please help me prepare the statement of changes in financial position. thank you very much.

please help me prepare the statement of changes in financial position. thank you very much.

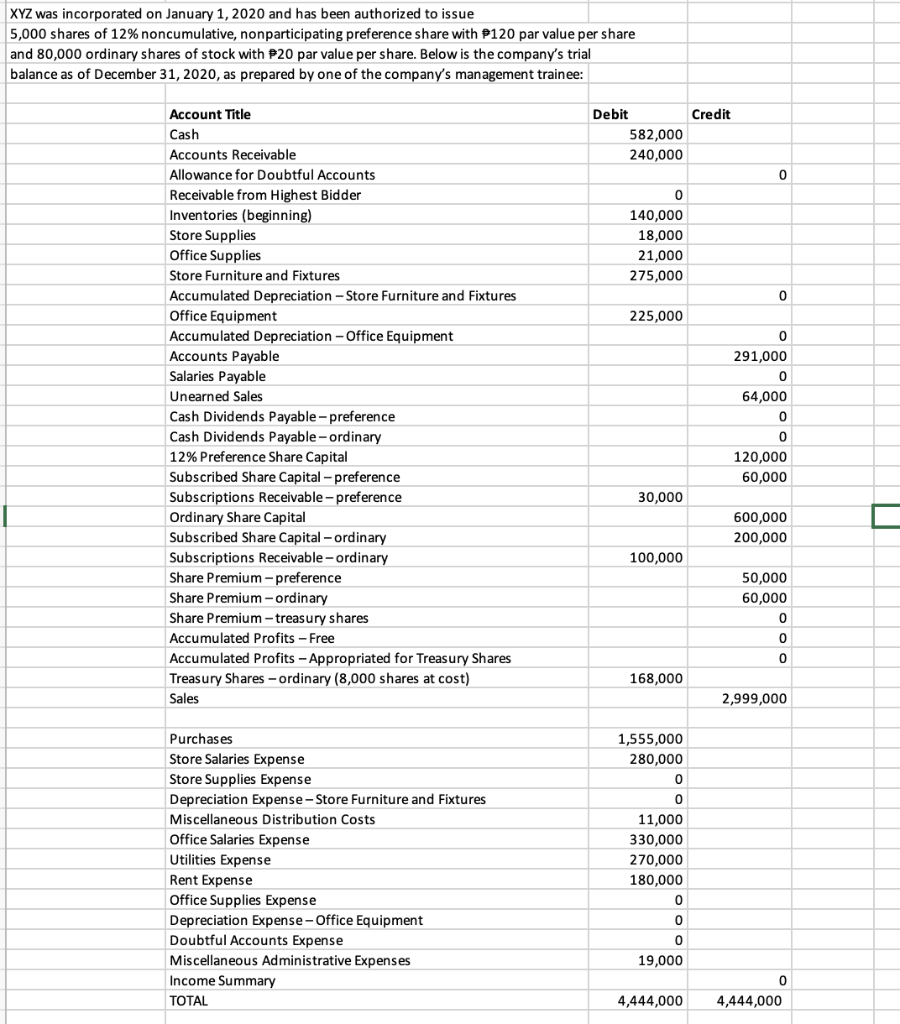

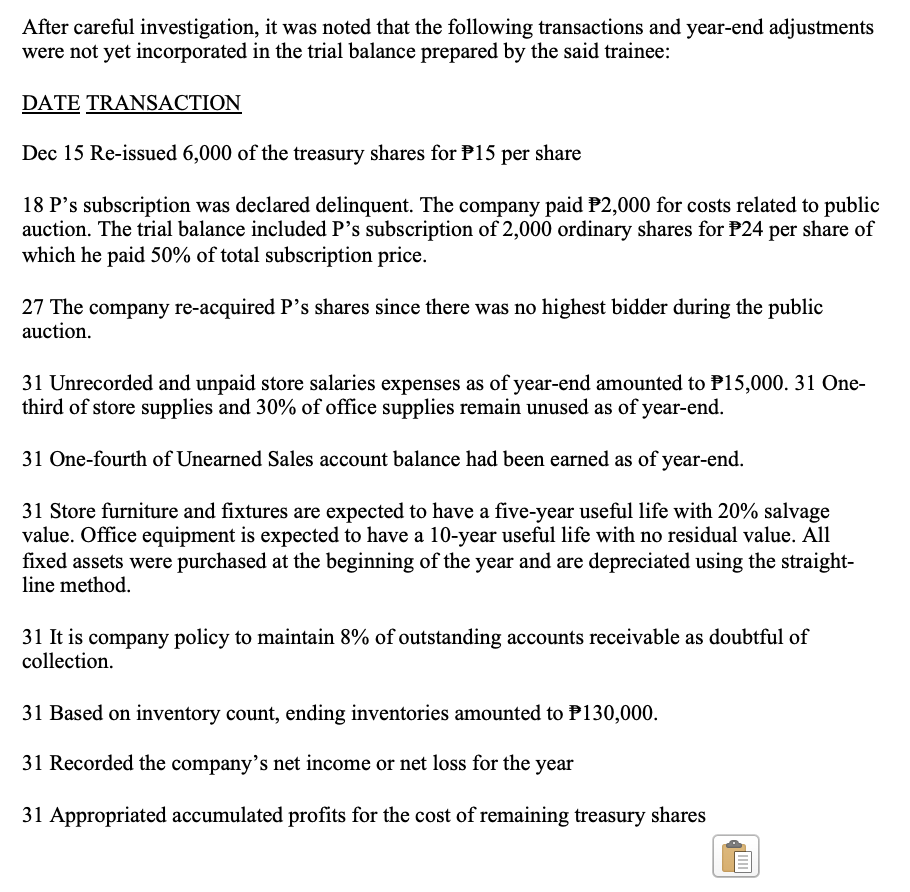

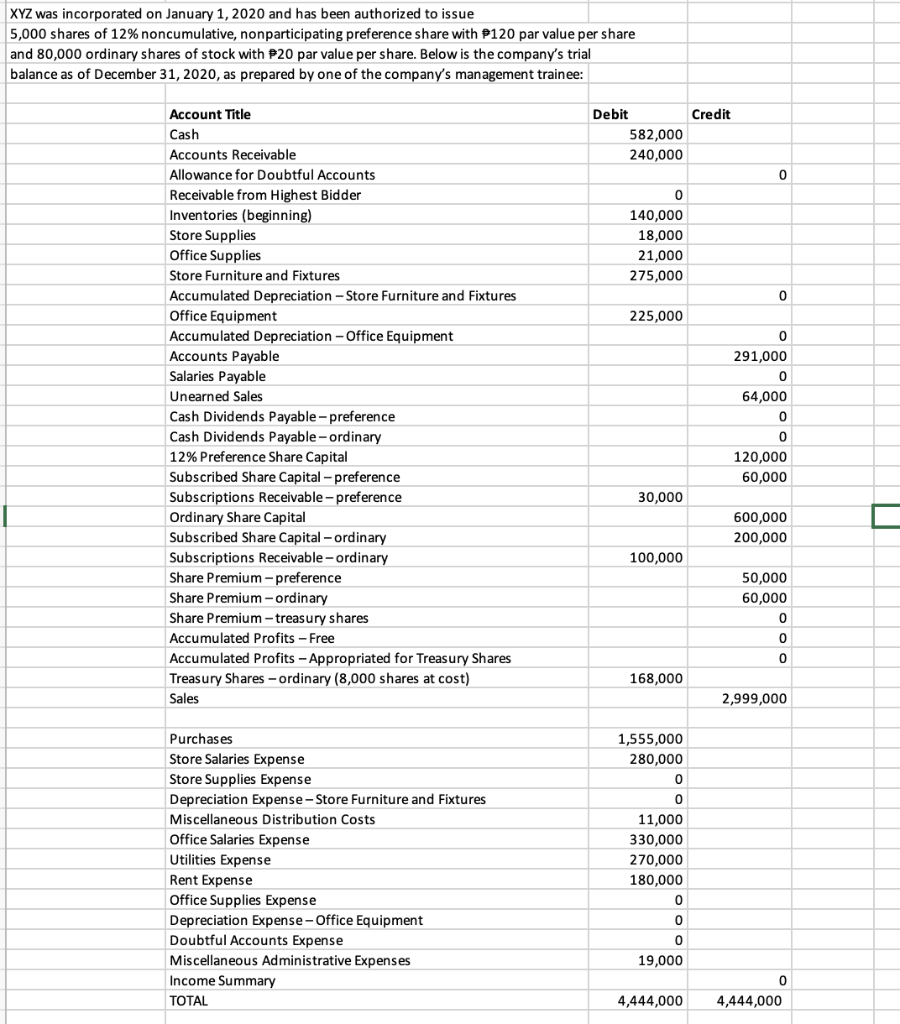

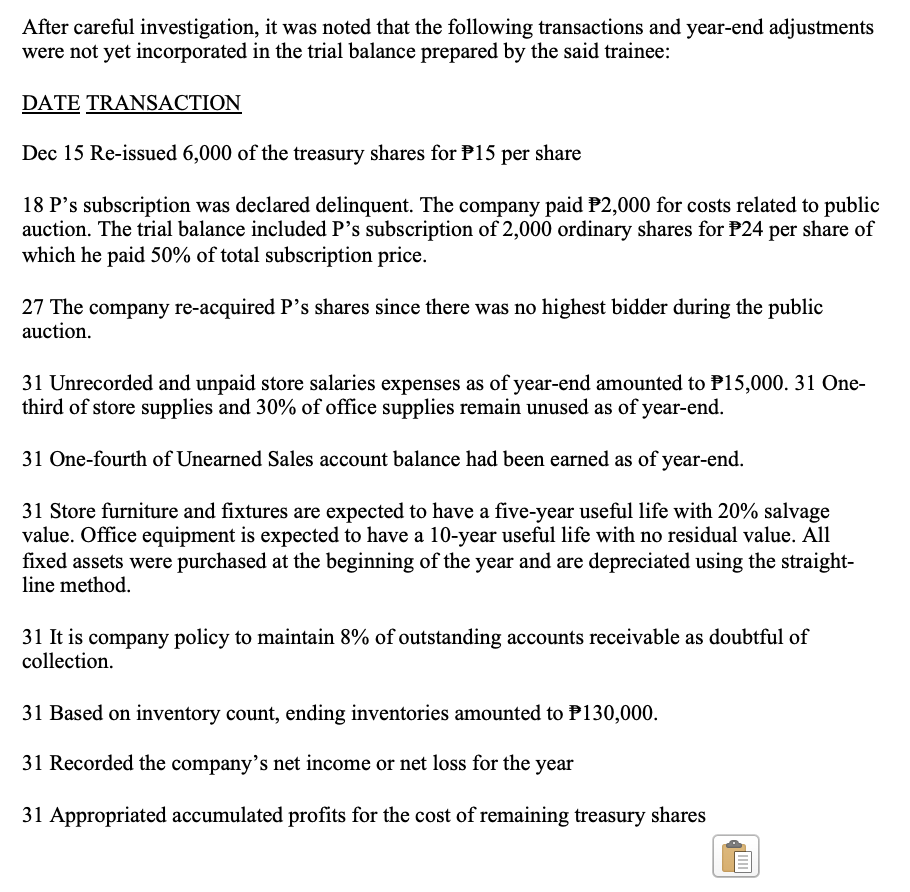

After careful investigation, it was noted that the following transactions and year-end adjustments were not yet incorporated in the trial balance prepared by the said trainee: DATE TRANSACTION Dec 15 Re-issued 6,000 of the treasury shares for P15 per share 18 P's subscription was declared delinquent. The company paid P2,000 for costs related to public auction. The trial balance included P's subscription of 2,000 ordinary shares for P24 per share of which he paid 50% of total subscription price. 27 The company re-acquired P's shares since there was no highest bidder during the public auction. 31 Unrecorded and unpaid store salaries expenses as of year-end amounted to P15,000. 31 One- third of store supplies and 30% of office supplies remain unused as of year-end. 31 One-fourth of Unearned Sales account balance had been earned as of year-end. 31 Store furniture and fixtures are expected to have a