Question

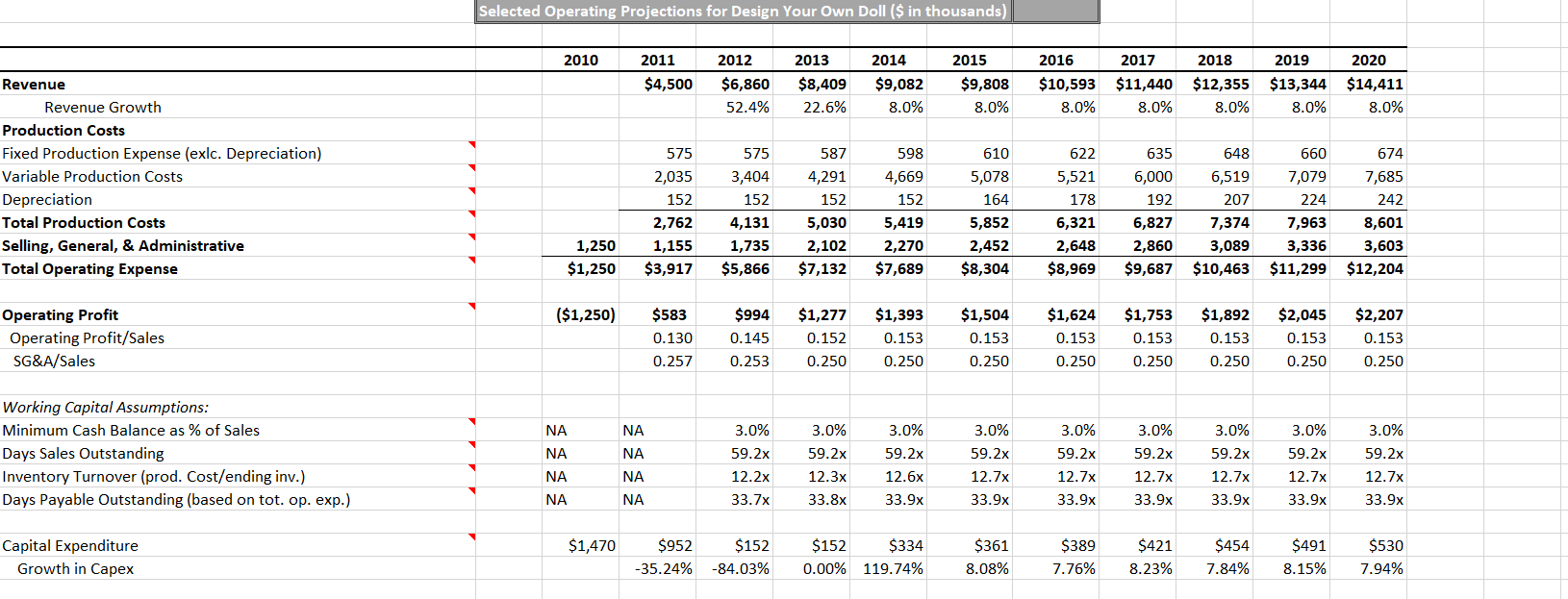

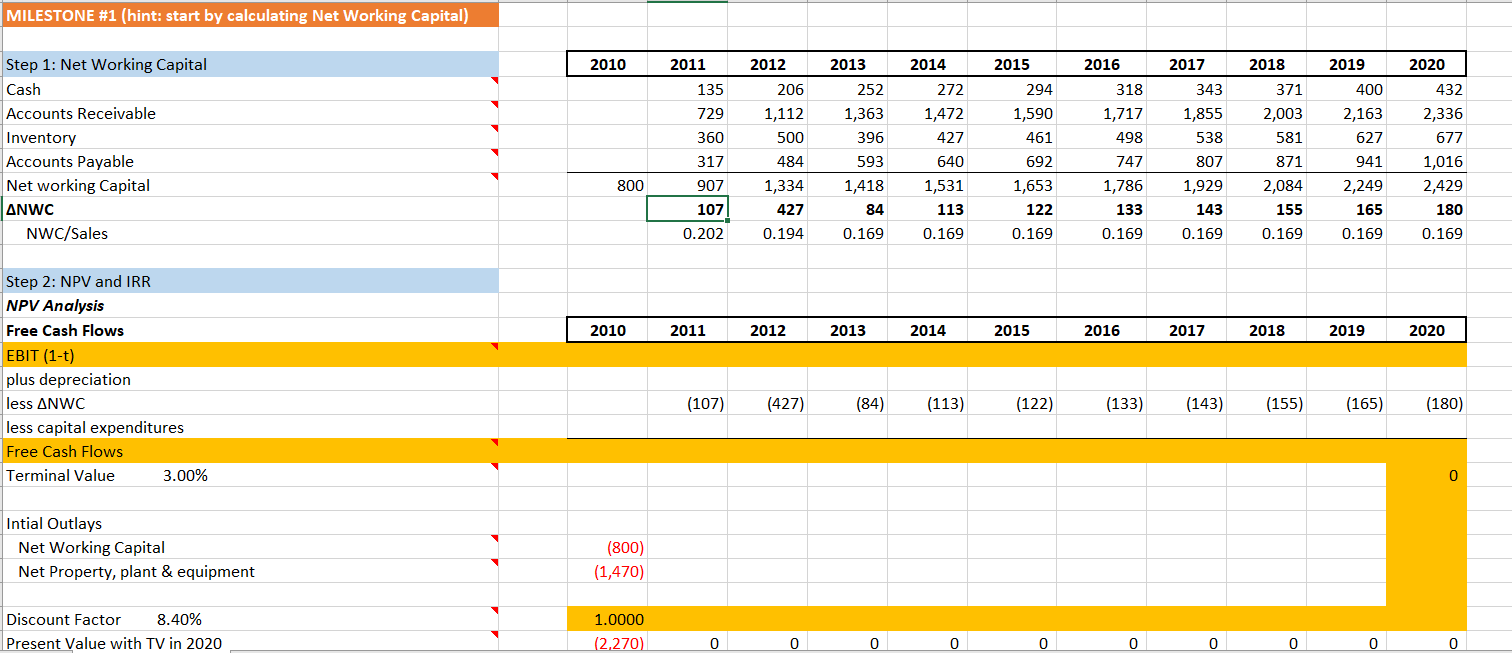

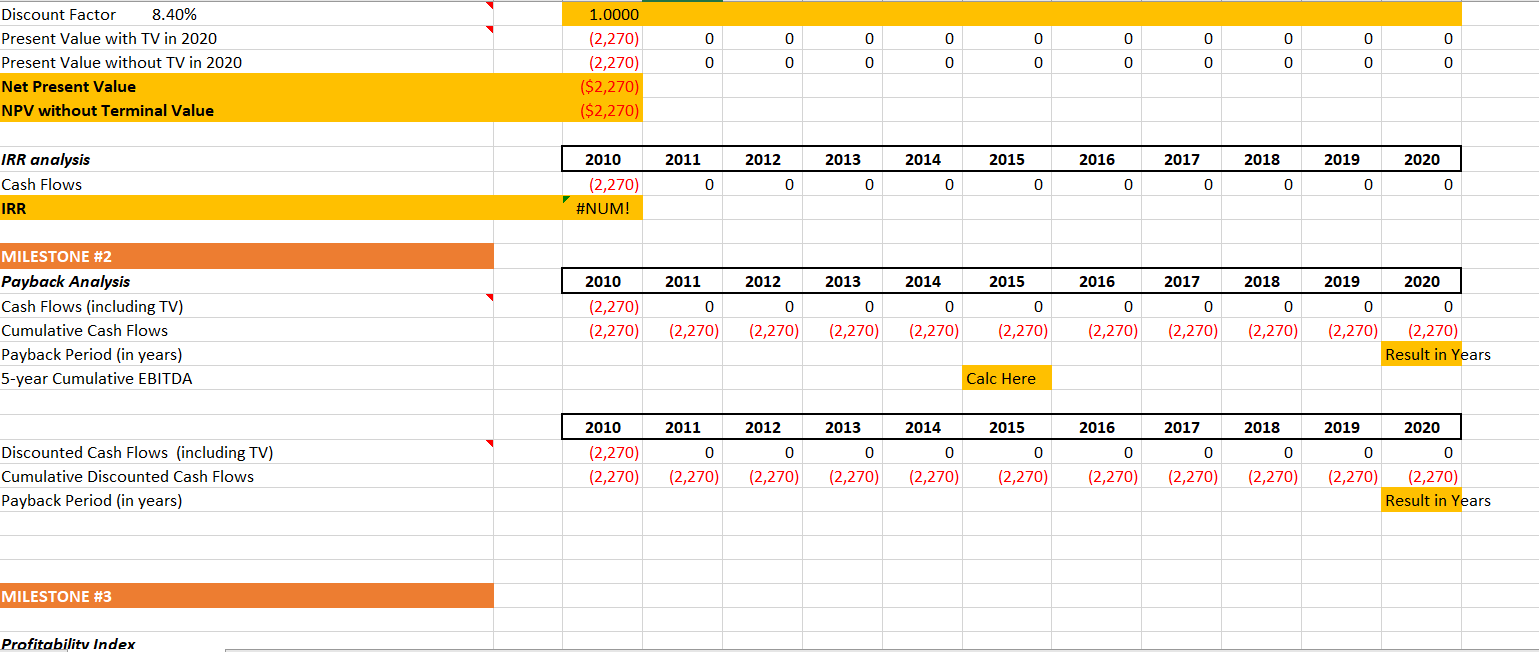

