Please help me solve this!!! lots of thanks!!!!

| Accounting 2 - Financial Statement Analysis Project | | | | | | | |

| Please refer to chapter 17 to refresh your memory on ratio analysis. | | | | | | | |

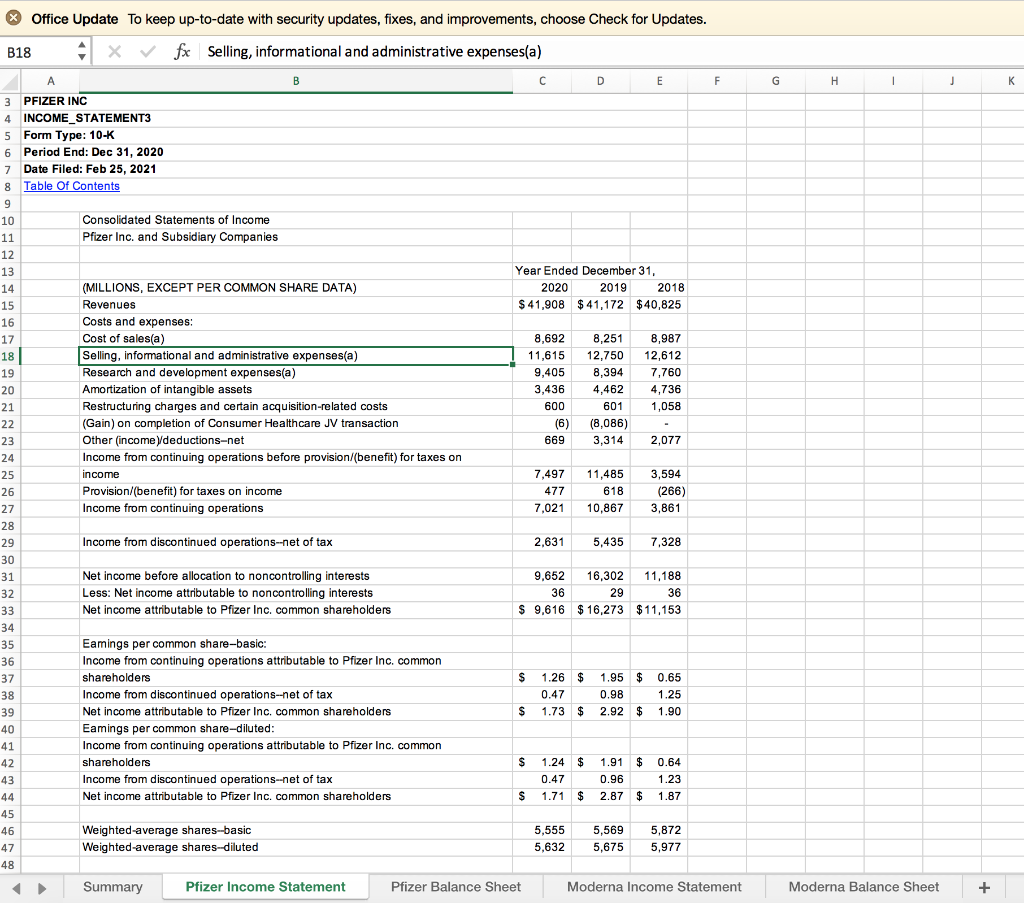

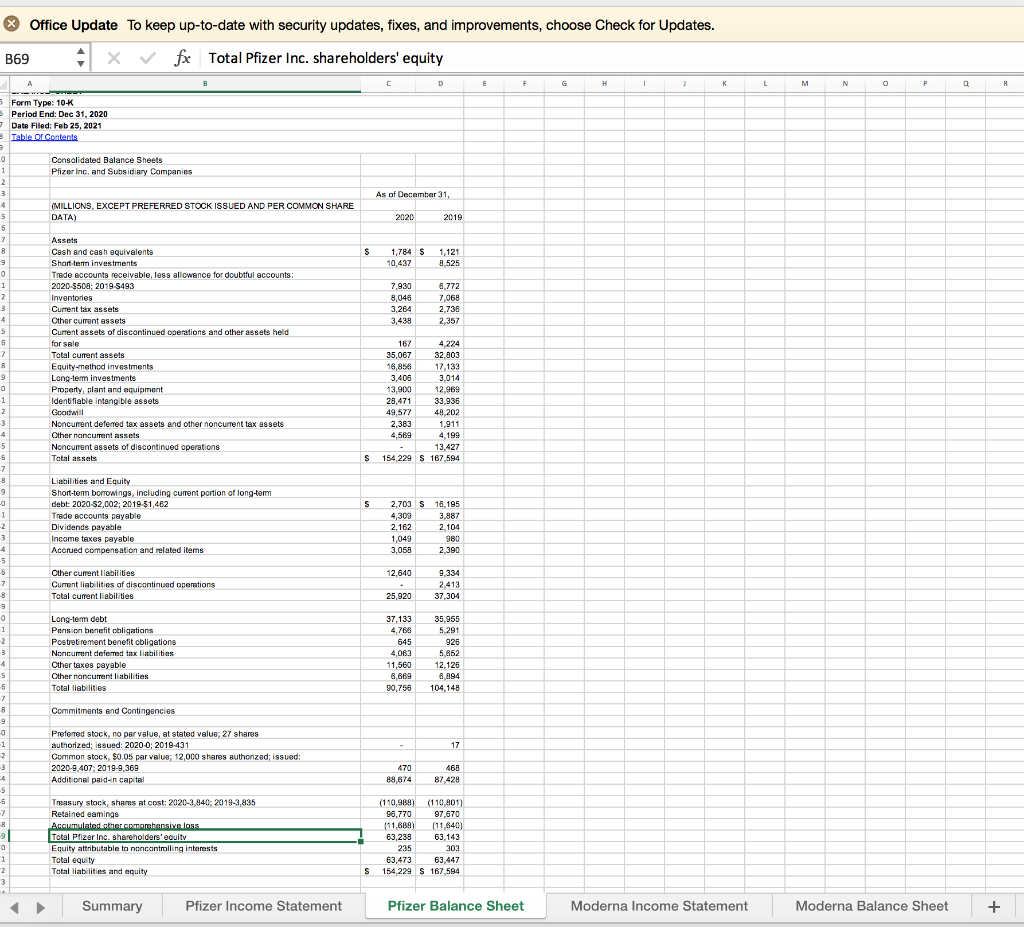

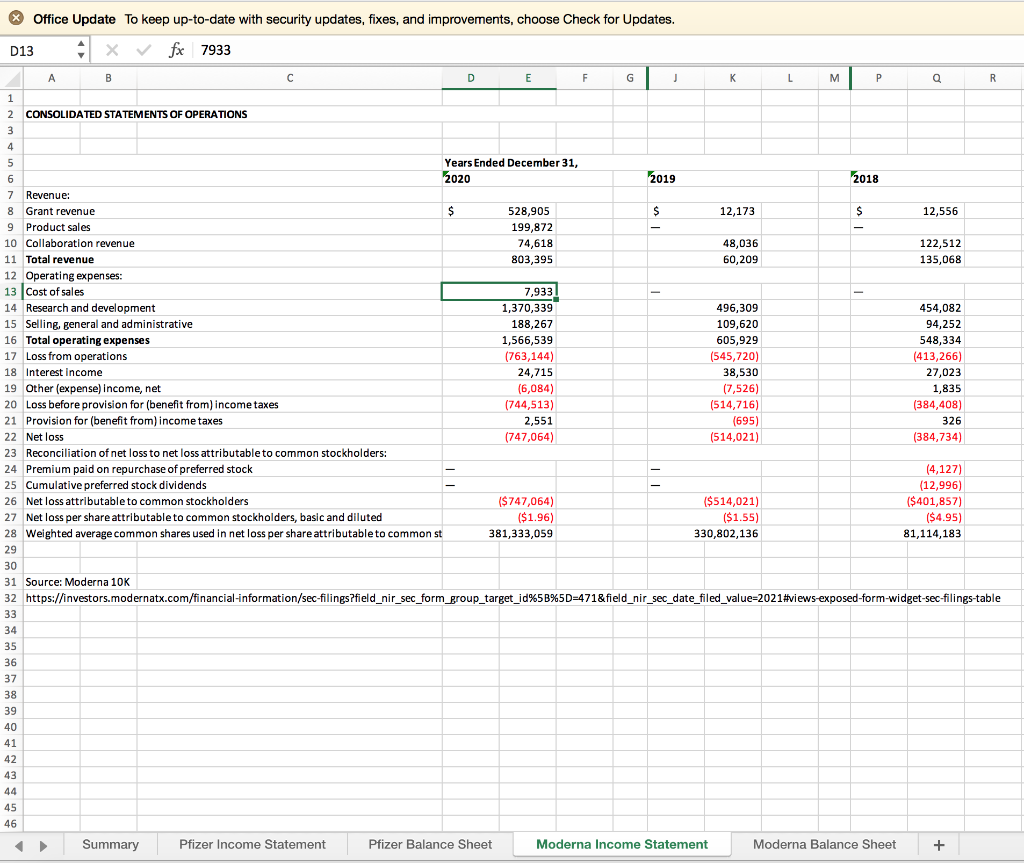

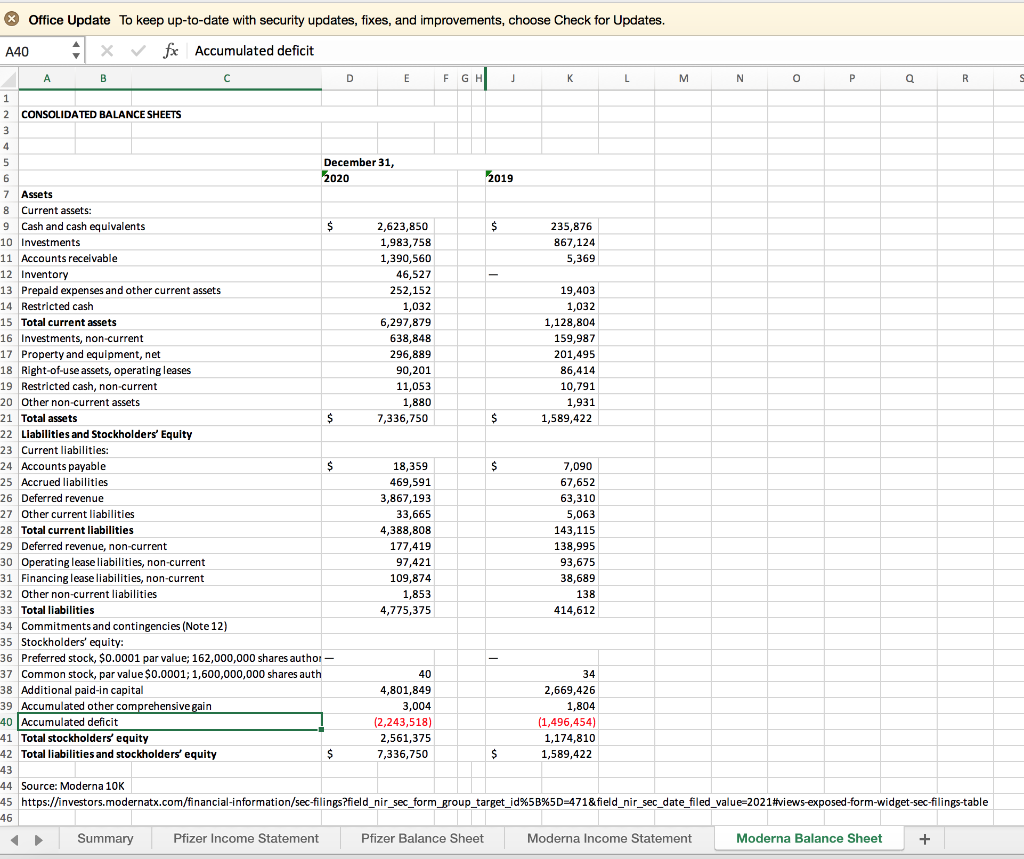

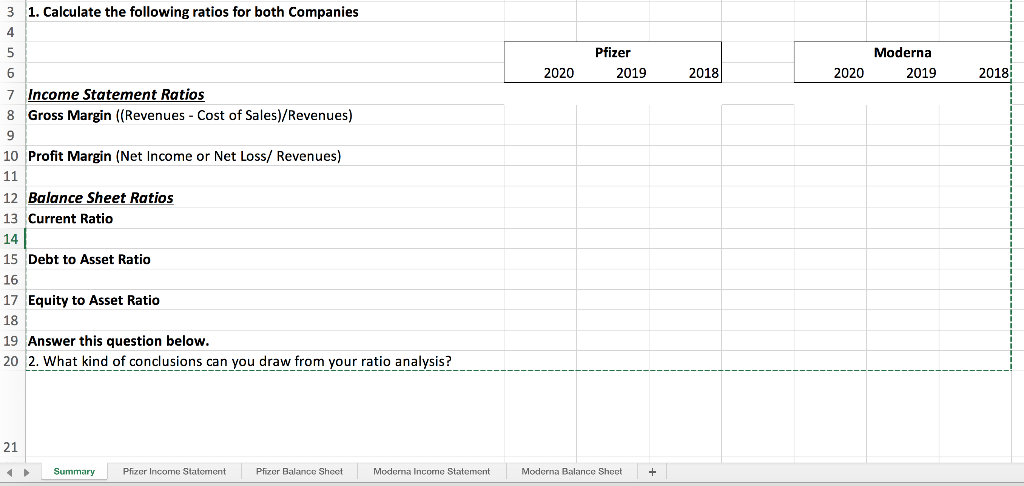

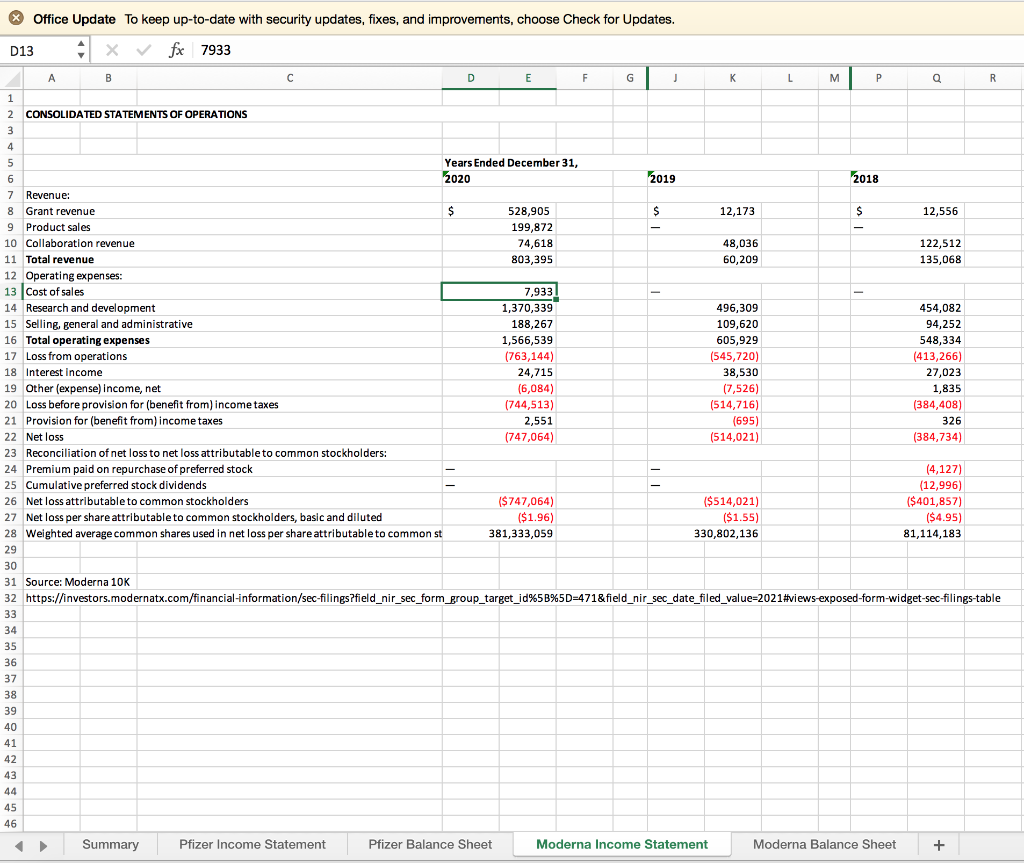

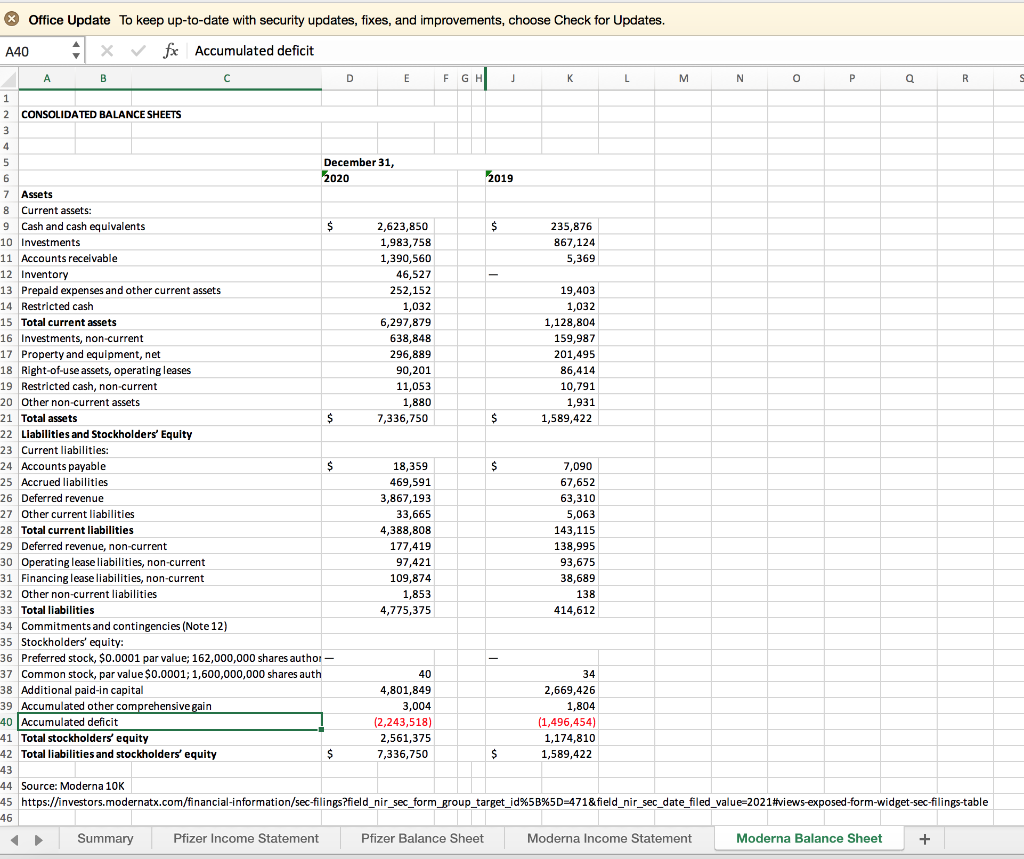

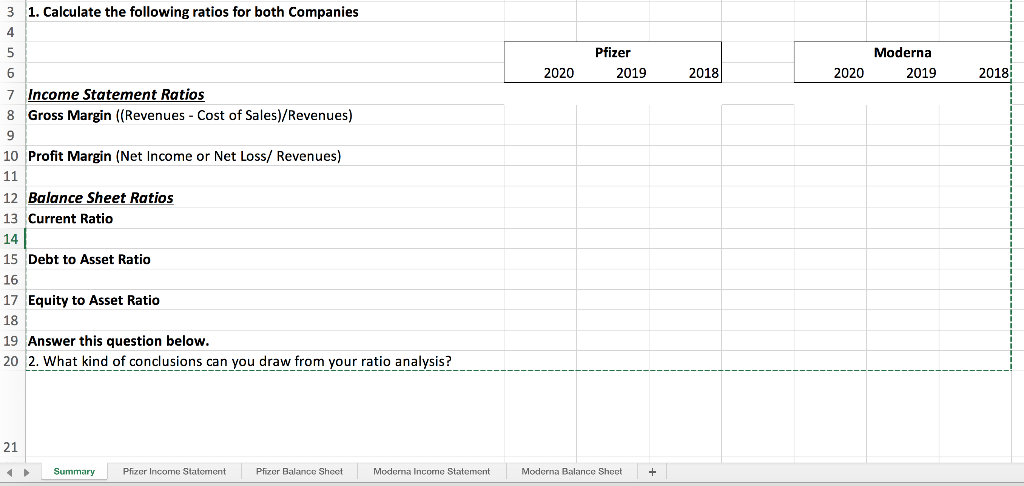

| 1. Calculate the following ratios for both Companies | | | | | | | |

| | | | | | | | |

| | Pfizer | | Moderna |

| | 2020 | 2019 | 2018 | | 2020 | 2019 | 2018 |

| Income Statement Ratios | | | | | | | |

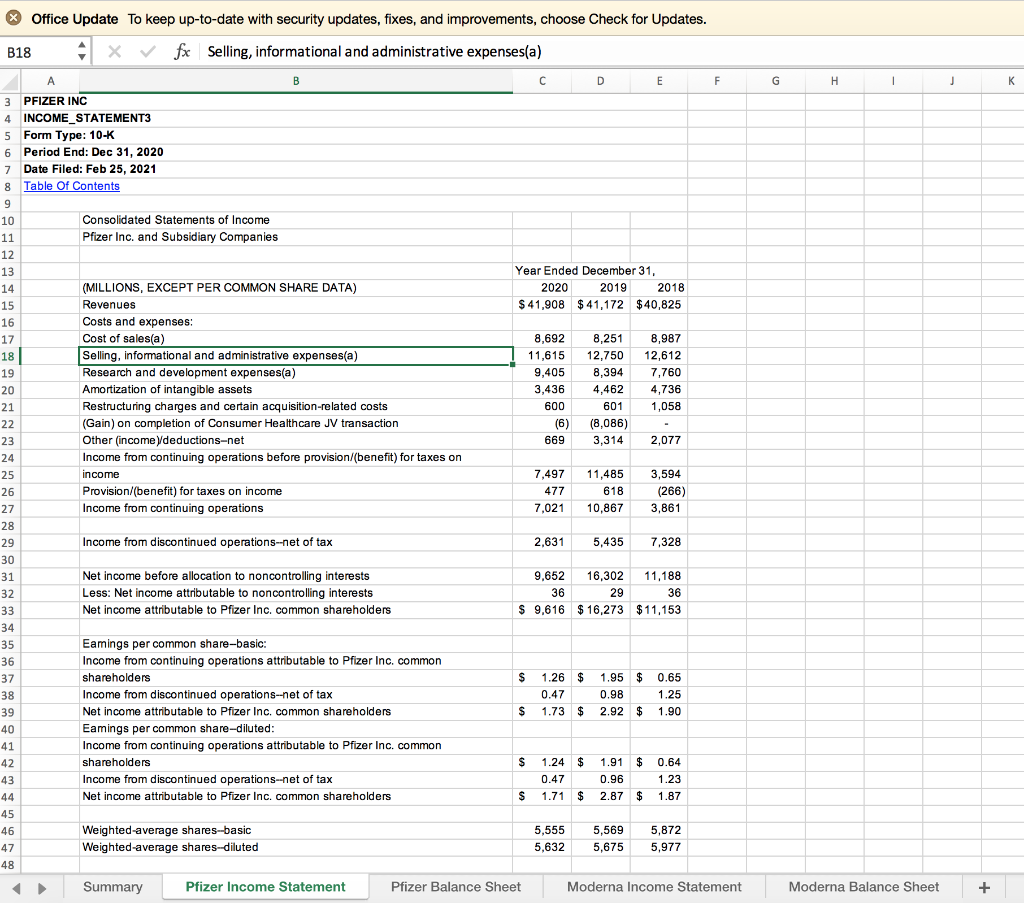

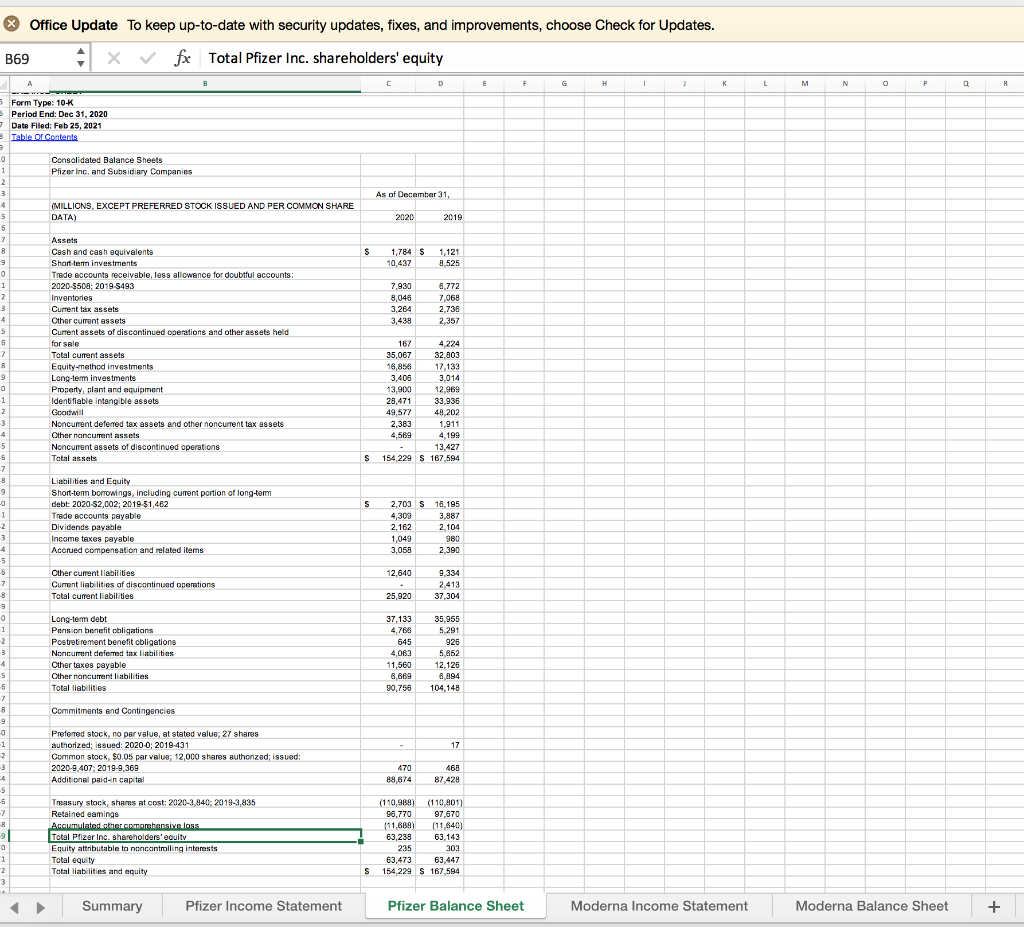

| Gross Margin ((Revenues - Cost of Sales)/Revenues) | | | | | | | |

| | | | | | | | |

| Profit Margin (Net Income or Net Loss/ Revenues) | | | | | | | |

| | | | | | | | |

| Balance Sheet Ratios | | | | | | | |

| Current Ratio | | | | | | | |

| | | | | | | | |

| Debt to Asset Ratio | | | | | | | |

| | | | | | | | |

| Equity to Asset Ratio | | | | | | | |

| | | | | | | | |

| Answer this question below. | | | | | | | |

| 2. What kind of conclusions can you draw from your ratio analysis? | | | | | |

x Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. F G H 1 K B18 X fx Selling, informational and administrative expenses(a) A B D E E 3 PFIZER INC 4 INCOME_STATEMENT3 5 Form Type: 10K 6 Period End: Dec 31, 2020 7 Date Filed: Feb 25, 2021 8 Table of Contents 9 10 Consolidated Statements of Income 11 Pfizer Inc. and Subsidiary Companies 12 13 Year Ended December 31, 14 (MILLIONS, EXCEPT PER COMMON SHARE DATA) 2020 2019 2018 15 Revenues $ 41,908 $ 41,172 $40,825 16 Costs and expenses: 17 Cost of sales(a) 8,692 8,251 8,987 18 Selling, informational and administrative expenses(a) 11,615 12.750 12,612 19 Research and development expenses(a) 9,405 8,394 7,760 20 Amortization of intangible assets 3,436 4,462 4,736 21 Restructuring charges and certain acquisition-related costs 600 601 1,058 22 (Gain) on completion of Consumer Healthcare JV transaction (6) (8,086) 23 Other (income)deductions-net 669 3,314 2,077 24 Income from continuing operations before provision/(benefit) for taxes on 25 income 7,497 11,485 3,594 26 Provision/(benefit) for taxes on income 477 618 (266) 27 Income from continuing operations 7,021 28 28 29 Income from discontinued operations--net of tax 2,631 5,435 7,328 30 31 Net income before allocation to noncontrolling interests 9,652 16,302 11,188 32 Less: Net income attributable to noncontrolling