Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me . PARTNERSHIP Graystone Traders is a partnership business formed by Gray and Stone. Graystone Traders supplies concrete products to building contractors and

please help me .

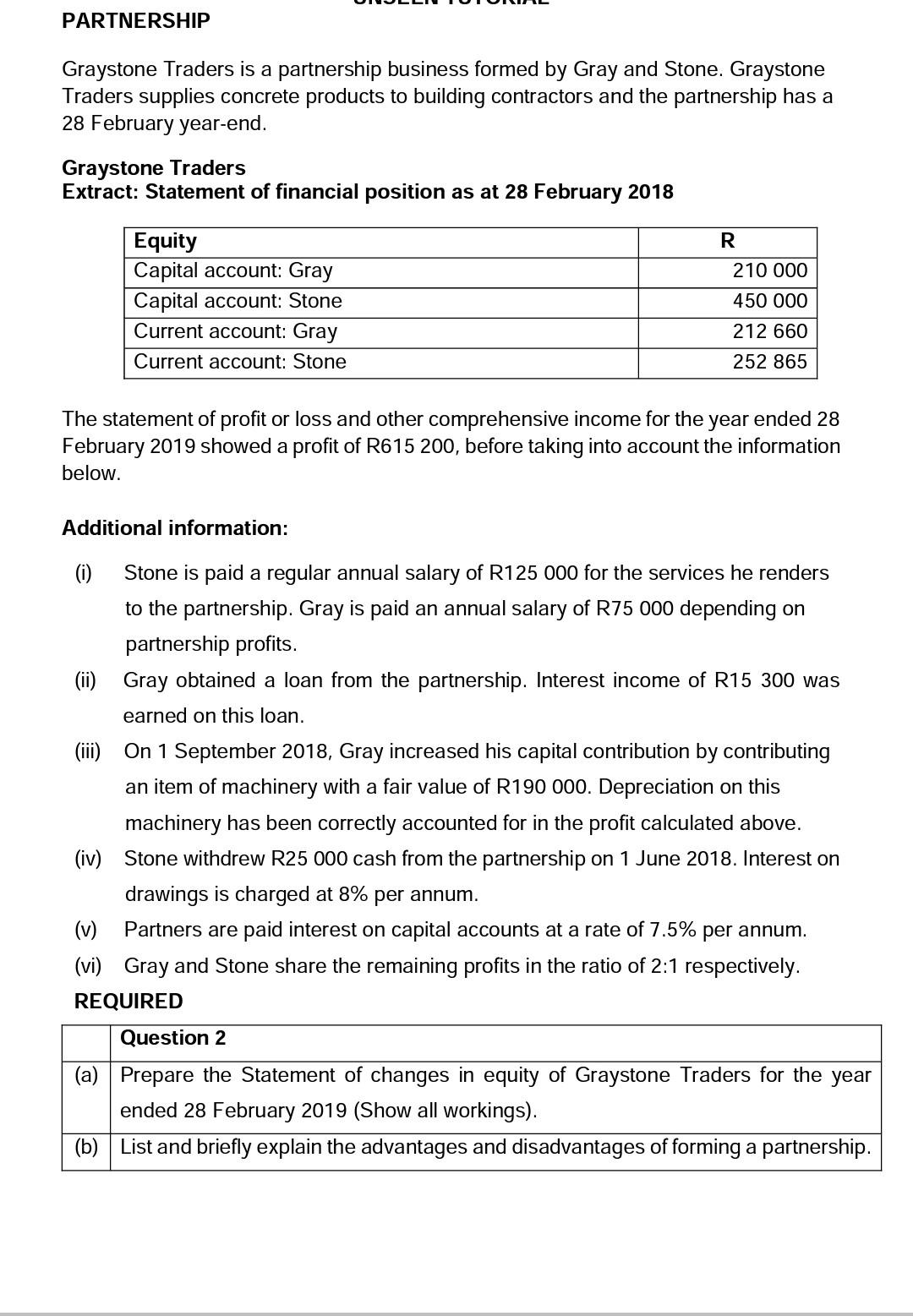

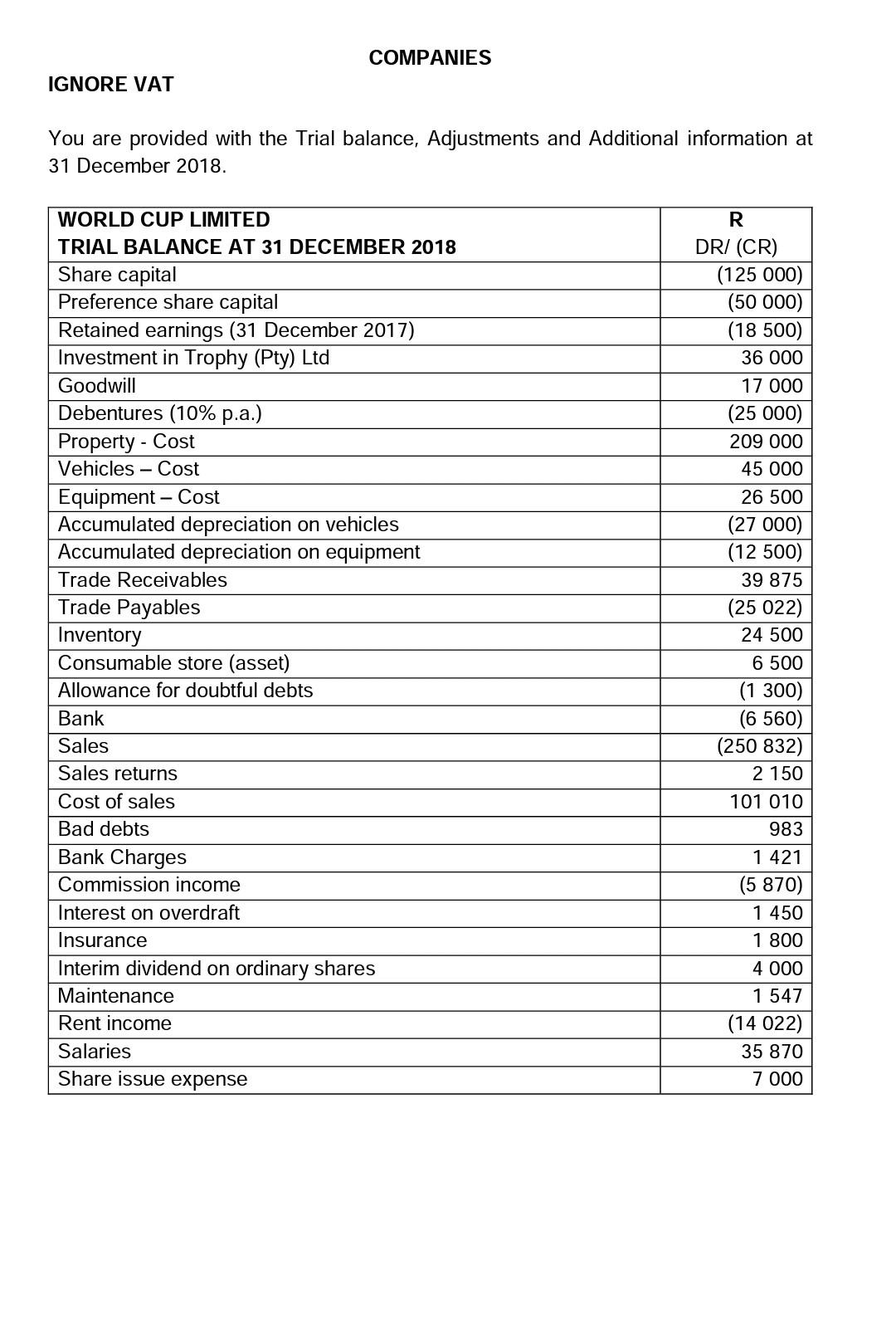

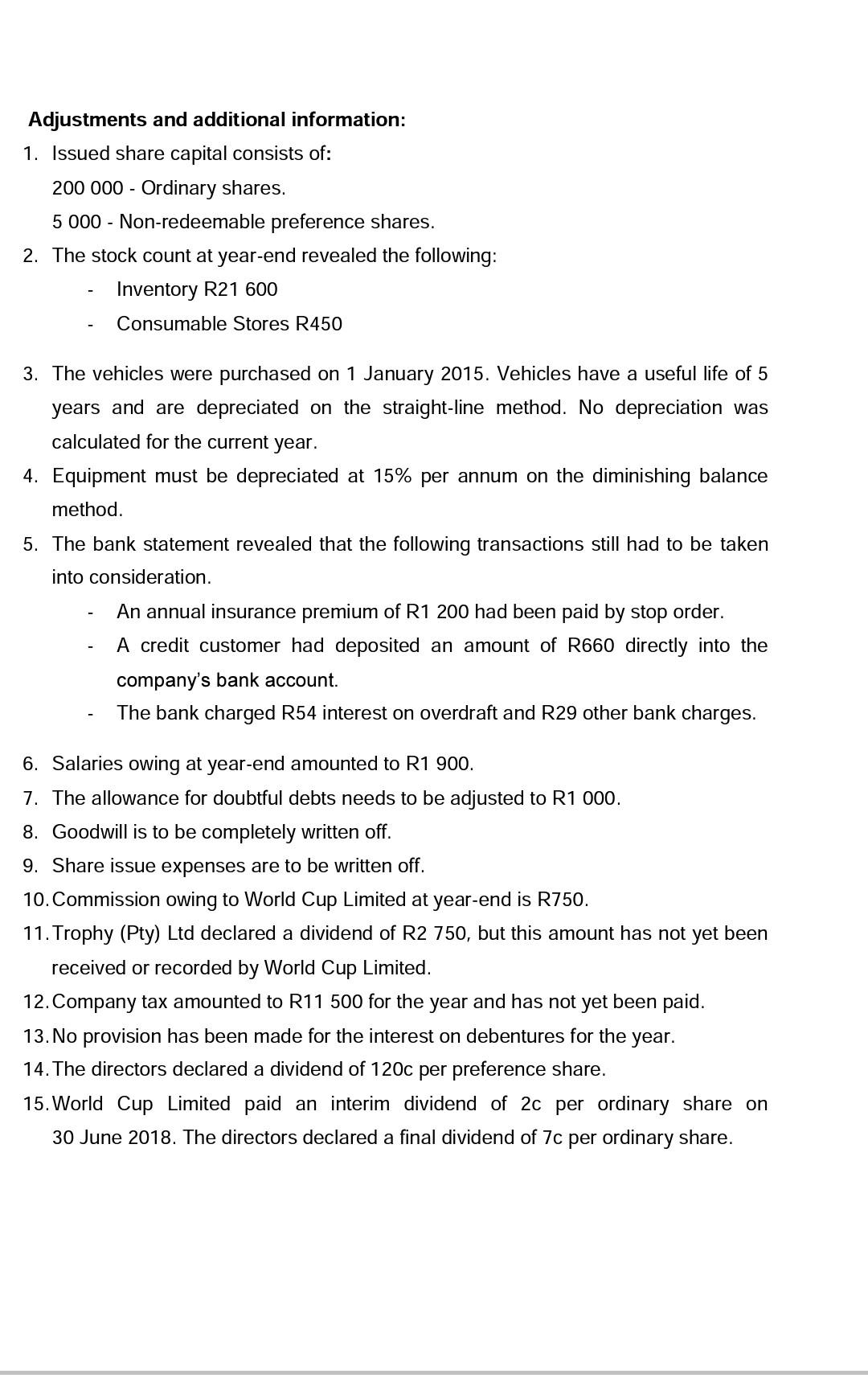

PARTNERSHIP Graystone Traders is a partnership business formed by Gray and Stone. Graystone Traders supplies concrete products to building contractors and the partnership has a 28 February year-end. Graystone Traders Extract: Statement of financial position as at 28 February 2018 Equity R 210 000 Capital account: Gray Capital account: Stone 450 000 Current account: Gray 212 660 Current account: Stone 252 865 The statement of profit or loss and other comprehensive income for the year ended 28 February 2019 showed a profit of R615 200, before taking into account the information below. Additional information: (i) Stone is paid a regular annual salary of R125 000 for the services he renders to the partnership. Gray is paid an annual salary of R75 000 depending on partnership profits. (ii) Gray obtained a loan from the partnership. Interest income of R15 300 was earned on