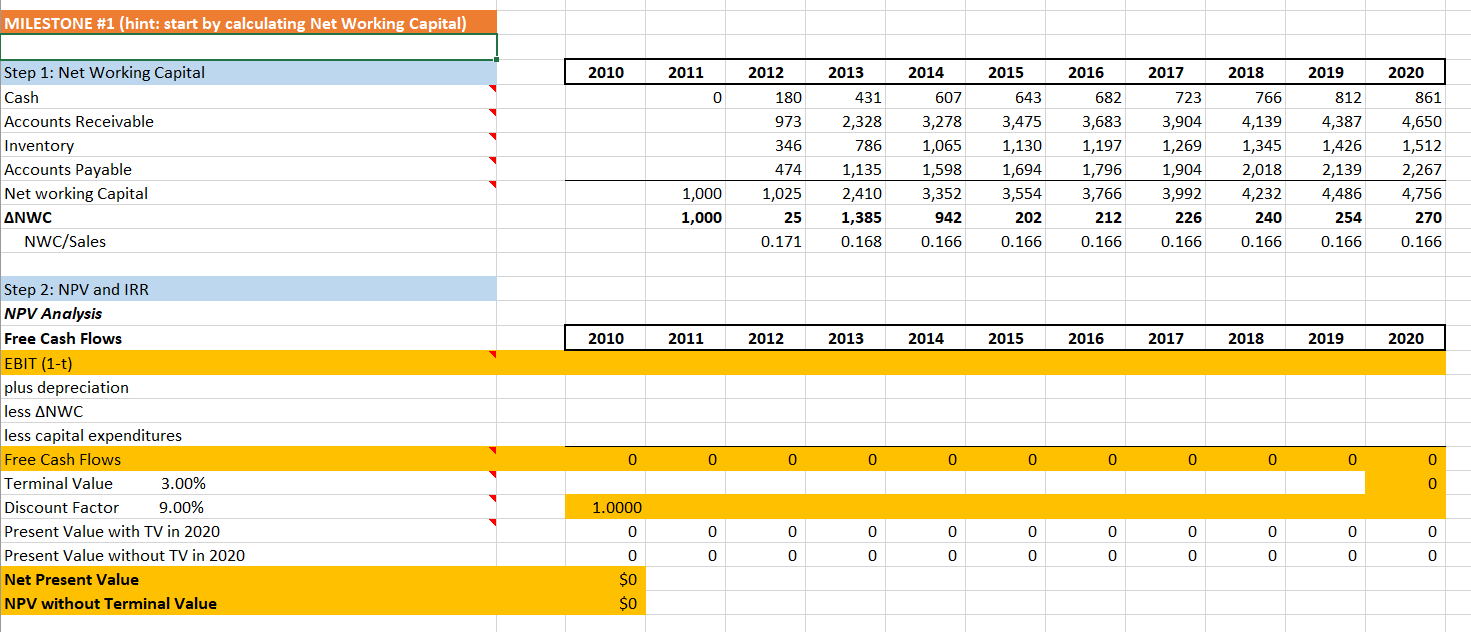

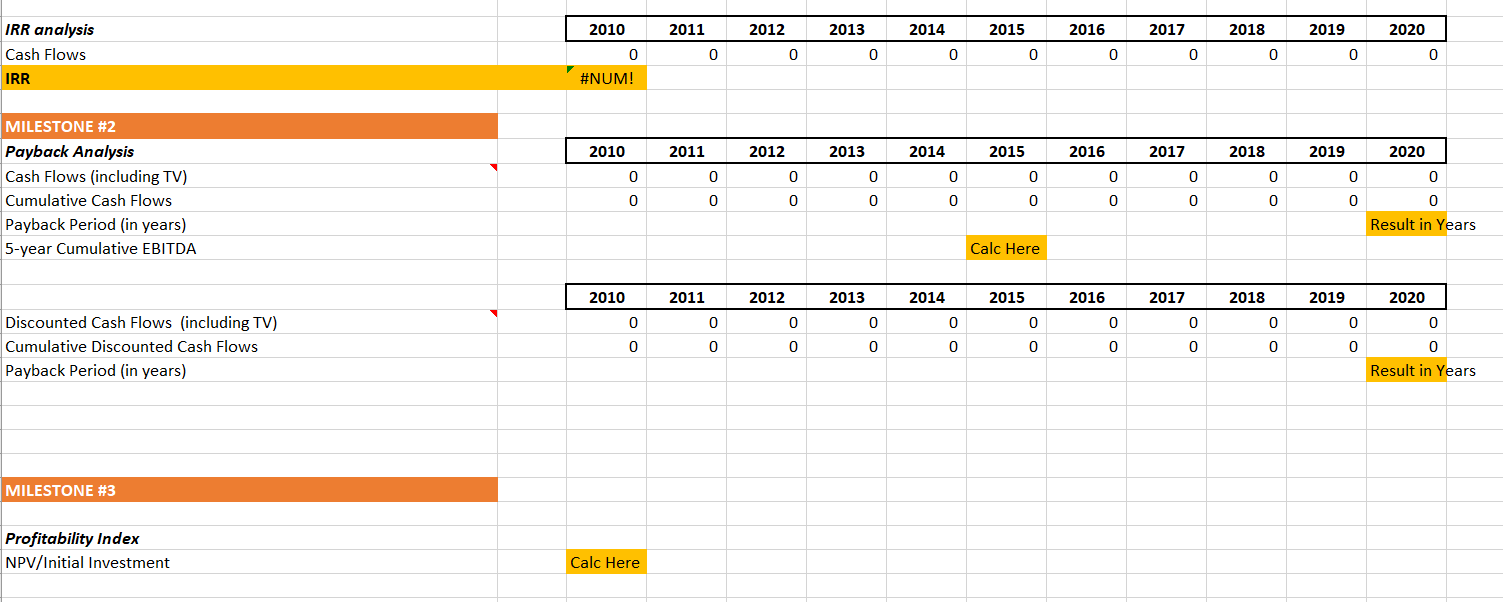

