Answered step by step

Verified Expert Solution

Question

1 Approved Answer

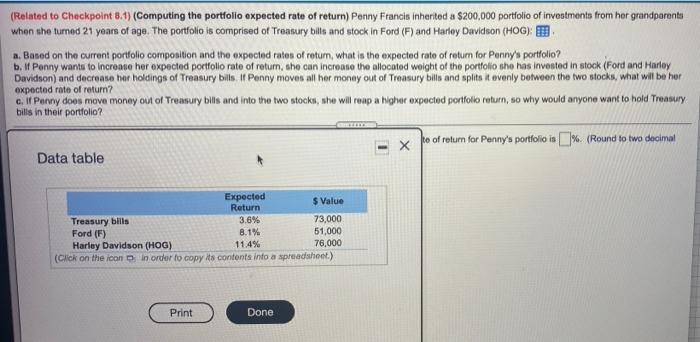

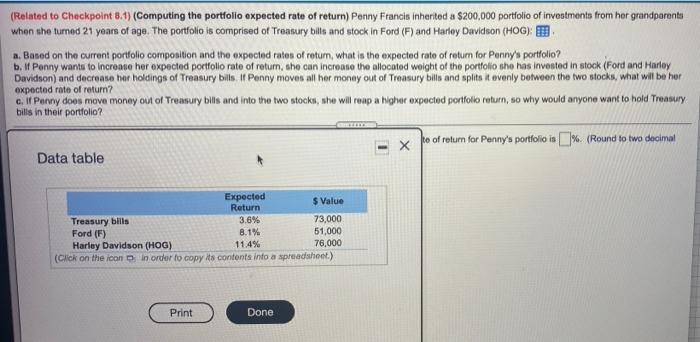

Please help me out with all parts (A,b,c). Thank you in advance! (Related to Checkpoint 8.1) (Computing the portfolio expected rate of return) Penny Francis

Please help me out with all parts (A,b,c). Thank you in advance!

(Related to Checkpoint 8.1) (Computing the portfolio expected rate of return) Penny Francis inherited a $200,000 portfolio of investments from her grandparents whon she turned 21 years of age. The portfolio is comprised of Treasury bills and stock in Ford (F) and Harley Davidson (HOG): 3 a. Based on the current portfolio composition and the expected rates of retum, what is the expected rate of return for Penny's portfolio? b. Ponny wants to increase her expected portfolio rate of retum, she can increase the allocated weight of the portfolio sho has invested in stock (Ford and Harley Davidson) and decrease her holdings of Treasury bills. If Penny moves all her money out of Treasury bills and splits it evenly between the two stocks, what will be her expected rate of return? c. It Perny does move money out of Treasury bills and into the two stocks, she will coup a higher expected portfolio roturn, so why would anyone want to hold Treasury bills in their portfolio? X to of return for Penny's portfolio in % (Round to two decimal Data table Expected $ Value Return Treasury blis 3.6% 73,000 8.1% 51,000 Harley Davidson (HOG) 11.4% 76,000 (Click on the icon in order to copy its contents into a spreadsheet.) Ford (F) | Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started