Answered step by step

Verified Expert Solution

Question

1 Approved Answer

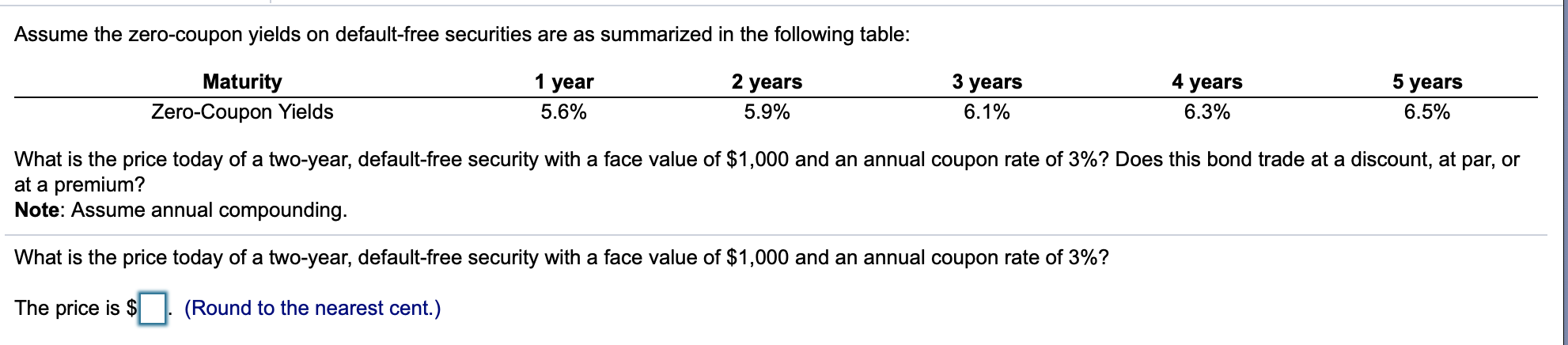

please help me solve these 1 year Assume the zero-coupon yields on default-free securities are as summarized in the following table: 2 years 3 years

