Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me Solano Company has sales of $620,000, cost of goods sold of $430,000, other operating expenses of $51,000, average invested assets of $1,900,000,

please help me

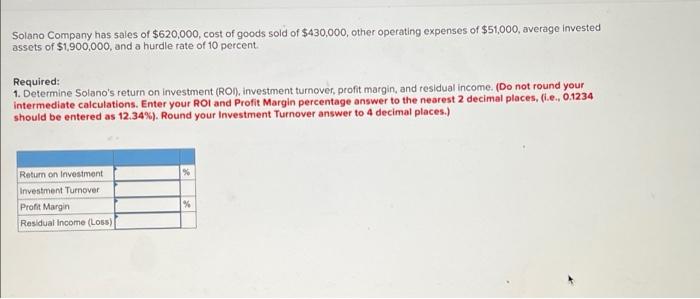

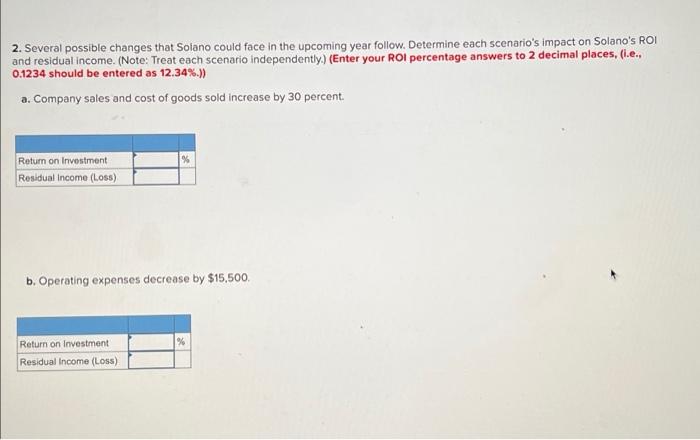

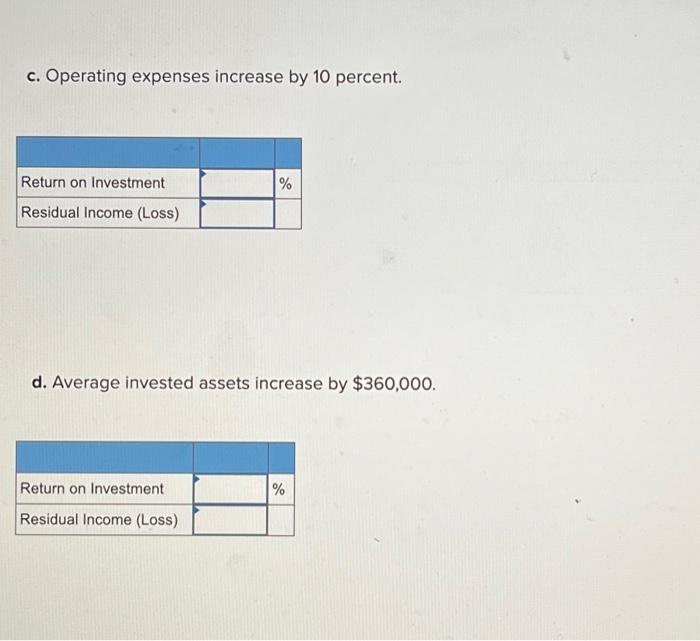

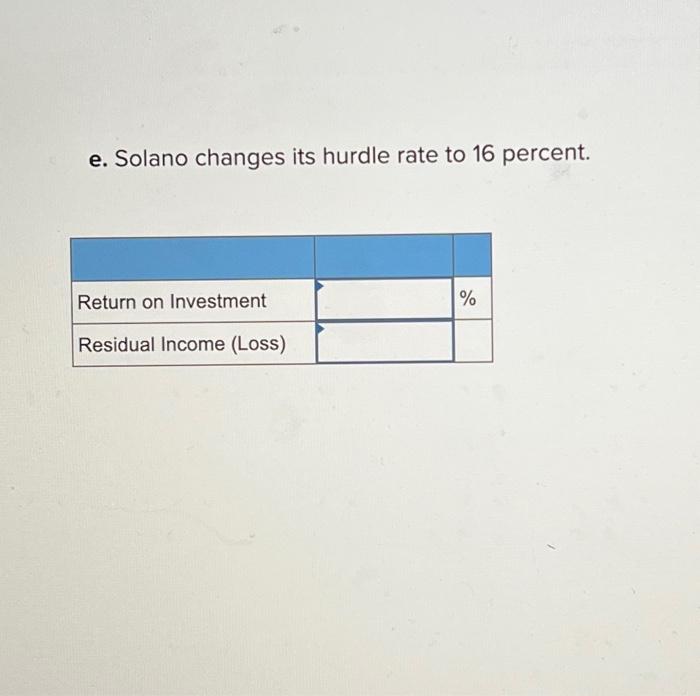

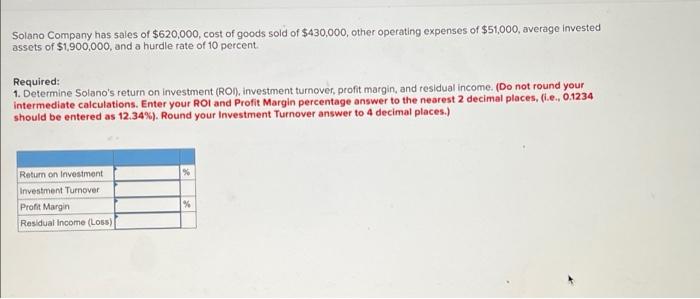

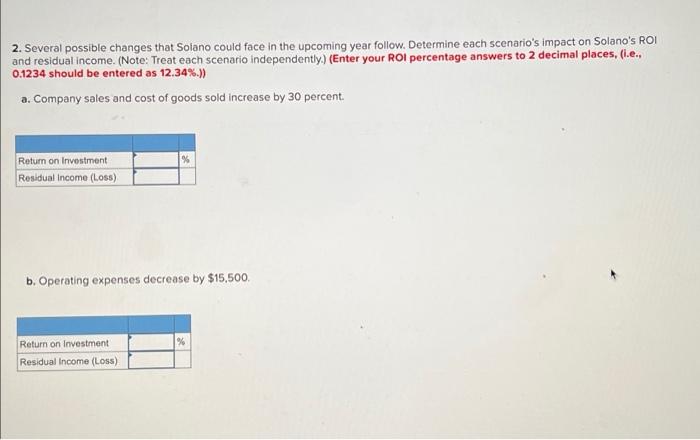

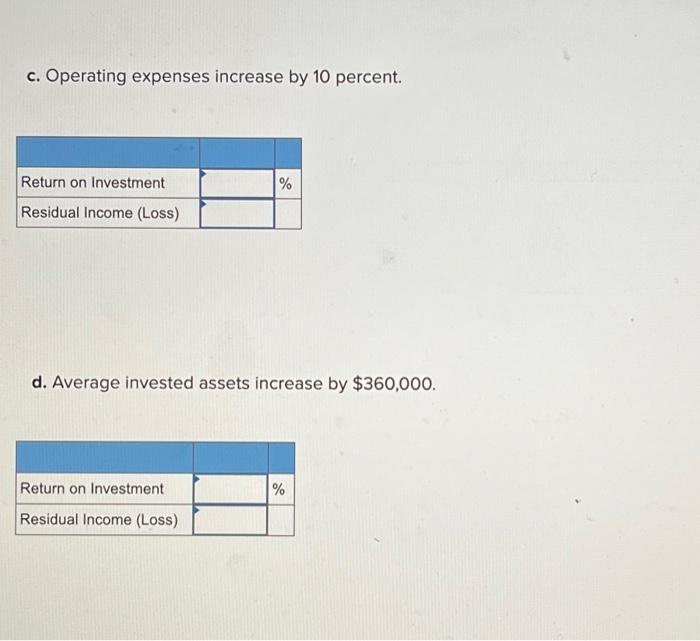

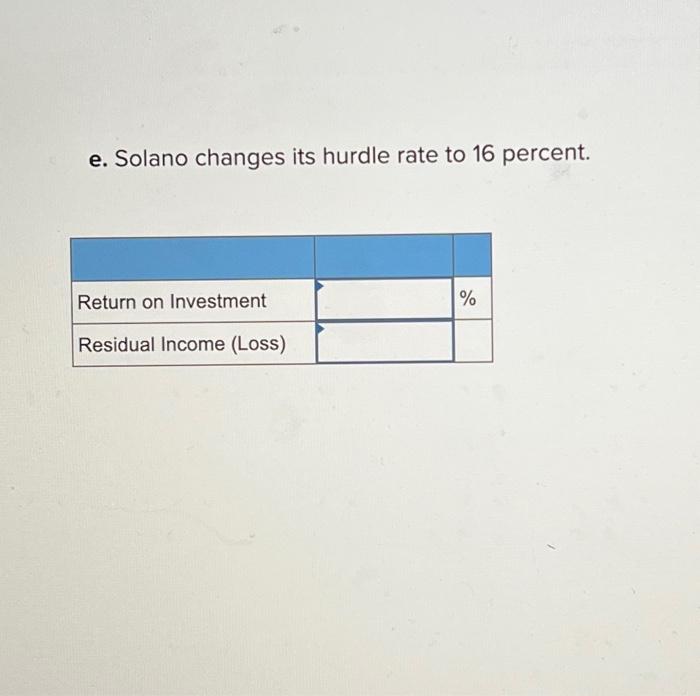

Solano Company has sales of $620,000, cost of goods sold of $430,000, other operating expenses of $51,000, average invested assets of $1,900,000, and a hurdle rate of 10 percent Required: 1. Determine Solano's return on investment (ROI), investment turnover, profit margin, and residual income. (Do not round your intermediate calculations. Enter your ROI and Profit Margin percentage answer to the nearest 2 decimal places, (i.e., 0.1234 should be entered as 12.34%). Round your investment Turnover answer to 4 decimal places.) Return on Investment Investment Turnover Profit Margin Residual income (Loss) % 2. Several possible changes that Solano could face in the upcoming year follow. Determine each scenario's impact on Solano's ROI and residual income. (Note: Treat each scenario independently.) (Enter your ROI percentage answers to 2 decimal places, (l.e., 0.1234 should be entered as 12.34%.)) a. Company sales and cost of goods sold increase by 30 percent Return on Investment Residual income (Loss) b. Operating expenses decrease by $15,500. Return on Investment Residual Income (Loss) c. Operating expenses increase by 10 percent. Return on Investment % Residual Income (Loss) d. Average invested assets increase by $360,000. Return on Investment % Residual Income (Loss) e. Solano changes its hurdle rate to 16 percent. Return on Investment % Residual Income (Loss)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started