Answered step by step

Verified Expert Solution

Question

1 Approved Answer

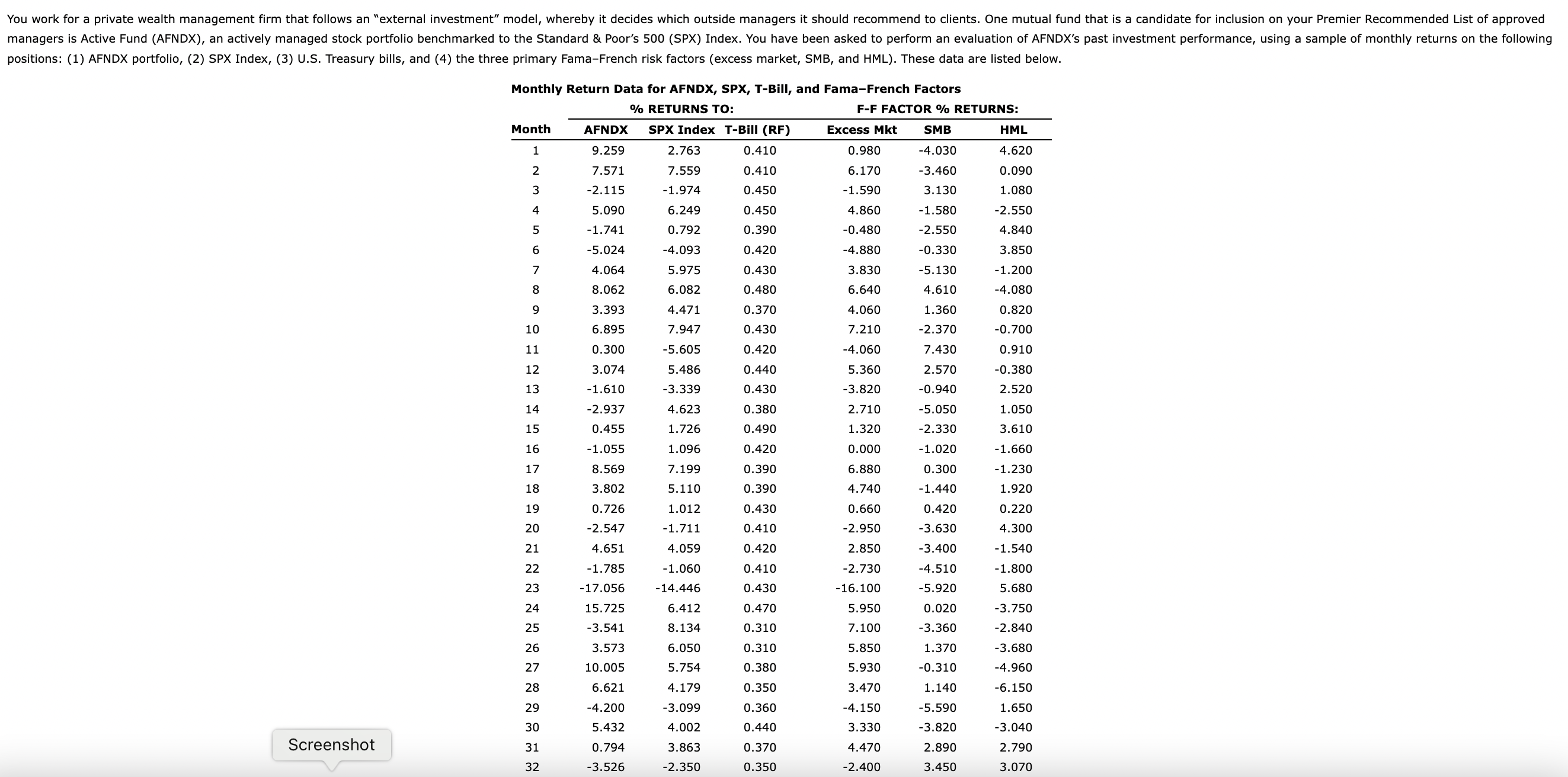

Please help me! positions: (1) AFNDX portfolio, (2) SPX Index, (3) U.S. Treasury bills, and (4) the three primary Fama-French risk factors (excess market, SMB,

Please help me!

