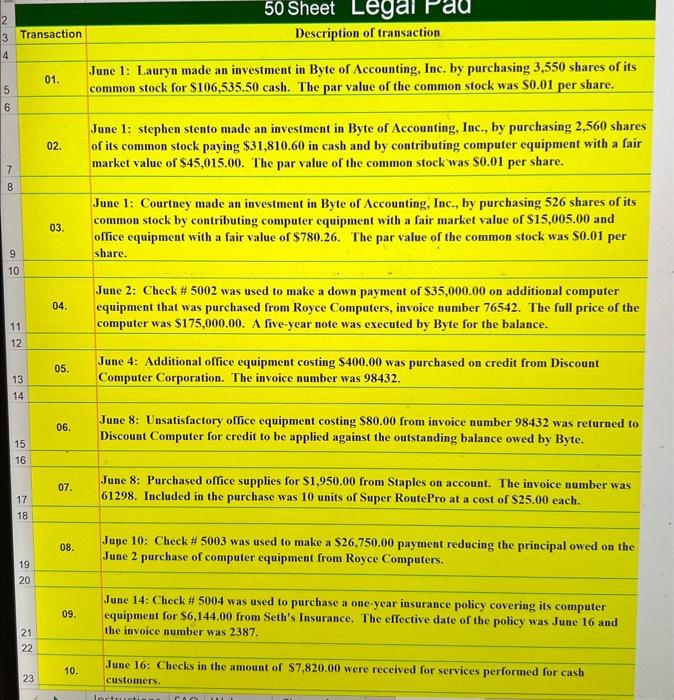

please help me journalize these transactions. i only need help journalizing transactions 32-46 please help!!!

