Answered step by step

Verified Expert Solution

Question

1 Approved Answer

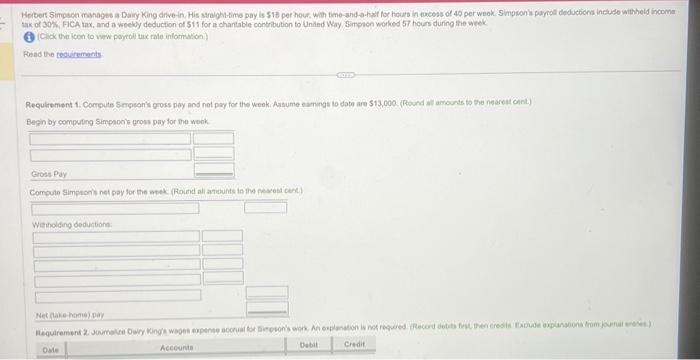

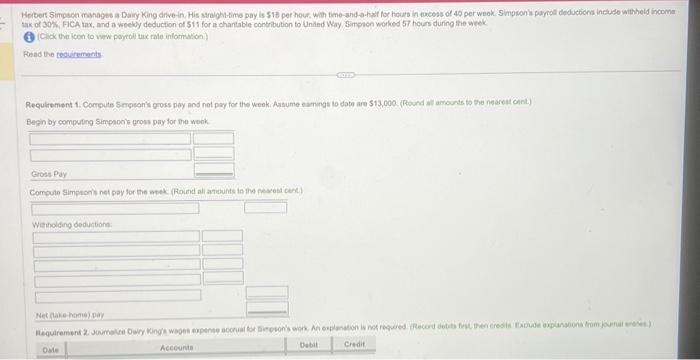

please help me solve this. tak of 30 , FCA tax, and a weeky deduction of 511 for a chartable contribution to Unded Way Smpton

please help me solve this.

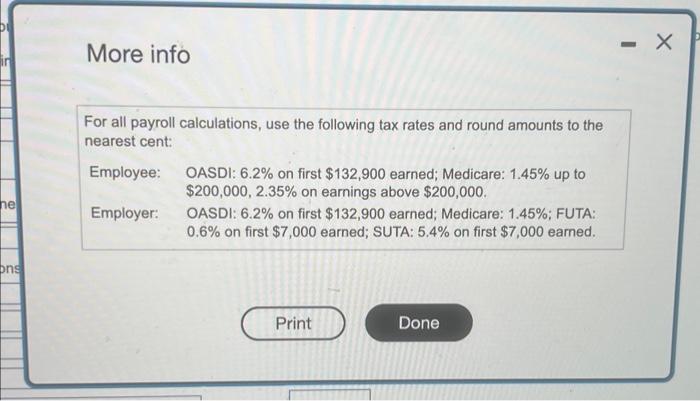

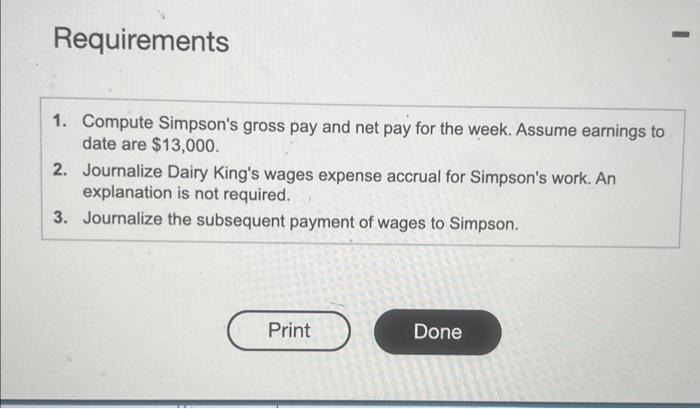

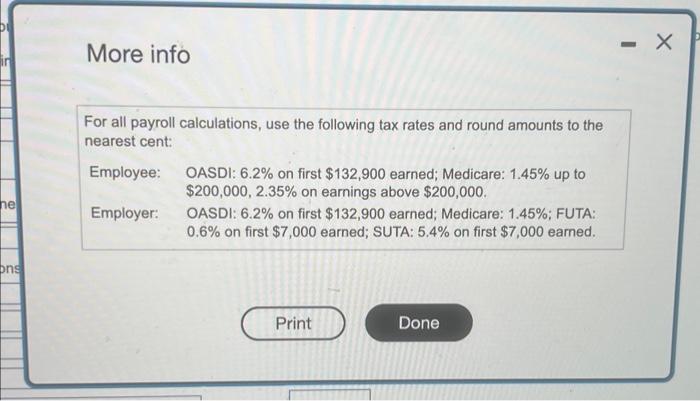

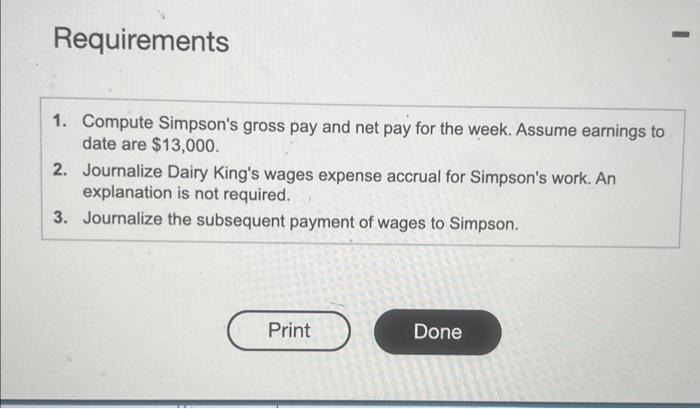

tak of 30 , FCA tax, and a weeky deduction of 511 for a chartable contribution to Unded Way Smpton worled 57 hours during the week (3) (Cidx the icen to vew poyroill tax rale inlomiakion) Renad the teovirements Begin by computing simpacolk gross pay for the wook Comoute Simbenon net bav for the week (Found all ariounts te the nescest cest.) More info For all payroll calculations, use the following tax rates and round amounts to the nearest cent: Employee: OASDI: 6.2% on first $132,900 earned; Medicare: 1.45% up to $200,000,2.35% on earnings above $200,000. Employer: OASDI: 6.2% on first $132,900 earned; Medicare: 1.45%; FUTA: 0.6% on first $7,000 earned; SUTA: 5.4% on first $7,000 earned. Requirements 1. Compute Simpson's gross pay and net pay for the week. Assume earnings to date are $13,000. 2. Journalize Dairy King's wages expense accrual for Simpson's work. An explanation is not required. 3. Journalize the subsequent payment of wages to Simpson

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started