this loan. (iii) On 1 September 2018, Gray increased his capital contribution by contributing an item of machinery with a fair value of R190 000. Depreciation on this machinery has been correctly accounted for in the profit calculated above. (iv) Stone withdrew R25 000 cash from the partnership on 1 June 2018. Interest on drawings is charged at 8% per annum. (v) Partners are paid interest on capital accounts at a rate of 7.5% per annum. (vi) Gray and Stone share the remaining profits in the ratio of 2:1 respectively. REQUIRED Question 2 (a) Prepare the Statement of changes in equity of Graystone Traders for the year ended 28 February 2019 (Show all workings). (b) List and briefly explain the advantages and disadvantages of forming a partnership. COMPANIES IGNORE VAT You are provided with the Trial balance, Adjustments and Additional information at 31 December 2018. WORLD CUP LIMITED R TRIAL BALANCE AT 31 DECEMBER 2018 DR/ (CR) Share capital Preference share capital Retained earnings (31 December 2017) Investment in Trophy (Pty) Ltd Goodwill Debentures (10% p.a.) Property - Cost Vehicles - Cost Equipment - Cost Accumulated depreciation on vehicles Accumulated depreciation on equipment Trade Receivables Trade Payables Inventory Consumable store (asset) Allowance for doubtful debts Bank Sales Sales returns Cost of sales Bad debts Bank Charges Commission income Interest on overdraft Insurance Interim dividend on ordinary shares Maintenance Rent income Salaries Share issue expense (125 000) (50 000) (18 500) 36 000 17 000 (25 000) 209 000 45 000 26 500 (27 000) (12 500) 39 875 (25 022) 24 500 6 500 (1 300) (6 560) (250 832) 2 150 101 010 983 1 421 (5 870) 1 450 1 800 4 000 1 547 (14 022) 35 870 7 000 Adjustments and additional information: 1. Issued share capital consists of: 200 000 - Ordinary shares. 5 000 - Non-redeemable preference shares. 2. The stock count at year-end revealed the following: Inventory R21 600 Consumable Stores R450 3. The vehicles were purchased on 1 January 2015. Vehicles have a useful life of 5 years and are depreciated on the straight-line method. No depreciation was calculated for the current year. 4. Equipment must be depreciated at 15% per annum on the diminishing balance method. 5. The bank statement revealed that the following transactions still had to be taken into consideration. An annual insurance premium of R1 200 had been paid by stop order. A credit customer had deposited an amount of R660 directly into the company's bank account. The bank charged R54 interest on overdraft and R29 other bank charges. 6. Salaries owing at year-end amounted to R1 900. 7. The allowance for doubtful debts needs to be adjusted to R1 000. 8. Goodwill is to be completely written off. 9. Share issue expenses are to be written off. 10. Commission owing to World Cup Limited at year-end is R750. 11. Trophy (Pty) Ltd declared a dividend of R2 750, but this amount has not yet been received or recorded by World Cup Limited. 12. Company tax amounted to R11 500 for the year and has not yet been paid. 13. No provision has been made for the interest on debentures for the year. 14. The directors declared a dividend of 120c per preference share. 15. World Cup Limited paid an interim dividend of 2c per ordinary share on 30 June 2018. The directors declared a final dividend of 7c per ordinary share. REQUIRED Note: Show and reference all workings. Round off to the nearest Rand. (a) Prepare the Statement of profit or loss and other comprehensive income for the year ended 31 December 2018. (b) Prepare the Statement of financial position as at 31 December 2018 (Equity and Liabilities section only)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started