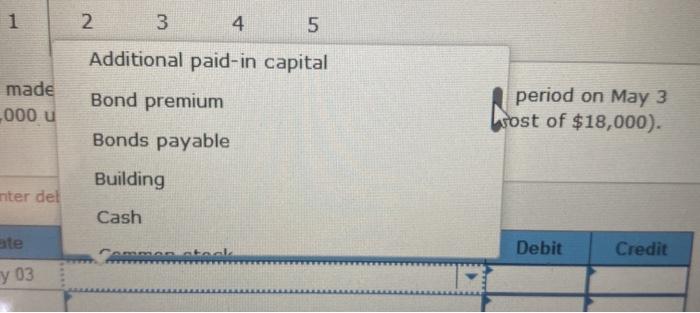

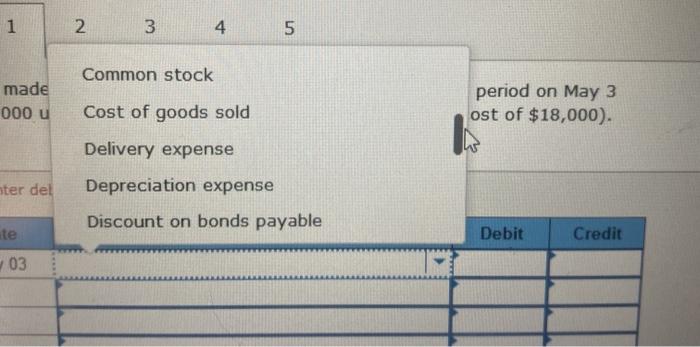

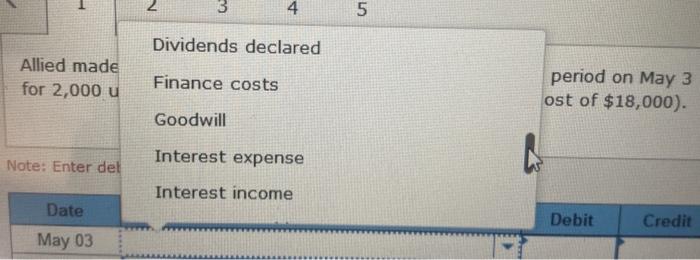

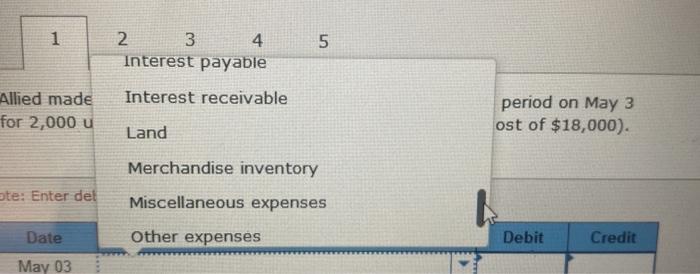

please help me solve. here are the jounal entry options

thank you

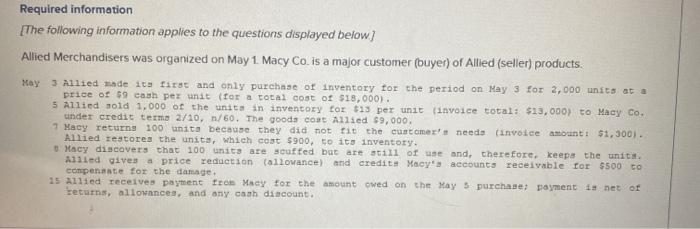

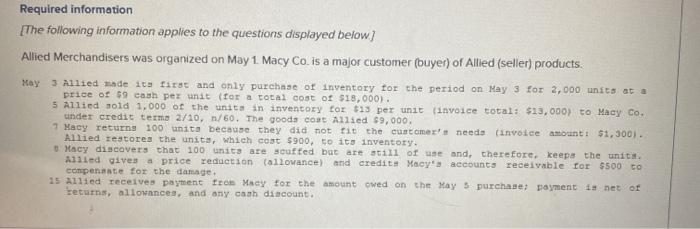

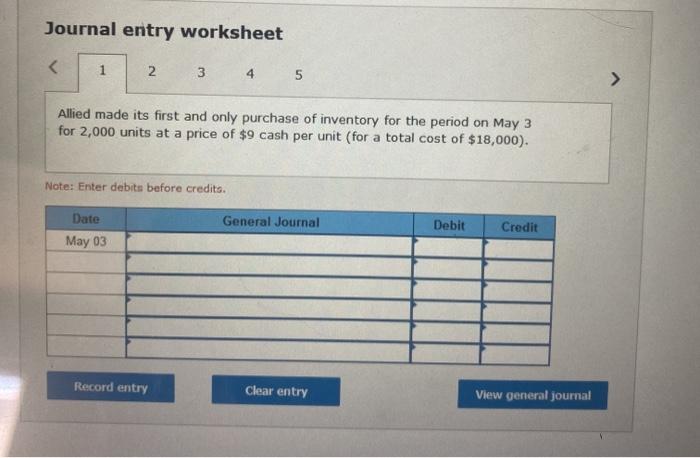

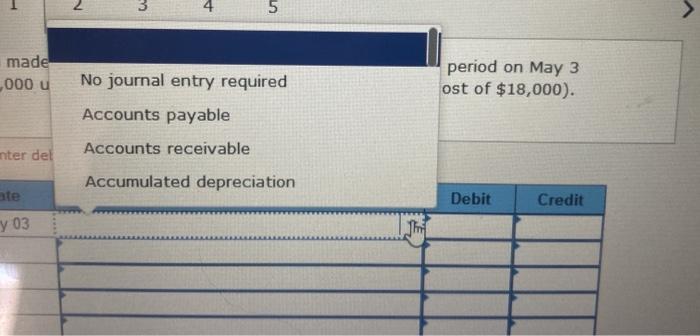

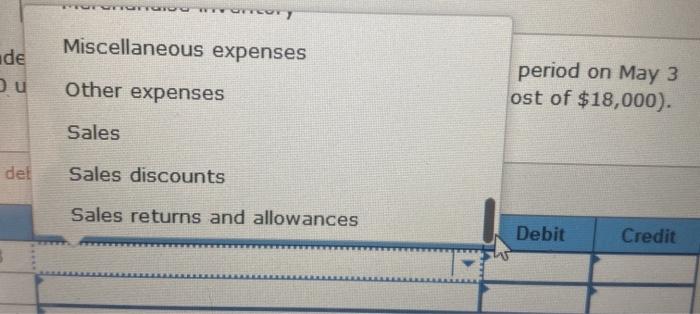

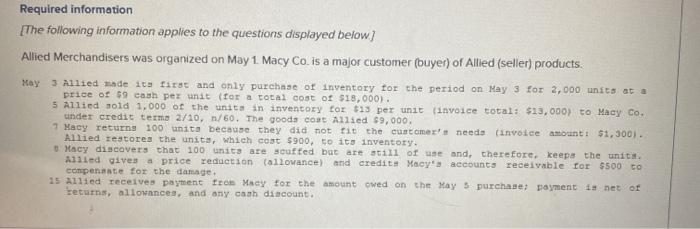

Required information [The following information applies to the questions displayed below) Allied Merchandisers was organized on May 1. Macy Co. is a major customer (buyer) of Allied (seller) products. May 3 Allied made its first and only purchase of inventory for the period on May 3 for 2,000 units at a price of $9 cash per unit (for a total cost of $18,000). 5 Allied sold 1,000 of the unita in inventory for $13 per unit invoice total: $13,000) to Macy Co. under credit tema 2/10, 1/60. The goods coat Allied $9,000 Macy returns 100 units because they did not fit the customer's needs (invoice amount: $1,300). Allied restores the unita, which cost $900, to its inventory. Macy discovers that 100 units are scufted but are still of use and therefore, keeps the unit Allied gives price reduction (allowance) and credit Macy's accounts receivable for $500 to compensate for the damage. 