Please help me . Safe me please

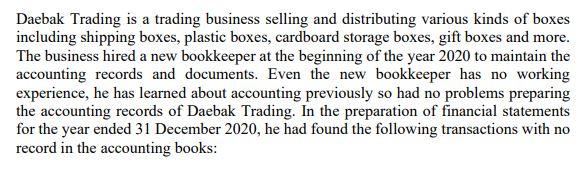

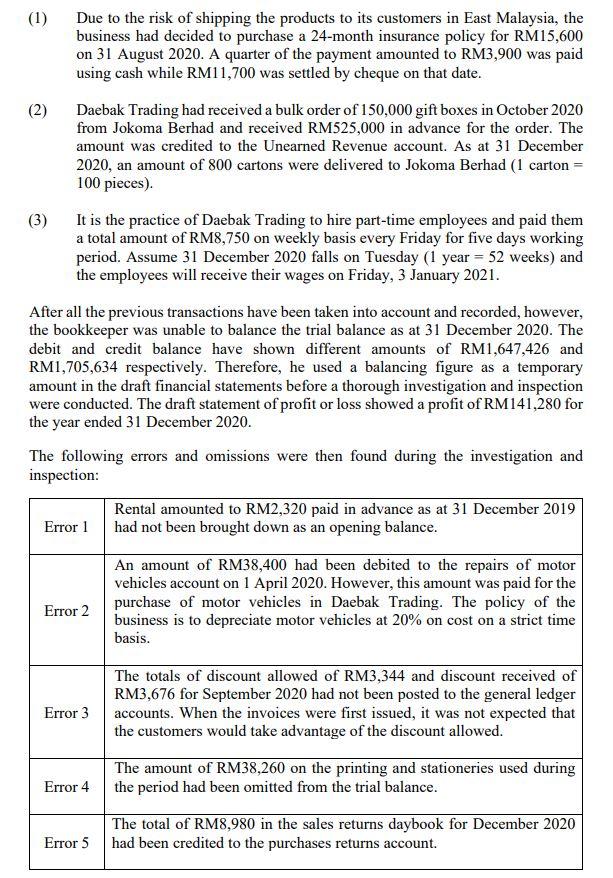

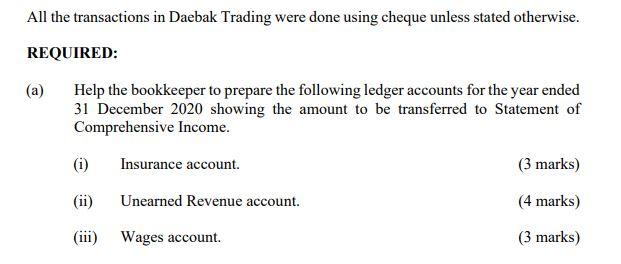

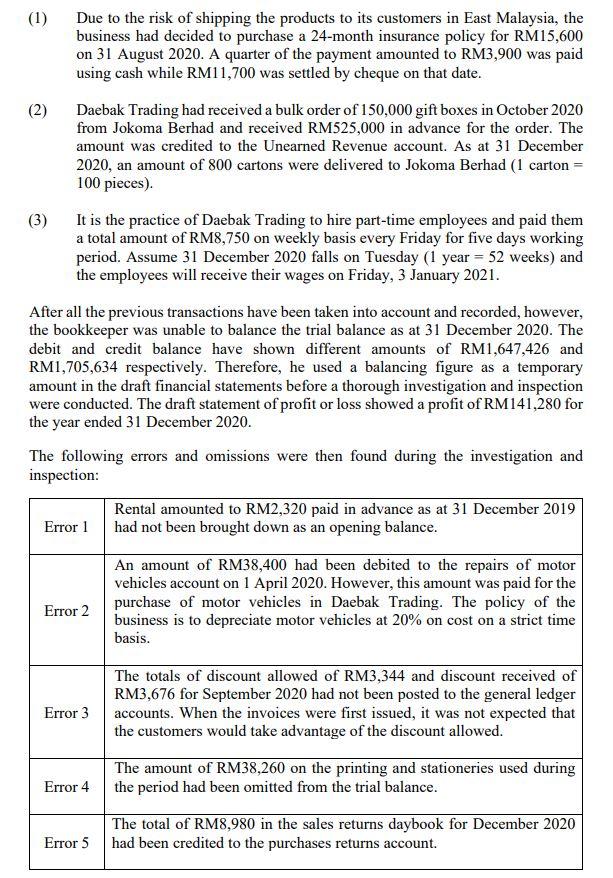

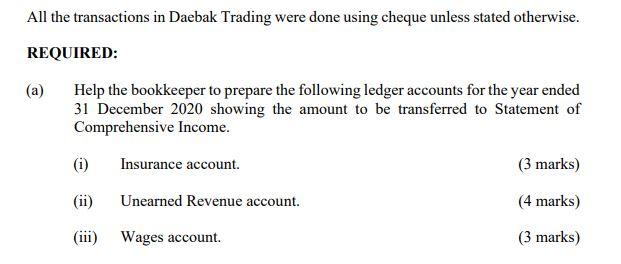

Daebak Trading is a trading business selling and distributing various kinds of boxes including shipping boxes, plastic boxes, cardboard storage boxes, gift boxes and more. The business hired a new bookkeeper at the beginning of the year 2020 to maintain the accounting records and documents. Even the new bookkeeper has no working experience, he has learned about accounting previously so had no problems preparing the accounting records of Daebak Trading. In the preparation of financial statements for the year ended 31 December 2020, he had found the following transactions with no record in the accounting books: (1) Due to the risk of shipping the products to its customers in East Malaysia, the business had decided to purchase a 24-month insurance policy for RM15,600 on 31 August 2020. A quarter of the payment amounted to RM3,900 was paid using cash while RM11,700 was settled by cheque on that date. (2) Daebak Trading had received a bulk order of 150,000 gift boxes in October 2020 from Jokoma Berhad and received RM525,000 in advance for the order. The amount was credited to the Unearned Revenue account. As at 31 December 2020, an amount of 800 cartons were delivered to Jokoma Berhad (1 carton = 100 pieces). (3) It is the practice of Daebak Trading to hire part-time employees and paid them a total amount of RM8,750 on weekly basis every Friday for five days working period. Assume 31 December 2020 falls on Tuesday (1 year = 52 weeks) and the employees will receive their wages on Friday, 3 January 2021. After all the previous transactions have been taken into account and recorded, however, the