Please help me solve this question

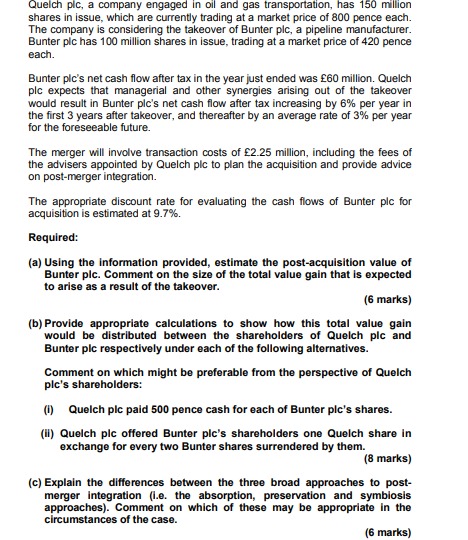

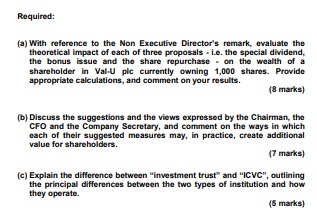

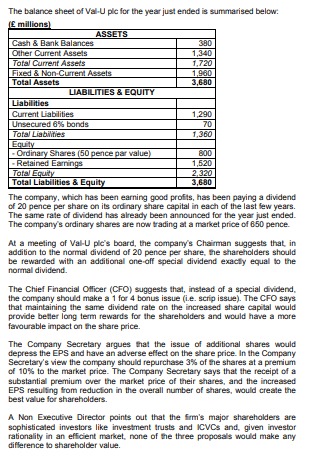

Quelch pic, a company engaged in oil and gas transportation, has 150 million shares in issue, which are currently trading at a market price of 800 pence each. The company is considering the takeover of Bunter plc, a pipeline manufacturer. Bunter pic has 100 million shares in issue, trading at a market price of 420 pence each. Bunter pic's net cash flow after tax in the year just ended was E60 million. Quelch plc expects that managerial and other synergies arising out of the takeover would result in Bunter pic's net cash flow after tax increasing by 6% per year in the first 3 years after takeover, and thereafter by an average rate of 3% per year for the foreseeable future. The merger will involve transaction costs of $2.25 million, including the fees of the advisers appointed by Quelch pic to plan the acquisition and provide advice on post-merger integration. The appropriate discount rate for evaluating the cash flows of Bunter plc for acquisition is estimated at 9.7%. Required: (a) Using the Information provided, estimate the post-acquisition value of Bunter pic. Comment on the size of the total value gain that is expected to arise as a result of the takeover. (6 marks) (b) Provide appropriate calculations to show how this total value gain would be distributed between the shareholders of Quelch pic and Bunter pic respectively under each of the following alternatives. Comment on which might be preferable from the perspective of Quelch pic's shareholders: (1) Quelch pic paid 500 pence cash for each of Bunter pic's shares. (ll) Quelch pic offered Bunter pic's shareholders one Quelch share in exchange for every two Bunter shares surrendered by them. (8 marks) (c) Explain the differences between the three broad approaches to post- merger integration (le. the absorption, preservation and symbiosis approaches). Comment on which of these may be appropriate In the circumstances of the case. (6 marks)Required: (a) With reference to the Non Executive Director's remark, evaluate the theoretical impact of each of three proposals - i.e. the special dividend, the bonus issue and the share repurchase - on the wealth of a shareholder in Val-U plc currently owning 1,000 shares. Provide appropriate calculations, and comment on your results. (8 marks) (b) Discuss the suggestions and the views expressed by the Chairman, the CFO and the Company Secretary, and comment on the ways in which each of their suggested measures may, in practice, create additional value for shareholders. (7 marks] (c) Explain the difference between "investment trust" and "(CVC", outlining the principal differences between the two types of institution and how they operate. (5 marks]The balance sheet of Val-U ple for the year just ended is summarised below. (E millions) ASSETS Cash & Bank Balances 380 Other Current Assets 1,340 Total Current Assets 1,720 Fixed & Non Current Assets 1,960 Total Assets 3,680 LIABILITIES & EQUITY Liabilities Current Liabilities 1,290 Unsecured 6% bonds 70 Total Liabilities 1.360 Equity Ordinary Shares (50 pence par value) 800 Retained Earnings 1,520 Total Equily 2.320 Total Liabilities & Equity 3,680 The comparry, which has been earning good profits, has been paying a dividend of 20 pence per share on its ordinary share capital in each of the last few years. The same rate of dividend has already been announced for the year just ended. The company's ordinary shares are now trading al a market price of 850 pence. At a meeting of Val-U ple's board, the company's Chairman suggests that, in addition to the normal dividend of 20 pence per share, the shareholders should be rewarded with an additional one off special dividend exactly equal to the normal dividend. The Chief Financial Officer (CFO) suggests that, instead of a special dividend, the company should make a 1 for 4 bonus issue (i.e. scrip issue). The CFO says that maintaining the same dividend rate on the increased share capital would provide beller long term rewards for the shareholders and would have a more favourable impact on the share price. The Company Secretary argues that the issue of additional shares would depress the BPS and have an adverse effect on the share price. In the Company Secretary's view the company should repurchase 3%% of the shares at a premium of 10% to the market price. The Company Secretary says that the receipt of a substantial premium over the market price of their shares, and the increased EPS resulting from reduction in the overall number of shares, would create the best value for shareholders. A Non Executive Director points out that the firm's major shareholders are sophisticated investors like investment trusts and ICVCs and, given investor rationality in an efficient market, none of the three proposals would make any difference to shareholder value