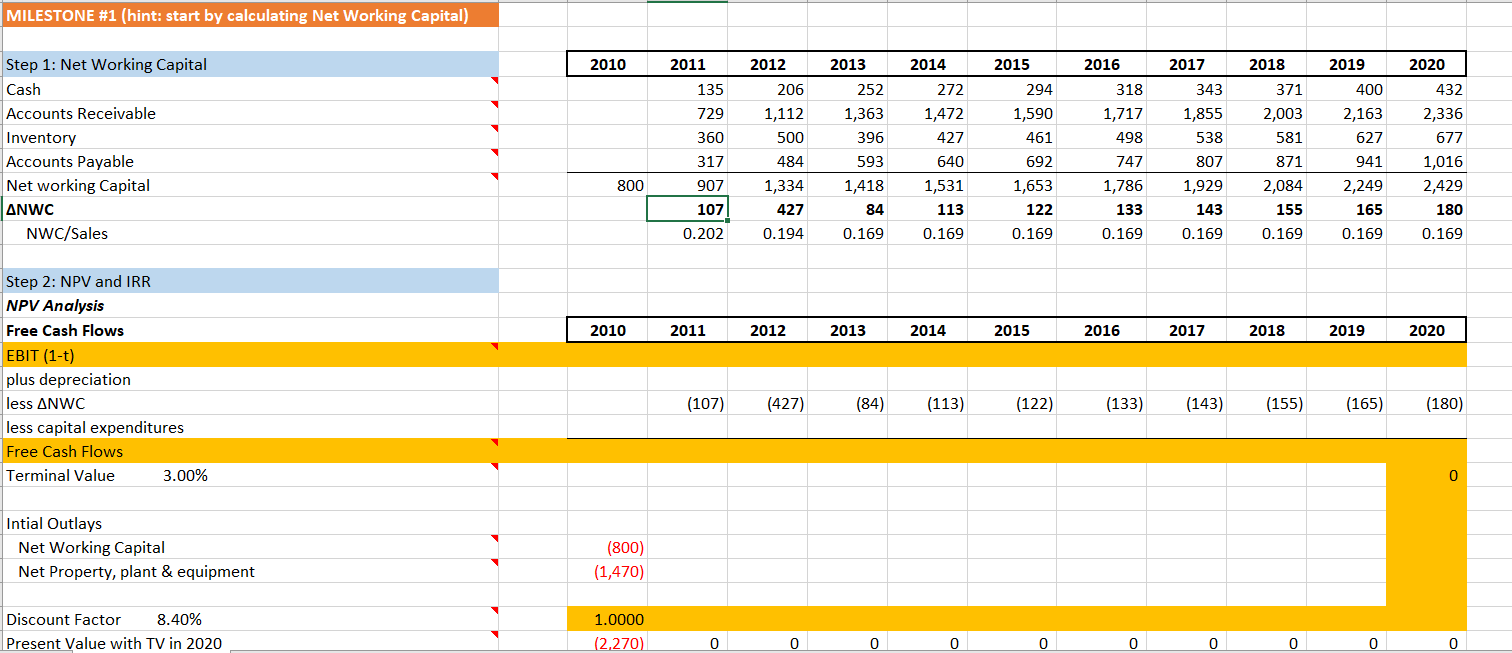

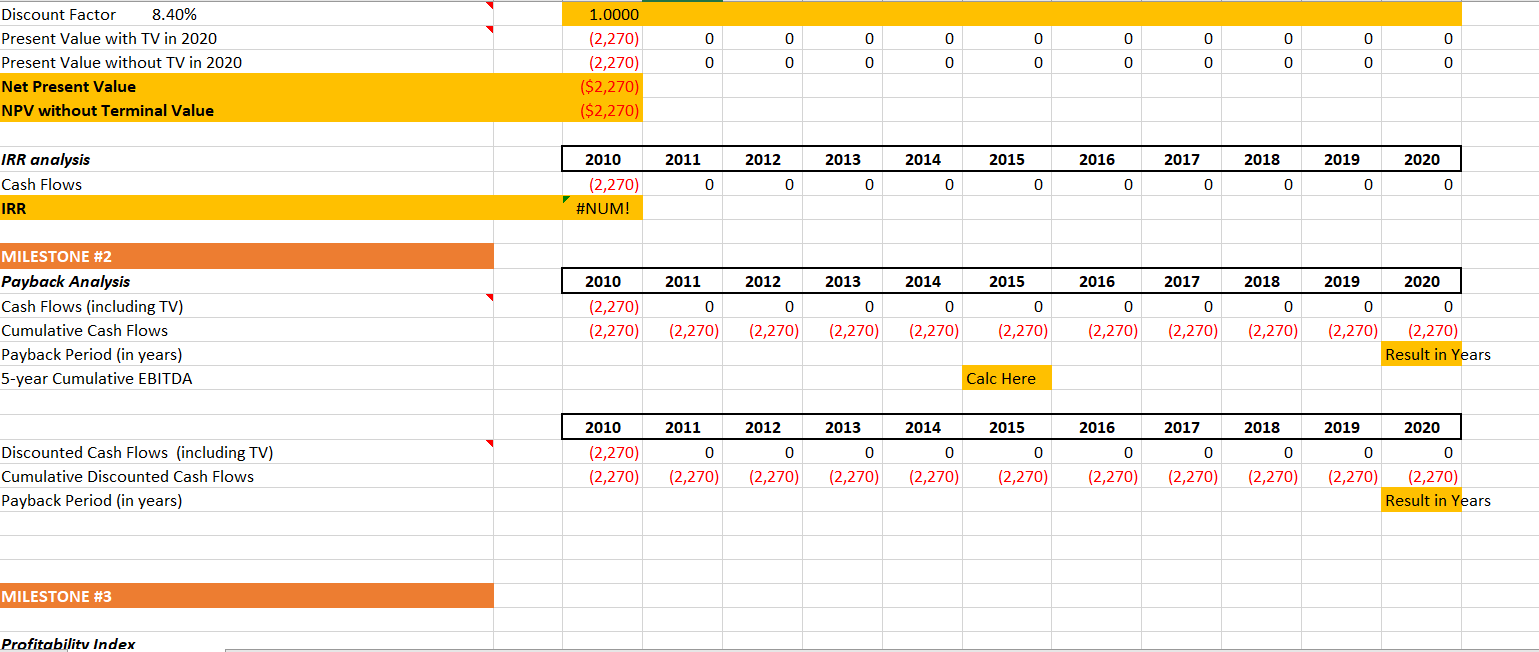

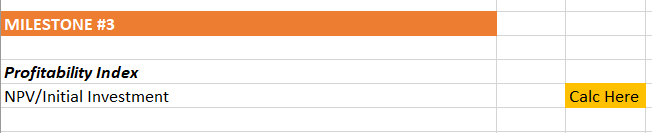

