PLEASE help me im lost

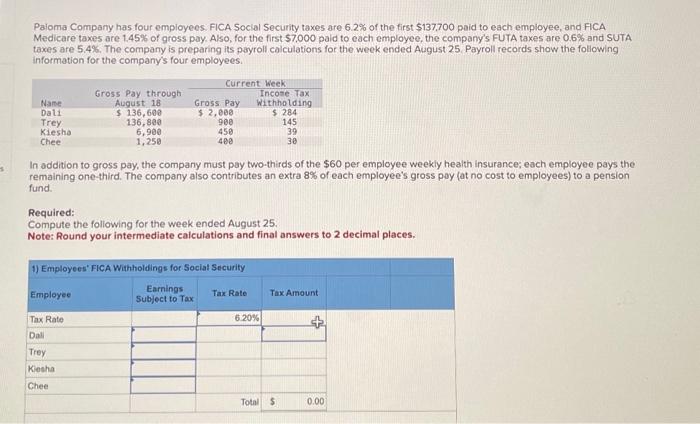

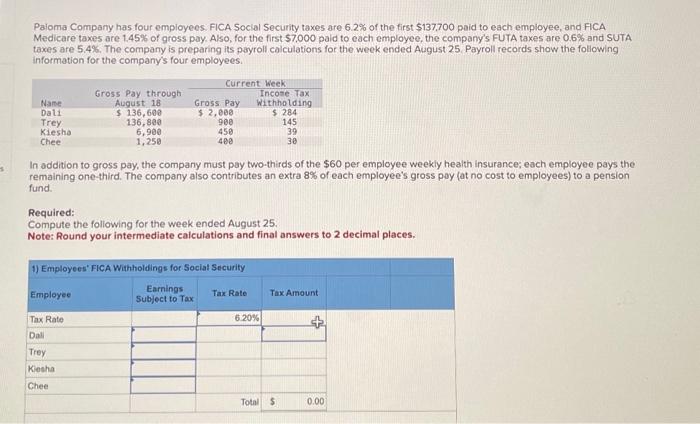

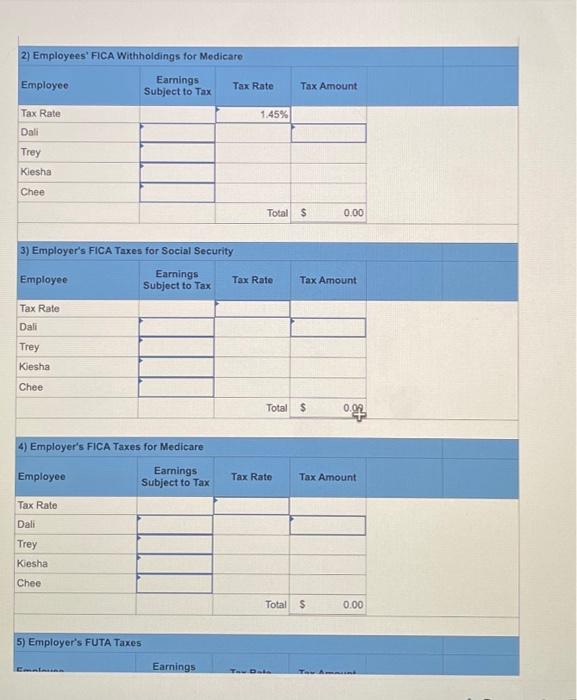

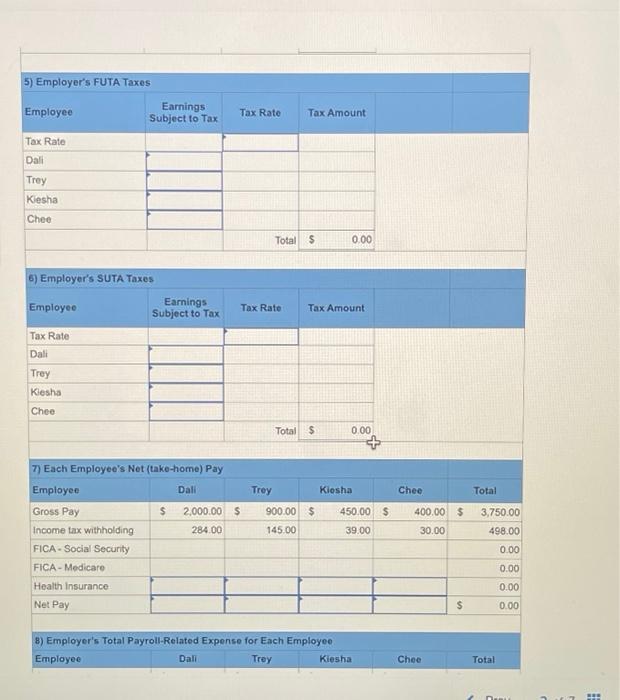

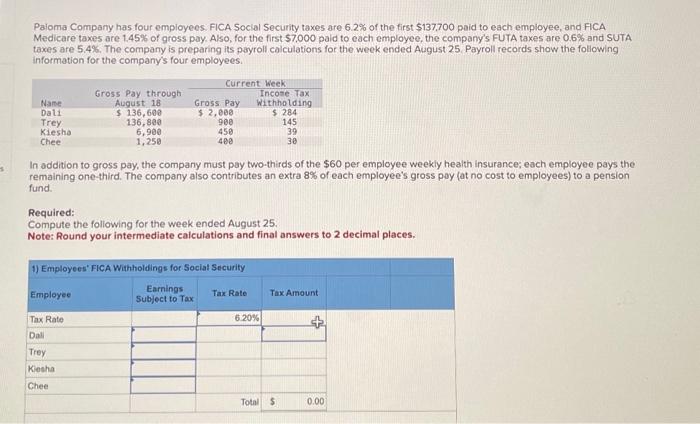

Paioma Company has four employees. FICA Social Security taxes are 6.2% of the first $137,700 paid to each employee, and FiCA Medicare taxes are 1.45% of gross pay. Also, for the first $7.000 paid to each employee, the company's FUTA taxes are 0.6% and SUTA taxes are 5.4%. The company is preparing its payroll calculations for the week ended August 25 . Payroll records show the following information for the company's four employees. In addition to gross pay, the company must pay two-thirds of the $60 per employee weekly health insurance; each employee pays the remaining one-third. The company also contributes an extra 8% of each employee's gross pay (at no cost to employees) to a pension fund. Required: Compute the following for the week ended August 25. Note: Round your intermediate calculations and final answers to 2 decimal places. \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ 2) Employees' FiCA Withholdings for Medicate } \\ \hline Employee & \begin{tabular}{l} Earnings \\ Subject to Tax \end{tabular} & Tax Rate & Tax Amount \\ \hline Tax Rate & & 1.45% & \\ \hline \multicolumn{4}{|l|}{ Dali } \\ \hline \multicolumn{4}{|l|}{ Trey } \\ \hline \multicolumn{4}{|l|}{ Kiesha } \\ \hline \multicolumn{4}{|l|}{ Chee } \\ \hline & & Total & 0.00 \\ \hline \end{tabular} 3) Employer's FICA Taxes for Social Security \begin{tabular}{|l|l|l|l|} \hline Employee & \begin{tabular}{c} Earnings \\ Subject to Tax \end{tabular} & Tax Rate & Tax Amount \\ \hline Tax Rate & & & \\ \hline Dali & & & \\ \hline Trey & & & \\ \hline Kiesha & & & \\ \hline Chee & & & \\ \hline & & Total $ & 0.09 \\ \hline \end{tabular} 4) Employer's FICA Taxes for Medicare \begin{tabular}{|l|l|l|l|} \hline Employee & \begin{tabular}{c} Earnings \\ Subject to Tax \end{tabular} & Tax Rate & Tax Amount \\ \hline Tax Rate & & & \\ \hline Dali & & & \\ \hline Trey & & & \\ \hline Kiesha & & & \\ \hline Chee & & & \\ \hline & & Total & S \\ \hline \end{tabular} 5) Employer's FUTA Taxes 5) Employer's FUTA Taxes \begin{tabular}{|l|l|l|l|} \hline Employee & \begin{tabular}{c} Earnings \\ Subject to Tax \end{tabular} & Tax Rate & Tax Amount \\ \hline Tax Rate & & & \\ \hline Dali & & & \\ \hline Trey & & & \\ \hline Kesha & & & \\ \hline Chee & & & \\ \hline & & & \\ \hline \end{tabular} 6) Employer's SUTA Taxes 8) Employer's Total Payroll-Related Expense for Each Employee Employee Dali Troy Kiesha Chee Total Required information [The following information applies to the questions displayed below] On October 29 , Lobo Company began operations by purchasing razors for resale. The razors have a 90 -day warranty. When a razor is returned, the company discards it and mais a new one