Please help me solve this problem

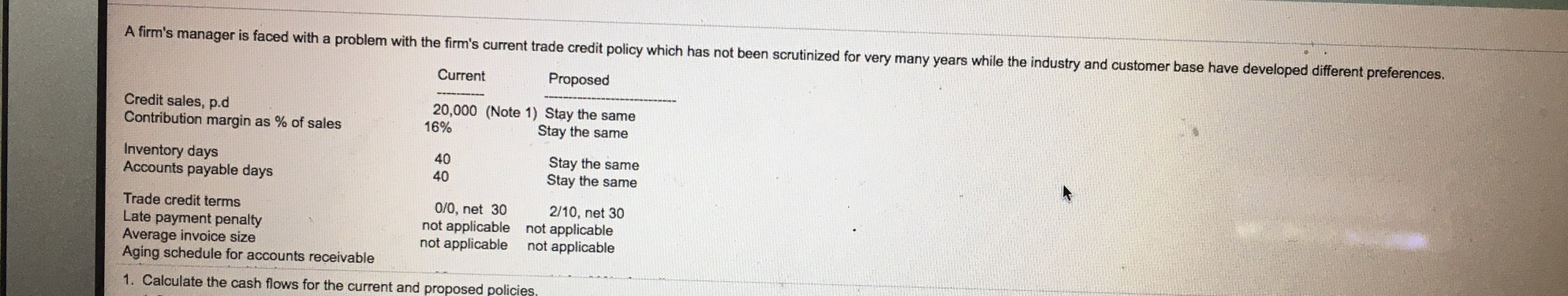

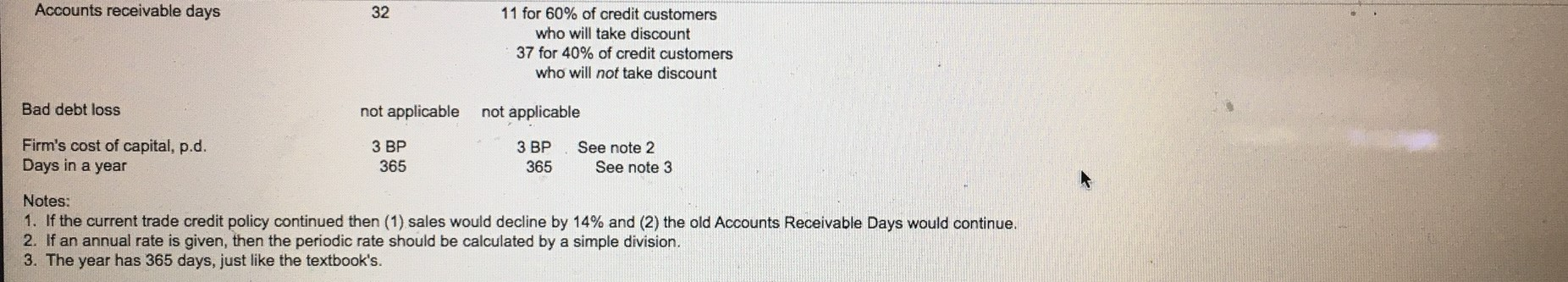

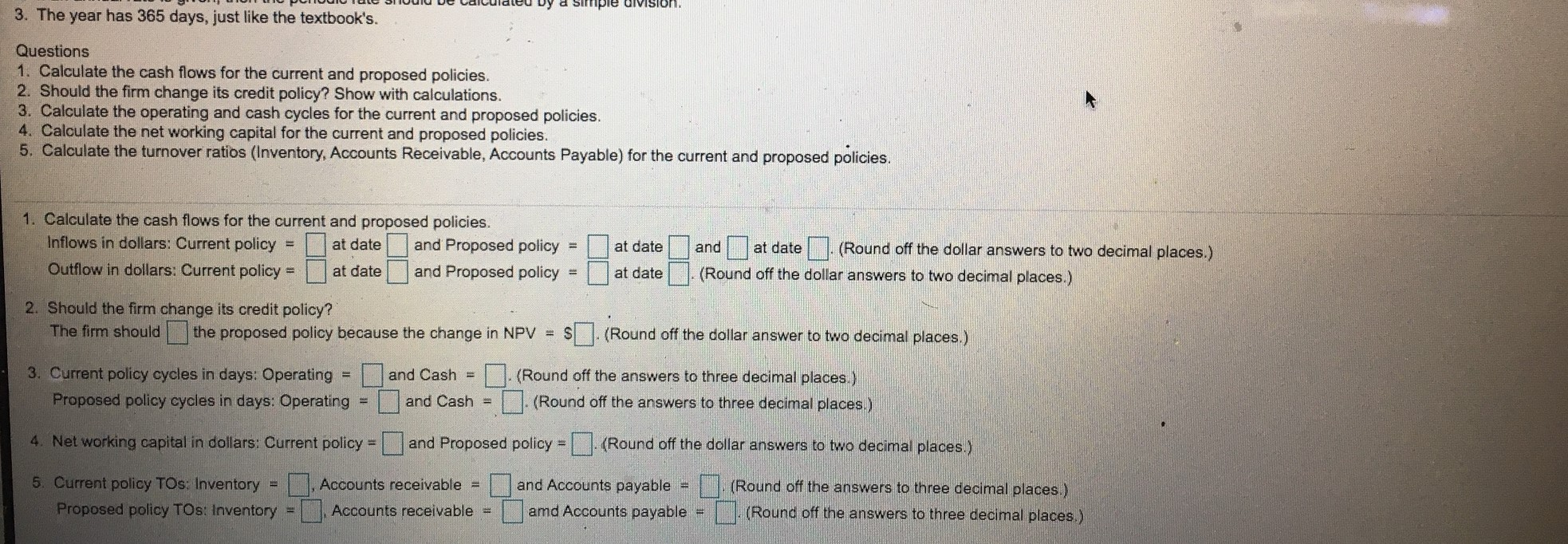

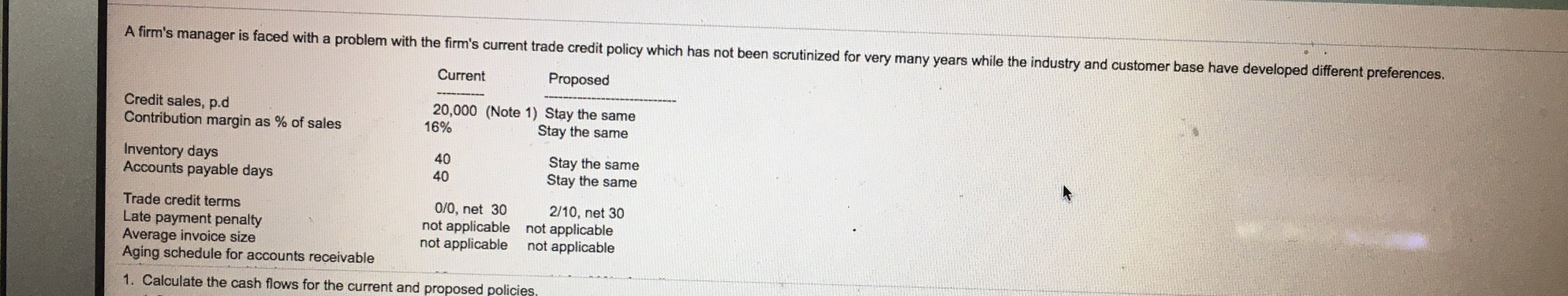

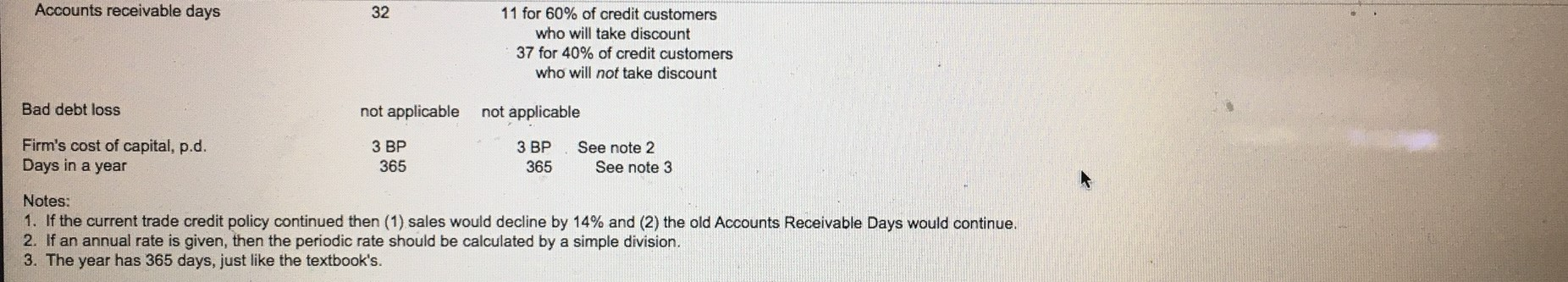

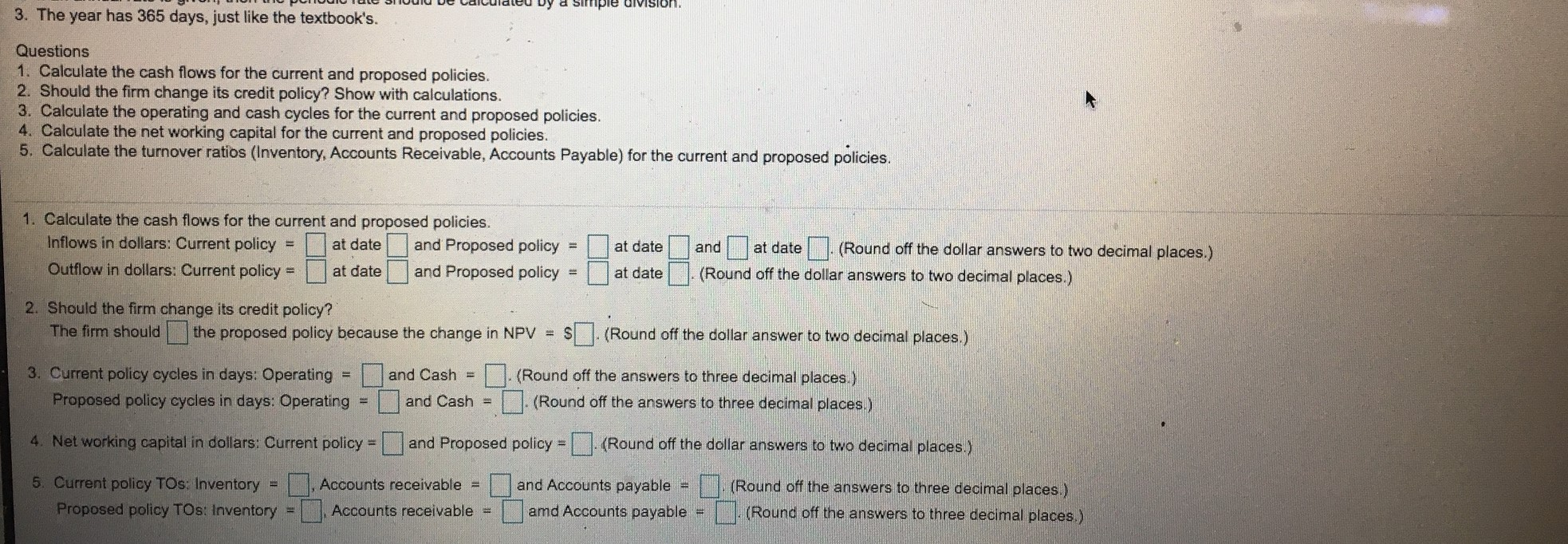

A firm's manager is faced with a problem with the firm's current trade credit policy which has not been scrutinized for very many years while the industry and customer base have developed different preferences. Current Proposed Credit sales, p.d Contribution margin as % of sales 20,000 (Note 1) Stay the same 16% Stay the same Inventory days Accounts payable days 40 40 Stay the same Stay the same Trade credit terms 0/0, net 30 2/10, net 30 Late payment penalty not applicable not applicable Average invoice size not applicable not applicable Aging schedule for accounts receivable 1. Calculate the cash flows for the current and proposed policies. Accounts receivable days 32 11 for 60% of credit customers who will take discount 37 for 40% of credit customers who will not take discount Bad debt loss not applicable not applicable Firm's cost of capital, p.d. Days in a year 3 BP 365 365 See note 2 See note 3 Notes: 1. If the current trade credit policy continued then (1) sales would decline by 14% and (2) the old Accounts Receivable Days would continue. 2. If an annual rate is given, then the periodic rate should be calculated by a simple division. 