Answered step by step

Verified Expert Solution

Question

1 Approved Answer

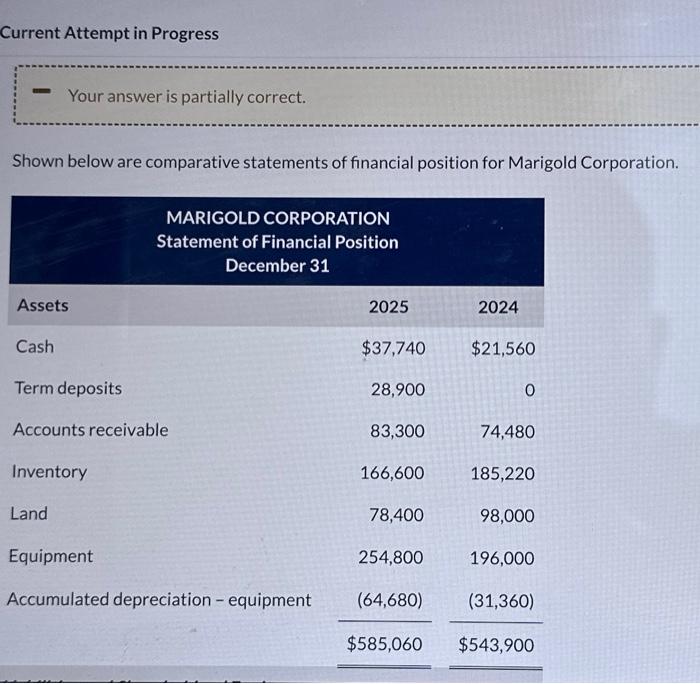

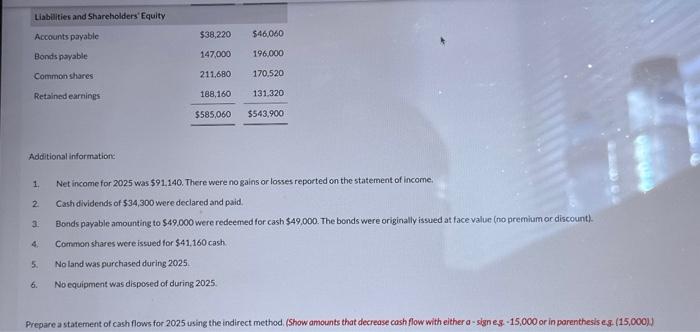

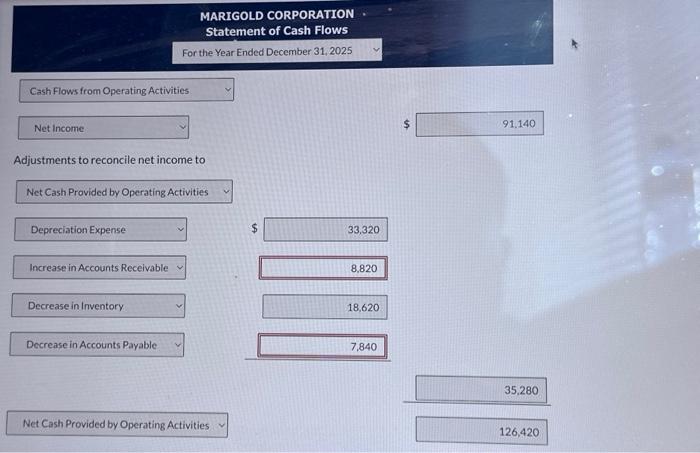

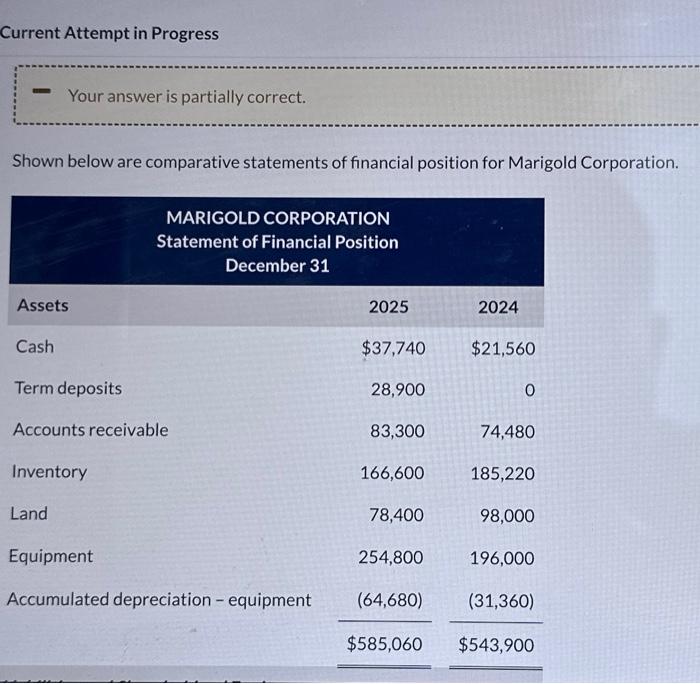

please help me out with this assisgnment especially the incorrect answers? Current Attempt in Progress Your answer is partially correct. Shown below are comparative statements

please help me out with this assisgnment especially the incorrect answers?

