Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me im stuck thank you Silven Industries, which manufactures and sells a trighly successful line of summer lotions and insect repellents, has decided

please help me im stuck

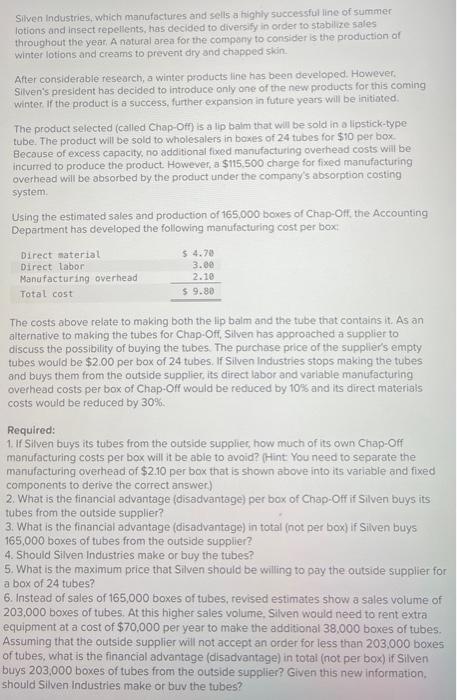

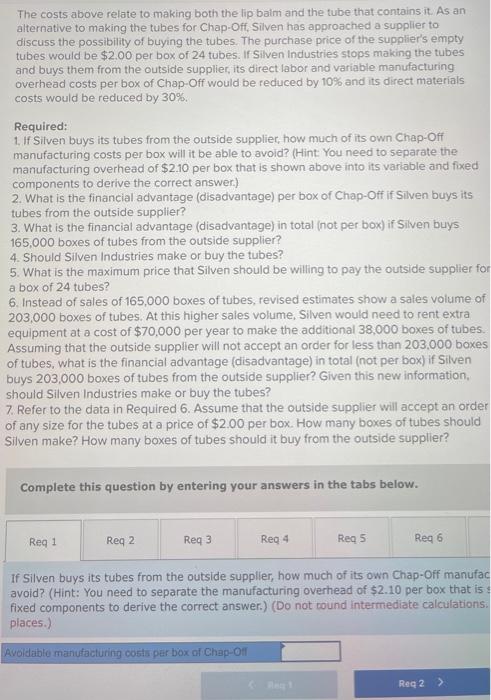

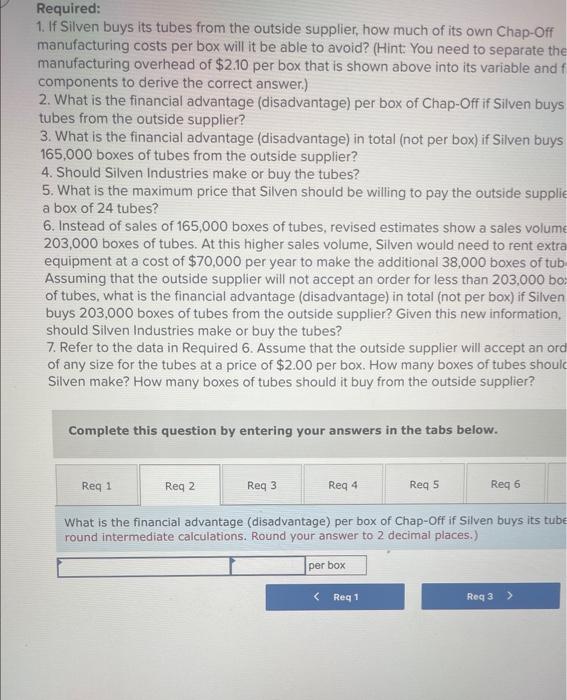

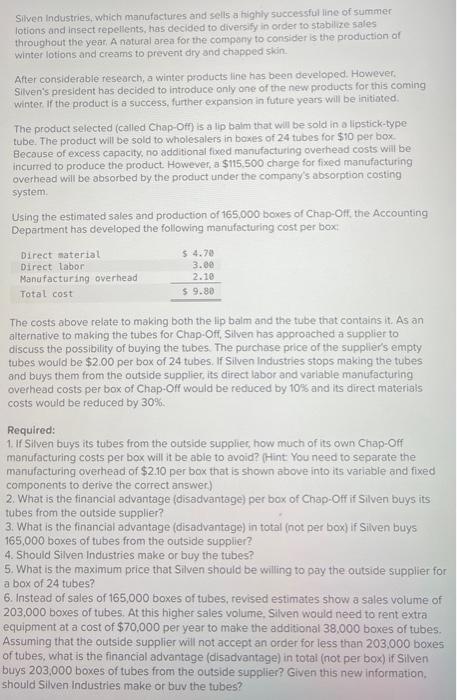

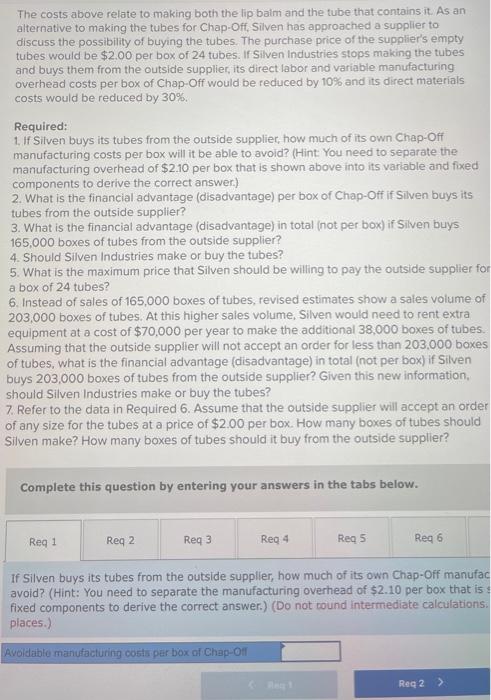

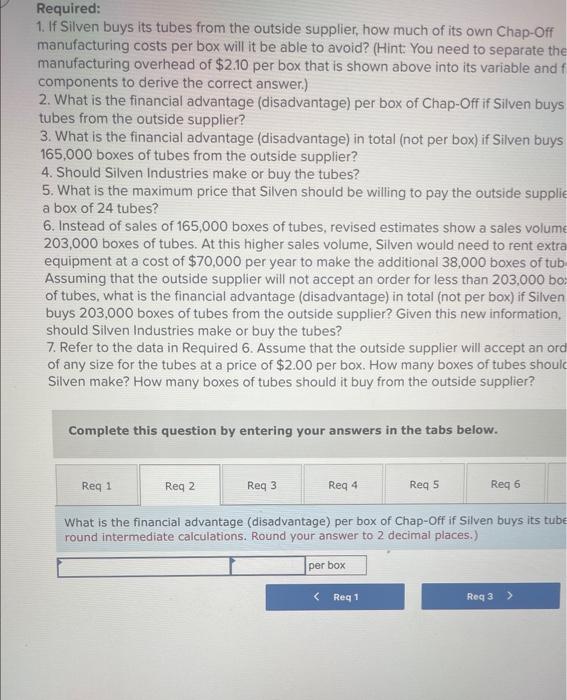

Silven Industries, which manufactures and sells a trighly successful line of summer lotions and insect repellents, has decided to diversify in order to stabilize sales throughout the year, A natural area for the company to consider is the production of winter lotions and creams to prevent dry and chapped skin. After considerable research, a winter products line has been developed. However. Silven's president has decided to introduce only one of the new products for this coming winter. If the product is a success, further expansion in future years will be initiated. The product selected (called Chap-Off) is a lip baim that will be sold in a lipstick-type tube. The product will be sold to wholesalers in boxes of 24 tubes for $10 per box Because of excess capacity, no additional fixed manufacturing overhead costs will be incurred to produce the product. However, a $115,500 charge for fixed manufacturing overhead will be absorbed by the product under the company's absorption costing system Using the estimated sales and production of 165,000 boxes of Chap-OIf, the Accounting Department has developed the following manufacturing cost per box: The costs above relate to making both the lip balm and the tube that contains it. As an alternative to making the tubes for Chap.Oft, Silven has approached a supplier to discuss the possibility of buying the tubes. The purchase price of the supplier's empty tubes would be $2.00 per box of 24 tubes. If Silven Industries stops making the tubes and buys them from the outside supplier, its direct labor and variable manufacturing overhead costs per box of Chap.Off would be reduced by 10% and its direct materials costs would be reduced by 30%. Required: 1. If Silven buys its tubes from the outside supplier, how much of its own Chap-Off manufacturing costs per box will it be able to avoid? (Hint You need to separate the manufacturing overhead of $2.10 per box that is shown above into its variable and fixed components to derive the correct answer) 2. What is the financial advantage (disadvantage) per box of Chap-Off if Silven buys its tubes from the outside supplier? 3. What is the financial advantage (disadvantage) in total (not per box) if Silven buys 165,000 boxes of tubes from the outside supplier? 4. Should Silven Industries make or buy the tubes? 5. What is the maximum price that Silven should be willing to pay the outside supplier for a box of 24 tubes? 