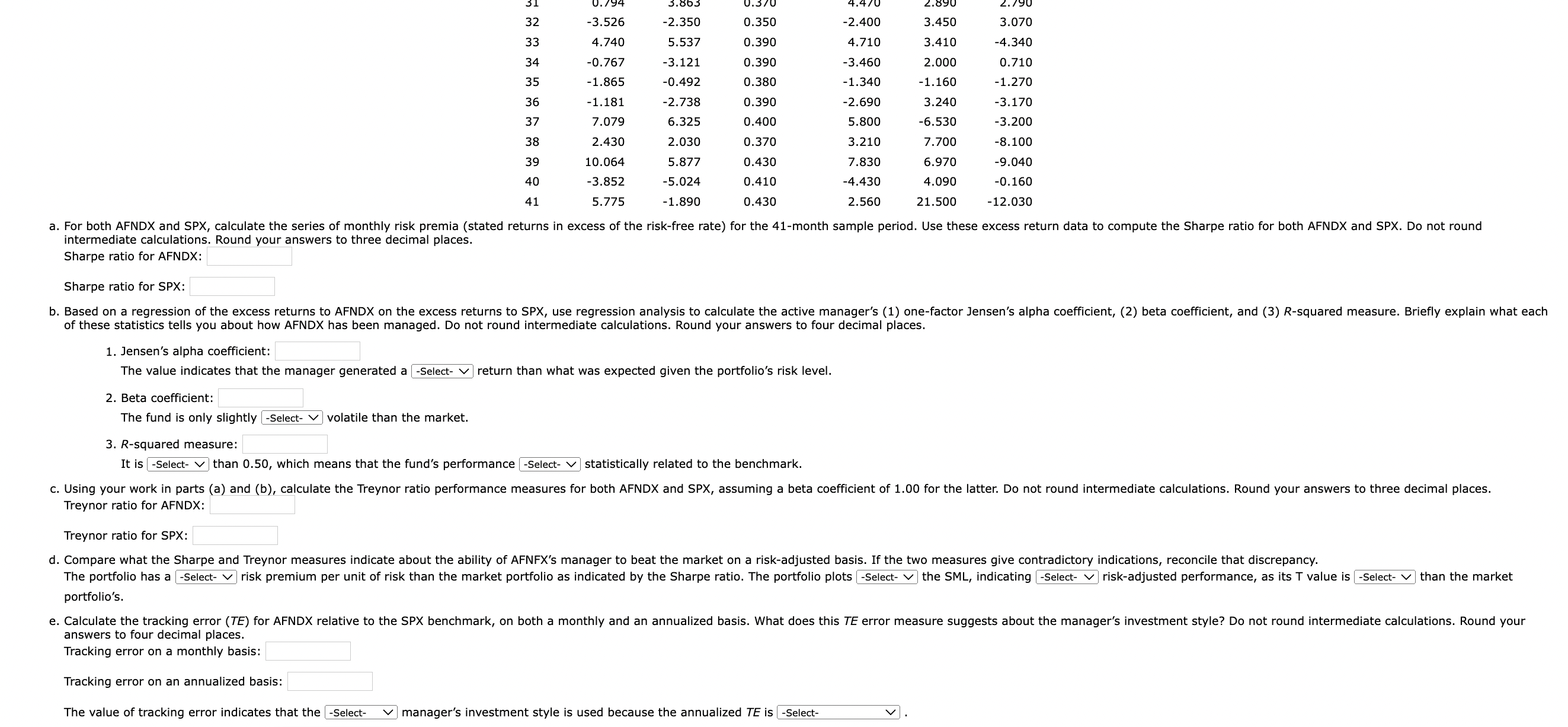

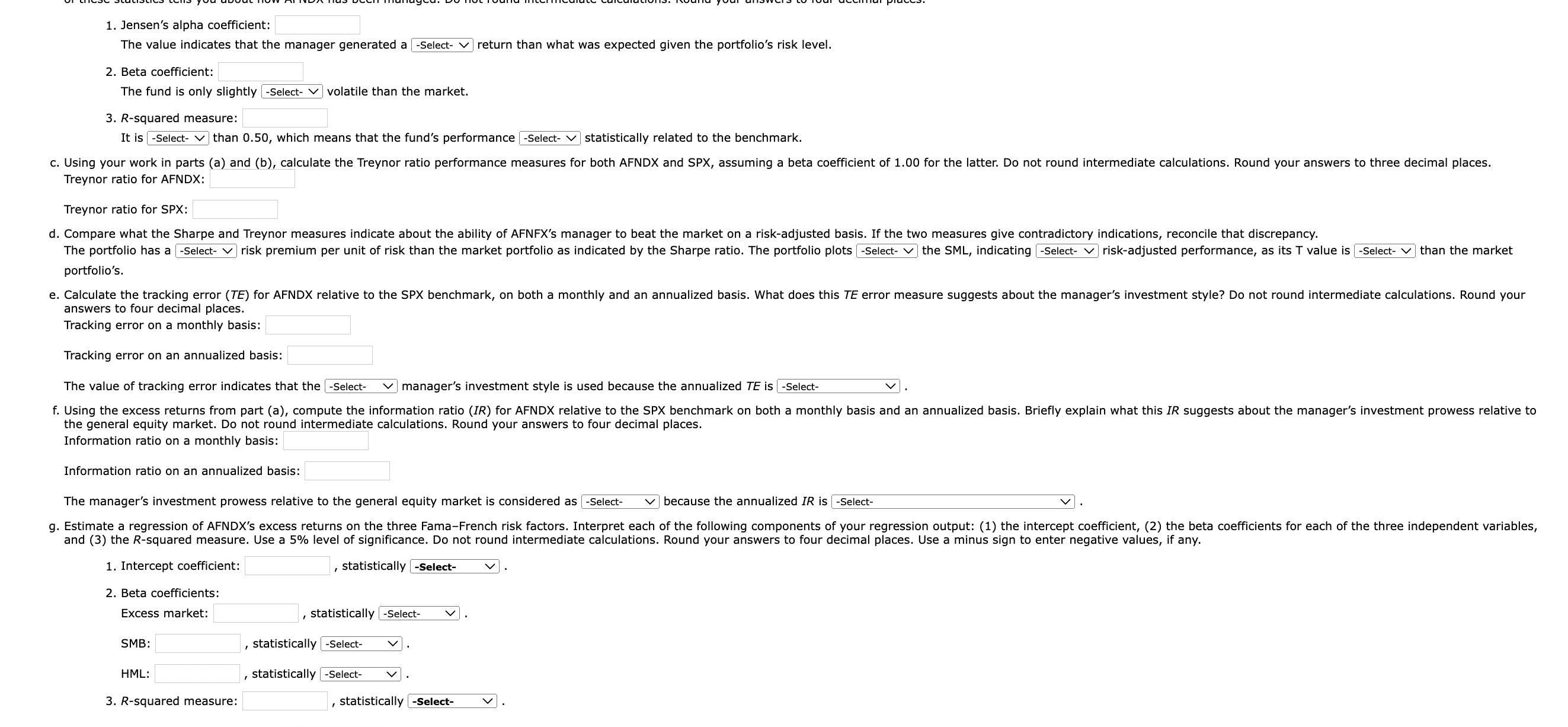

positions: (1) AFNDX portfolio, (2) SPX Index, (3) U.S. Treasury bills, and (4) the three primary Fama-French risk factors (excess market, SMB, and HML). These data are listed below. intermediate calculations. Round vour answers to three decimal places. Sharpe ratio for AFNDX: Sharpe ratio for SPX: of these statistics tells you about how AFNDX has been managed. Do not round intermediate calculations. Round your answers to four decimal places. 1. Jensen's alpha coefficient: The value indicates that the manager generated a return than what was expected given the portfolio's risk level. 2. Beta coefficient: The fund is only slightly - Select- V volatile than the market. 3. R-squared measure: It is -Select- V than 0.50 , which means that the fund's performance statistically related to the benchmark. Treynor ratio for AFNDX Treynor ratio for SPX: The portfolio has a risk premium per unit of risk than the market portfolio as indicated by the Sharpe ratio. The portfolio plots | the SML, indicating risk-adjusted performance, as its T value is than the market portfolio's. answers to four decimal places. Tracking error on a monthly basis: Tracking error on an annualized basis: The value of tracking error indicates that the - -Select- V manager's investment style is used because the annualized TE is - Select- 1. Jensen's alpha coefficient: The value indicates that the manager generated a -Select- V return than what was expected given the portfolio's risk level. 2. Beta coefficient The fund is only slightly -Select- V volatile than the market. 