please help me solve these

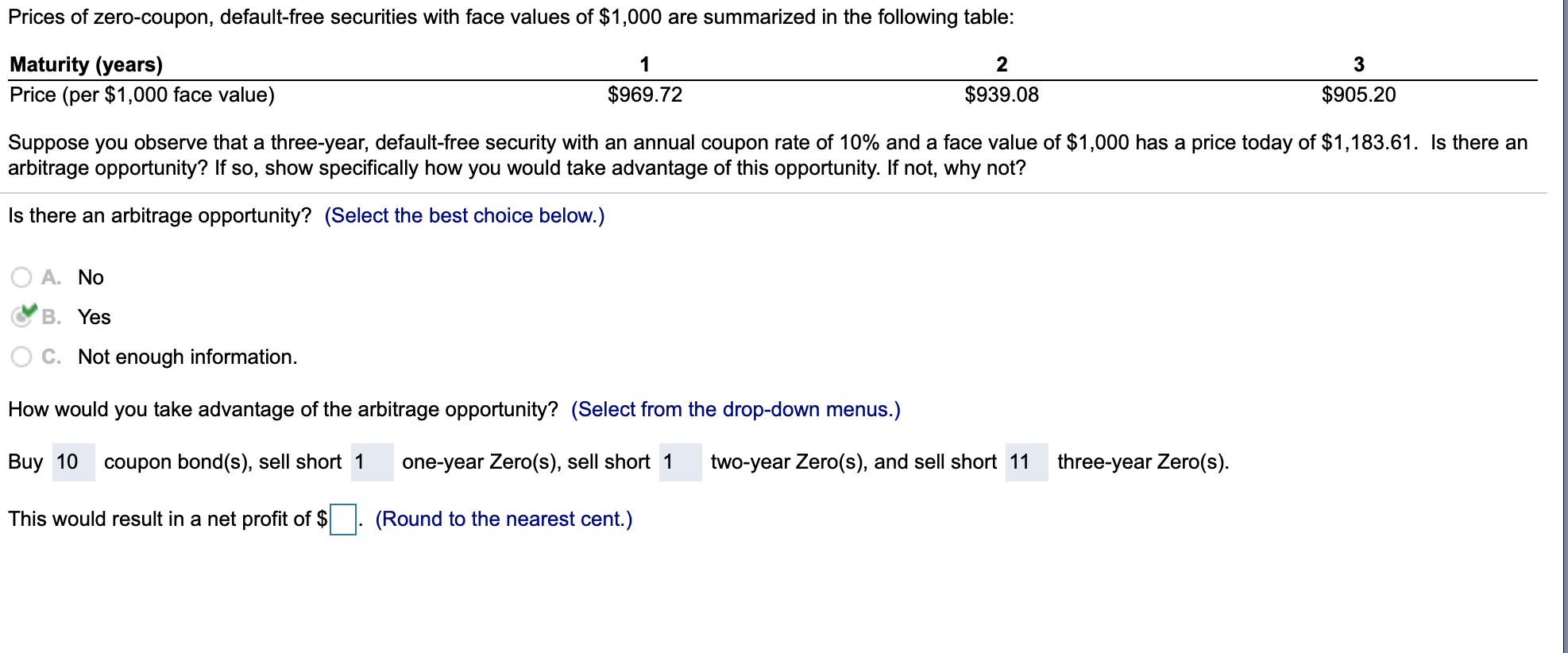

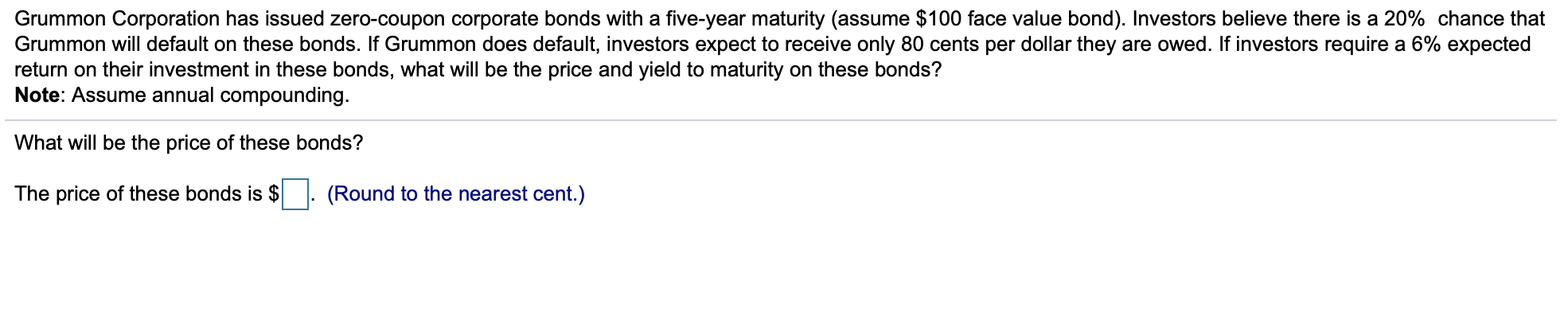

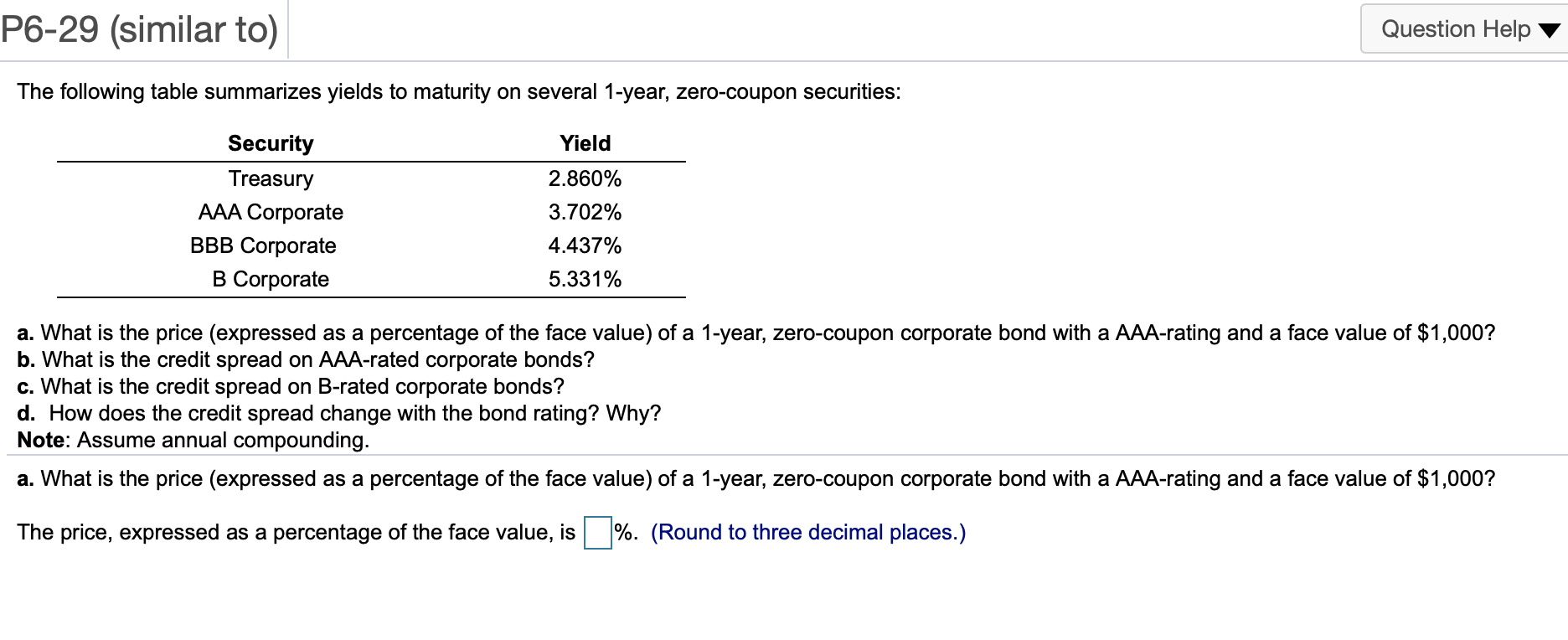

1 year Assume the zero-coupon yields on default-free securities are as summarized in the following table: 2 years 3 years 4 years 5 years Maturity 6.1% 5.9% 6.3% 6.5% Zero-Coupon Yields 5.6% What is the price today of a two-year, default-free security with a face value of $1,000 and an annual coupon rate of 3%? Does this bond trade at a discount, at par, or at a premium? Note: Assume annual compounding. What is the price today of a two-year, default-free security with a face value of $1,000 and an annual coupon rate of 3%? The price is $ (Round to the nearest cent.) Prices of zero-coupon, default-free securities with face values of $1,000 are summarized in the following table: Maturity (years) Price (per $1,000 face value) 1 $969.72 2 $939.08 3 $905.20 Suppose you observe that a three-year, default-free security with an annual coupon rate of 10% and a face value of $1,000 has a price today of $1,183.61. Is there an arbitrage opportunity? If so, show specifically how you would take advantage of this opportunity. If not, why not? Is there an arbitrage opportunity? (Select the best choice below.) A. No B. Yes C. Not enough information. How would you take advantage of the arbitrage opportunity? (Select from the drop-down menus.) Buy 10 coupon bond(s), sell short 1 one-year Zero(s), sell short 1 two-year Zero(s), and sell short 11 three-year