bookkeeper was unable to balance the trial balance as at 31 December 2020. The debit and credit balance have shown different amounts of RM1,647,426 and RM1,705,634 respectively. Therefore, he used a balancing figure as a temporary amount in the draft financial statements before a thorough investigation and inspection were conducted. The draft statement of profit or loss showed a profit of RM141,280 for the year ended 31 December 2020. The following errors and omissions were then found during the investigation and inspection: Rental amounted to RM2,320 paid in advance as at 31 December 2019 Error 1 had not been brought down as an opening balance. An amount of RM38,400 had been debited to the repairs of motor vehicles account on 1 April 2020. However, this amount was paid for the Error 2 purchase of motor vehicles in Daebak Trading. The policy of the business is to depreciate motor vehicles at 20% on cost on a strict time basis. The totals of discount allowed of RM3,344 and discount received of RM3,676 for September 2020 had not been posted to the general ledger Error 3 accounts. When the invoices were first issued, it was not expected that the customers would take advantage of the discount allowed. The amount of RM38,260 on the printing and stationeries used during Error 4 the period had been omitted from the trial balance. The total of RM8,980 in the sales returns daybook for December 2020 Error 5 had been credited to the purchases returns account. All the transactions in Daebak Trading were done using cheque unless stated otherwise. REQUIRED: (a) Help the bookkeeper to prepare the following ledger accounts for the year ended 31 December 2020 showing the amount to be transferred to Statement of Comprehensive Income. (i) Insurance account. (3 marks) (ii) Unearned Revenue account. (4 marks) (iii) Wages account