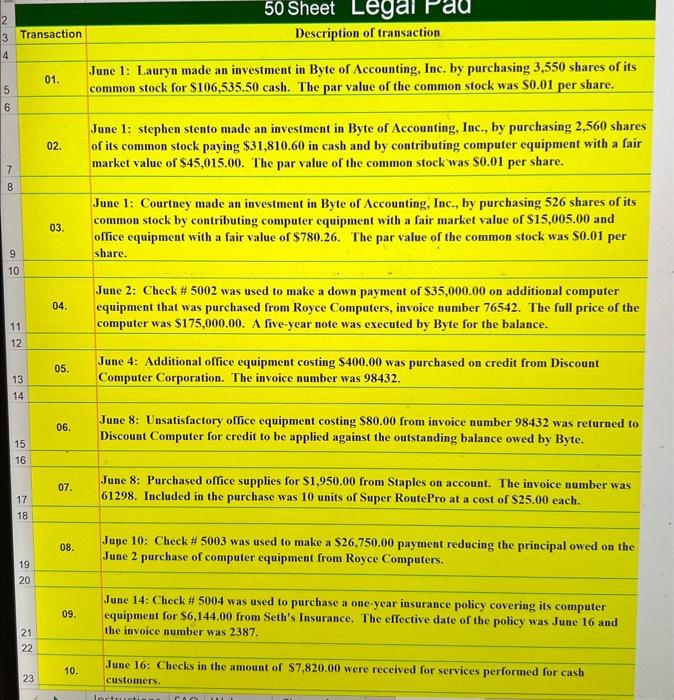

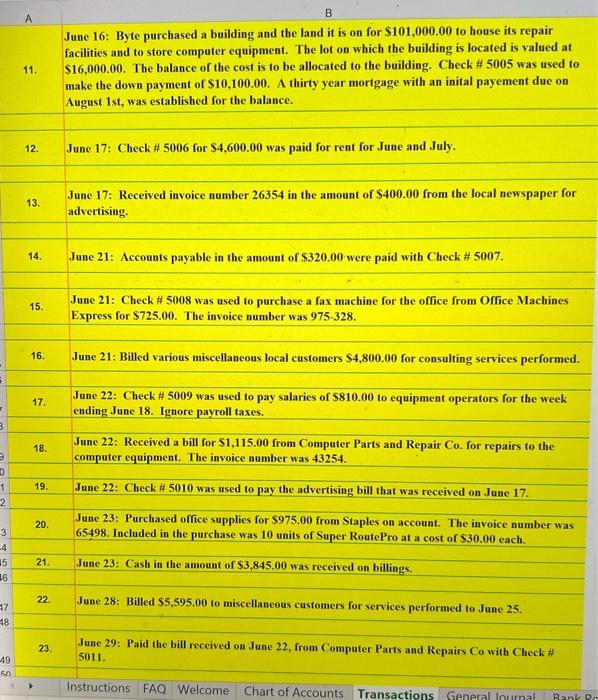

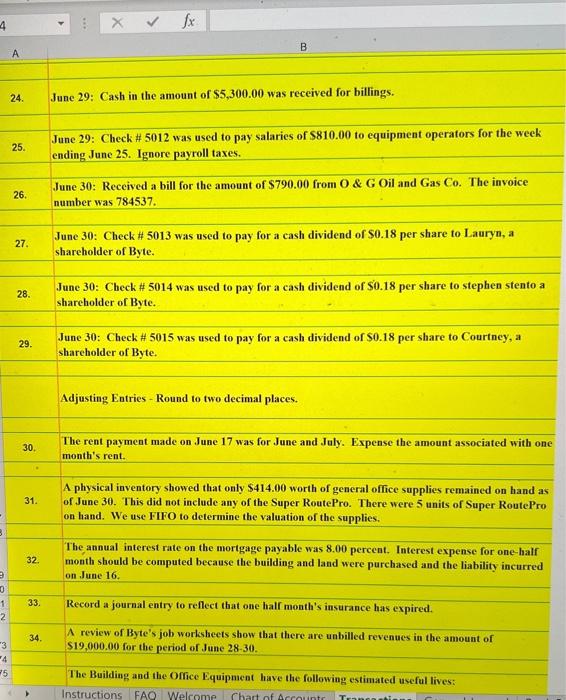

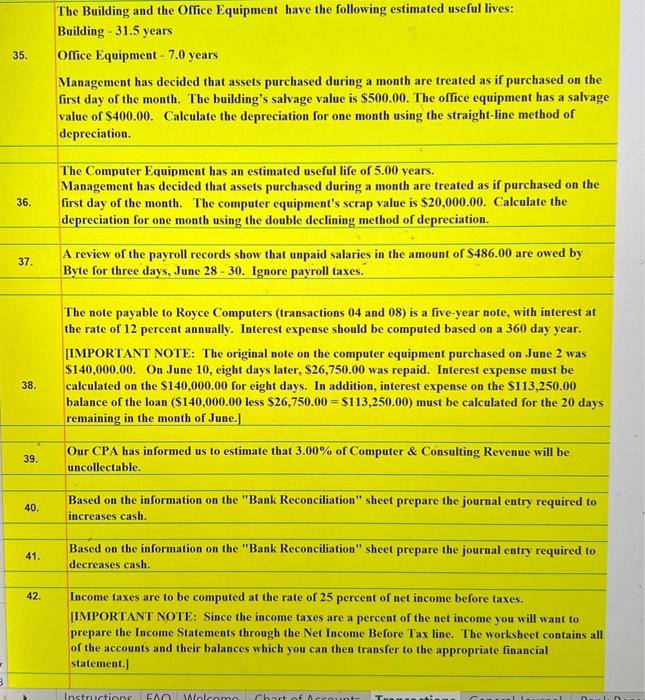

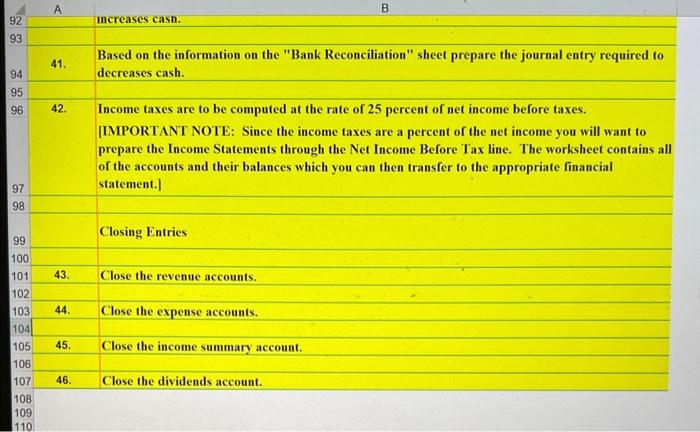

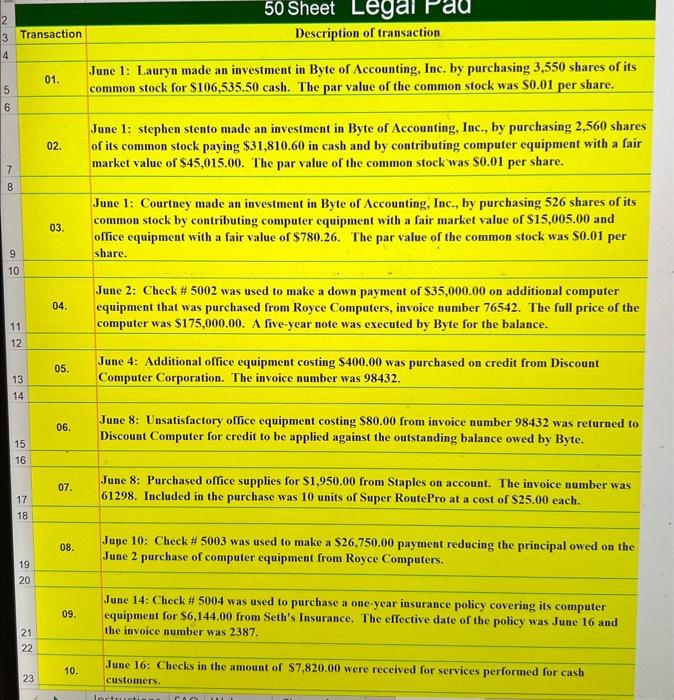

A June 16: Byte purchased a building and the land it is on for $101,000.00 to house its repair facilities and to store computer equipment. The lot on which the building is located is valued at 11. $16,000.00. The balance of the cost is to be allocated to the building. Check #5005 was used to make the down payment of $10,100.00. A thirty year mortgage with an inital payement due on August 1st, was established for the balance. 12. June 17: Check # 5006 for $4,600.00 was paid for rent for June and July. 13. June 17: Received invoice number 26354 in the amount of $400.00 from the local newspaper for advertising. 14. June 21: Accounts payable in the amount of $320.00 were paid with Check # 5007. 15. June 21: Check # 5008 was used to purchase a fax machine for the office from Office Machines Express for $725.00. The invoice number was 975-328. 16. June 21: Billed various miscellaneous local customers $4,800.00 for consulting services performed. 17. June 22: Check # 5009 was used to pay salaries of $810.00 to equipment operators for the week ending June 18. Ignore payroll taxes. 18. June 22: Received a bill for $1,115.00 from Computer Parts and Repair Co. for repairs to the computer equipment. The invoice number was 43254. 19. June 22: Check # 5010 was used to pay the advertising bill that was received on June 17. 20. June 23: Purchased office supplies for $975.00 from Staples on account. The invoice number was 65498 . Included in the purchase was 10 units of Super RoutePro at a cost of $30.00 each. 21. June 23: Cash in the amount of $3,845,00 was received on billings. 