please help me solve e,f,g,h

the previous parts are already solved by a chegg expert

thank you very much :)

here are part a-d for bond a and b from chegg expert

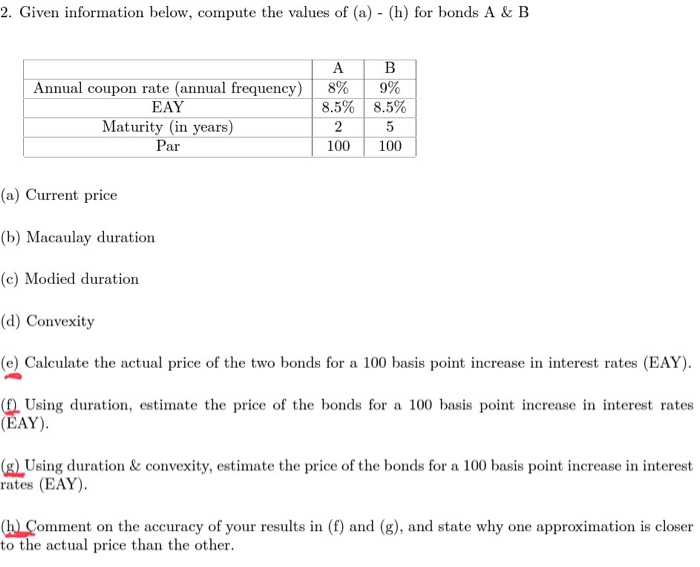

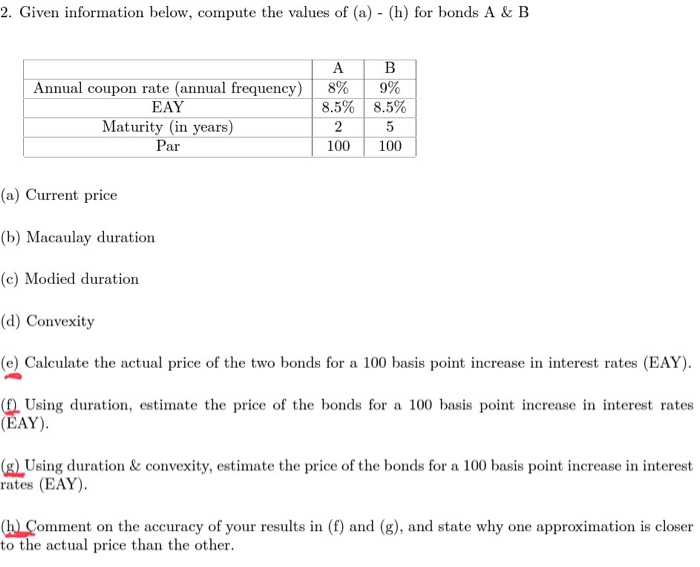

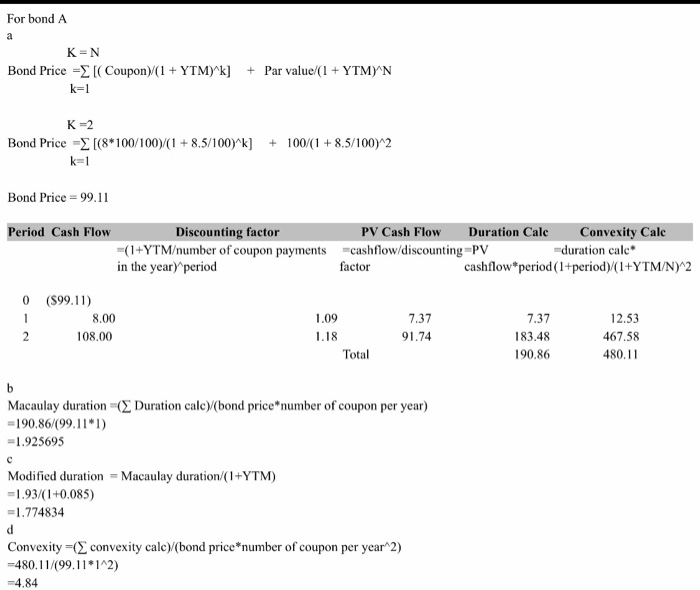

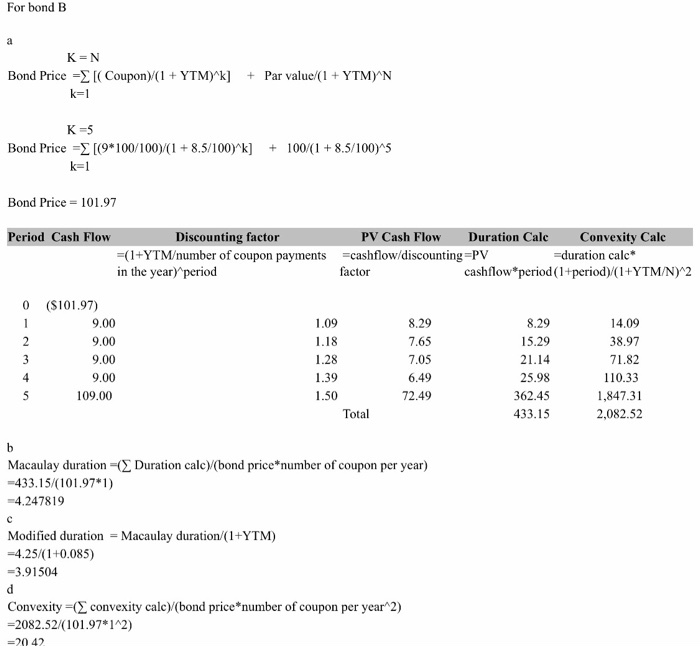

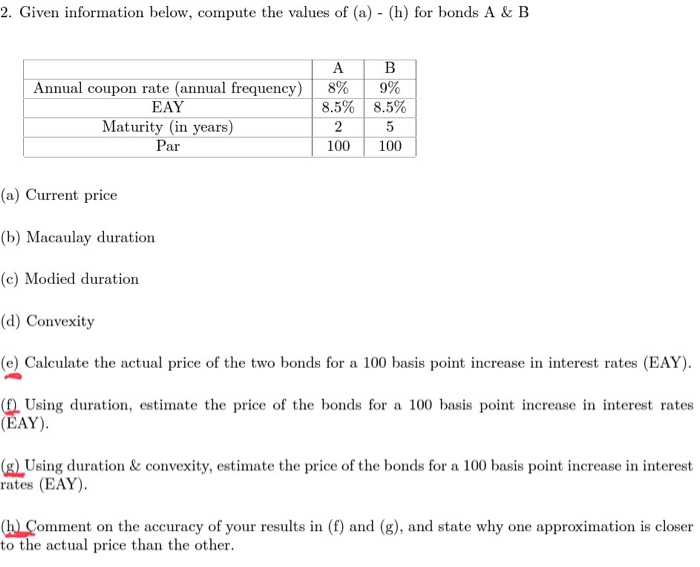

2. Given information below, compute the values of (a) - (h) for bonds A & B Annual coupon rate (annual frequency) | 8% | 9% 8.5% | 8.5% EAY Maturity (in years) 100 100 ar (a) Current price (b) Macaulay duration (c) Modied duration (d) Convexity (e) Calculate the actual price of the two bonds for a 100 basis point increase in interest rates (EAY) (f) Using duration, estimate the price of the bonds for a 100 basis point increase in interest rates (EAY) (Using duration & convexity, estimate the price of the bonds for a 100 basis point increase in interest rates (EAY) (hComment on the accuracy of your results in (f) and (g), and state why one approximation is closer to the actual price than the other For bond A Bond Price = [( Coupon)/(1 + YTMYk] Par value(1+ YTMYN + k-1 K-2 Bond Price[(8" 100/100)/( 1+8.5/100)"k] 100/(1+8.5/100)"2 + k-1 Bond Price 99.11 Period Cash Flow Discounting factor PV Cash Flo Duration Calc Convexity