Please help me out with these questions! Thank you so much!

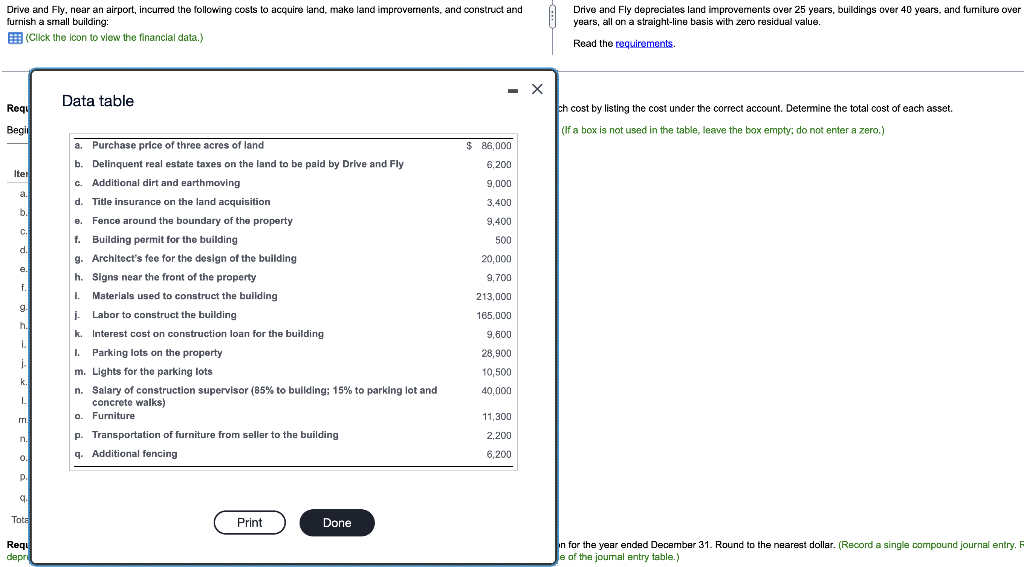

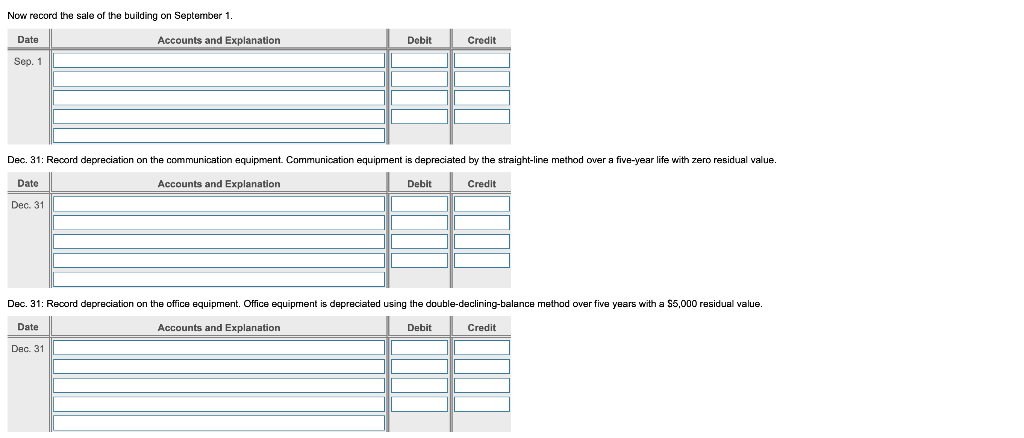

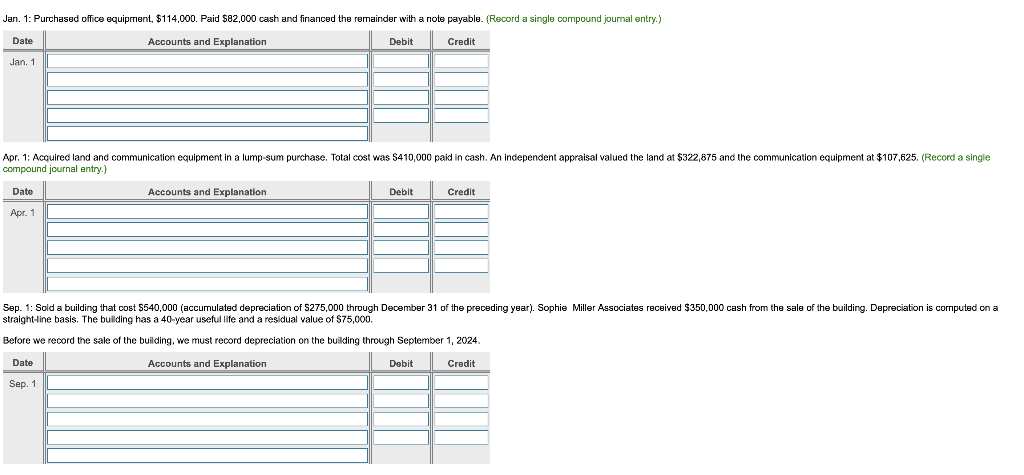

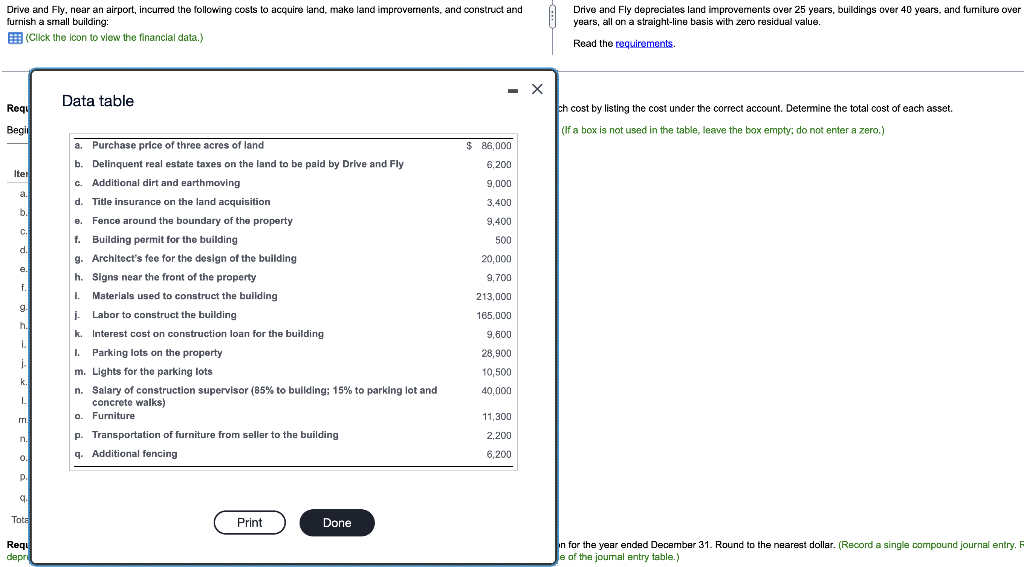

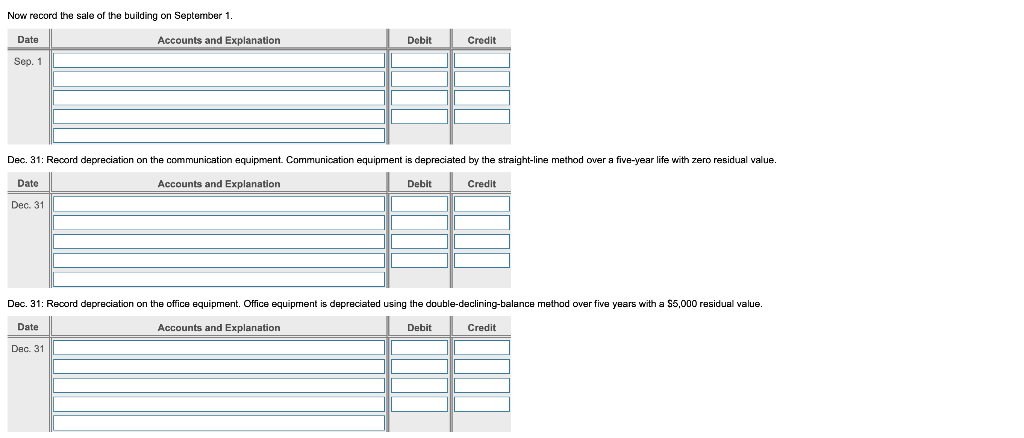

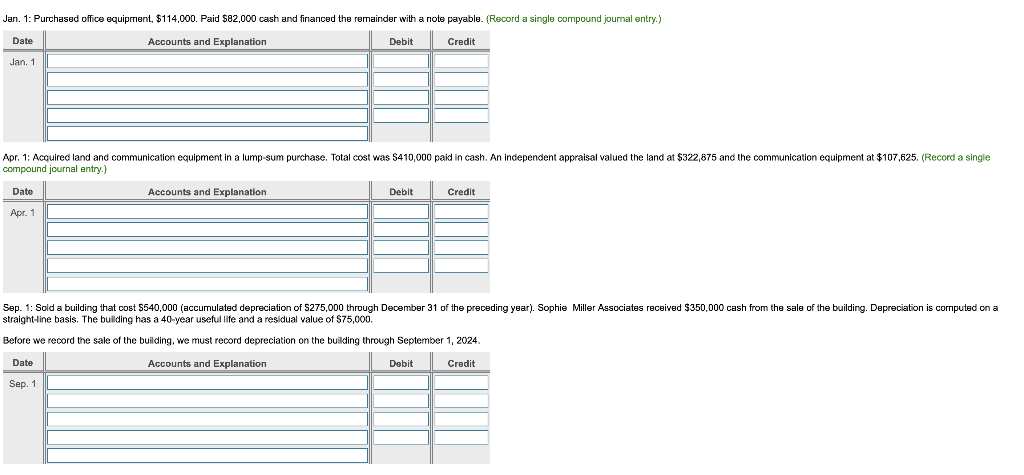

Drive and Fly, near an airport, incurred the following costs to acquire land, make land improvements, and construct and furnish a small building: B (Click the icon to view the financial data.) Drive and Fly depreciates land improvements over 25 years, buildings over 40 years, and furniture over years, all on a straight-line basis with zero residual value. Read the requirements . - X Reqy Data table ch cost by listing the cost under the correct account. Determine the total cost of each asset. (If a box is not used in the table, leave the box empty; do not enter a zero.) Begit $ 86,000 6,200 Iter 9,000 a. 3,400 b 9,400 c. d. 500 20,000 e. 9.700 f. i. a. Purchase price of three acres of land . b. Delinquent real estate taxes on the land to be paid by Drive and Fly c. Additional dirt and earthmoving d. Title insurance on the land acquisition a. Fence around the boundary of the property f. Building permit for the building g. Architect's fee for the design of the building h. Signs near the front of the property Materials used to construct the building j. Labor to construct the building k. Interest cost on construction loan for the building I. Parking lots on the property m. Lights for the parking lots n. Salary of construction supervisor (85% to building: 15% to parking lot and concrete walks) O. Furniture p. Transportation of furniture from seller to the building q. Additional fencing 213,000 g. . h. h 165,000 9,600 I. i 1. 