Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me number 9 & 10 4 This is h Iha Accounting Project: Taamaj, a sole-proprietor, created luicy Lemonade on December 1, 2018 lulcy

Please help me number 9 & 10

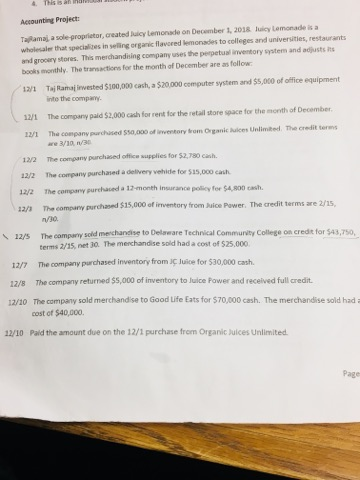

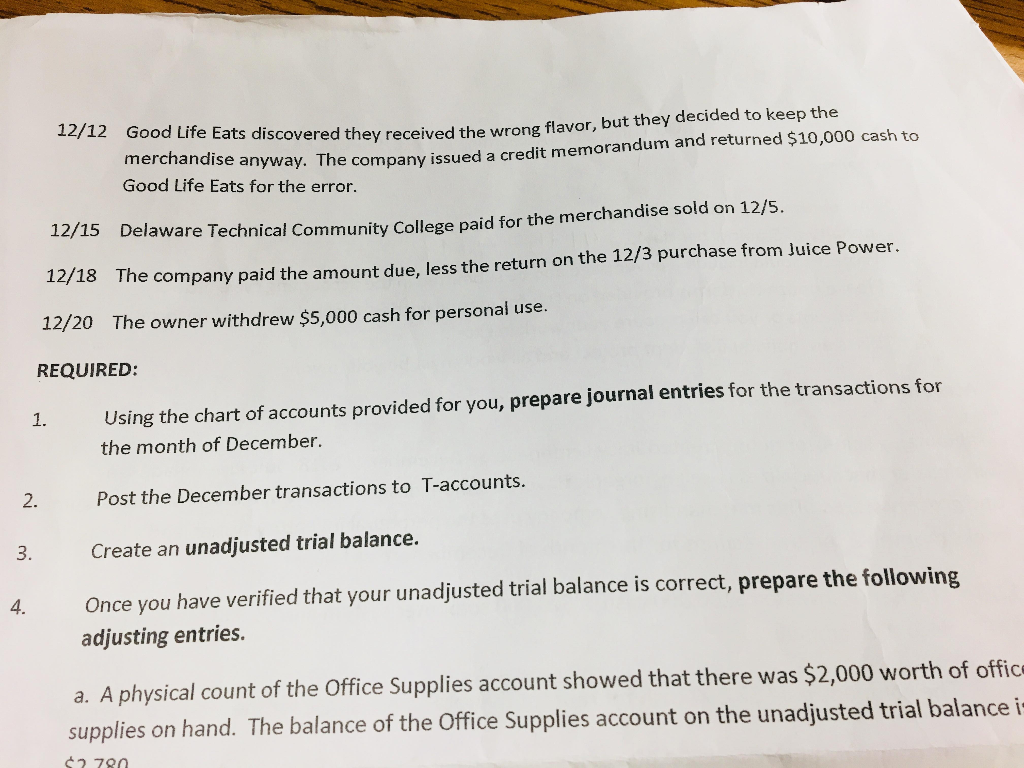

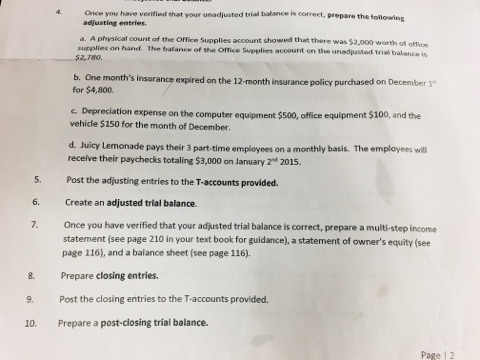

4 This is h Iha Accounting Project: Taamaj, a sole-proprietor, created luicy Lemonade on December 1, 2018 lulcy Lemonade is a wholesaler that specializes in selling organic flavored lemonades to colleges and universities, restaurants and grocery stores. This merchandising company uses the perpetual inventory system and adjusts its books monthly. The trasactions for the month of December are as fellow 12/1 Taj Ramaj inwested $100,000 cash, a $20,000 cemputer system and $5,000 of office equipment inte the compay 12/1 The company paid $2,000 cash for rent for the retail store space for the month of December The cedit teres The companypurchised SSO,000ofinventory orn Organic Aice, unlimited 12/2 The company purchased office supplies for $2,780 cash. 2/2 The company purchased a delivery vehide for $15,000 cash 12/2 The company purehaced a 12-month insurance poicy f $4,800 cash. 12/3 The company purchased $15,000 of inventory from Juice Pawer. The credit terms are 2/15, 2 n/3o sold meichandise to Delaware Techrical Community College on credit for $43,750 12/5 The campay terms 2/15, net 30. The menchandise sold had a cost of $25,000 12/7 The company parchased inventory from JC Juice for $30,000 cash. 12/8 The company returned $5,000 of inventory to luice Power and recelved full credit. 12/10 The company sold merchandise to Good Life Eats for $70,000 cash. The merchandise sold had a cost of $40,000. 12/10 Pald the amount due on the 12/1 purchase frem Organic Juices Unlimited Page 12/12 Good Life Eats discovered th ey received the wrong flavor, but they decided to keep the merchandise anyway. The company issued a credit memorandum and returned $10,000 cash to Good Life Eats for the error. 12/15 Delaware Technical Community College paid for the merchandise sold on 12/5. 12/18 The company paid the amount due, less the return on the 12/3 purchase from Juice Power. 12/20 The owner withdrew $5,000 cash for personal use. REQUIRED Using the chart of accounts provided for you, prepare journal entries for the transactions for the month of December. 1. 2. Post the December transactions to T-accounts. 3. Create an unadjusted trial balance. 4. Once you have verified that your unadjusted trial balance is correct, prepare the following adjusting entries. a. A physical count of the Office Supplies account showed that there was $2,000 worth of offic supplies on hand. The balance of the Office Supplies account on the unadjusted trial balance i Once you have verified that your unadjusted trial balance is correct, prepare the following adjusting entries a. A physical count of the Office Supplies account showed that there was $2,000 worth of offivce supplies on haned. The balance of the Office Supplies account on the unadjusted trial balance is 52,780 month's insurance expired on the 12-month insurance policy purchased on December 1 for $4,800. c. Depreciation expense on the computer equipment $500, office equipment $100, and the vehicle $150 for the month of December. d. Juicy Lemonade pays their 3 part-time employees on a monthly basis. The employees will receive their paychecks totaling $3,000 on January 2* 2015. 5. Post the adjusting entries to the T-accounts provided. 6. Create an adjusted trial balance 7. Once you have verified that your adjusted trial balance is correct, prepare a multi-step income statement (see page 210 in your text book for guidance), a statement of owner's equity (see page 116), and a balance sheet (see page 116). 