Please help me in solving these questions :)

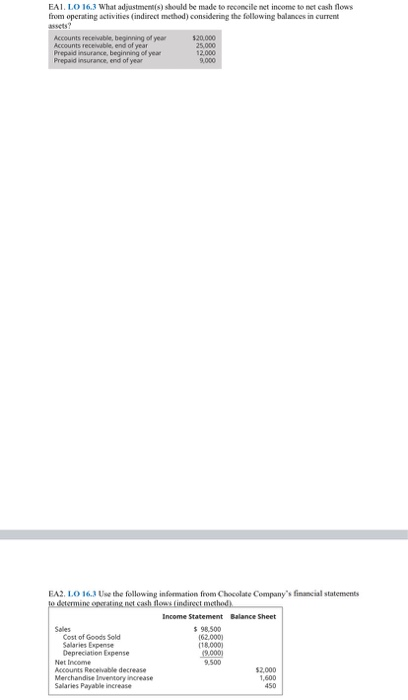

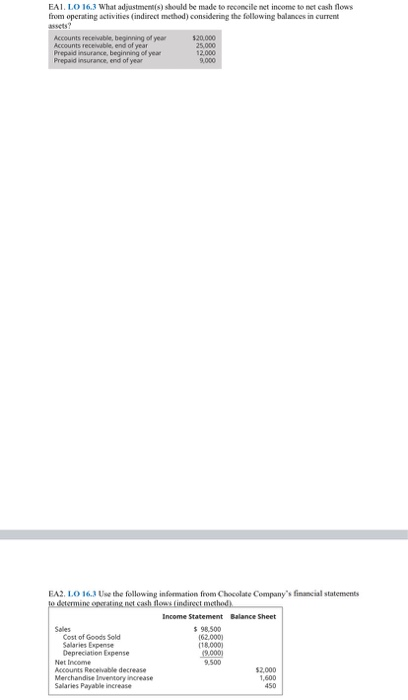

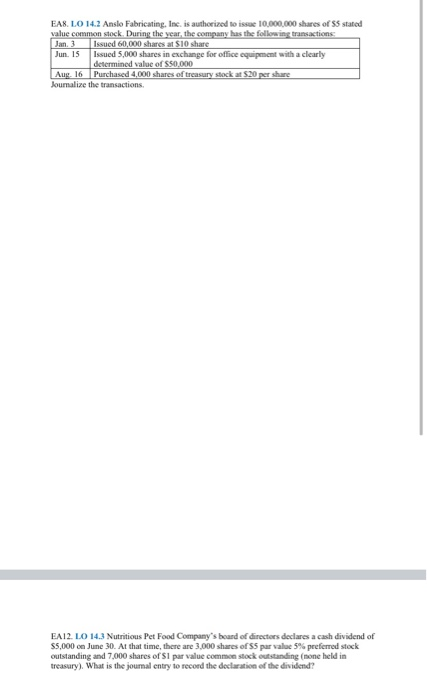

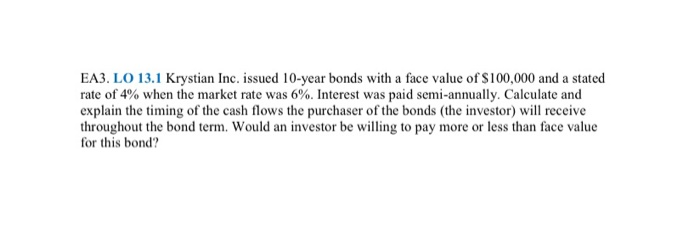

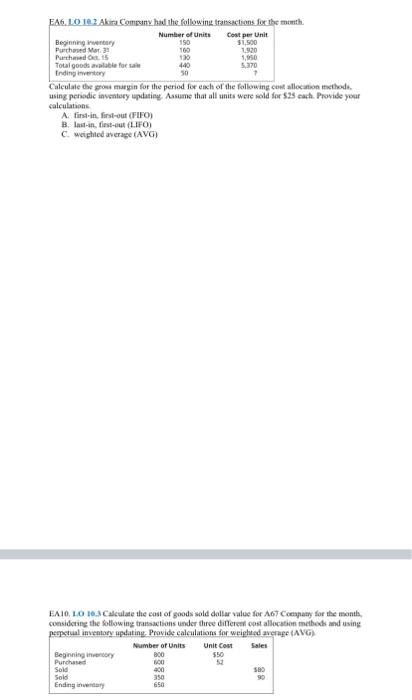

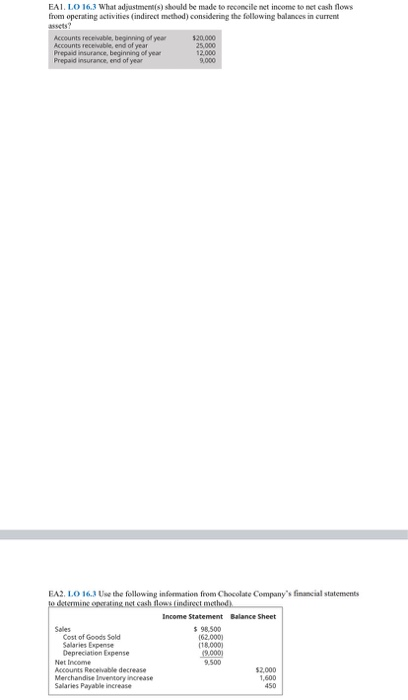

EAI LO 16.3 What adjustments) should be made to reconcile net income to net cash flows from operating activities indirect method) considering the following balances in current Accounts receivable beginning of your Prepaid insurance, beginning of year Prepaid insurance, end of year 25.000 12.000 EA2. LO 16.3 Use the following information from Chocolate Company's financial statements to determin a ting cash flow indirect method Income Statement Balance Sheet $ 9.500 Cost of Goods Sold 162.000 Salaries Expense 118.000 Depreciation Expense 19.000 Net Income 9.500 Accounts Receivable decrease $2,000 Merchandise Inventory increase Salaries Payable increase EA LO 14.2 Anslo Fabricating, Inc. is authorized to issue 10,000,000 shares of 5 stated value common stock During the year, the company has the following transactions Jan. 3 Issued 60,000 shares at SIO share Jun. 15 Issued 5,000 shares in exchange for office equipment with a clearly determined value of 50000 Aug 16 Purchased 4.000 shares of treasury stock at $20 per share Soumalize the transactions EA12. LO 143 Nutritious Pet Food Company's board of directors declares a cash dividend of $5,000 on June 30. At that time, there are 3.000 shares of Spar la 5% preferred stock outstanding and 7.000 shares of Si par value comme stock outstanding (none held in treasury). What is the journal entry to record the declaration of the dividend EA3. LO 13.1 Krystian Inc. issued 10-year bonds with a face value of $100,000 and a stated rate of 4% when the market rate was 6%. Interest was paid semi-annually. Calculate and explain the timing of the cash flows the purchaser of the bonds (the investor) will receive throughout the bond term. Would an investor be willing to pay more or less than