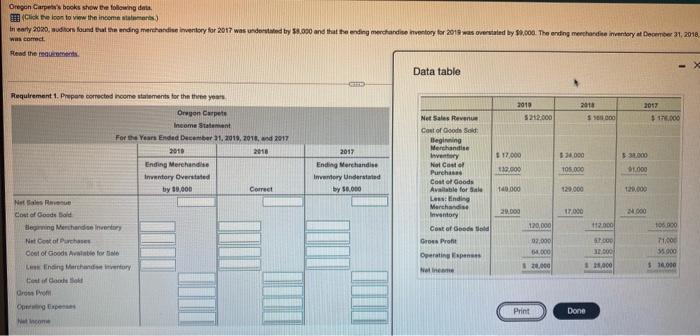

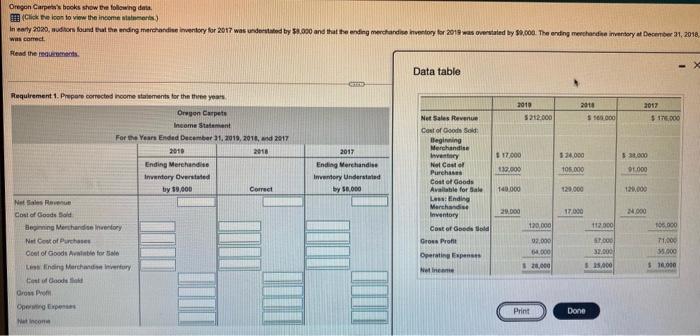

Please help me solve this.