interests 36 29 36 33 Net income attributable to Pfizer Inc. common shareholders $ 9,616 $ 16,273 $11,153 34 35 Eamings per common share-basic: 36 Income from continuing operations attributable to Pfizer Inc. common 37 shareholders $ 1.26 $ 1.95 $ $ 0.65 38 Income from discontinued operations--net of tax 0.47 0.98 1.25 39 Net income attributable to Pfizer Inc. common shareholders S 1.73 $ 2.92 $ 1.90 40 Eamings per common share-diluted: 41 Income from continuing operations attributable to Pfizer Inc. common 42 shareholders S 1.24 $ 1.91 $ 0.64 43 Income from discontinued operations-net of tax 0.47 0.96 1.23 44 Net income attributable to Pfizer Inc. common shareholders S 1.71 $ 2.87 $ 1.87 45 46 Weighted average shares--basic 5,555 5,569 5,872 47 Weighted average shares-diluted 5,632 5,675 5,977 48 10,867 3,861 Summary Pfizer Income Statement Pfizer Balance Sheet Moderna Income Statement Moderna Balance Sheet + x Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. B69 X fx Total Pfizer Inc. shareholders' equity A C C D E F H 1 3 L M N P R Form Type: 10K Period End: Dec 31, 2020 - Date Filed: Feb 25, 2021 Table of Contents Consolidated Balance Sheets Pfizer Inc. and Subsidiary Companies As of December 31, (MILLIONS, EXCEPT PREFERRED STOCK ISSUED AND PER COMMON SHARE DATA) 2020 2019 0 1 2 3 4 5 5 5. 7 8. 