face value for this bond? EAI LO 12.2 Homeland Plus specializes in home goods and accessories. In order for the company to expand its business, the company takes out a long-term loan in the amount of S650,000. Assume that any loans are created on January 1. The terms of the low include a periodic payment plan, where interest payments are accumulated each year but are only computed against the outstanding principal balance during that the annual interest rate is 5% Each year on December 31. the company pays down the principal balance by $80,000. This payment is considered part of the outstanding principal balance when computing the interest accumulation that also on December 31 of that year A Determine the outstanding principal balance on December of the first year that is computed for interest B Compute the interest accrued on December 31 of the first year C. Make a journal entry to record interest accumulated during the first year, but not paid as of December 31 of that first year FBI LO 12.2 Monster Drinks sells twenty-four cases of beverages on October 18 for $120 per case. On October 25. Monster sells another thirty-five cases for 140 per case. Sales taxis computed at 4% of the total sale. Prepare journal entries for each sale, including sales tax, and the remittance of all sales tax to the tax board on November 5. EAGLO 102 Akira Company had the following transactions for the month. Number of Units Cost per Unit Beginning inventory Purchased Mar 31 Total goods able for sale Ending inventory Calculate the gross margin for the period for ench of the following cost allocation methods using periodic inventory updating. Assume that all units were sold for $25 cach. Provide your calculations A first in first-out (FIFO) B. last-in, first-out LIFO) C. weighted average (AVG) EATO, LO 10.3 Calculate the cost of goods sold dollar value for A67 Company for the month considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for weighted average (AVG Number of Units Unit Cow Sales Beginning inventory Ending inventory