Answered step by step

Verified Expert Solution

Question

1 Approved Answer

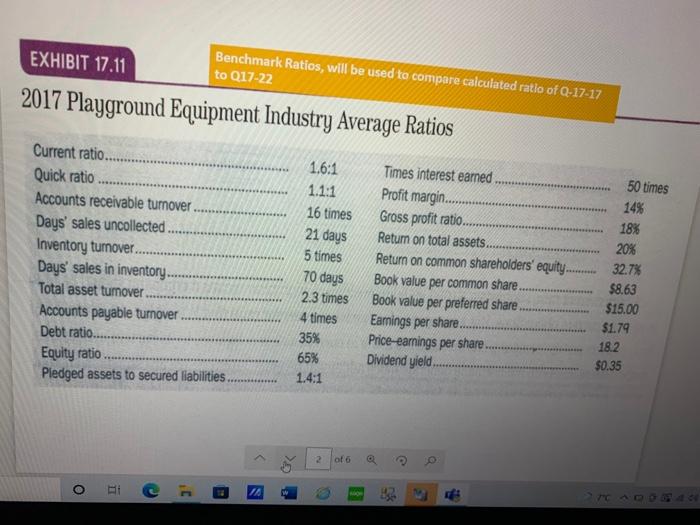

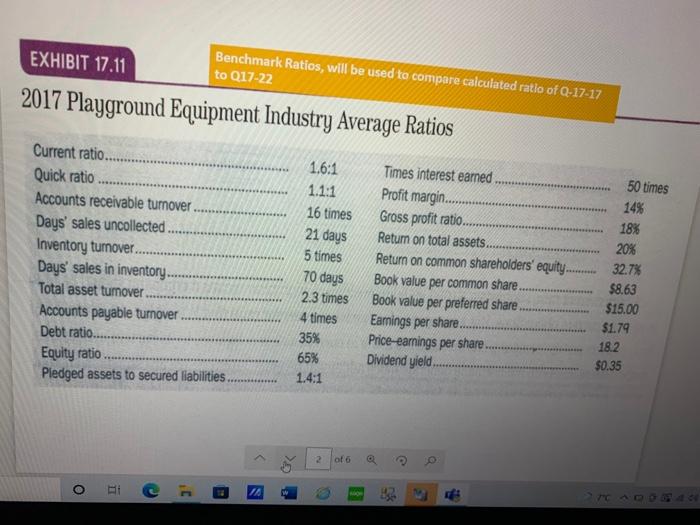

please help me solve this EXHIBIT 17.11 Benchmark Ratios, will be used to compare calculated ratio of Q-17-17 to Q17-22 2017 Playground Equipment Industry Average

please help me solve this

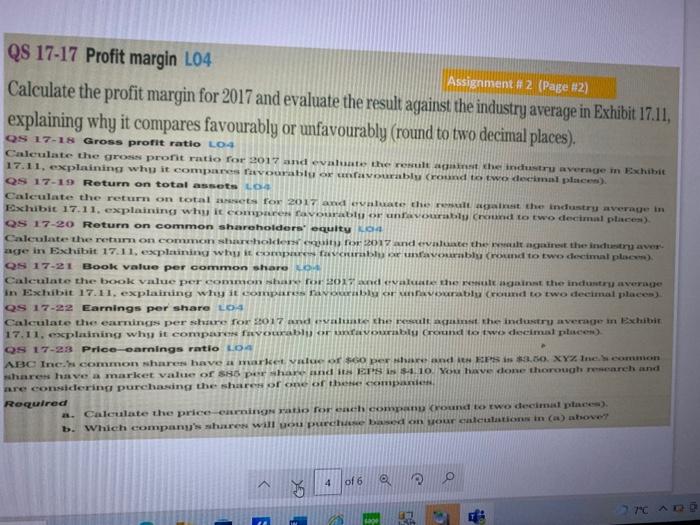

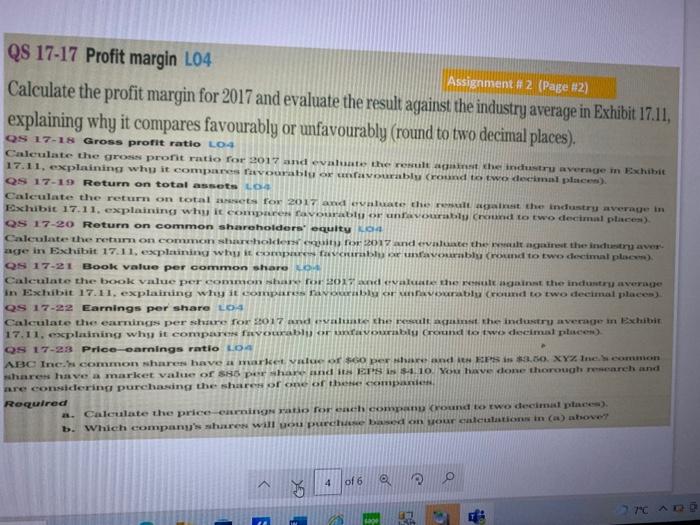

EXHIBIT 17.11 Benchmark Ratios, will be used to compare calculated ratio of Q-17-17 to Q17-22 2017 Playground Equipment Industry Average Ratios 50 times Current ratio. Quick ratio Accounts receivable turnover Days' sales uncollected. Inventory tumover... Days' sales in inventory Total asset tumover Accounts payable turnover Debt ratio.......... Equity ratio Pledged assets to secured liabilities 1.6:1 1.1:1 16 times 21 days 5 times 70 days 2.3 times 4 times 35% 65% 1.4:1 Times interest earned Profit margin........ Gross profit ratio. Return on total assets. Return on common shareholders' equity. Book value per common share. Book value per preferred share Earnings per share......... Price-earings per share. Dividend yield 14% 18% 20% 32.7% $8.63 $15.00 $1.79 18.2 $0.35 *** > of 6 O i I 10 - QS 17-17 Profit margin L04 Assignment # 2 (Page #2) Calculate the profit margin for 2017 and evaluate the result against the industry average in Exhibit 17.11, explaining why it compares favourably or unfavourably (round to two decimal places). QS 17-18 Gross profit ratio L04 Calculate the gross profit ratio for 2017 and evaluate the result at the industru averagem Exhibit 17.11, explaining why it compares favourablu ox navouablu (round to two decimal place) QS 17-11) Return on total assets LO Calculate the return on totalt for 2017 and evaluate the result want the industru average in Exhibit 17.11, explaining why it comparen favourably or unfavourub Cround to two decimal places) QS 17-20 Return on common shareholders' quity OH Calculate the retum on common shar holder for 2017 and evaluate the real against the industry aver auce in Exchibit 17.11. explaining white facevonu round to two decimal plac) QS 17-21 Book value per common share Calculate the book value perconan har for 2017 and evaluate the against the industry average in Exhibit 17.11. explaining why it compares favorable arunnvourablu (round to two decimal places) Qs 17-22 Earnings per share L04 Calculate the earnings per share for 2017 and evaluate the result against the industry average in Exhibir 17.11, explaining why it compare Hvourabhi or unavouablu Cround to two decimal places) OS 17-23 Price-carnings ratio LOA ABC Inc. common shares have market value o per and it is a XY. In common haren have a market value of 85 persone and in ETS 1.10. You have done thorough research and are considering purchasing the shares of one of the companie Required a. Calculate the price Origatio forench company Cound to two decimal place) b. Which company's when will ou purchase based on our calculation in (above 4 of 6 ra

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started