Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me in these questions Q. 2 Answer as appropriate. (30 marks) 1- Modern financial theory assumes that the primary goal of the firm

Please help me in these questions

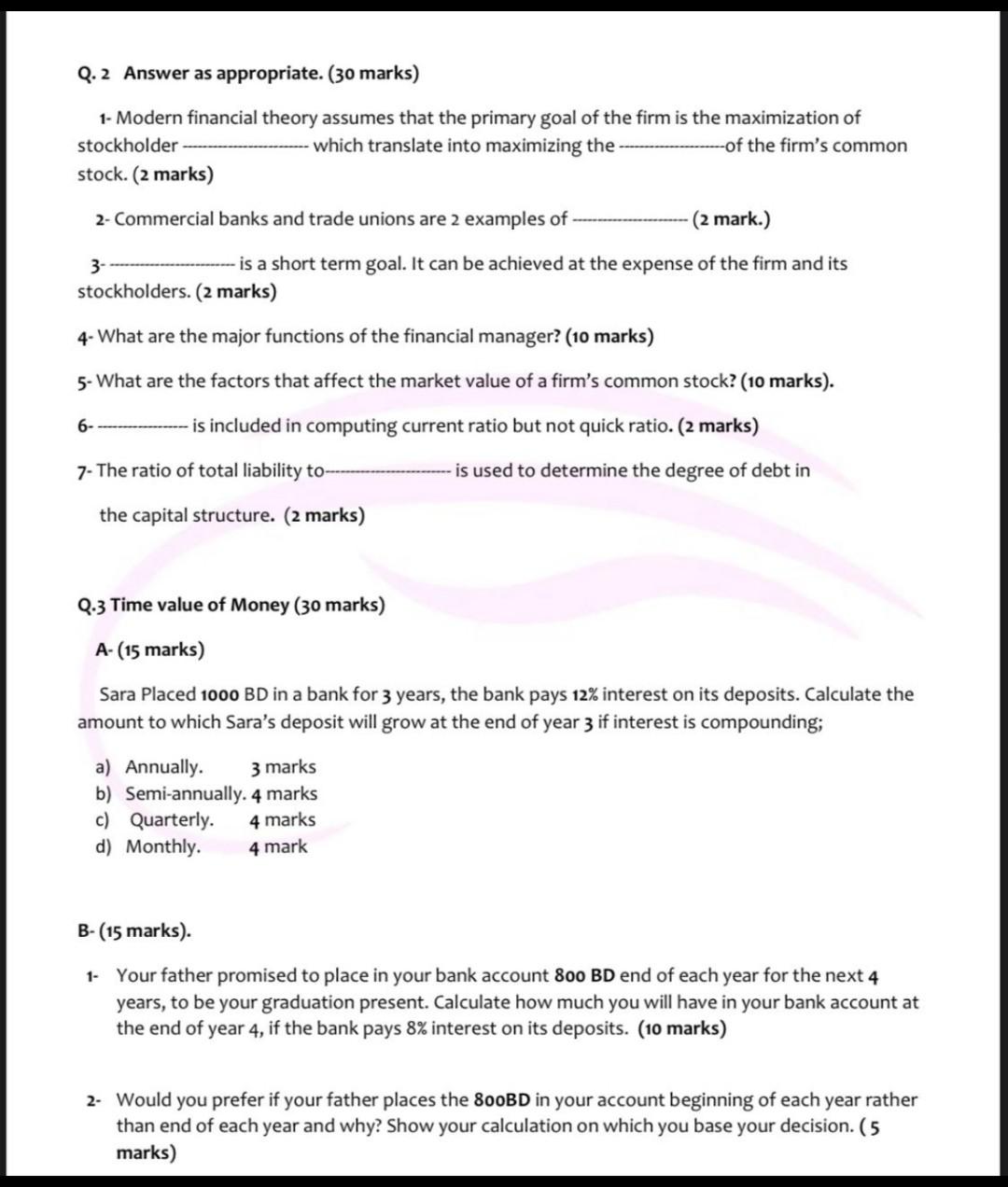

Q. 2 Answer as appropriate. (30 marks) 1- Modern financial theory assumes that the primary goal of the firm is the maximization of stockholder which translate into maximizing the of the firm's common stock. (2 marks) 2- Commercial banks and trade unions are 2 examples of (2 mark.) is a short term goal. It can be achieved at the expense of the firm and its stockholders. (2 marks) 4- What are the major functions of the financial manager? (10 marks) 5- What are the factors that affect the market value of a firm's common stock? (10 marks). is included in computing current ratio but not quick ratio. (2 marks) 7- The ratio of total liability to is used to determine the degree of debt in 3- 6- the capital structure. (2 marks) 0.3 Time value of Money (30 marks) A-(15 marks) Sara Placed 1000 BD in a bank for 3 years, the bank pays 12% interest on its deposits. Calculate the amount to which Sara's deposit will grow at the end of year 3 if interest is compounding; a) Annually. 3 marks b) Semi-annually. 4 marks c) Quarterly. 4 marks d) Monthly 4 mark B- (15 marks). 1. Your father promised to place in your bank account 800 BD end of each year for the next 4 years, to be your graduation present. Calculate how much you will have in your bank account at the end of year 4, if the bank pays 8% interest on its deposits. (10 marks) 2. Would you prefer if your father places the 800BD in your account beginning of each year rather than end of each year and why? Show your calculation on which you base your decisionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started