Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me Question 15 of 20 . What is the primary difference between an accountable plan and a nonaccountable plan for an S corporation?

please help me

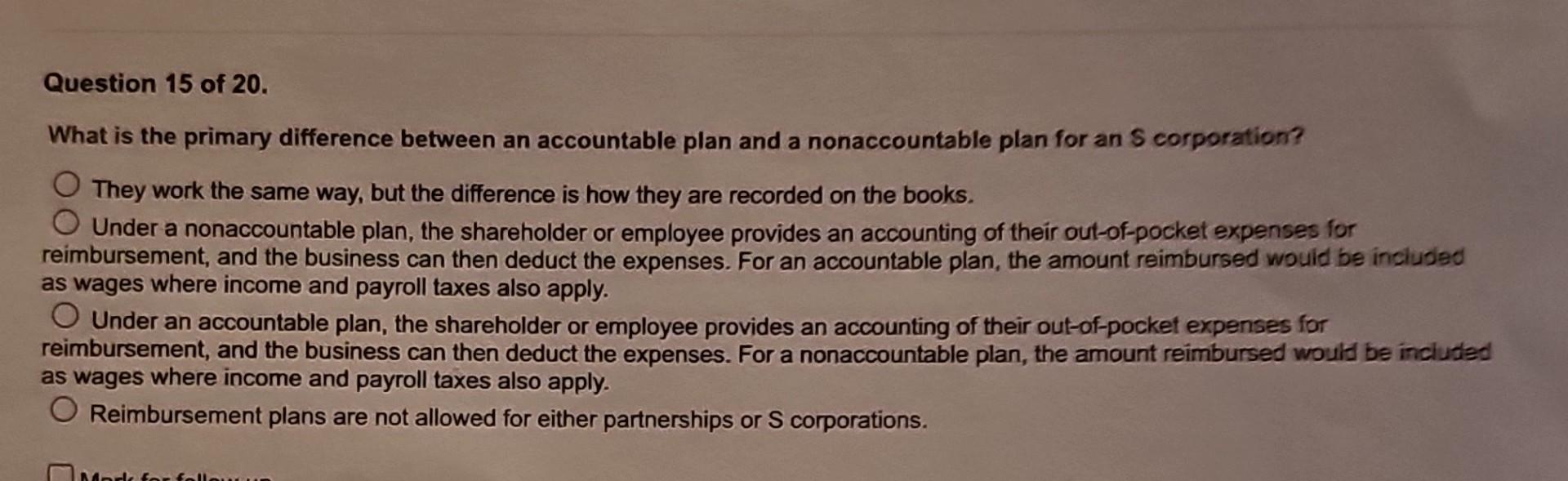

Question 15 of 20 . What is the primary difference between an accountable plan and a nonaccountable plan for an S corporation? They work the same way, but the difference is how they are recorded on the books. Under a nonaccountable plan, the shareholder or employee provides an accounting of their out-of-pocket expenses for reimbursement, and the business can then deduct the expenses. For an accountable plan, the amount reimbursed would be included as wages where income and payroll taxes also apply. Under an accountable plan, the shareholder or employee provides an accounting of their out-of-pocket expenses for reimbursement, and the business can then deduct the expenses. For a nonaccountable plan, the amount reimbursed would be included as wages where income and payroll taxes also apply. Reimbursement plans are not allowed for either partnerships or S corporationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started