6. Instead of sales of 165,000 boxes of tubes, revised estimates show a sales volume of 203,000 boxes of tubes, At this higher sales volume, Silven would need to rent extra equipment at a cost of $70,000 per year to make the additional 38,000 boxes of tubes. Assuming that the outside supplier will not accept an order for less than 203,000 boxes of tubes, what is the financial advantage (disadvantage) in total (not per box) if Silven buys 203,000 boxes of tubes from the outside supplier? Given this new information. should Silven-industries make or buv the tubes? The costs above relate to making both the lip baim and the tube that contains it. As an alternative to making the tubes for Chap-Off, Silven has approached a supplier to discuss the possibility of buying the tubes. The purchase price of the supplier's empty tubes would be $2.00 per box of 24 tubes. If Silven Industries stops making the tubes and buys them from the outside supplier, its direct labor and variable manufacturing overhead costs per box of Chap-Off would be reduced by 10% and its direct materials costs would be reduced by 30%. Required: 1. If Silven buys its tubes from the outside supplier, how much of its own Chap-Off manufacturing costs per box will it be able to avoid? (Hint: You need to separate the manufacturing overhead of $2.10 per box that is shown above into its varlable and fixed components to derive the correct answer.) 2. What is the financial advantage (disadvantage) per box of Chap-Off if Silven buys its tubes from the outside supplier? 3. What is the financial advantage (disadvantage) in total (not per box) if Silven buys 165,000 boxes of tubes from the outside supplier? 4. Should Silven Industries make or buy the tubes? 5. What is the maximum price that Silven should be willing to pay the outside supplier for a box of 24 tubes? 6. Instead of sales of 165,000 boxes of tubes, revised estimates show a sales volume of 203,000 boxes of tubes. At this higher sales volume, Silven would need to rent extra equipment at a cost of $70,000 per year to make the additional 38,000 boxes of tubes. Assuming that the outside supplier will not accept an order for less than 203,000 boxes of tubes, what is the financial advantage (disadvantage) in total (not per box) if Silven buys 203,000 boxes of tubes from the outside supplier? Given this new information, should Silven Industries make or buy the tubes? 7. Refer to the data in Required 6. Assume that the outside supplier will accept an order of any size for the tubes at a price of $2.00 per box. How many boxes of tubes should Silven make? How many boxes of tubes should it buy from the outside supplier? Complete this question by entering your answers in the tabs below. If Silven buys its tubes from the outside supplier, how much of its own Chap-Off manufac avoid? (Hint: You need to separate the manufacturing overhead of $2.10 per box that is fixed components to derive the correct answer.) (Do not wound intermediate calculations. places.) Required: 1. If Silven buys its tubes from the outside supplier, how much of its own Chap-Off manufacturing costs per box will it be able to avoid? (Hint: You need to separate the manufacturing overhead of $2.10 per box that is shown above into its variable and components to derive the correct answer.) 2. What is the financial advantage (disadvantage) per box of Chap-Off if Silven buys tubes from the outside supplier? 