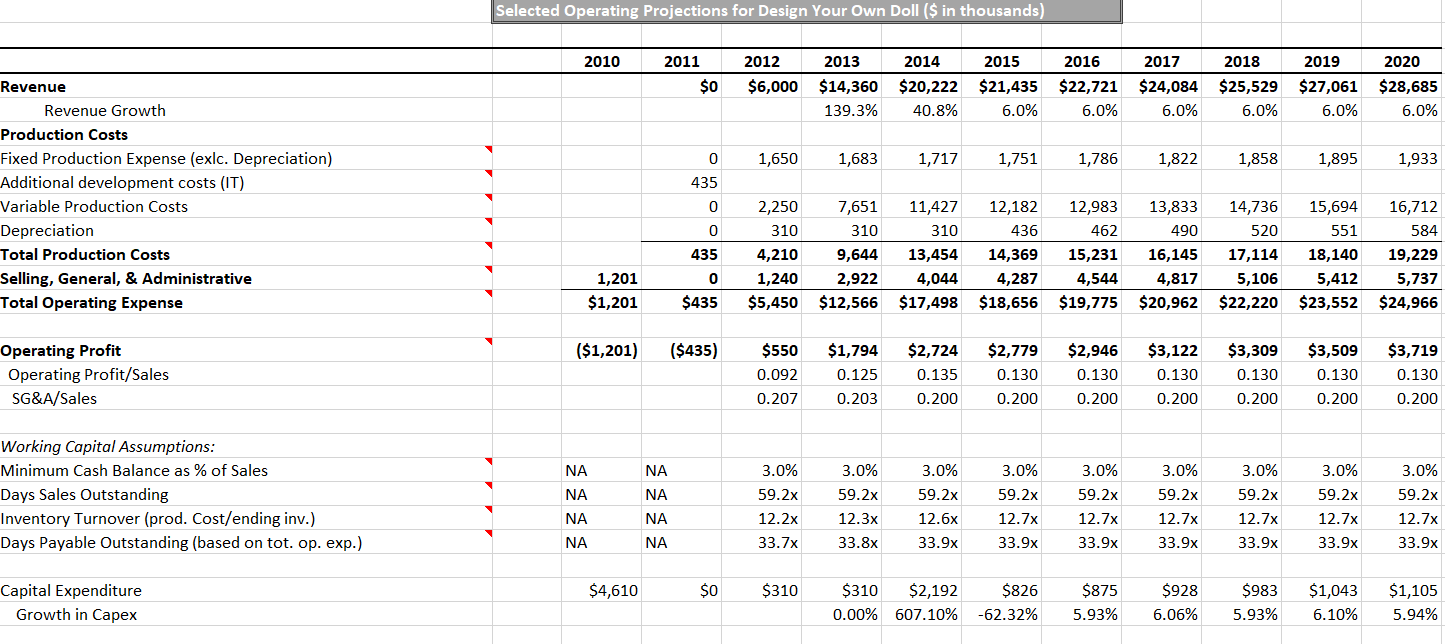

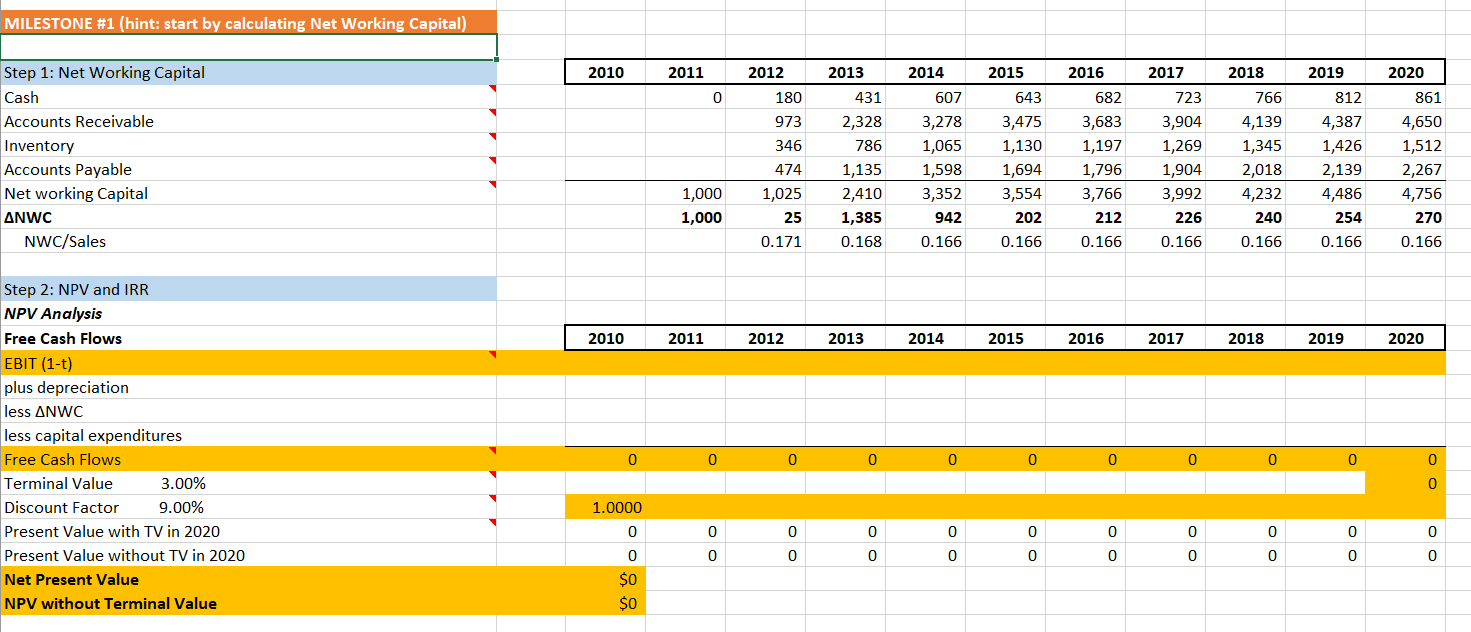

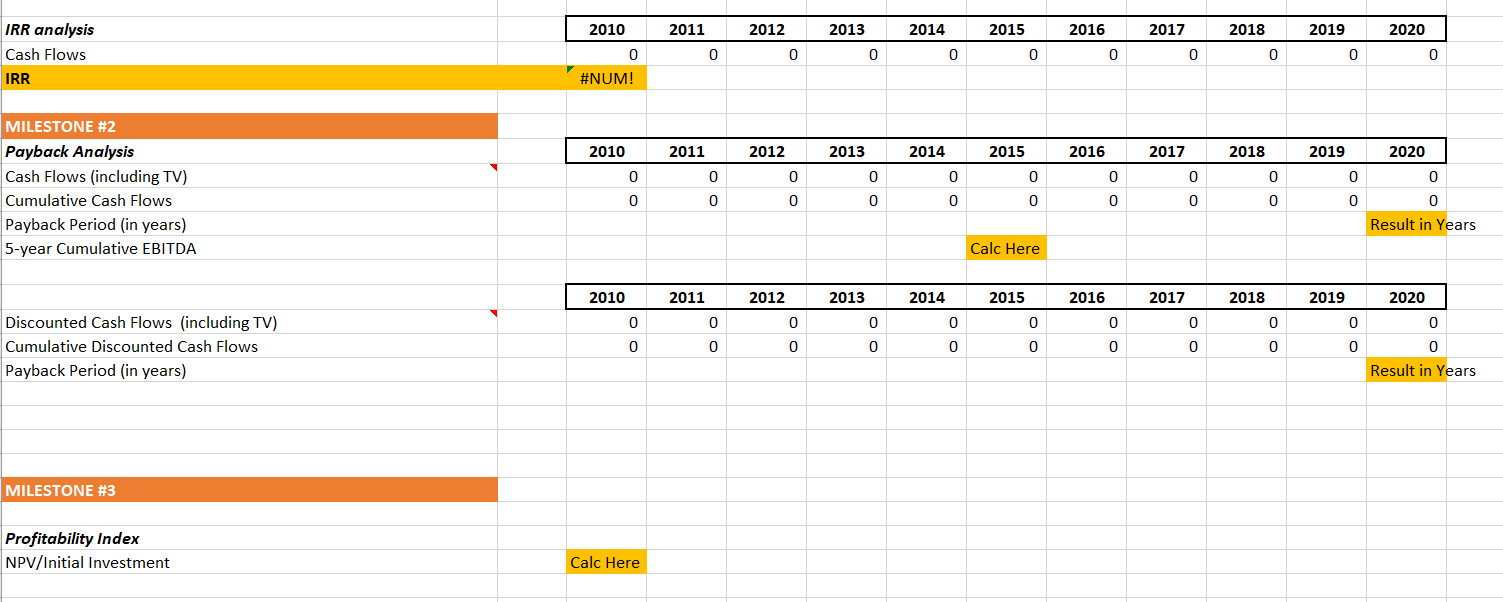

Please help me solve this. I am doing the heritage doll company and have to calculate the NPV, IRR, EBIT, payback in years, and profitability

Please help me solve this. I am doing the heritage doll company and have to calculate the NPV, IRR, EBIT, payback in years, and profitability index for both projects. Please help me fill this out.