9 0 a 1 2 3 4. S 1,784 S 10,437 1,121 8.525 7,930 8,046 3,264 3,439 6,772 7,068 2.736 2,357 Assets Cash and cash equivalents Short-term investments Trade accounts receivable, less allowance for doubtful accounts: 2020-$500: 2019-8493 Inventories Current tax assets Other current assets Current assets of discontinued operations and other assets held for sale Total current assets Equity-method investments Long-term investments Property, plant and equipment Identifiable intangible assets Goodwill Noncurrent deferred tax assets and other noncurrent tax assets Other mancurrent assets Noncurrent assets of discontinued operations Total assets 167 4224 35,067 32,303 16,856 17,133 3,408 3,014 13,900 12,969 28,471 33,936 49,577 48 202 2,383 1,911 4,569 4,199 13,427 154,229 S 167,594 S S 5 6 7 8 9 a 1 2 3 4 5 5 7 8 9 0 1 -2 3 4 5 -6 -7 8 9 0 1 2 3 S s Liabilities and Equity Short-term borrowings, including current portion of long-term debt: 2020-S2,002: 2019-51,462 Trade accounts payable Dividends payable Income taxes payable Accrued compensation and related items 2,703 S 16,195 4,309 3,887 2,162 2,104 1,049 980 3,050 2.390 12,640 Other current liabilities Current liabilities of discontinued operations Total current liabilities 9,334 2,413 37,304 25,920 Long-term debt Pension benefit obligations Postretirement benefit obligations Noncurrunt