please help me

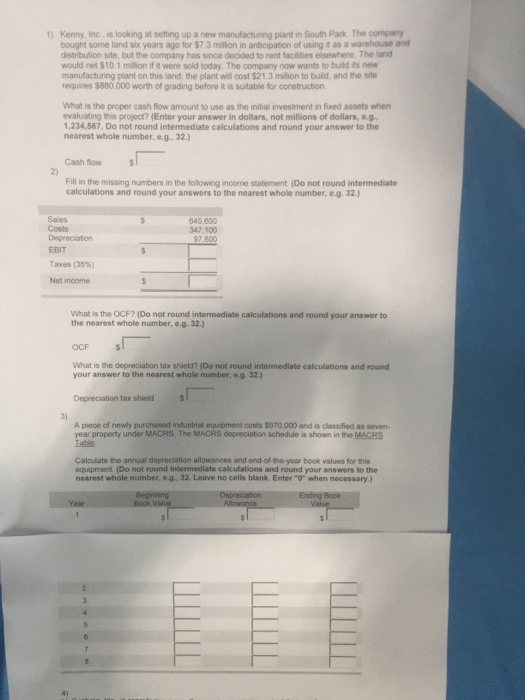

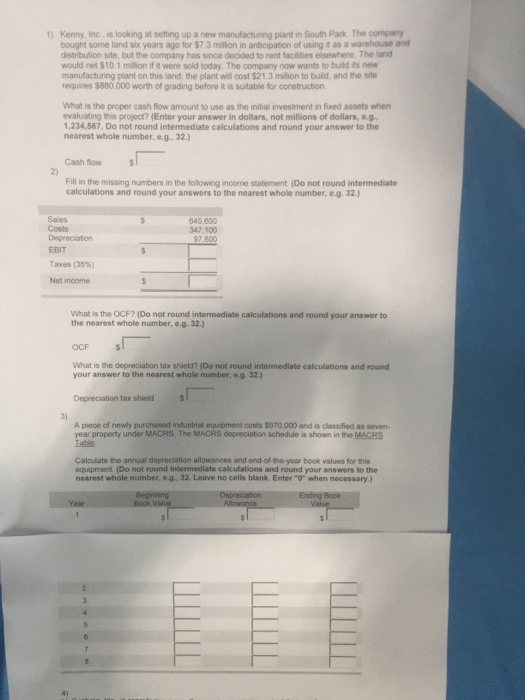

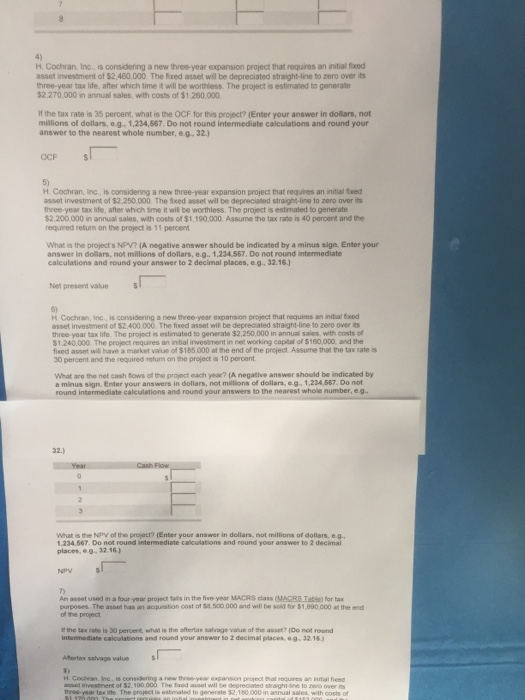

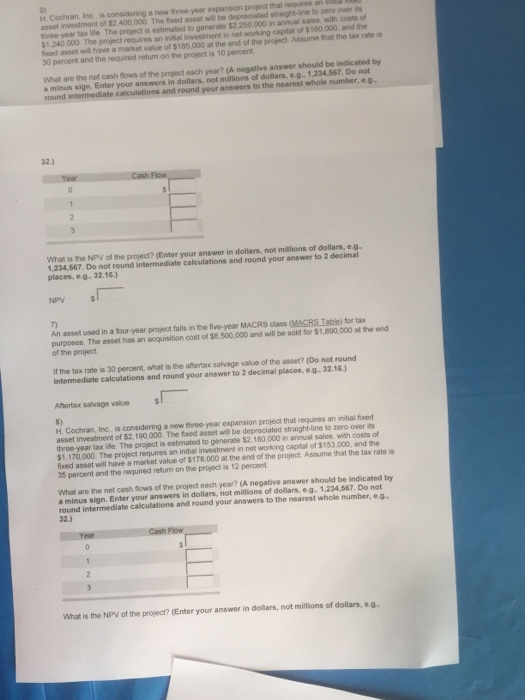

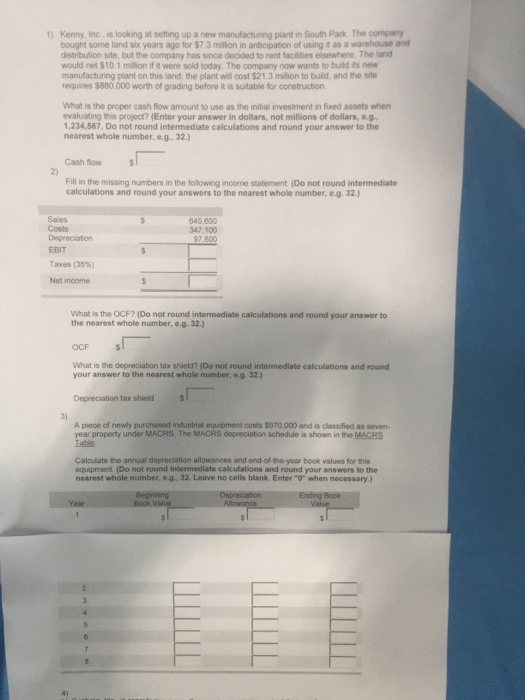

Kenny, Inc is looking at setting up a new manufacturing plant in South Park. The company bought some land six years ago for $7 3 million in anticipation of using it as a warehouse and distribution site, but the company has since deoided to rent facilities elsewhere The land would net S10.1 million if it were sold today. The company now wants to build its new manufactuing plant on this land; the plant will cost $21.3 milion to build, and the site requires $880,000 worth of grading before it is suitable for construction 1) What is the proper cash flow amount to use as the initial investment in fixed assets when evaluating this project? (Enter your answer in dollars, not millions of doilars, o.g 1,234,567. Do not round intermediate calculations and round your answer to the nearest whole number, e.g. 32.) Cash low 2) Fill in the missing numbers in the foilowing income statement (Do not round intermediate calculations and round your answers to the nearest whole number, e.g. 32) Sales 45.800 Costs EBIT Taxes (35%) Net income 347.100 7.800 What is the OCF? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g. 32.) OCF What is the depreciation tax shield? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g. 32) Depreciation tax shield 3) A piece of newly purchased industrial equipment costs $970,000 and is classified as seven- year property under MACRS The MACRS depreciation schedule is shown in the MACRS Tabie Caloulate the annual depreciation allowances and ond-ofthe year book values for this equipment. (Do not round intermediate calculations and round your answers to the nearest whole number,e.g.32.Leave no cells blank. Enter "" when necessary.) 4) 4) H Cochran Inc., is considering a new three-year expansion project that requires an initial fixed asset investment of $2,480,000 The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generale $2 270.000 in annual sales, with costs of $1.260.000 if the tax rates 35 percent, what is the OCF for this proect? (Enter your answer in dollars, not millions of dollars, e.g, 1,234,567. Do not round intermediate calculations and