3. R-squared measure: It is -Select- V than 0.50 , which means that the fund's performance statistically related to the benchmark. Treynor ratio for AFNDX: Treynor ratio for SPX: portfolio's. answers to four decimal places. Tracking error on a monthly basis: Tracking error on an annualized basis: The value of tracking error indicates that the manager's investment style is used because the annualized TE is the general equity market. Do not round intermediate calculations. Round your answers to four decimal places. Information ratio on a monthly basis: Information ratio on an annualized basis: The manager's investment prowess relative to the general equity market is considered as because the annualized IR is -Select- 1. Intercept coefficient: , statistically 2. Beta coefficients: Excess market: , statistically SMB: HML: , statistically 3. R-squared measure: , statistically positions: (1) AFNDX portfolio, (2) SPX Index, (3) U.S. Treasury bills, and (4) the three primary Fama-French risk factors (excess market, SMB, and HML). These data are listed below. intermediate calculations. Round vour answers to three decimal places. Sharpe ratio for AFNDX: Sharpe ratio for SPX: of these statistics tells you about how AFNDX has been managed. Do not round intermediate calculations. Round your answers to four decimal places. 1. Jensen's alpha coefficient: The value indicates that the manager generated a return than what was expected given the portfolio's risk level. 2. Beta coefficient: The fund is only slightly - Select- V volatile than the market. 