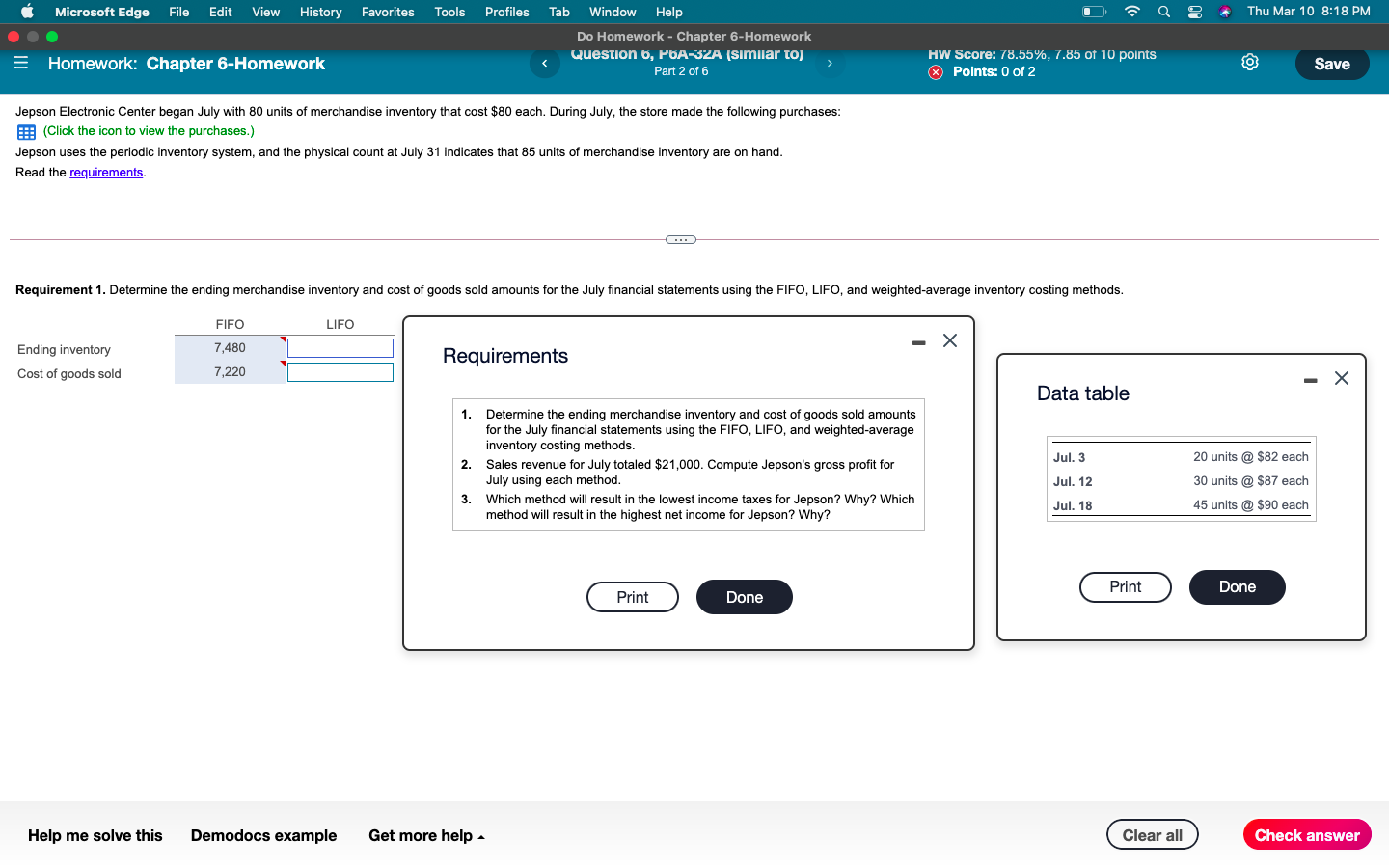

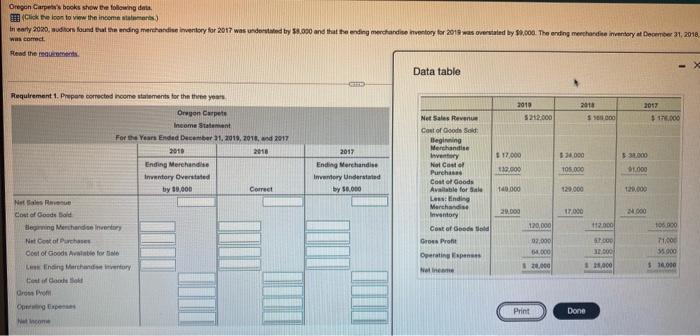

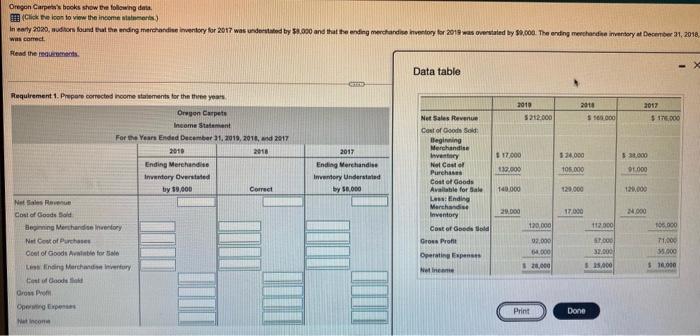

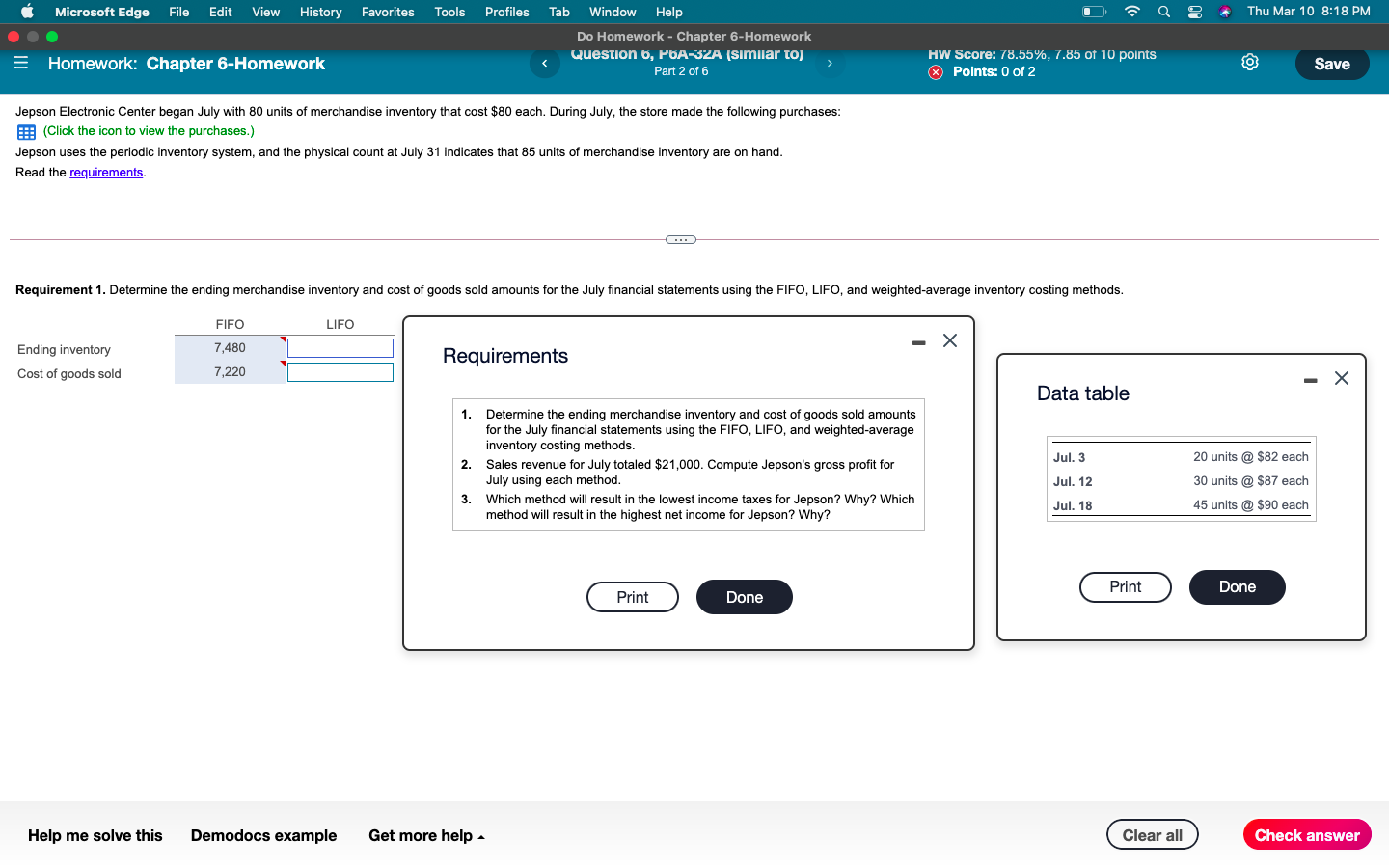

Microsoft Edge File Edit View History Favorites Tools Profiles Thu Mar 10 8:18 PM Tab Window Help Do Homework - Chapter 6-Homework Question 6, POA-32A (similar to) Part 2 of 6 = Homework: Chapter 6-Homework > HW Score: 78.55%, 7.85 of 10 points Points: 0 of 2 Save Jepson Electronic Center began July with 80 units of merchandise inventory that cost $80 each. During July, the store made the following purchases: E (Click the icon to view the purchases.) Jepson uses the periodic inventory system, and the physical count at July 31 indicates that 85 units of merchandise inventory are on hand. Read the requirements. .. Requirement 1. Determine the ending merchandise inventory and cost of goods sold amounts for the July financial statements using the FIFO, LIFO, and weighted average inventory costing methods. LIFO FIFO 7,480 7,220 - X Ending inventory Cost of goods sold Requirements - X Data table 1. Jul. 3 2. Determine the ending merchandise inventory and cost of goods sold amounts for the July financial statements using the FIFO, LIFO, and weighted average inventory costing methods. Sales revenue for July totaled $21,000. Compute Jepson's gross profit for July using each method. Which method will result in the lowest income taxes for Jepson? Why? Which method will result in the highest net income for Jepson? Why? Jul. 12 20 units @ $82 each 30 units @ $87 each 45 units @ $90 each 3. Jul. 18 Print Done Print Done Help me solve this Demodocs example Get more help Clear all Check answer Oregon Carpetbooks show the following det Click the loos tow the income talimat In early 2020, sudions found at the ending merchandise inventory for 2017 was underted by 8.000 and that the ending dardise inventory for 2019 was overed by 99.000. The ending merchandise inntry at December 31, 2018 was correct Read