round your answer to the nearest whole number, e.g. 32) OCF 5) H Cochran, Inc is considering a new three-year expansion project that requires an initial fixed asset investment of $2,250,.000. The Sxed asset wll be depreciated straight-ing to zero over its three year tax life, after which sme it will be worthless. The project is estimated to generate 2.200 000 in annual sales, with costs of $1,190,000. Assume the tax rate is 40 percent and the required return on the project is 11 percent What is the project's NPV? LA negative answer should be indicated by a minus sign. Enter your answer in dollars, not millions of dollars,e.g. 1,234 567. Do not round intermediate calculations and round your answer to 2 decimal places, e.g, 32.16) s Net present value H Cochran, Inc, is considering a new three-year expansion project that requises an initial foxeed asset invesiment of $2.400,000 The foxed asset wil be deprecialed straight-ine to zero over ts three year tax life. The project is estimated to generate $2,250.000 in annual sales, with costs of $1.240.000 The project requires an inial investment in net working capital of $160,000, and the fixed asset will have a market value of $185.000 at the end of the preject Assume that the tax rate is 30 percent and the required retun an the project is 10 percent What are the net cash flows of the project each year? (A negative answer should be indicated by a minus sign. Enter your answers in dollars, not millions of dollars,e.g 1,234,567. Do not round intermediate calculations and round your answers to the nearest whole number, eg 32.) What is the NPV of the project? (Enter your answer in dollars, not millions of dollars, e.g.. 234,567, Do not round intermediate calculations and round your answer to 2 decimal placesg. 32.16 7 An asset used in a four-year project talls in the ive year MACRS dass (MAGCRS Tabe) for tax purposes. The asset has an acquisition cost of $3,500 000 and will be sold for $1,890000 t the end of the project ef the tax rate is 30 percent, what is the aftertax salvage value of the asset? (Do not round intermediate calculations and round your answer to 2 decimal places g- 32.16 Atertax salvage valuae H Coche an Incis considering a rewth0eyeaopanson protect asset investment of $2.190 at eequres an in-need ree-year tax lite. The project is