Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me solve the following credit/debit portion, thanks! If you can show, that would be great! On January 1, 2014, Hamilton sold $2,300,000 in

Please help me solve the following credit/debit portion, thanks! If you can show, that would be great!

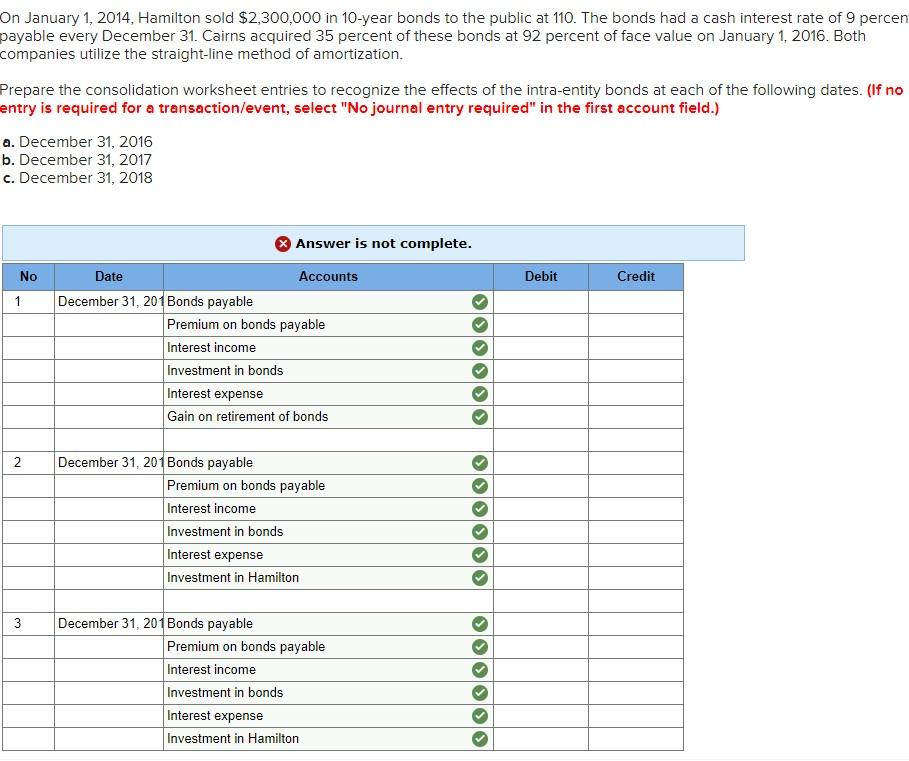

On January 1, 2014, Hamilton sold $2,300,000 in 10-year bonds to the public at 110. The bonds had a cash interest rate of 9 percen payable every December 31. Cairns acquired 35 percent of these bonds at 92 percent of face value on January 1, 2016. Both companies utilize the straight-line method of amortization. Prepare the consolidation worksheet entries to recognize the effects of the intra-entity bonds at each of the following dates. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) a. December 31, 2016 b. December 31, 2017 c. December 31, 2018 Answer is not complete. No Debit Credit 1 Date Accounts December 31, 201 Bonds payable Premium on bonds payable Interest income Investment in bonds Interest expense Gain on retirement of bonds 2 December 31, 201 Bonds payable Premium on bonds payable Interest income Investment in bonds Interest expense Investment in Hamilton lol lol 3 December 31, 201 Bonds payable Premium on bonds payable Interest income Investment in bonds Interest expense Investment in Hamilton

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started