Please help me solve these questions.

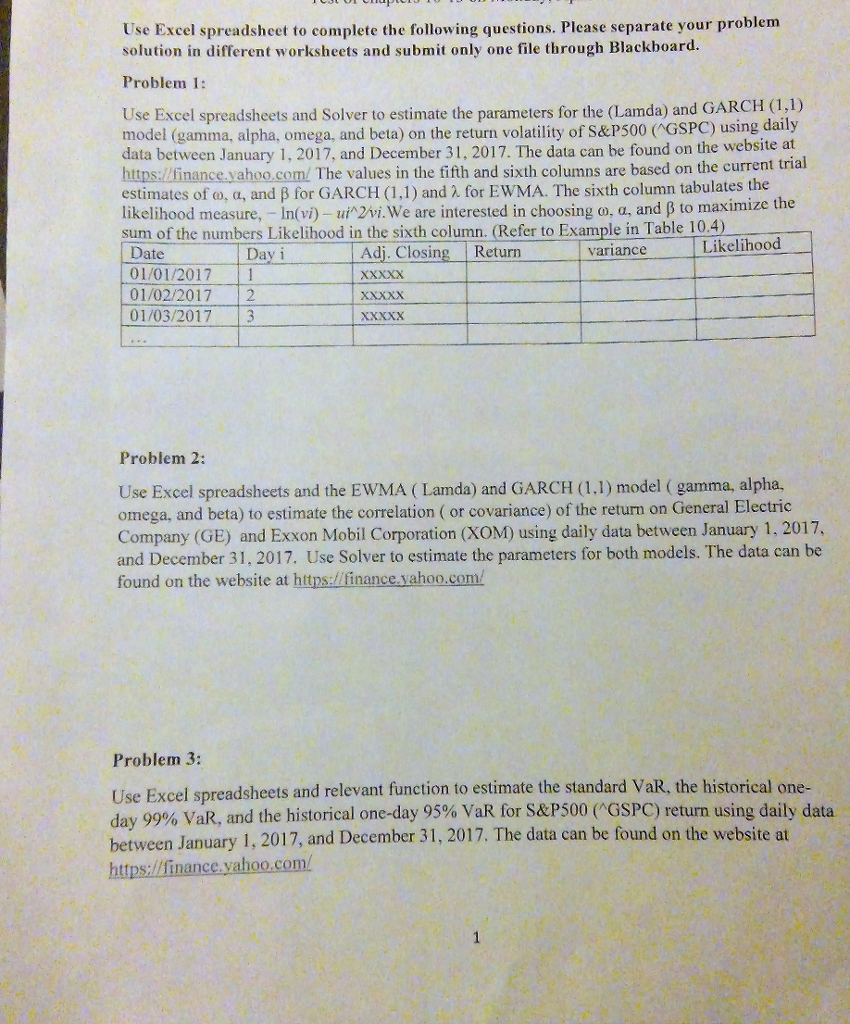

Use Excel spreadsheet to complete the following questions. Please separate your problem solution in different worksheets and submit only one file through Blackboard. Problem 1: Use Excel spreadsheets and Solver to estimate the parameters for the (Lamda) and GARCH (1,1) model (gamma, alpha, omega, and beta) on the return volatility of S&PS https:/jinance.yahoo.com/ The values in the fifth and sixth columns are based on the current trial estimates of o, a, and B for GARCH (1,1) and for EWMA. The sixth column tabulates the likelihood measure,-In(v) ui2w.we are interested in choosing o. ?, and ? to maximize the sum of the numbers Likelihood in the sixth column. (Refer to Example in Table 10.4) Likelihood Adj. Closing Return Date 01/01/2017 1 01/02/2017 2 01/03/2017 3 Day i variance XxxXXX XxXXX Problem 2: Use Excel spreadsheets and the EWMA (Lamda) and GARCH (1.1) model (gamma, alpha, omega, and beta) to estimate the correlation (or covariance) of the return on General Electric Company (GE) and Exxon Mobil Corporation (XOM) using daily data between January 1, 2017, and December 31, 2017. Use Solver to estimate the parameters for both models. The data can be found on the website at https://finance.yahoo.com! Problem 3: Use Excel spreadsheets and relevant function to estimate the standard VaR, the historical one- day 99% VaR, and the historical one-day 95% VaR for S&P500 ( GSPC) return using daily data between January 1, 2017, and December 31, 2017. The data can be found on the website at https://finance yahoo.com/ Use Excel spreadsheet to complete the following questions. Please separate your problem solution in different worksheets and submit only one file through Blackboard. Problem 1: Use Excel spreadsheets and Solver to estimate the parameters for the (Lamda) and GARCH (1,1) model (gamma, alpha, omega, and beta) on the return volatility of S&PS https:/jinance.yahoo.com/ The values in the fifth and sixth columns are based on the current trial estimates of o, a, and B for GARCH (1,1) and for EWMA. The sixth column tabulates the likelihood measure,-In(v) ui2w.we are interested in choosing o. ?, and ? to maximize the sum of the numbers Likelihood in the sixth column. (Refer to Example in Table 10.4) Likelihood Adj. Closing Return Date 01/01/2017 1 01/02/2017 2 01/03/2017 3 Day i variance XxxXXX XxXXX Problem 2: Use Excel spreadsheets and the EWMA (Lamda) and GARCH (1.1) model (gamma, alpha, omega, and beta) to estimate the correlation (or covariance) of the return on General Electric Company (GE) and Exxon Mobil Corporation (XOM) using daily data between January 1, 2017, and December 31, 2017. Use Solver to estimate the parameters for both models. The data can be found on the website at https://finance.yahoo.com! Problem 3: Use Excel spreadsheets and relevant function to estimate the standard VaR, the historical one- day 99% VaR, and the historical one-day 95% VaR for S&P500 ( GSPC) return using daily data between January 1, 2017, and December 31, 2017. The data can be found on the website at https://finance yahoo.com/