from Merchandise Inventory to the customer. The company's cost per new razor is $20 and its retall selling price is $75. The company expects warranty costs to equal 8% of dollar sales. The following transactions occurred. Novenber 11 Sold 105 razors for $7,875 eash. Novenber 30 Recognized warranty expense related to Novenber sales with an adjusting entry. becenber 9 Meplaced 15 razors that were returned under the warranty. Decenber 16 Sold 220 razors for $16,500 cash. Decenber 29 Replaced 30 razors that were returned under the warranty. December 31 Recognized warranty expense related to Decenber sales with an odjusting entry. January 5 Sold 150 razors for $11,25 cash. January 17 Reptaced 50 razors that were returned under the warranty. January 31 Recognized warranty expense related to January sales with an adjusting entry. (1) Required information Part 10 ot 5 Required information [The following information applies to the questions displayed below.] On October 29 , Lobo Company began operations by purchasing razors for resale. The razors have a 90 -day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise Inventory to the customer. The company's cost per new razor is $20 and its retall selling price is $75. The company expects warranty costs to equal 8% of dollar sales. The following transactions occurred. Novenber 11 Sold 105 razors for $7,375 cash. Novenber 30 Pecognized warranty expense related to Novenber sales with an adjusting entry. Decenber' 9 Replaced 15 razors that were returned under the warranty. Decenber 16 Sold 220 razors for $16,500 cash. Decenber 29 Replaced 30 razors that were returned under the warranty. Decenber 31 Pecognized warranty expense related to Decenber sates with an adjusting entry. January 5 Sold 150 razors for $11,250 cash. January 17 Replaced 50 razors that were returned under the warranty. January 31 Recognized warranty expense related to January sales with an adjusting entry. 4. What is the balance of the Estimated Warranty Llability account as of December 31 ? Required information (The following information applies to the questions displayed below] On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90 -day warranty. When a fazor is returned, the company discards it and mails a new one from Merchandise inventory to the customet. The company's cost per new razor is $20 and its retail selling price is $75. The company expects warranty costs to equal 8% of dollar soles. The following transoctions occurred. Noverber 11 Sold 105 razors for $7,375 cash. Novenber 30 . Recognized warranty expense related to Novenber sales with an adjusting entry. Decenber 9 Replaced 15 razors that were returaed under the warranty. Decenber 16 Sold 220 razors for $16,5e9 cash. Decenber 29 Decenber 31 Replaced 30 razars that were returned under the warranty, January 17 Rold 158 razors for $11,250 cash. January 31 Recognired worranty expense reloted to