deferred tax liabilities Other taxes payable Other noncurrent liabilities Total liabilities 37,133 4.768 645 4,063 11,560 8,669 90,750 35,955 5.291 926 5,652 12,120 8,294 104,148 Commitments and Contingencies 5 5 7 B 9 0 -1 2 -3 17 Preferred stock, no par value, at stated value: 27 shares authorized; issued: 2020-0; 2019-431 Common stock, $0.05 par value; 12,000 shares authorized; issued: 2020-9.407.2019-9,369 Additional paid in capital 470 89,674 468 87,428 -5 5 -7 8 9 a 1 2 L Treasury stock, sharus at cost: 2020-3,940; 2019-3,835 Retained eamings Accumulated atheromarehensive loss Total Pfizer Inc. shareholders' equity Equity attributable to noncontrolling interests Total equity Total liabilities and equity (110,989) (110,801) 96,770 97,670 (11,689) (11,840) ) 63,238 63,143 235 302 63,473 63,447 154,229 S 167,594 S Summary Pfizer Income Statement Pfizer Balance Sheet Moderna Income Statement Moderna Balance Sheet + Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. D13 Xfx 7933 A B C D E F G L M P Q R 1 2 CONSOLIDATED STATEMENTS OF OPERATIONS 3 4 5 Years Ended December 31, 6 2020 2019 2018 7 Revenue: 8 Grant revenue $ 528,905 $ 12, 173 $ 12,556 9 Product sales 199,872 10 Collaboration revenue 74,618 48,036 122,512 ........... 