Answered step by step

Verified Expert Solution

Question

1 Approved Answer

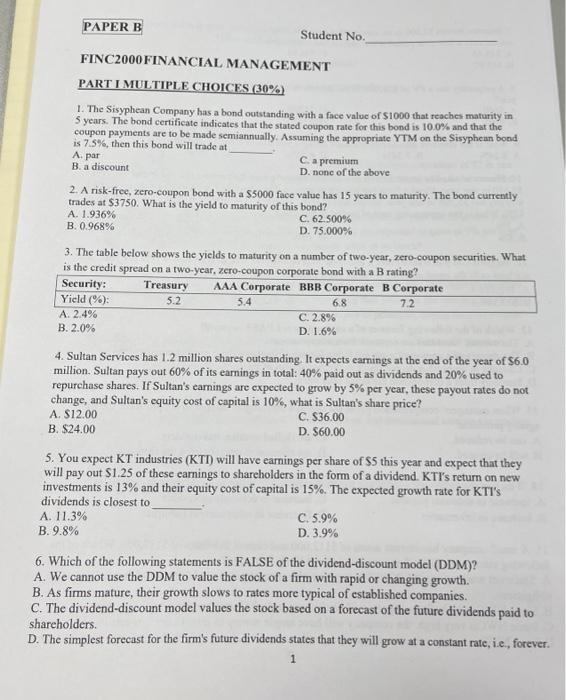

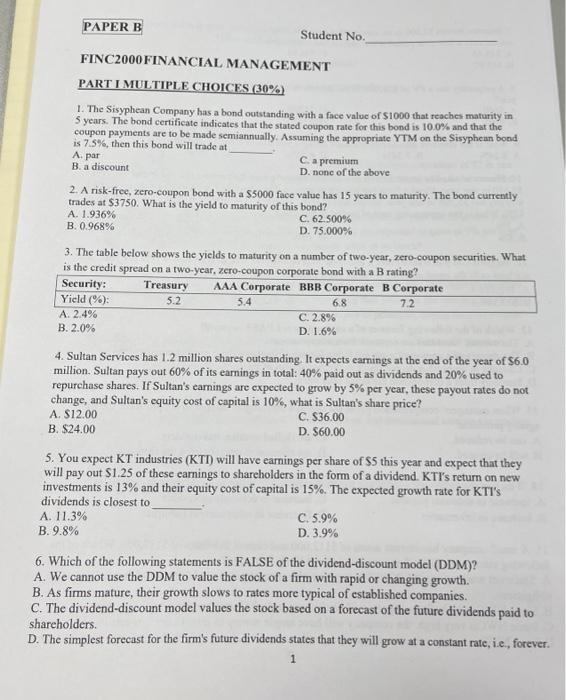

please help me!!!!!!!! PAPERB Student No. FINC2000FINANCIAL MANAGEMENT PARTI MULTIPLE CHOICES (30%) A. par 1. The Sisyphean Company has a bond outstanding with a face

please help me!!!!!!!!

PAPERB Student No. FINC2000FINANCIAL MANAGEMENT PARTI MULTIPLE CHOICES (30%) A. par 1. The Sisyphean Company has a bond outstanding with a face value of $1000 that reaches maturity in 5 years. The bond certificate indicates that the stated coupon rate for this bond is 10.0% and that the coupon payments are to be made semiannually. Assuming the appropriate YTM on the Sisyphean bond is 7.5%, then this bond will trade at C. a premium B. a discount D. nonc of the above 2. A risk-free, zero-coupon bond with a $5000 face value has 15 years to maturity. The bond currently trades at $3750. What is the yield to maturity of this bond? A. 1.936% C. 62.50096 B 0.968% D. 75.000 3. The table below shows the yields to maturity on a number of two-year, zero-coupon securities. What is the credit spread on a two-year, zero-coupon corporate bond with a B rating? Security: Treasury AAA Corporate BBB Corporate B Corporate Yield (%): 5.2 5.4 6.8 7.2 A. 2.4% C. 2.8% B. 2.0% D. 1.6% 4. Sultan Services has 1.2 million shares outstanding. It expects earnings at the end of the year of $6.0 million. Sultan pays out 60% of its earnings in total: 40% paid out as dividends and 20% used to repurchase shares. If Sultan's carnings are expected to grow by 5% per year, these payout rates do not change, and Sultan's equity cost of capital is 10%, what is Sultan's share price? A. S12.00 C. $36.00 B. $24.00 D. $60.00 5. You expect KT industries (KTT) will have earnings per share of $5 this year and expect that they will pay out $1.25 of these earnings to shareholders in the form of a dividend. KTI's return on new investments is 13% and their equity cost of capital is 15%. The expected growth rate for KTI's dividends is closest to A. 11.3% C. 5.9% B.9.8% D. 3.9% 6. Which of the following statements is FALSE of the dividend-discount model (DDM)? A. We cannot use the DDM to value the stock of a firm with rapid or changing growth. B. As firms mature, their growth slows to rates more typical of established companies. C. The dividend-discount model values the stock based on a forecast of the future dividends paid to shareholders. D. The simplest forecast for the firm's future dividends states that they will grow at a constant rate, i.e., forever

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started