Zero(s). This would result in a net profit of $ (Round to the nearest cent.) Grummon Corporation has issued zero-coupon corporate bonds with a five-year maturity (assume $100 face value bond). Investors believe there is a 20% chance that Grummon will default on these bonds. If Grummon does default, investors expect to receive only 80 cents per dollar they are owed. If investors require a 6% expected return on their investment in these bonds, what will be the price and yield to maturity on these bonds? Note: Assume annual compounding. What will be the price of these bonds? The price of these bonds is $ (Round to the nearest cent.) P6-29 (similar to) Question Help The following table summarizes yields to maturity on several 1-year, zero-coupon securities: Yield 2.860% Security Treasury AAA Corporate BBB Corporate B Corporate 3.702% 4.437% 5.331% a. What is the price (expressed as a percentage of the face value) of a 1-year, zero-coupon corporate bond with a AAA-rating and a face value of $1,000? b. What is the credit spread on AAA-rated corporate bonds? What is the credit spread on B-rated corporate bonds? d. How does the credit spread change with the bond rating? Why? Note: Assume annual compounding. a. What is the price (expressed as a percentage of the face value) of a 1-year, zero-coupon corporate bond with a AAA-rating and a face value of $1,000? The price, expressed as a percentage of the face value, is %. (Round to three decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started