Please help me solve this problem

the cost classification and the variable and fixed cost the instructions are posted. please show me how you got answers so I can understand. thanks

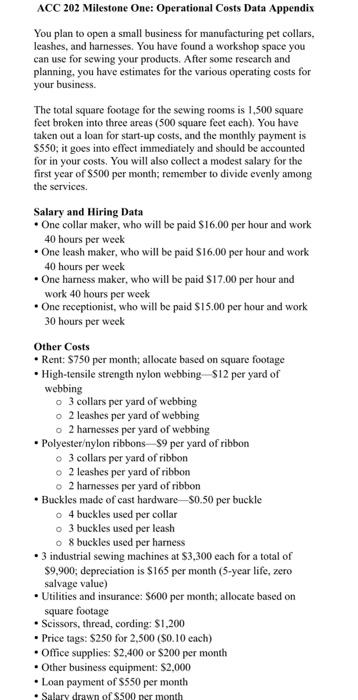

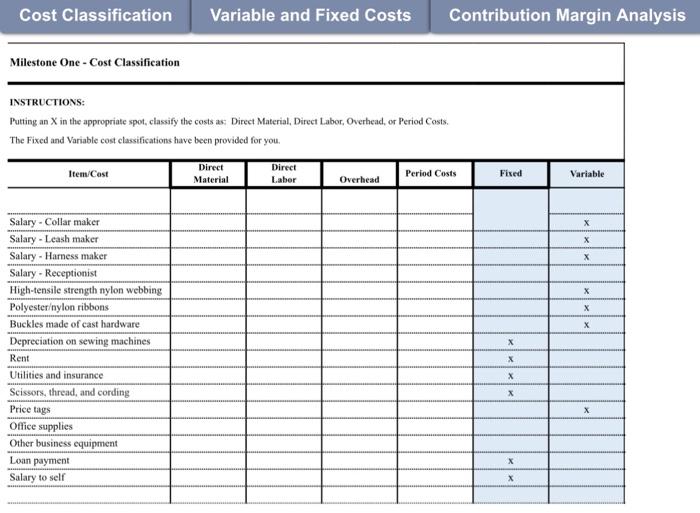

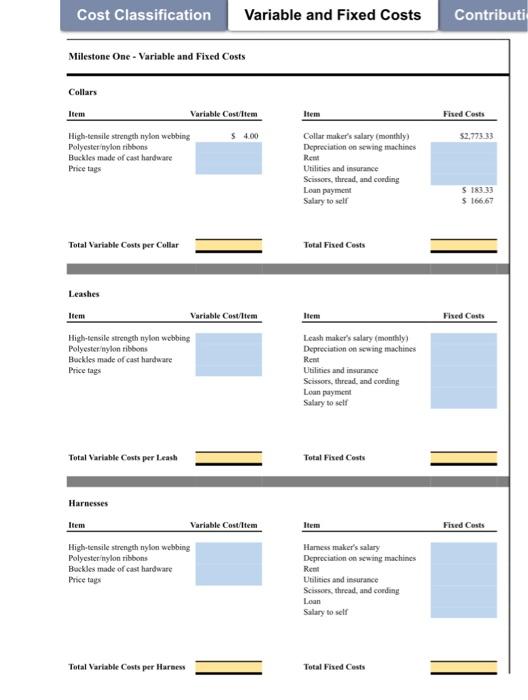

Milestone One Guidelines and Rubric Overview Successful entrepreneurs understand all aspects of business, especially costs and costing systems. In the course project, you will assume the role of the owner of a small business and apply managerial accounting principles to evaluate and manage costs related to your services within a costing system. In the first milestone of the project, you will determine and classify the costs necessary for opening your business. Scenario You plan to open a business manufacturing collars, leashes, and harnesses for pets. To begin. you will manufacture these in a standard style and size with plans to expand your range over the year. In a few weeks, you will present your company's financial strategy to some key investors. To begin creating your strategy, you need to consider and record all the costs associated with operating your business. You have decided to use the job order costing system. Prompt Use the given operational costs in the Milestone One Operational Costs Data Appendix Word Document to complete the first two tabs, "Cost Classification" and "Variable and Fixed Costs," in the Project Workbook Spreadsheet. Salary and Hiring Data - One collar maker, who will be paid $16.00 per hour and work 40 hours per week - One leash maker, who will be paid \$I6.00 per hour and work 40 hours per week - One harness maker, who will be paid $17.00 per hour and work 40 hours per week - One receptionist, who will be paid $15,00 per hour and work 30 hours per week Other Costs - Rent: $750 per month; allocate based on square footage - High-tensile strength nylon webbing- $12 per yard of webbing - 3 collars per yard of webbing - 2 leashes per yard of webbing - 2 harnesses per yard of webbing - Polyesterylon ribbons- $9 per yard of ribbon 3 collars per yard of ribbon 2 leashes per yard of ribbon 2 harnesses per yard of ribbon - Buckles made of cast hardware- $0.50 per buckle 4 buckles used per collar - 3 buckles used per leash - 8 buckles used per harness - 3 industrial sewing machines at $3,300 each for a total of $9,900; depreciation is $165 per month (5-year life, zero salvage valuc) - Utilities and insurance: $600 per month; allocate based on square footage - Scissors, thread, cording: $1,200 - Price tags: $250 for 2,500 ( $0.10 each) - Office supplies: $2,400 or $200 per month - Other business equipment: $2,000 - Loan payment of $550 per month INSTRUCTIONS: Putting an X in the appropriate spot, classify the costs as: Direct Material, Direct Labor, Overhead, or Period Costs. The Fixed and Variable cost classifications have been provided for you. Cost Classification Variable and Fixed Costs Contributi Milestone One - Variable and Fixed Costs Collars Item High-tensile strength nylon wobbing Polyester inylon ribbens Backles made of cast hardware Price tags Variable Cos4/tem 5400 Total Variable Cests per Collar Total Fincd Cests Leashes ltem Variable Costltem High-Eensile serength nylon wobbing Polyester inylon ribbons Bockles made of cast harduare Price tags Item Fized Cests Collar maker's salary (monthly) 52,774.33 Depreciation on scaing machines Rewat Utilities and insurance Scissors, thread, and cooding Loan paymem Salary to self 5. 183.33 5. 166.67 Total Variable Cests per Leash Total Fixed Costs Harnesses Item Variable Costltem High-tensile strength nylon webbing Polyesterinylon ribbons Bockles made of cast hardware Price tags ltem Fixed Cests Leash maker's salary (monthly) Depreciation on sewing machines Rent Utilities and insurance Scissors, thread, and cooding Loan payment Salary so self Item Fised Cests Hances maker's salary Depreciation on sewing machincs Ren Uvilitier and iesurasec Scissues, thread, and coeding. Lion Salary to self Total Variable Cests per Hareess Total Fixed Cests