11 Total revenue 803,395 60,209 135,068 12 Operating expenses: 13 Cost of sales 7,933 14 Research and development 1,370,339 496,309 454,082 10 Benda 15 Selling, general and administrative 188,267 109,620 94,252 16 Total operating expenses 1,566,539 605,929 548,334 17 Loss from operations (763,144) (545,720) (413,266) 18 Interest income 24,715 38,530 27,023 19 Other (expense) income, net (6,084) (7,526) 1,835 20 Loss before provision for (benefit from) income taxes (744,513) (514,716) (384,408) 21 Provision for (benefit from) income taxes 2,551 (695) 326 22 Net loss (747,064) (514,021) (384,734) 23 Reconciliation of net loss to net loss attributable to common stockholders: 24 Premium paid on repurchase of preferred stock (4,127) 25 Cumulative preferred stock dividends (12,996) 26 Net loss attributable to common stockholders ($ 747,064) ($514,021) ($401,857) 27 Net loss per share attributable to common stockholders, basic and diluted ($1.96) ($1.55) ($4.95) 28 Weighted average common shares used in net loss per share attributable to common st 381,333,059 330,802,136 81,114,183 29 2 30 31 Source: Moderna 10K 32 https://investors.modernatx.com/financial-information/sec-filings?field_nir_sec_form_group_target_id%5B%5D=471&field_nir_sec_date_filed_value=2021#views-exposed-form-widget-sec-filings-table 33 34 35 36 37 38 39 40 41 42 43 44 45 46 Summary Pfizer Income Statement Pfizer Balance Sheet Moderna Income Statement