15 Allied receives payment from Macy for the amount owed on the May 5 purchase: payment is net of returns, allowances, and any cash discount. Journal entry worksheet Allied made its first and only purchase of inventory for the period on May 3 for 2,000 units at a price of $9 cash per unit (for a total cost of $18,000). Note: Enter debits before credits General Journal Date May 03 Debit Credit Record entry Clear entry View general journal 4 5 made 000 u period on May 3 ost of $18,000). No journal entry required Accounts payable Accounts receivable Accumulated depreciation nter del ate Debit Credit y 03 jom 1 1 23 4 5 Additional paid-in capital made 000 u Bond premium period on May 3 Lost of $18,000). Bonds payable Building nter det Cash ate al Debit Credit y 03 1 2 3 4 5 Common stock made 000 u Cost of goods sold period on May 3 ost of $18,000). Delivery expense Depreciation expense ter del Discount on bonds payable ate Debit Credit 03 3 4 5 Dividends declared Allied made for 2,000 u Finance costs period on May 3 ost of $18,000). Goodwill Interest expense Note: Enter del Interest income Date Debit Credit May 03 1 5 2 3 4 Interest payable Interest receivable Allied made for 2,000 u period on May 3 ost of $18,000) Land Merchandise inventory ate: Enter det Miscellaneous expenses Date Other expenses Debit Credit HA > May 03 *** We were Miscellaneous expenses de bu Other expenses period on May 3 ost of $18,000). Sales del Sales discounts Sales returns and allowances Debit Credit 5