidown menu near the bottom of the bow, and dick on Go. 2) Uncheck the Solver add-in and dick OR of 5 tep 1. 4) Check the solver addin and spiect OK. tample 10.4: Cquivalent Annial cost To find the equivalent amnal cost ( UAC) we find the net preient valve of the project, then find the annuity thatrepresents the annuat cost based on the ufe of the project. We have two 106 114 We can calculate the NPV of eech proged an: At you see, with Solver you first enter the target cell you would like to set to a specific value, in this case, the NPV cell, since the lowest bid peice is the price that results in a zero NPV, we chose to st the NPV cell equal to a value of iera. Next, we select the cell we would like to change in order to set the target cell equal to the value we chese. In this case, we changed the unit price cell. This is why the original value we entered for the unit price it irfelevant: Solver will charge the value when it solves the problem. On the "Min. price" worksheet, you can see the answer report generated by Solver, In this caie, the bid price that results io a zero NPV Is: Minimum bid price: 3 possible points We restored the orieinal unit price so you could use Solver on this probien for practice. NOTE: There is a bug in Solver that will octur occasionally. in some cases, Solver will not isunch or, if you try to save one oc more of the reports, rou may see "Solver: Arinexpected intemal erroc of wailable memory was echaustef pop up. In this case, the solution is to uninstall Solver and reinstall it. To do this: 1) Go to the File tab on the top left, click Cxtel ootions, choose Add-in, select fxcel Add-ins in the pulidown menu near the bottom of the bow, and dick on Go. 2) Uncheck the Solver add-in and dick OR of 5 tep 1. 4) Check the solver addin and spiect OK. tample 10.4: Cquivalent Annial cost To find the equivalent amnal cost ( UAC) we find the net preient valve of the project, then find the annuity thatrepresents the annuat cost based on the ufe of the project. We have two 106 114 We can calculate the NPV of eech proged an: usingt the bottom up approsch, the OC - for each altemauve is: 1/2 point for each correct cell. Total of 1 possible point. Net income + Depreciation ow, we can calculate the PV of costs for each project: DV of costs. 1 point for each correct ceal Total of 2 possible points. Use Excel PV function: Add initial costs, Discount Rate, Ufe of the Project, Operating Cash Flow (negative) sing the PMT function to find the EAC, we get: 1 ooint for each coctecticell. Totat of 2 possible points. Use Excel PMT function Oiscount Rate, Ufe of the Project, Present Value calculated above (negativel. In the finat analysis, we should cioose the sntem that is the least oppeasive, which is the fatration 5 stem 3 points for the correct ivstem choicel Oelete the cell listing the 2) Chapter 10-Problem Some Special Cases of Discounted Cash Flow Analysis 5. Settine a Bid Price In the chapter, when we explained the process for setsine a Bid price, we assumed that the depreciation wav straight-fine. This assumption means that the math requiced to solve the NFV functon is much simpler, With Mucas depreciasony even if sales are the same evervyeat, the cash flows will be different each year. With fecel, we can solve for just about amy varlable. Suppose we ace bidding on the followire project. The contract will last for fout vears, and the equipment will be depreciated on a three-vear Macks achedule. What is the minimum bid. ic. price we covld submut? 2) with oue typothetical price This will be: Netar whaen wik Fines on sale Qiven Mhenw solves value The tical canh flows for each rear of the priect are: Vearty operasing Cah flow Wet Wonire Comalat stat of Myed inreativel After Taksidam valise At you see, with Solver you first enter the target cell you would like to set to a specific value, in this case, the NPV cell, since the lowest bid peice is the price that results in a zero NPV, we chose to st the NPV cell equal to a value of iera. Next, we select the cell we would like to change in order to set the target cell equal to the value we chese. In this case, we changed the unit price cell. This is why the original value we entered for the unit price it irfelevant: Solver will charge the value when it solves the problem. On the "Min. price" worksheet, you can see the answer report generated by Solver, In this caie, the bid price that results io a zero NPV Is: Minimum bid price: 3 possible points We restored the orieinal unit price so you could use Solver on this probien for practice. NOTE: There is a bug in Solver that will octur occasionally. in some cases, Solver will not isunch or, if you try to save one oc more of the reports, rou may see "Solver: Arinexpected intemal erroc of wailable memory was echaustef pop up. In this case, the solution is to uninstall Solver and reinstall it. To do this: 1) Go to the File tab on the top left, click Cxtel ootions, choose Add-in, select fxcel Add-ins in the pulidown menu near the bottom of the bow, and dick on Go. 2) Uncheck the Solver add-in and dick OR of 5 tep 1. 4) Check the solver addin and spiect OK. tample 10.4: Cquivalent Annial cost To find the equivalent amnal cost ( UAC) we find the net preient valve of the project, then find the annuity thatrepresents the annuat cost based on the ufe of the project. We have two 106 114 We can calculate the NPV of eech proged an: At you see, with Solver you first enter the target cell you would like to set to a specific value, in this case, the NPV cell, since the lowest bid peice is the price that results in a zero NPV, we chose to st the NPV cell equal to a value of iera. Next, we select the cell we would like to change in order to set the target cell equal to the value we chese. In this case, we changed the unit price cell. This is why the original value we entered for the unit price it irfelevant: Solver will charge the value when it solves the problem. On the "Min. price" worksheet, you can see the answer report generated by Solver, In this caie, the bid price that results io a zero NPV Is: Minimum bid price: 3 possible points We restored the orieinal unit price so you could use Solver on this probien for practice. NOTE: There is a bug in Solver that will octur occasionally. in some cases, Solver will not isunch or, if you try to save one oc more of the reports, rou may see "Solver: Arinexpected intemal erroc of wailable memory was echaustef pop up. In this case, the solution is to uninstall Solver and reinstall it. To do this: 1) Go to the File tab on the top left, click Cxtel ootions, choose Add-in, select fxcel Add-ins in the pulidown menu near the bottom of the bow, and dick on Go. 2) Uncheck the Solver add-in and dick OR of 5 tep 1. 4) Check the solver addin and spiect OK. tample 10.4: Cquivalent Annial cost To find the equivalent amnal cost ( UAC) we find the net preient valve of the project, then find the annuity thatrepresents the annuat cost based on the ufe of the project. We have two 106 114 We can calculate the NPV of eech proged an: usingt the bottom up approsch, the OC - for each altemauve is: 1/2 point for each correct cell. Total of 1 possible point. Net income + Depreciation ow, we can calculate the PV of costs for each project: DV of costs. 1 point for each correct ceal Total of 2 possible points. Use Excel PV function: Add initial costs, Discount Rate, Ufe of the Project, Operating Cash Flow (negative) sing the PMT function to find the EAC, we get: 1 ooint for each coctecticell. Totat of 2 possible points. Use Excel PMT function Oiscount Rate, Ufe of the Project, Present Value calculated above (negativel. In the finat analysis, we should cioose the sntem that is the least oppeasive, which is the fatration 5 stem 3 points for the correct ivstem choicel Oelete the cell listing the