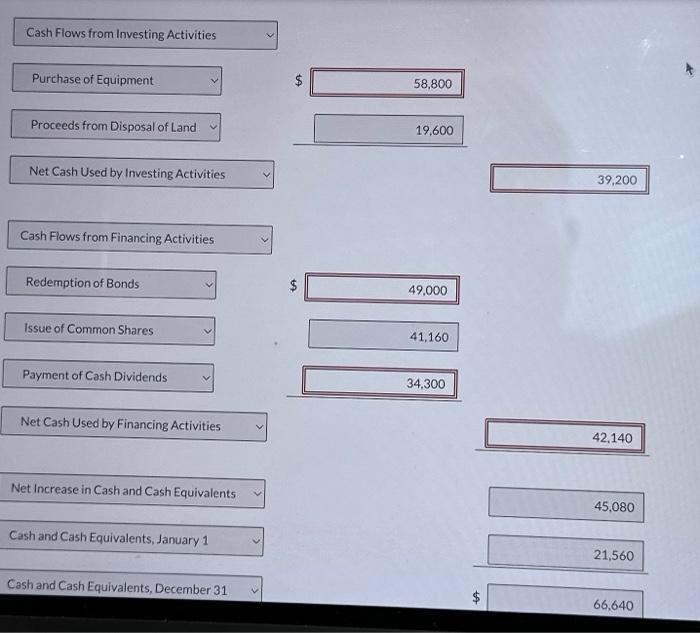

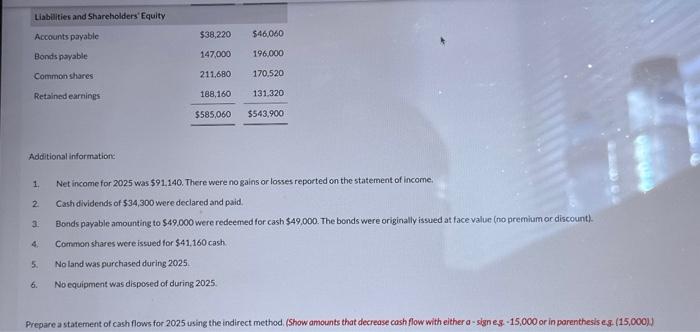

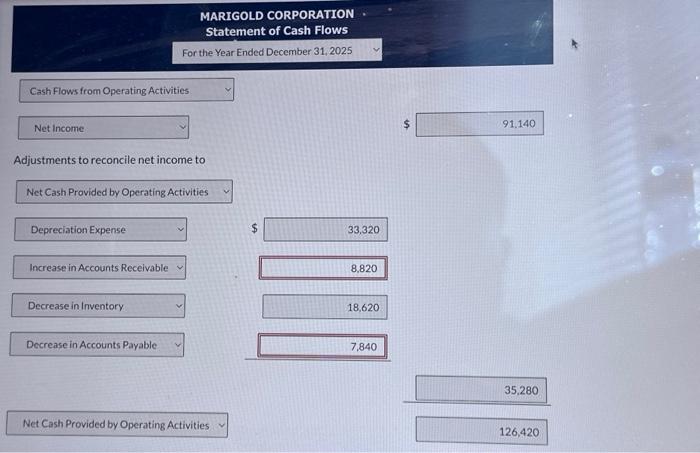

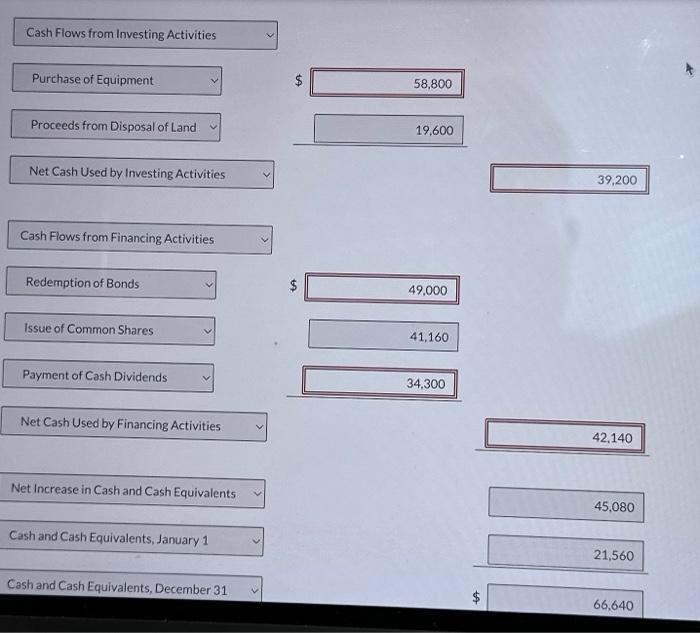

Current Attempt in Progress Your answer is partially correct. Shown below are comparative statements of financial position for Marigold Corporation. Additional information: 1. Net income for 2025 was 591,140 . There were no gains or losses reported on the statement of income. 2. Cash dividends of $34,300 were declared and paid. 3. Bonds payable amounting to $49,000 were redeemed for cash $49,000. The bonds were originally issued at face value (no premium or discount). 4. Common shares were issued for $41,160 cash 5. Noland was purchased during 2025. 6. No equipment was disposed of during 2025. MARIGOLD CORPORATION . Statement of Cash Flows For the Year Ended December 31, 2025 Cash Flows from Operating Activities Net Income $91.140 Adjustments to reconcile net income to Net Cash Provided by Operating Activities Depreciation Expense Increase in Accounts Receivable Decrease in Inventory Decrease in Accounts Payable Net Cash Provided by Operating Activities $33,320 \begin{tabular}{|r|} \hline \\ \hline \end{tabular} \begin{tabular}{r} \hline 18,620 \\ \hline \end{tabular} \begin{tabular}{r} \hline 7,840 \\ \hline \end{tabular} 35,280 126,420 Cash Flows from Investing Activities Purchase of Equipment 19,600 Net Cash Used by Investing Activities Cash Flows from Financing Activities Redemption of Bonds $49,000 Issue of Common Shares 41,160 Payment of Cash Dividends 34,300 Proceeds from Disposal of Land Net Cash Used by Investing Activities 39,200 Net Cash Used by Financing Activities 42,140 Net Increase in Cash and Cash Equivalents 45,080 Cash and Cash Equivalents, January 1 21,560 Cash and Cash Equivalents, December 31 $ 66,640

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started