28,900 10,500 k. 40,000 I. 11,300 n. 2,200 6.200 0. p. 9. a. Tote Print Done Requ depr In for the year ended December 31. Round to the nearest dollar. (Record a single compound journal entry. le of the journal entry table.) Now record the sale of the building on September 1. Date Accounts and Explanation Debit Credit Sep. 1 Dec. 31: Record depreciation on the communication equipment. Communication equipment is depreciated by the straight-line method over a five-year life with zero residual value. Date Accounts and Explanation Debit Credit Dec. 31 Dec. 31: Record depreciation on the office equipment Office equipment is depreciated using the double-declining-balance method over five years with a $5,000 residual value. Date Accounts and Explanation Debit Credit Dec. 31 Jan. 1: Purchased office equipment, $114,000. Paid $82,000 cash and financed the remainder with a note payable. (Record a single compound journal entry.) Date Accounts and Explanation Debit Credit Jan. 1 Apr. 1: Acquired land and communication equipment in a lump-sum purchase. Total cost was $410,000 paid in cash. An independent appraisal valued the land at $322,875 and the communication equipment at $107,625. (Record a single compound journal entry) Date Accounts and Explanation Debit Credit Apr. 1 computed on a Sep. 1: Sold a building that cost $540,000 (accumulated depreciation of S275,000 through December 31 of the preceding year). Sophie Miller Associates received $350,000 cash from the sale of the building. Depreciation straight-line basis. The building has a 40-year useful life and a residual value of $75,000. Before