Please help me . Please

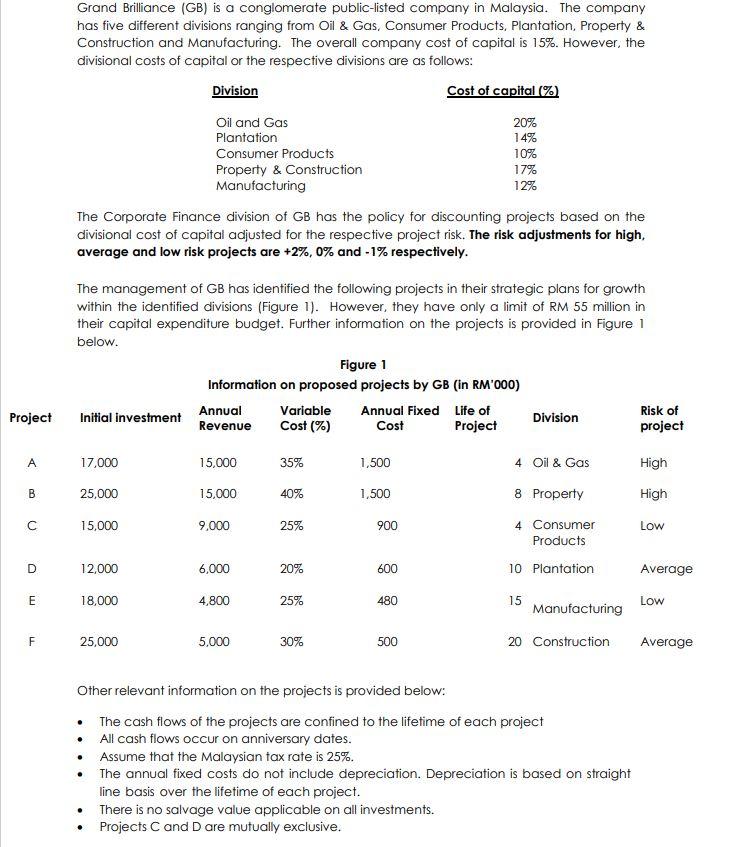

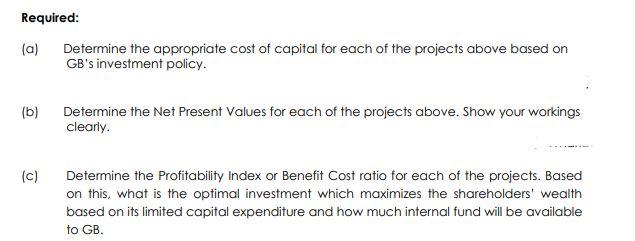

Grand Brilliance (GB) is a conglomerate public-listed company in Malaysia. The company has five different divisions ranging from Oil & Gas, Consumer Products, Plantation, Property & Construction and Manufacturing. The overall company cost of capital is 15%. However, the divisional costs of capital or the respective divisions are as follows: Division Cost of capital (%) Oil and Gas 20% Plantation 14% Consumer Products 10% Property & Construction 17% Manufacturing 12% The Corporate Finance division of GB has the policy for discounting projects based on the divisional cost of capital adjusted for the respective project risk. The risk adjustments for high, average and low risk projects are +2%, 0% and -1% respectively. The management of GB has identified the following projects in their strategic plans for growth within the identified divisions (Figure 1). However, they have only a limit of RM 55 million in their capital expenditure budget. Further information on the projects is provided in Figure 1 below. Figure 1 Information on proposed projects by GB (in RM'000) Annual Variable Initial investment Annual Fixed Life of Risk of Division Revenue Cost (%) Cost Project project Project A 17,000 15,000 35% 1,500 4 Oil & Gas High B 25,000 15,000 40% 1,500 8 Property High 15,000 9,000 25% 900 Low 4 Consumer Products 10 Plantation D 12,000 6,000 20% 600 Average E 18,000 4,800 25% 480 15 Low Manufacturing F 25,000 5,000 30% 500 20 Construction Average Other relevant information on the projects is provided below: The cash flows of the projects are confined to the lifetime of each project All cash flows occur on anniversary dates. Assume that the Malaysian tax rate is 25%. The annual fixed costs do not include depreciation. Depreciation is based on straight line basis over the lifetime of each project. There is no salvage value applicable on all investments. Projects C and D are mutually exclusive. Required: (a) Determine the appropriate cost of capital for each of the projects above based on GB's investment policy. (b) Determine the Net Present Values for each of the projects above. Show your workings clearly (c) Determine the Profitability Index or Benefit Cost ratio for each of the projects. Based on this, what is the optimal investment which maximizes the shareholders' wealth based on its limited capital expenditure and how much internal fund will be available to GB. Grand Brilliance (GB) is a conglomerate public-listed company in Malaysia. The company has five different divisions ranging from Oil & Gas, Consumer Products, Plantation, Property & Construction and Manufacturing. The overall company cost of capital is 15%. However, the divisional costs of capital or the respective divisions are as follows: Division Cost of capital (%) Oil and Gas 20% Plantation 14% Consumer Products 10% Property & Construction 17% Manufacturing 12% The Corporate Finance division of GB has the policy for discounting projects based on the divisional cost of capital adjusted for the respective project risk. The risk adjustments for high, average and low risk projects are +2%, 0% and -1% respectively. The management of GB has identified the following projects in their strategic plans for growth within the identified divisions (Figure 1). However, they have only a limit of RM 55 million in their capital expenditure budget. Further information on the projects is provided in Figure 1 below. Figure 1 Information on proposed projects by GB (in RM'000) Annual Variable Initial investment Annual Fixed Life of Risk of Division Revenue Cost (%) Cost Project project Project A 17,000 15,000 35% 1,500 4 Oil & Gas High B 25,000 15,000 40% 1,500 8 Property High 15,000 9,000 25% 900 Low 4 Consumer Products 10 Plantation D 12,000 6,000 20% 600 Average E 18,000 4,800 25% 480 15 Low Manufacturing F 25,000 5,000 30% 500 20 Construction Average Other relevant information on the projects is provided below: The cash flows of the projects are confined to the lifetime of each project All cash flows occur on anniversary dates. Assume that the Malaysian tax rate is 25%. The annual fixed costs do not include depreciation. Depreciation is based on straight line basis over the lifetime of each project. There is no salvage value applicable on all investments. Projects C and D are mutually exclusive. Required: (a) Determine the appropriate cost of capital for each of the projects above based on GB's investment policy. (b) Determine the Net Present Values for each of the projects above. Show your workings clearly (c) Determine the Profitability Index or Benefit Cost ratio for each of the projects. Based on this, what is the optimal investment which maximizes the shareholders' wealth based on its limited capital expenditure and how much internal fund will be available to GB