Answered step by step

Verified Expert Solution

Question

1 Approved Answer

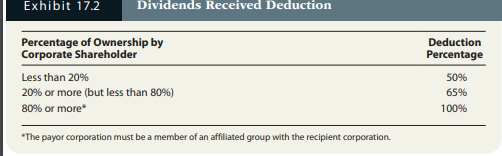

Please help me solve this Exhibit 17.2 Dividends Received Deduction begin{tabular}{lc} hline PercentageofOwnershipbyCorporateShareholder & DeductionPercentage hline Less than 20% & 50% 20% or

Please help me solve this

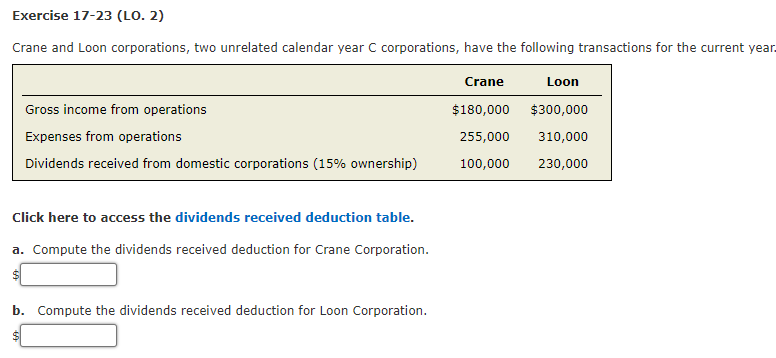

Exhibit 17.2 Dividends Received Deduction \begin{tabular}{lc} \hline PercentageofOwnershipbyCorporateShareholder & DeductionPercentage \\ \hline Less than 20% & 50% \\ 20% or more (but less than 80%) & 65% \\ 80% or more & 100% \\ \hline \end{tabular} *The payor corporation must be a member of an affiliated group with the recipient corporation. Exercise 17-23 (LO. 2) Crane and Loon corporations, two unrelated calendar year C corporations, have the following transactions for the current year Click here to access the dividends received deduction table. a. Compute the dividends received deduction for Crane Corporation. $ b. Compute the dividends received deduction for Loon Corporation

Exhibit 17.2 Dividends Received Deduction \begin{tabular}{lc} \hline PercentageofOwnershipbyCorporateShareholder & DeductionPercentage \\ \hline Less than 20% & 50% \\ 20% or more (but less than 80%) & 65% \\ 80% or more & 100% \\ \hline \end{tabular} *The payor corporation must be a member of an affiliated group with the recipient corporation. Exercise 17-23 (LO. 2) Crane and Loon corporations, two unrelated calendar year C corporations, have the following transactions for the current year Click here to access the dividends received deduction table. a. Compute the dividends received deduction for Crane Corporation. $ b. Compute the dividends received deduction for Loon Corporation Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started