we record the sale of the building, we must record depreciation on the building through September 1, 2024 Date Accounts and Explanation Debit Credit Sep. 1 Drive and Fly, near an airport, incurred the following costs to acquire land, make land improvements, and construct and furnish a small building: B (Click the icon to view the financial data.) Drive and Fly depreciates land improvements over 25 years, buildings over 40 years, and furniture over years, all on a straight-line basis with zero residual value. Read the requirements . - X Reqy Data table ch cost by listing the cost under the correct account. Determine the total cost of each asset. (If a box is not used in the table, leave the box empty; do not enter a zero.) Begit $ 86,000 6,200 Iter 9,000 a. 3,400 b 9,400 c. d. 500 20,000 e. 9.700 f. i. a. Purchase price of three acres of land . b. Delinquent real estate taxes on the land to be paid by Drive and Fly c. Additional dirt and earthmoving d. Title insurance on the land acquisition a. Fence around the boundary of the property f. Building permit for the building g. Architect's fee for the design of the building h. Signs near the front of the property Materials used to construct the building j. Labor to construct the building k. Interest cost on construction loan for the building I. Parking lots on the property m. Lights for the parking lots n. Salary of construction supervisor (85% to building: 15% to parking lot and concrete walks) O. Furniture p. Transportation of furniture from seller to the building q. Additional fencing 213,000 g. . h. h 165,000 9,600 I. i 1. 