Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me solve all 4 finance questions, will rate positive!! please only attempt if you will answer all. thank you and will return the

please help me solve all 4 finance questions, will rate positive!! please only attempt if you will answer all. thank you and will return the favor!

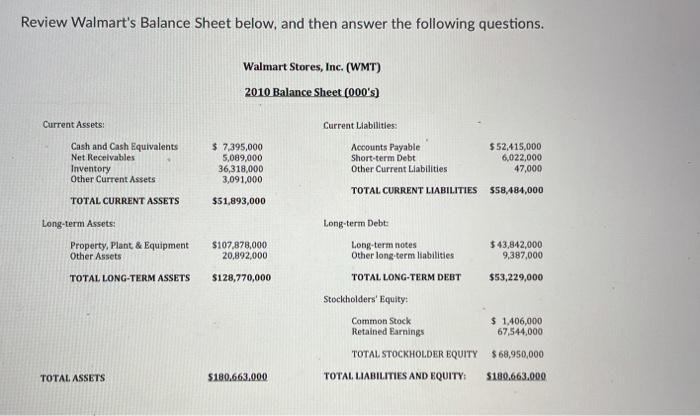

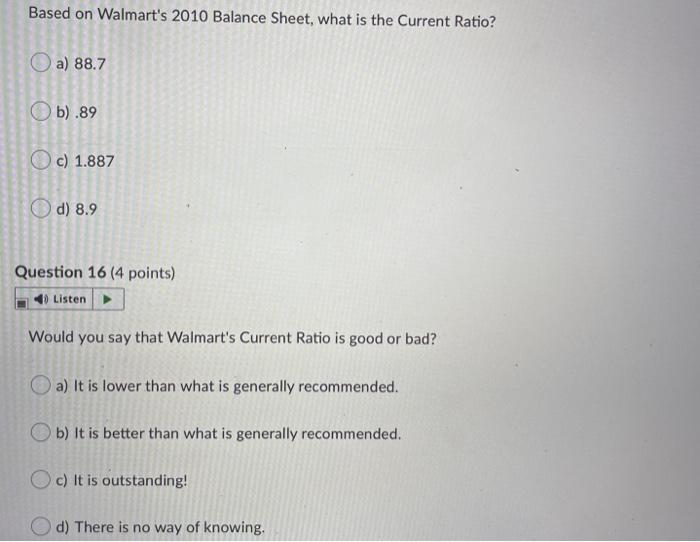

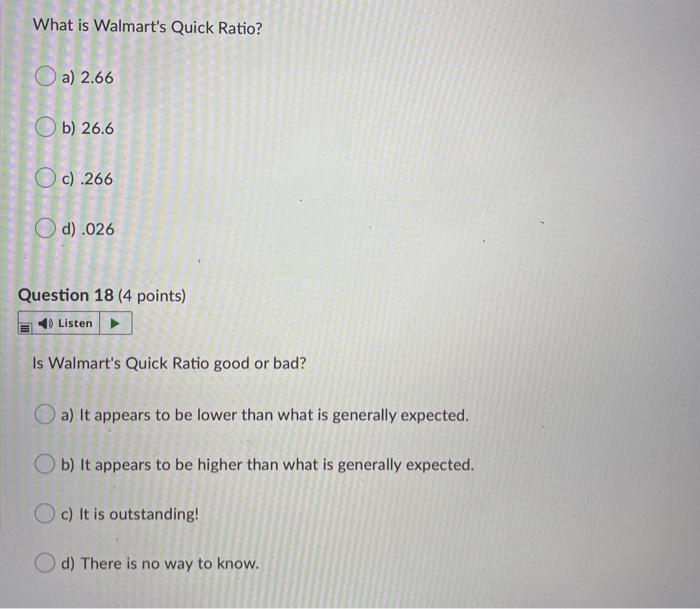

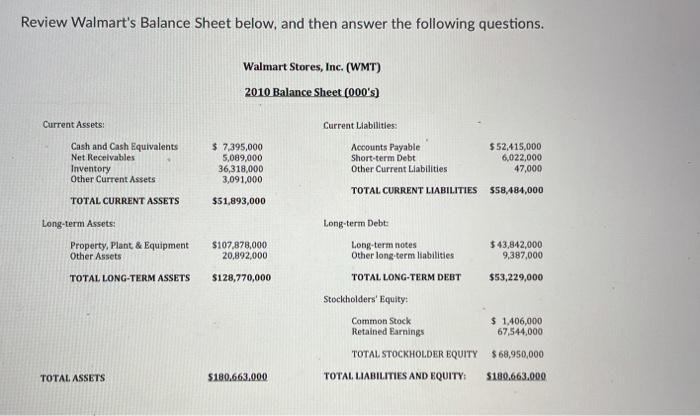

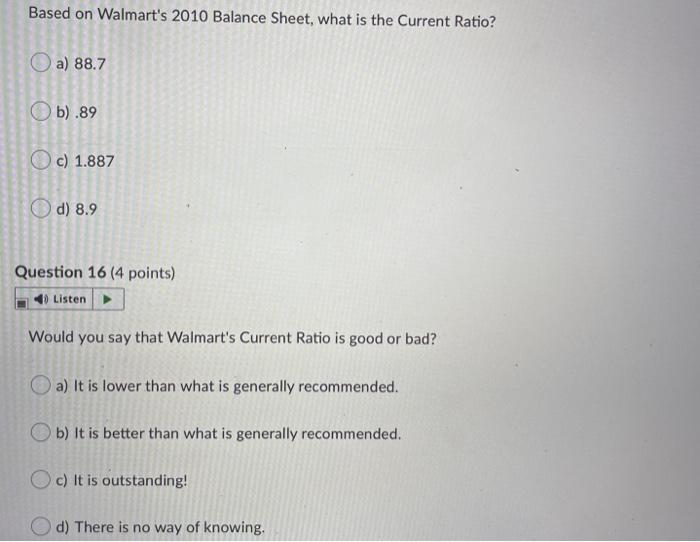

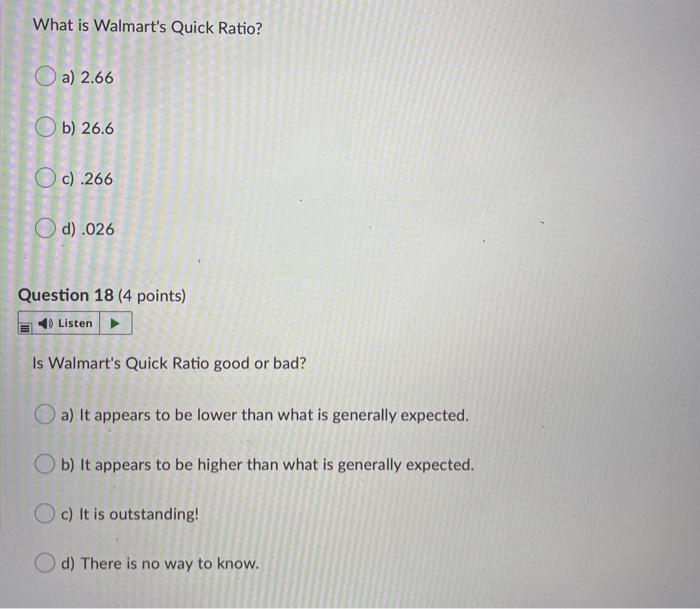

Review Walmart's Balance Sheet below, and then answer the following questions. Walmart Stores, Inc. (WMT) 2010 Balance Sheet (000's) Current Assets: Current Liabilities: Cash and Cash Equivalents Net Receivables Inventory Other Current Assets $ 7,395,000 5,089,000 36,318,000 3,091,000 Accounts Payable Short-term Debt Other Current Liabilities $ 52,415,000 6,022,000 47,000 TOTAL CURRENT LIABILITIES $58,484,000 TOTAL CURRENT ASSETS $51,893,000 Long-term Assets: Long-term Debt: Property, Plant & Equipment Other Assets $107,878,000 20,892,000 Long-term notes Other long-term liabilities $43,842,000 9,387,000 TOTAL LONG-TERM ASSETS $128,770,000 TOTAL LONG-TERM DEBT $53,229,000 Stockholders' Equity Common Stock Retained Earnings $ 1,406,000 67,544,000 TOTAL STOCKHOLDER EQUITY $68,950,000 TOTAL ASSETS $180.663.000 TOTAL LIABILITIES AND EQUITY: $180.663.000 Based on Walmart's 2010 Balance Sheet, what is the Current Ratio? a) 88.7 Ob).89 c) 1.887 d) 8.9 Question 16 (4 points) 4) Listen Would you say that Walmart's Current Ratio is good or bad? a) It is lower than what is generally recommended. Ob) It is better than what is generally recommended. c) It is outstanding! d) There is no way of knowing. What is Walmart's Quick Ratio? a) 2.66 Ob) 26.6 Oc).266 d).026 Question 18 (4 points) Listen Is Walmart's Quick Ratio good or bad? a) It appears to be lower than what is generally expected. b) It appears to be higher than what is generally expected. c) It is outstanding! d) There is no way to know

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started