22. June 28: Billed $5,595,00 to miscellaneous customers for services performed to June 25 . 23. June 29: Paid the bill received on June 22, from Computer Parts and Repairs Co with Check # 5011. Instructions FAQ Welcome Chart of Accounts A B 24. June 29: Cash in the amount of $5,300.00 was received for billings. 25. June 29: Check # 5012 was used to pay salaries of $810.00 to equipment operators for the week ending June 25. Ignore payroll taxes. 26. June 30: Received a bill for the amount of $790.00 from O&G Oil and Gas Co. The invoice number was 784537. 33. Record a journal entry to reflect that one half month's insurance has expired. 34. A review of Byte's job worksheets show that there are unbilled revenues in the amount of $19,000.00 for the period of June 28-30. The Building and the Office Equipment have the following estimated useful lives: The Building and the Office Equipment have the following estimated useful lives: Building - 31.5 years 35. Office Equipment - 7.0 years Management has decided that assets purchased during a month are treated as if purchased on the first day of the month. The building's salvage value is $500.00. The office equipment has a salvage value of $400.00. Calculate the depreciation for one month using the straight-line method of depreciation. 42. Income taxes are to be computed at the rate of 25 percent of net income before taxes. [IMPORTANT NOTE: Since the income taxes are a percent of the net income you will want to prepare the Income Statements through the Net Income Before Tax line. The worksheet contains all of the accounts and their balances which you can then transfer to the appropriate financial statement.]