Cale -duration calc cashflowperiod (1+period) (1+YTM/N)*2 (1+YTMumber of coupon payments cashflow/discounting PV in the yearperiod factor 0 (S99.11) 1.09 8.00 7.37 7.37 12.53 1.18 183.48 467.58 108.00 91.74 480.11 Total 190.86 Macaulay duration ( Duration calc)/(bond price number of coupon per year) = 190.86(99-11*1) = 1 .925695 Modified duration Macaulay duration/(1+YTM) 1.93/(1+0.085) = 1.774834 Convexity-( convexity calc)( bond price *number of coupon per year2) -480.11/99.11*12) -4.84 For bond B K- N Bond Price- [( Coupon)/(1 + YTMYk] Par value/( 1 + YTMYN + k-1 K-5 Bond Price = [(9* 100 100)/(1 +8.5/100Yk] 100/(1+8.5/ 100Y5 + k-1 Bond Price 101.97 Period Cash Flow Discounting factor PV Cash Flow Convexity Calc -duration calc cashflow period (1+period) (1+YTM/N)2 Duration Calc =(1+YTMumber of coupon payments in the year) -cashflow/discounting=PV factor 0 (S101.97) 8.29 8.29 9.00 1.09 14.09 38.97 7.65 9.00 1.18 15.29 7.05 71.82 9.00 1.28 21.14 9.00 1.39 25.98 110.33 6.49 72.49 362.45 1,847.31 .50 109.00 2,082.52 Total 433.15 Macaulay duration Duration calc )(bond price*number of coupon per year) 433.15/(101.97*1) -4.247819 Modified duration-Macaulay duration (1+YTM) 4.25 (1+0.085) -3.91504 Convexity-( convexity calc)(bond price *number of coupon per year"2) 2082.52/(101.97*1A2) =20 42