Moderna Balance Sheet + * Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. A40 fx Accumulated deficit K S 2019 A B D E F G H J L M N o P R 1 2. CONSOLIDATED BALANCE SHEETS 3 4 5 December 31, 6 2020 7 Assets 8 Current assets: 9 Cash and cash equivalents $ 2,623,850 $ 235,876 1..... 10 Investments 1,983,758 867,124 11 Accounts receivable 1,390,560 5,369 12 Inventory 46,527 13 Prepaid expenses and other current assets 252,152 19,403 14 Restricted cash 1,032 103) 1,032 w... 15 Total current assets 6,297,879 1,128,804 16 Investments, non-current 638,848 159,987 17 Property and equipment, net 296,889 206 200 201,495 18 Right-of-use assets, operating leases 90,201 86,414 19 Restricted cash, non-current 11,053 10,791 20 Other non-current assets - 1,880 1,931 21 Total assets $ 7,336,750 $ 1,589,422 22 Llabilities and Stockholders' Equity 23 Current liabilities: 24 Accounts payable $ 18,359 $ 7,090 25 Accrued liabilities cucu madres 469,591 67,652 26 Deferred revenue 3,867,193 63,310 27 Other current liabilities 33,665 5,063 . 28 Total current liabilities 4,388,808 143,115 29 Deferred revenue, non-current 177,419 138,995 30 petang 30 Operating lease liabilities, non-current 97,421 93,675 31 Financing lease liabilities, non-current 109,874 38,689 32 Other non-current liabilities 1,853 138 . 