Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE HELP ME. SHOW YOUR WORK. ANSWER ON CHEGGS IS INCORRECT PLEASE DONT PROVIDE SAME ANSSWER. At the time of her death in 2022 ,

PLEASE HELP ME. SHOW YOUR WORK. ANSWER ON CHEGGS IS INCORRECT PLEASE DONT PROVIDE SAME ANSSWER.

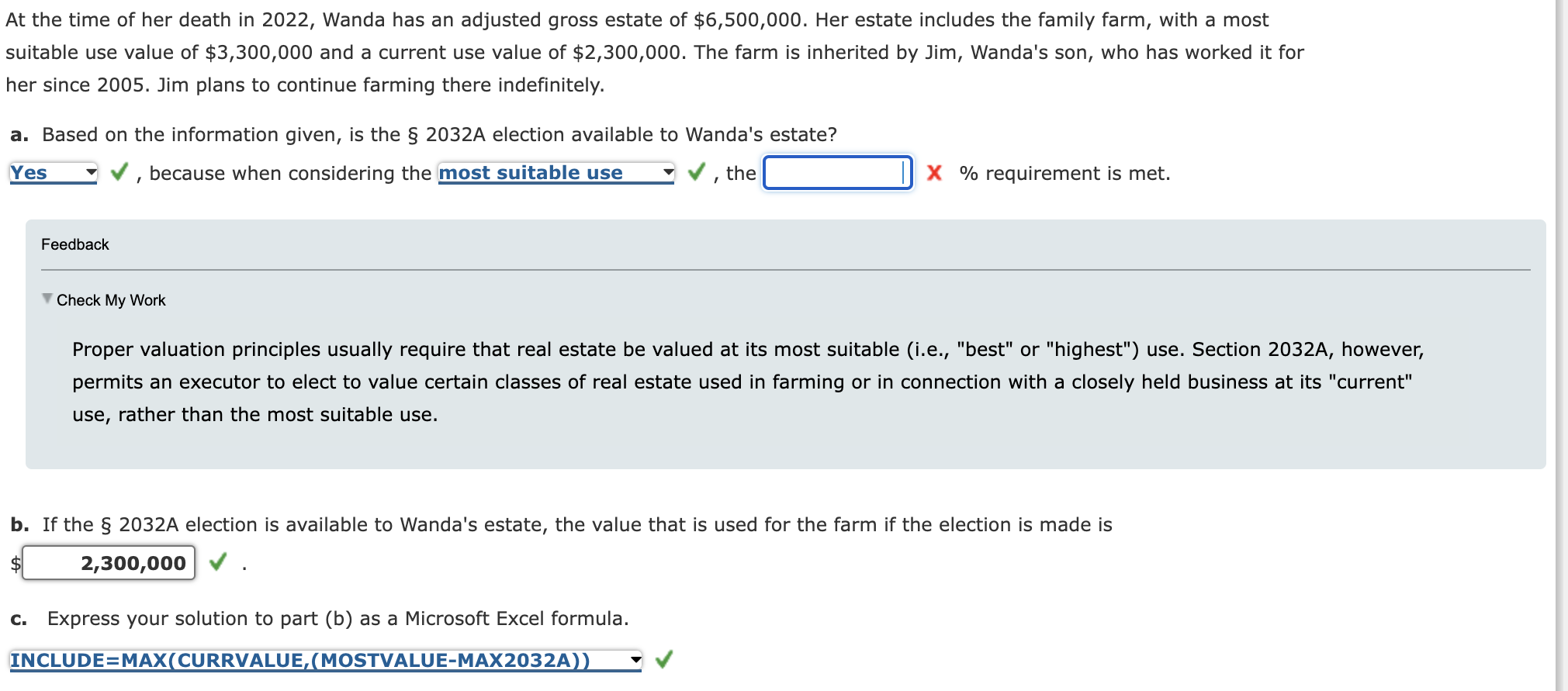

At the time of her death in 2022 , Wanda has an adjusted gross estate of $6,500,000. Her estate includes the family farm, with a most suitable use value of $3,300,000 and a current use value of $2,300,000. The farm is inherited by Jim, Wanda's son, who has worked it for her since 2005. Jim plans to continue farming there indefinitely. a. Based on the information given, is the 2032 election available to Wanda's estate? , because when considering the V, the X \% requirement is met. Feedback Check My Work Proper valuation principles usually require that real estate be valued at its most suitable (i.e., "best" or "highest") use. Section 2032A, however, permits an executor to elect to value certain classes of real estate used in farming or in connection with a closely held business at its "current" use, rather than the most suitable use. b. If the 2032A election is available to Wanda's estate, the value that is used for the farm if the election is made is c. Express your solution to part (b) as a Microsoft Excel formulaStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started