3. What is the financial advantage (disadvantage) in total (not per box) if Silven buys 165,000 boxes of tubes from the outside supplier? 4. Should Silven Industries make or buy the tubes? 5. What is the maximum price that Silven should be willing to pay the outside supplie a box of 24 tubes? 6. Instead of sales of 165,000 boxes of tubes, revised estimates show a sales volume 203,000 boxes of tubes. At this higher sales volume, Silven would need to rent extra equipment at a cost of $70,000 per year to make the additional 38,000 boxes of tub Assuming that the outside supplier will not accept an order for less than 203,000 bo of tubes, what is the financial advantage (disadvantage) in total (not per box) if Silven buys 203,000 boxes of tubes from the outside supplier? Given this new information, should Silven Industries make or buy the tubes? 7. Refer to the data in Required 6. Assume that the outside supplier will accept an ord of any size for the tubes at a price of $2.00 per box. How many boxes of tubes shoulc Silven make? How many boxes of tubes should it buy from the outside supplier? Complete this question by entering your answers in the tabs below. What is the financial advantage (disadvantage) per box of Chap-Off if Silven buys its tube round intermediate calculations. Round your answer to 2 decimal places.) Required: 1. If Silven buys its tubes from the outside supplier, how much of its own Chap-Off manufacturing costs per box will it be able to avoid? (Hint: You need to separate the manufacturing overhead of $2.10 per box that is shown above into its variable and fixed components to derive the correct answer.) 2. What is the financial advantage (disadvantage) per box of Chap-Off if Silven buys its tubes from the outside supplier? 3. What is the financial advantage (disadvantage) in total (not per box) if Silven buys 165.000 boxes of tubes from the outside supplier? 4. Should Silven Industries make or buy the tubes? 5. What is the maximum price that Silven should be willing to pay the outside supplier for a box of 24 tubes? 6. Instead of sales of 165,000 boxes of tubes, revised estimates show a sales volume of 203,000 boxes of tubes. At this higher sales volume, Silven would need to rent extra equipment at a cost of $70,000 per year to make the additional 38,000 boxes of tubes. Assuming that the outside supplier will not accept an order for less than 203,000 boxes of tubes, what is the financial advantage (disadvantage) in total (not per box) if Silven buys 203,000 boxes of tubes from the outside supplier? Given this new information, should Silven Industries make or buy the tubes? 7. Refer to the data in Required 6. Assume that the outside supplier will accept an order of any size for the tubes at a price of $2.00 per box. How many boxes of tubes should Silven make? How many boxes of tubes should it buy from the outside supplier? Complete this question by entering your answers in the tabs below. What is the financial advantage (disadvantage) in total (not per box) if Silven buys 165,000t supplier? Required: 1. If Silven buys its tubes from the outside supplier, how much of its own Chap-Off manufacturing costs per box will it be able to avoid? (Hint: You need to separate the manufacturing overhead of $2.10 per box that is shown above into its variable and fix components to derive the correct answer.) 