3. The year has 365 days, just like the textbook's. by a simple division. 3. The year has 365 days, just like the textbook's. Questions 1. Calculate the cash flows for the current and proposed policies. 2. Should the firm change its credit policy? Show with calculations. 3. Calculate the operating and cash cycles for the current and proposed policies. 4. Calculate the net working capital for the current and proposed policies. 5. Calculate the turnover ratios (Inventory, Accounts Receivable, Accounts Payable) for the current and proposed policies. 1. Calculate the cash flows for the current and proposed policies. Inflows in dollars: Current policy at date and Proposed policy Outflow in dollars: Current policy = at date and Proposed policy at date and at date (Round off the dollar answers to two decimal places.) (Round off the dollar answers to two decimal places.) at date 2. Should the firm change its credit policy? The firm should the proposed policy because the change in NPV = $ (Round off the dollar answer to two decimal places.) 3. Current policy cycles in days: Operating = and Cash = (Round off the answers to three decimal places.) Proposed policy cycles in days: Operating and Cash = (Round off the answers to three decimal places) 4. Net working capital in dollars: Current policy - and Proposed policy = (Round off the dollar answers to two decimal places.) 5. Current policy TOS: Inventory = Proposed policy TOs: Inventory Accounts receivable = Accounts receivable = and Accounts payable = amd Accounts payable (Round off the answers to three decimal places.) (Round off the answers to three decimal places.) A firm's manager is faced with a problem with the firm's current trade credit policy which has not been scrutinized for very many years while the industry and customer base have developed different preferences. Current Proposed Credit sales, p.d Contribution margin as % of sales 20,000 (Note 1) Stay the same 16% Stay the same Inventory days Accounts payable days 40 40 Stay the same Stay the same Trade credit terms 0/0, net 30 2/10, net 30 Late payment penalty not applicable not applicable Average invoice size not applicable not applicable Aging schedule for accounts receivable 1. Calculate the cash flows for the current and proposed policies. Accounts receivable days 32 11 for 60% of credit customers who will take discount 37 for 40% of credit customers who will not take discount Bad debt loss not applicable not applicable Firm's cost of capital, p.d. Days in a year 3 BP 365 365 See note 2 See note 3 Notes: 1. If the current trade credit policy continued then (1) sales would decline by 14% and (2) the old Accounts Receivable Days would continue. 2. If an annual rate is given, then the periodic rate should be calculated by a simple division. 3. The year has 365 days, just like the textbook's. by a simple division. 3. The year has 365 days, just like the textbook's. Questions 1. Calculate the cash flows for the current and proposed policies. 2. Should the firm change its credit policy? Show with calculations. 3. Calculate the operating and cash cycles for the current and proposed policies. 4. Calculate the net working capital for the current and proposed policies. 5. Calculate the turnover ratios (Inventory, Accounts Receivable, Accounts Payable) for the current and proposed policies. 1. Calculate the cash flows for the current and proposed policies. Inflows in dollars: Current policy at date and Proposed policy Outflow in dollars: Current policy = at date and Proposed policy at date and at date (Round off the dollar answers to two decimal places.) (Round off the dollar answers to two decimal places.) at date 2. Should the firm change its credit policy? The firm should the proposed policy because the change in NPV = $ (Round off the dollar answer to two decimal places.) 3. Current policy cycles in days: Operating = and Cash = (Round off the answers to three decimal places.) Proposed policy cycles in days: Operating and Cash = (Round off the answers to three decimal places) 4. Net working capital in dollars: Current policy - and Proposed policy = (Round off the dollar answers to two decimal places.) 5. Current policy TOS: Inventory = Proposed policy TOs: Inventory Accounts receivable = Accounts receivable = and Accounts payable = amd Accounts payable (Round off the answers to three decimal places.) (Round off the answers to three decimal places.)