January sates with an adjusting entry, 5. What is the balance of the Estimated Warranty Liability account os of January ? Paioma Company has four employees. FICA Social Security taxes are 6.2% of the first $137,700 paid to each employee, and FiCA Medicare taxes are 1.45% of gross pay. Also, for the first $7.000 paid to each employee, the company's FUTA taxes are 0.6% and SUTA taxes are 5.4%. The company is preparing its payroll calculations for the week ended August 25 . Payroll records show the following information for the company's four employees. In addition to gross pay, the company must pay two-thirds of the $60 per employee weekly health insurance; each employee pays the remaining one-third. The company also contributes an extra 8% of each employee's gross pay (at no cost to employees) to a pension fund. Required: Compute the following for the week ended August 25. Note: Round your intermediate calculations and final answers to 2 decimal places. \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ 2) Employees' FiCA Withholdings for Medicate } \\ \hline Employee & \begin{tabular}{l} Earnings \\ Subject to Tax \end{tabular} & Tax Rate & Tax Amount \\ \hline Tax Rate & & 1.45% & \\ \hline \multicolumn{4}{|l|}{ Dali } \\ \hline \multicolumn{4}{|l|}{ Trey } \\ \hline \multicolumn{4}{|l|}{ Kiesha } \\ \hline \multicolumn{4}{|l|}{ Chee } \\ \hline & & Total & 0.00 \\ \hline \end{tabular} 3) Employer's FICA Taxes for Social Security \begin{tabular}{|l|l|l|l|} \hline Employee & \begin{tabular}{c} Earnings \\ Subject to Tax \end{tabular} & Tax Rate & Tax Amount \\ \hline Tax Rate & & & \\ \hline Dali & & & \\ \hline Trey & & & \\ \hline Kiesha & & & \\ \hline Chee & & & \\ \hline & & Total $ & 0.09 \\ \hline \end{tabular} 4) Employer's FICA Taxes for Medicare \begin{tabular}{|l|l|l|l|} \hline Employee & \begin{tabular}{c} Earnings \\ Subject to Tax \end{tabular} & Tax Rate & Tax Amount \\ \hline Tax Rate & & & \\ \hline Dali & & & \\ \hline Trey & & & \\ \hline Kiesha & & & \\ \hline Chee & & & \\ \hline & & Total & S \\ \hline \end{tabular} 5) Employer's FUTA Taxes 5) Employer's FUTA Taxes \begin{tabular}{|l|l|l|l|} \hline Employee & \begin{tabular}{c} Earnings \\ Subject to Tax \end{tabular} & Tax Rate & Tax Amount \\ \hline Tax Rate & & & \\ \hline Dali & & & \\ \hline Trey & & & \\ \hline Kesha & & & \\ \hline Chee & & & \\ \hline & & & \\ \hline \end{tabular} 6) Employer's SUTA Taxes 8) Employer's Total Payroll-Related Expense for Each Employee Employee Dali Troy Kiesha Chee Total Required information [The following information applies to the questions displayed below] On October 29 , Lobo Company began operations by purchasing razors for resale. The razors have a 90 -day warranty. When a razor is returned, the company discards it and mais a new one from Merchandise Inventory to the customer. The company's cost per new razor is $20 and its retall selling price is $75. The company expects warranty costs to equal 8% of dollar sales. The following transactions occurred. Novenber 11 Sold 105 razors for $7,875 eash. Novenber 30 Recognized warranty expense related to Novenber sales with an adjusting entry. becenber 9 Meplaced 15 razors that were returned under the warranty. Decenber 16 Sold 220 razors for $16,500 cash. Decenber 29 Replaced 30 razors that were returned under the warranty. December 31 Recognized warranty expense related to Decenber sales with an odjusting entry. January 5 Sold 150 razors for $11,25 cash. January 17 Reptaced 50 razors that were returned under the warranty. January 31 Recognized warranty expense related to January sales with an adjusting entry. (1) Required information Part 10 ot 5 Required information [The following information applies to the questions displayed below.] On October 29 , Lobo Company began operations by purchasing razors for resale. The razors have a 90 -day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise Inventory to the customer. The company's cost per new razor is $20 and its retall selling price is $75. The company expects warranty costs to equal 8% of dollar sales. The following transactions occurred. Novenber 11 Sold 105 razors for $7,375 cash. Novenber 30 Pecognized warranty expense related to Novenber sales with an adjusting entry. Decenber' 9 Replaced 15 razors that were returned under the warranty. Decenber 16 Sold 220 razors for $16,500 cash. Decenber 29 Replaced 30 razors that were returned under the warranty. Decenber 31 Pecognized warranty expense related to Decenber sates with an adjusting entry. January 5 Sold 150 razors for $11,250 cash. January 17 Replaced 50 razors that were returned under the warranty. January 31 Recognized warranty expense related to January sales with an adjusting entry. 4. What is the balance of the Estimated Warranty Llability account as of December 31 ? Required information (The following information applies to the questions displayed below] On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90 -day warranty. When a fazor is returned, the company discards it and mails a new one from Merchandise inventory to the customet. The company's cost per new razor is $20 and its retail selling price is $75. The company expects warranty costs to equal 8% of dollar soles. The following transoctions occurred. Noverber 11 Sold 105 razors for $7,375 cash. Novenber 30 . Recognized warranty expense related to Novenber sales with an adjusting entry. Decenber 9 Replaced 15 razors that were returaed under the warranty. Decenber 16 Sold 220 razors for $16,5e9 cash. Decenber 29 Decenber 31 Replaced 30 razars that were returned under the warranty, January 17 Rold 158 razors for $11,250 cash. January 31 Recognired worranty expense reloted to January sates with an adjusting entry, 5. What is the balance of the Estimated Warranty Liability account os of January