2. What is the financial advantage (disadvantage) per box of Chap-Off if Silven buys it tubes from the outside supplier? 3. What is the financial advantage (disadvantage) in total (not per box) if Silven buys 165,000 boxes of tubes from the outside supplier? 4. Should Silven Industries make or buy the tubes? 5. What is the maximum price that Silven should be willing to pay the outside supplie a box of 24 tubes? 6. Instead of sales of 165,000 boxes of tubes, revised estimates show a sales volume 203,000 boxes of tubes. At this higher sales volume, Silven would need to rent extra equipment at a cost of $70,000 per year to make the additional 38,000 boxes of tube Assuming that the outside supplier will not accept an order for less than 203,000 box of tubes, what is the financial advantage (disadvantage) in total (not per box) if Silven buys 203,000 boxes of tubes from the outside supplier? Given this new information, should Silven Industries make or buy the tubes? 7. Refer to the data in Required 6. Assume that the outside supplier will accept an ord of any size for the tubes at a price of $2.00 per box. How many boxes of tubes shoulc Silven make? How many boxes of tubes should it buy from the outside supplier? Complete this question by entering your answers in the tabs below. Should Silven Industries make or buy the tubes? 3. What is the financial advantage (disadvantage) in total (not per box) if Silven bi 165,000 boxes of tubes from the outside supplier? 4. Should Silven Industries make or buy the tubes? 5. What is the maximum price that Silven should be willing to pay the outside sup a box of 24 tubes? 6. Instead of sales of 165,000 boxes of tubes, revised estimates show a sales vol 203,000 boxes of tubes. At this higher sales volume, Silven would need to rent e equipment at a cost of $70,000 per year to make the additional 38,000 boxes of Assuming that the outside supplier will not accept an order for less than 203,000 of tubes, what is the financial advantage (disadvantage) in total (not per box) if Sil buys 203,000 boxes of tubes from the outside supplier? Given this new informati should Silven Industries make or buy the tubes? 7. Refer to the data in Required 6. Assume that the outside supplier will accept an of any size for the tubes at a price of $2.00 per box. How many boxes of tubes sh Silven make? How many boxes of tubes should it buy from the outside supplier? Complete this question by entering your answers in the tabs below. What is the maximum price that Silven should be willing to pay the outside supplier intermediate calculations. Round your answer to 2 decimal places.) a box of 24 tubes? 