8. Prepare closing entries. 9. Post the closing entries to the T-accounts provided. 10. Prepare a post-closing trial balance. Page | 2 4 This is h Iha Accounting Project: Taamaj, a sole-proprietor, created luicy Lemonade on December 1, 2018 lulcy Lemonade is a wholesaler that specializes in selling organic flavored lemonades to colleges and universities, restaurants and grocery stores. This merchandising company uses the perpetual inventory system and adjusts its books monthly. The trasactions for the month of December are as fellow 12/1 Taj Ramaj inwested $100,000 cash, a $20,000 cemputer system and $5,000 of office equipment inte the compay 12/1 The company paid $2,000 cash for rent for the retail store space for the month of December The cedit teres The companypurchised SSO,000ofinventory orn Organic Aice, unlimited 12/2 The company purchased office supplies for $2,780 cash. 2/2 The company purchased a delivery vehide for $15,000 cash 12/2 The company purehaced a 12-month insurance poicy f $4,800 cash. 12/3 The company purchased $15,000 of inventory from Juice Pawer. The credit terms are 2/15, 2 n/3o sold meichandise to Delaware Techrical Community College on credit for $43,750 12/5 The campay terms 2/15, net 30. The menchandise sold had a cost of $25,000 12/7 The company parchased inventory from JC Juice for $30,000 cash. 12/8 The company returned $5,000 of inventory to luice Power and recelved full credit. 12/10 The company sold merchandise to Good Life Eats for $70,000 cash. The merchandise sold had a cost of $40,000. 12/10 Pald the amount due on the 12/1 purchase frem Organic Juices Unlimited Page 12/12 Good Life Eats discovered th ey received the wrong flavor, but they decided to keep the merchandise anyway. The company issued a credit memorandum and returned $10,000 cash to Good Life Eats for the error. 12/15 Delaware Technical Community College paid for the merchandise sold on 12/5. 12/18 The company paid the amount due, less the return on the 12/3 purchase from Juice Power. 12/20 The owner withdrew $5,000 cash for personal use. REQUIRED Using the chart of accounts provided for you, prepare journal entries for the transactions for the month of December. 1. 2. Post the December transactions to T-accounts. 3. Create an unadjusted trial balance. 4. Once you have verified that your unadjusted trial balance is correct, prepare the following adjusting entries. a. A physical count of the Office Supplies account showed that there was $2,000 worth of offic supplies on hand. The balance of the Office Supplies account on the unadjusted trial balance i Once you have verified that your unadjusted trial balance is correct, prepare the following adjusting entries a. A physical count of the Office Supplies account showed that there was $2,000 worth of offivce supplies on haned. The balance of the Office Supplies account on the unadjusted trial balance is 52,780 month's insurance expired on the 12-month insurance policy purchased on December 1 for $4,800. c. Depreciation expense on the computer equipment $500, office equipment $100, and the vehicle $150 for the month of December. d. Juicy Lemonade pays their 3 part-time employees on a monthly basis. The employees will receive their paychecks totaling $3,000 on January 2* 2015. 5. Post the adjusting entries to the T-accounts provided. 6. Create an adjusted trial balance 7. Once you have verified that your adjusted trial balance is correct, prepare a multi-step income statement (see page 210 in your text book for guidance), a statement of owner's equity (see page 116), and a balance sheet (see page 116). 8. Prepare closing entries. 9. Post the closing entries to the T-accounts provided. 10. Prepare a post-closing trial balance. Page | 2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started