28,900 10,500 k. 40,000 I. 11,300 n. 2,200 6.200 0. p. 9. a. Tote Print Done Requ depr In for the year ended December 31. Round to the nearest dollar. (Record a single compound journal entry. le of the journal entry table.) Now record the sale of the building on September 1. Date Accounts and Explanation Debit Credit Sep. 1 Dec. 31: Record depreciation on the communication equipment. Communication equipment is depreciated by the straight-line method over a five-year life with zero residual value. Date Accounts and Explanation Debit Credit Dec. 31 Dec. 31: Record depreciation on the office equipment Office equipment is depreciated using the double-declining-balance method over five years with a $5,000 residual value. Date Accounts and Explanation Debit Credit Dec. 31 Jan. 1: Purchased office equipment, $114,000. Paid $82,000 cash and financed the remainder with a note payable. (Record a single compound journal entry.) Date Accounts and Explanation Debit Credit Jan. 1 Apr. 1: Acquired land and communication equipment in a lump-sum purchase. Total cost was $410,000 paid in cash. An independent appraisal valued the land at $322,875 and the communication equipment at $107,625. (Record a single compound journal entry) Date Accounts and Explanation Debit Credit Apr. 1 computed on a Sep. 1: Sold a building that cost $540,000 (accumulated depreciation of S275,000 through December 31 of the preceding year). Sophie Miller Associates received $350,000 cash from the sale of the building. Depreciation straight-line basis. The building has a 40-year useful life and a residual value of $75,000. Before we record the sale of the building, we must record depreciation on the building through September 1, 2024 Date Accounts and Explanation Debit Credit Sep. 1