6. Instead of sales of 165,000 boxes of tubes, revised estimates show a sales volume of 203,000 boxes of tubes. At this higher sales volume, Silven would need to rent extra equipment at a cost of $70,000 per year to make the additional 38,000 boxes of tubes. Assuming that the outside supplier will not accept an order for less than 203,000 boxes of tubes, what is the financial advantage (disadvantage) in total (not per box) if Silven buys 203,000 boxes of tubes from the outside supplier? Given this new information, should Silven Industries make or buy the tubes? 7. Refer to the data in Required 6. Assume that the outside supplier will accept an order of any size for the tubes at a price of $2.00 per box. How many boxes of tubes should Silven make? How many boxes of tubes should it buy from the outside supplier? Complete this question by entering your answers in the tabs below. Instead of sales of 165,000 boxes of tubes, revised estimates show a sales volume of 203,00 sales volume, Silven would need to rent extra equipment at a cost of $70,000 per year to ma of tubes. Assuming that the outside supplier will not accept an order for less than 203,000 bc financial advantage (disadvantage) in total (not per box) if Silven buys 203,000 boxes of tubi Given this new information, should Silven Industries make or buy the tubes? a box of 24 tubes? 6. Instead of sales of 165,000 boxes of tubes, revised estimates show a sales volume of 203,000 boxes of tubes. At this higher sales volume, Silven would need to rent extra equipment at a cost of $70,000 per year to make the additional 38,000 boxes of tubes. Assuming that the outside supplier will not accept an order for less than 203,000 boxes of tubes, what is the financial advantage (disadvantage) in total (not per box) if Silven buys 203,000 boxes of tubes from the outside supplier? Given this new information, should Silven Industries make or buy the tubes? 7. Refer to the data in Required 6. Assume that the outside supplier will accept an order of any size for the tubes at a price of $2.00 per box. How many boxes of tubes should Silven make? How many boxes of tubes should it buy from the outside supplier? Complete this question by entering your answers in the tabs below. Instead of sales of 165,000 boxes of tubes, revised estimates show a sales volume 203,00 sales volume, Silven would need to rent extra equipment at a cost of $70,000 per year to ma of tubes. Assuming that the outside supplier will not accept an order for less than 203,000 bc financial advantage (disadvantage) in total (not per box) if Silven buys 203,000 boxes of tubi Given this new information, should Silven Industries make or buy the tubes? should Silven Industries make or buy the tubes? 7. Refer to the data in Required 6. Assume that the outside supplier will accept an order of any size for the tubes at a price of $2.00 per box. How many boxes of tubes should Silven make? How many boxes of tubes should it buy from the outside supplier? Complete this question by entering your answers in the tabs below. Refer to the data in Required 6. Assume that the outside supplier will accept an order of any $2.00 per box. How many boxes of tubes should Silven make? How many boxes of tubes sho supplier? (Round your intermediate calculations to 2 decimal places.) thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started