33 Total liabilities 4,775,375 414,612 34 Commitments and contingencies (Note 12) 35 Stockholders' equity: 36 Preferred stock, $0.0001 par value; 162,000,000 shares author 37 Common stock, par value $0.0001;1,600,000,000 shares auth 40 34 38 Additional paid-in capital 4,801,849 2,669,426 39 Accumulated other comprehensive gain 3,004 1,804 40 Accumulated deficit (2.243,518) (1,496,454) 41 Total stockholders' equity 2,561,375 1,174,810 42 Total liabilities and stockholders' equity $ 7,336,750 $ 1,589,422 43 44 Source: Moderna 10K 45 https://investors.modernatx.com/financial-information/sec-filings?field_nir_sec_form_group_target_id%5B%5D=471&field_nir_sec_date_filed_value=2021#views-exposed-form-widget-sec-filings-table 46 Summary Pfizer Income Statement Pfizer Balance Sheet Moderna Income Statement Moderna Balance Sheet + 3 1. Calculate the following ratios for both Companies 4 Pfizer 2019 Moderna 2019 2020 2018 2020 2018 5 6 7 Income Statement Ratios 8 Gross Margin (Revenues - Cost of Sales)/Revenues) 9 10 Profit Margin (Net Income or Net Loss/ Revenues) 11 12 Balance Sheet Ratios 13 Current Ratio 14 15 Debt to Asset Ratio 16 17 Equity to Asset Ratio 18 19 Answer this question below. 20 2. What kind of conclusions can you draw from your ratio analysis? 21 Summary Pfizer Income Statement Pfizer Balance Sheet Moderna Income Statement Moderna Balance Sheet