five-year useful life with 20% salvage value. Office equipment is expected to have a 10-year useful life with no residual value. All fixed assets were purchased at the beginning of the year and are depreciated using the straight- line method. 31 It is company policy to maintain 8% of outstanding accounts receivable as doubtful of collection. 31 Based on inventory count, ending inventories amounted to P130,000. 31 Recorded the company's net income or net loss for the year 31 Appropriated accumulated profits for the cost of remaining treasury shares XYZ was incorporated on January 1, 2020 and has been authorized to issue 5,000 shares of 12% noncumulative, nonparticipating preference share with P120 par value per share and 80,000 ordinary shares of stock with P20 par value per share. Below is the company's trial balance as of December 31, 2020, as prepared by one of the company's management trainee: Credit Debit 582,000 240,000 0 0 140,000 18,000 21,000 275,000 0 225,000 0 Account Title Cash Accounts Receivable Allowance for Doubtful Accounts Receivable from Highest Bidder Inventories (beginning) Store Supplies Office Supplies Store Furniture and Fixtures Accumulated Depreciation - Store Furniture and Fixtures Office Equipment Accumulated Depreciation - Office Equipment Accounts Payable Salaries Payable Unearned Sales Cash Dividends Payable-preference Cash Dividends Payable-ordinary 12% Preference Share Capital Subscribed Share Capital - preference Subscriptions Receivable-preference Ordinary Share Capital Subscribed Share Capital - ordinary Subscriptions Receivable-ordinary Share Premium-preference Share Premium-ordinary Share Premium-treasury shares Accumulated Profits - Free Accumulated Profits - Appropriated for Treasury Shares Treasury Shares - ordinary (8,000 shares at cost) Sales 291,000 0 64,000 0 0 120,000 60,000 30,000 600,000 200,000 100,000 50,000 60,000 0 0 0 168,000 2,999,000 Purchases Store Salaries Expense Store Supplies Expense Depreciation Expense-Store Furniture and Fixtures Miscellaneous Distribution Costs Office Salaries Expense Utilities Expense Rent Expense Office Supplies Expense Depreciation Expense-Office Equipment Doubtful Accounts Expense Miscellaneous Administrative Expenses Income Summary TOTAL 1,555,000 280,000 0 0 11,000 330,000 270,000 180,000 0 0 0 19,000 4,444,000 0 4,444,000

please help me prepare the statement of changes in financial position. thank you very much.

please help me prepare the statement of changes in financial position. thank you very much.