the rest Data table 2017 2010 5212.000 2018 S300 $ 170.000 2017 17 000 34.000 3.000 1000 132.000 105.000 Ending Merchandise Intry Understated by 50.000 Net Sales Revenue Cost of God's Sl Beginning Merchandise Inventory Nel costo Purchase Cost of Goods Available for sale Lewinding March Inventory Cost of Good Gross Pro 140 000 Requirement 1. Prepare corrected income statements for the three years Orwen Carpets Income Statement For the Year Ended December 31, 2019, 2010, and 2017 2010 2010 Ending Mere Inventory Overstated by 80.000 Correct Net als Cost of Goods Bold lleging Merchandisiner Net Cook of Purchase Cool of Goods Avatable for til Ending Machinery Costcode Grote Pro Open 129.000 20. DOO 17.000 000 120,000 112.000 105.000 07.000 SPOD TO 55.900 Operating Net nee 1.00 1,000 20.00 $ 10.000 Print Done con Oregon Carper's books show the following det Click the icon to view the income in In early 2020, nuditors found at the ending merchandise inventory for 2017 was understated by $1.000 and that the ending merchandise intory 2018 was overated by $8,000. The ending merchande inventory December 31, 2010 was correct Read the reducts Data table C Requirement 1. Prepare corrected nome statements for the three years 2010 5212.000 2018 S 560 000 2017 $ 1.000 17.000 34000 2017 Ending Merchandise Inventory Understated by 18.000 Net Sales Revenue Cost of Beginning Merchandise Inventory Nel costo Purchas Coat of Goods Available for Sale Linding Merchand Inventory 30.000 1000 112.000 105.000 140.000 120.000 Oregon Carpets Income Statement For the Year Ended December 31, 2010, 2011, 2017 2010 2018 Ending Merchandise Indory Overstated by $9.000 Corret Net Sales Revue Cost of Goods Sold Being Methodno Net Cost of Purchase Cet of Goods Arawbl for Solo Lining Merchandfury Cost of Good Gross Pro Opera 120.000 20.000 17.000 2000 120.000 112.000 100.000 Cost of Good Gold Gross Prote 07.000 000 SP. 32.000 T10 55.000 Operating Expenses Net 20.000 315.000 $ 100 Print Done con