3. R-squared measure: It is -Select- V than 0.50 , which means that the fund's performance statistically related to the benchmark. Treynor ratio for AFNDX Treynor ratio for SPX: The portfolio has a risk premium per unit of risk than the market portfolio as indicated by the Sharpe ratio. The portfolio plots | the SML, indicating risk-adjusted performance, as its T value is than the market portfolio's. answers to four decimal places. Tracking error on a monthly basis: Tracking error on an annualized basis: The value of tracking error indicates that the - -Select- V manager's investment style is used because the annualized TE is - Select- 1. Jensen's alpha coefficient: The value indicates that the manager generated a -Select- V return than what was expected given the portfolio's risk level. 2. Beta coefficient The fund is only slightly -Select- V volatile than the market. 3. R-squared measure: It is -Select- V than 0.50 , which means that the fund's performance statistically related to the benchmark. Treynor ratio for AFNDX: Treynor ratio for SPX: portfolio's. answers to four decimal places. Tracking error on a monthly basis: Tracking error on an annualized basis: The value of tracking error indicates that the manager's investment style is used because the annualized TE is the general equity market. Do not round intermediate calculations. Round your answers to four decimal places. Information ratio on a monthly basis: Information ratio on an annualized basis: The manager's investment prowess relative to the general equity market is considered as because the annualized IR is -Select- 1. Intercept coefficient: , statistically 2. Beta coefficients: Excess market: , statistically SMB: HML: , statistically 3. R-squared measure: , statisticallyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started