Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me in creating an Adjusted Journal Entry with the Information I provide. Within this post I will show the Original Transaction aswell as

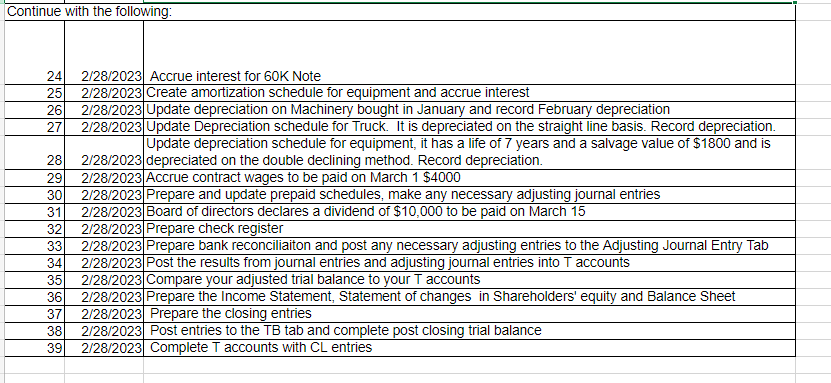

Please help me in creating an Adjusted Journal Entry with the Information I provide. Within this post I will show the Original Transaction aswell as an image showing what to do for the Adjusted Journal Entries. PLEASE SHOW ME THE NUMBERS AND HOW YOU GOT IT

Original Journal Entries:

Date Description Account Debit Credit Ref #

INVENTORY

ACCOUNTS PAYABLE

To record inventory purchase

INTEREST EXPENSE

NOTES PAYABLE

CHECKING

To record payment on K Loan

WAGES PAYABLE

CHECKING

To record payment of contract wages

VEHICLES

CHECKING

To record purchase of truck

PREPAID INSURANCE

CHECKING

To record purchase of truck insurance

POSTAGE

CHECKING

To record postage

ACCOUNTS RECEIVABLE

PRODUCT SALES

COST OF GOODS SOLD

INVENTORY

To record sale and inventory adjustment

REPAIRS AND MAINTENANCE

CHECKING

To record repair on truck

INVENTORY

ACCOUNTS PAYABLE

To record inventory purchase

INVENTORY

ACCOUNTS PAYABLE

To record inventory purchase

SALES RETURNS AND ALLOWANCE

ACCOUNTS RECEIVABLE

To record sales allowance

ACCOUNTS PAYABLE

INVENTORY

CHECKING

To record payment of inventory purchased on

EQUIPMENT

NOTES PAYABLE

To record purchase of Equipment

EQUIPMENT

CHECKING

To record delivery and installation

EQUIPMENT

CHECKING

To record inspection

CHECKING

PRODUCT SALES

COST OF GOODS SOLD

INVENTORY

To record sale and inventory adjustment

SALARIES AND WAGES

CHECKING

To record contract wages

ACCOUNTS RECEIVABLE

PRODUCT SALES

COST OF GOODS SOLD

INVENTORY

To record sale and inventory adjustment

CHECKING

SALES DISCOUNT

ACCOUNTS RECEIVABLE

To record cash receipt from customer

ACCOUNTS RECEIVABLE

SERVICE SALES

SALES DISCOUNT

To record cash receipt from customer

AUTO EXPENSE

CHECKING

To record purchase of gas

UTILITIES

CHECKING

To record water sewer and garbage payment

AUTO EXPENSE

VISA PAYABLE

To record payment for Visa Bill in JanuaryContinue with the following:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started