estmsted to generate 32,180,000 in annual sales, with costs of 0) H Cochran, Inc, is considaring a new three year expansion project that requires an asset investment of $2 400,000 The fixed asset will be depreciated straight-ine to zero over its in annual sales, with costs of 1.240.000 The project requires an initial investment in net working capital of $160,000, and the fxed asset will have a market value of $185.000 at the end of the project Assume that the tax rate is 30 percent and the required return on the project is 10 percent What are the net cash fows of the project each year? (A negative answer should be indicated by a minus sign. Enter your answers in dollars, not millions of dollars, .g.. 1,234.567 Do not and round your answers to the nearest whole number, e.g 32-) What is the NPV of the project? (Enter your answer in dollars, not millions of dollars, e.g 1234,567. Do not round intermediate calculations and round your answer to 2 decimal places, e.g-32.16 NPV 7) An asset used in a four-year project falls in the five-year MACRS class (MACRS Table) for tax purposes. The asset has an acquisition cost of $8.500,000 and will be sold for $1,890,000 at the end of the project If the tax rate is 30 percent, what is the aftertax salvage value of the asser? (Do not round intermediate calculations and round your answer to 2 decimal places, e-g.32.16) Ahortax salvage value 8) H. Cochran, Inc. is considering a new three-year expansion project that requires an initial fixed asset investment of $2,190,000. The fxed asset will be depreciated straight-line to zero over its three-year tax ife. The project is estimated to generale $2 180,000 in annual salos, with costs of $1,170,000 The project requires an initial investment in net working capital of $153,000, and the fixed asset will have a market value of $178,000 at the end of the project. Assume that the tax rate is 35 percent and the required return on the project is 12 percent What are the net cash fows of the project each year? (A negative answer should be indicated by a minus sign. Enter your answers in dollars, not milions of dollars, .g 1.234,567. Do not round intermediate calculations and round your answers to the nearest whole number,e.g 32.) Flow What is the NPV of the project? (Enter your answer in doilars, not millions of dollars, e.g