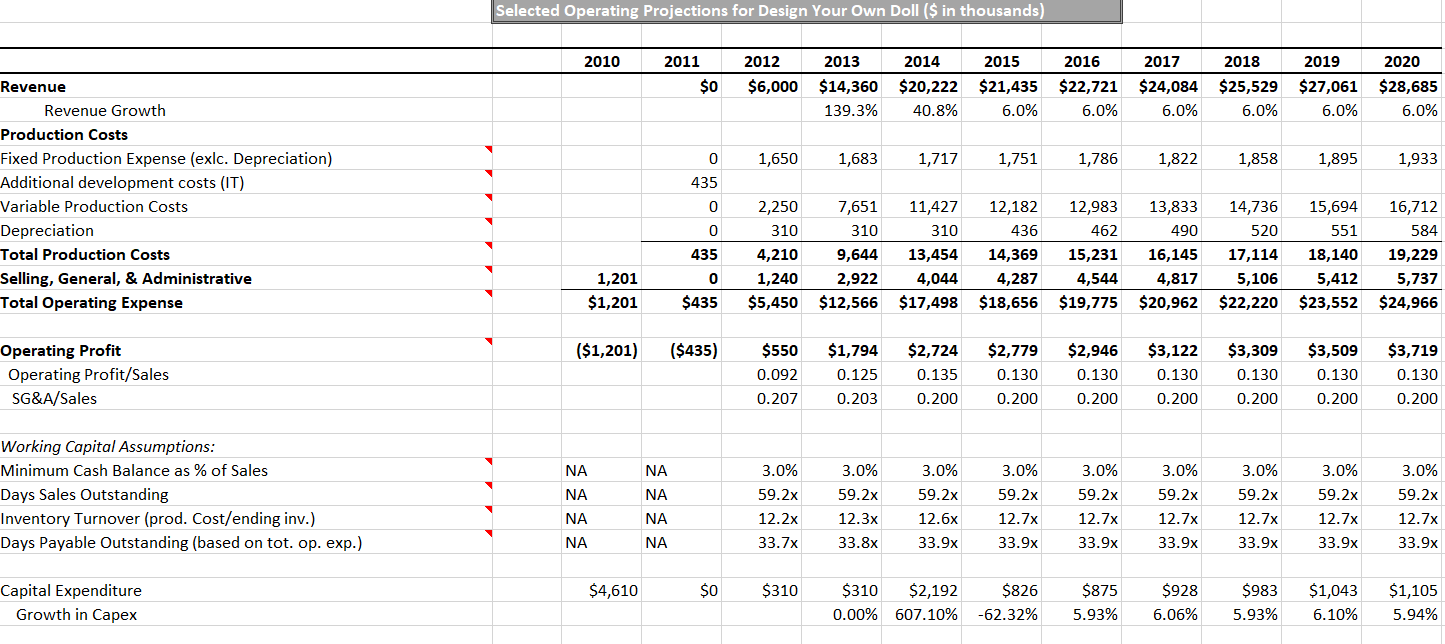

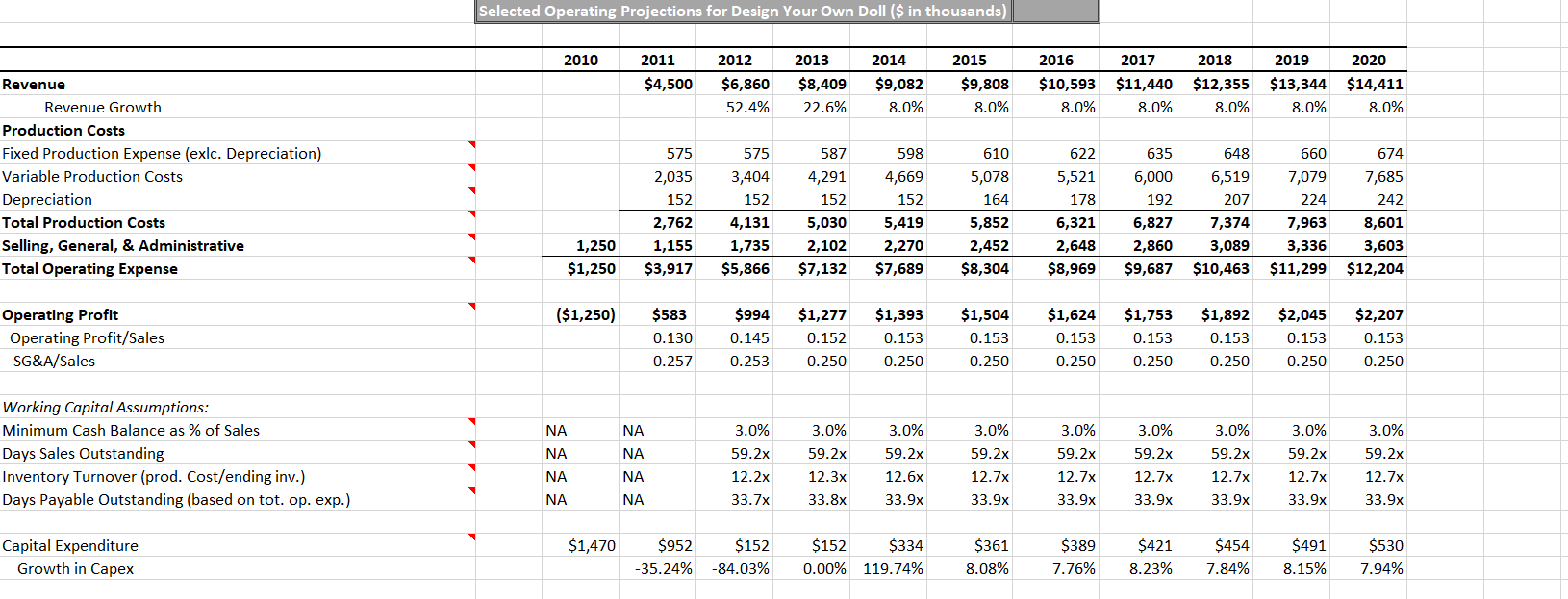

Overview: In this first milestone assignment, you will begin to analyze the New Heritage Doll Company case study, taking on the role of Emily Harris, the company's financial analyst. Emily is tasked with evaluating the merit of two capital projects, performing key calculations, and taking into considerations the questions about the two projects that senior management is likely to ask. She must choose the best project and defend her selection by explaining how the project aligns with the company's overall mission. To do so, she must explain how she arrived at her decision, justifying her methodology, outlining the strengths and weaknesses of the selected project, and offering a plan to mitigate any associated risk.

First project: (don't mind the label)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started