Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me solve the above questions with a red highlighted box. Thanks! On January 1, 2025, Bramble Corp. had these stockholders' equity accounts. During

Please help me solve the above questions with a red highlighted box. Thanks!

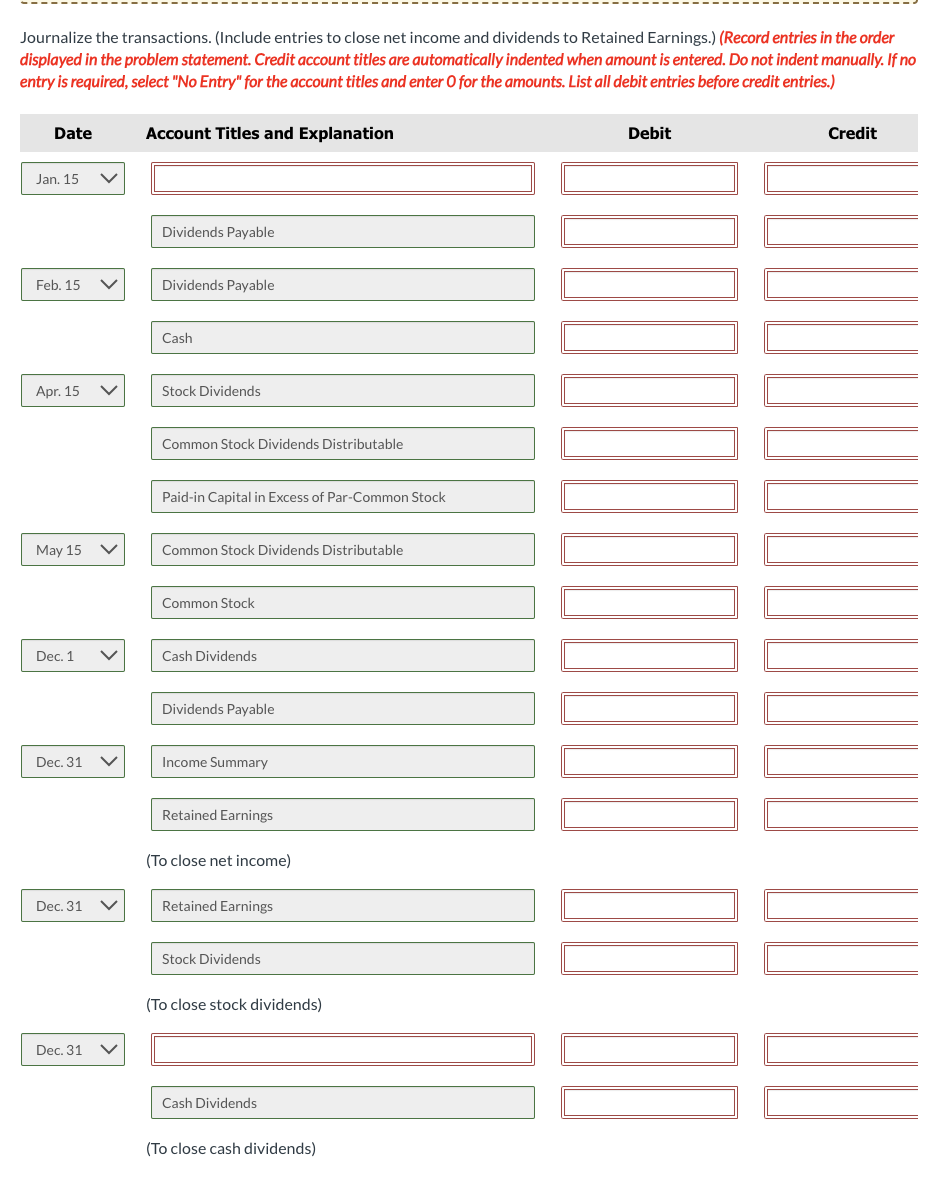

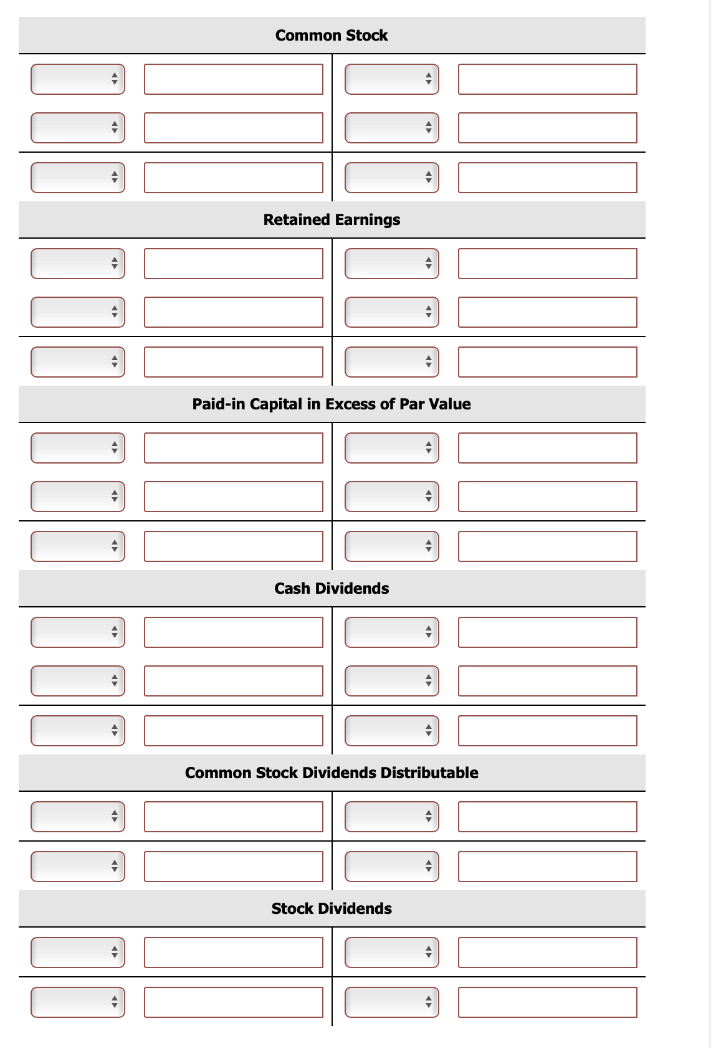

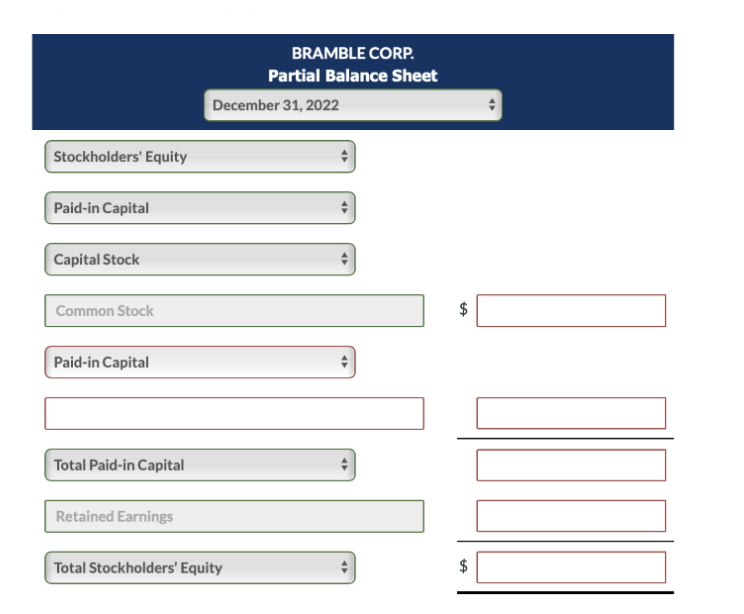

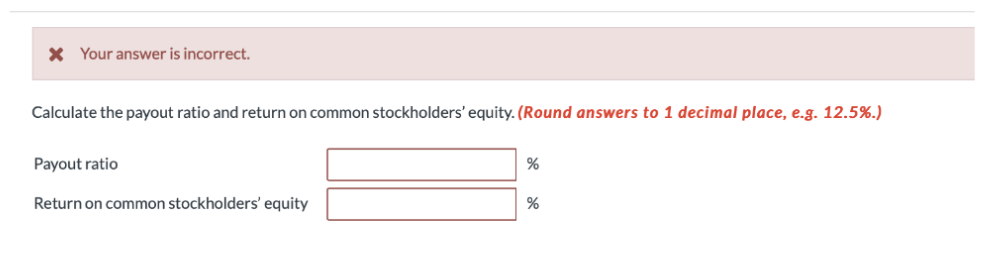

On January 1, 2025, Bramble Corp. had these stockholders' equity accounts. During the year, the following transactions occurred. Jan. 15 Declared a $0.60 cash dividend per share to stockholders of record on January 31, payable February 15. Feb. 15 Paid the dividend declared in January. Apr. 15 Declared a 10\% stock dividend to stockholders of record on April 30, distributable May 15. On April 15, the market price of the stock was $12 per share. May 15 Issued the shares for the stock dividend. Dec. 1 Declared a \$0.60 per share cash dividend to stockholders of record on December 15, payable January 10, 2026. Dec. 31 Determined that net income for the year was $352,000. Journalize the transactions. (Include entries to close net income and dividends to Retained Earnings.) (Record entries in the order displayed in the problem statement. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required. select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) Common Stock Retained Earnings Paid-in Capital in Excess of Par Value Cash Dividends Common Stock Dividends Distributable Stock Dividends BRAMBLE CORP. Partial Balance Sheet December 31, 2022 Stockholders' Equity Paid-in Capital Capital Stock Common Stock $ Paid-in Capital Total Paid-in Capital Retained Earnings Total Stockholders' Equity $ X Your answer is incorrect. Calculate the payout ratio and return on common stockholders' equity. (Round answers to 1 decimal place, e.g. 12.5\%.) Payout ratio % Return on common stockholders' equity %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started