Answered step by step

Verified Expert Solution

Question

1 Approved Answer

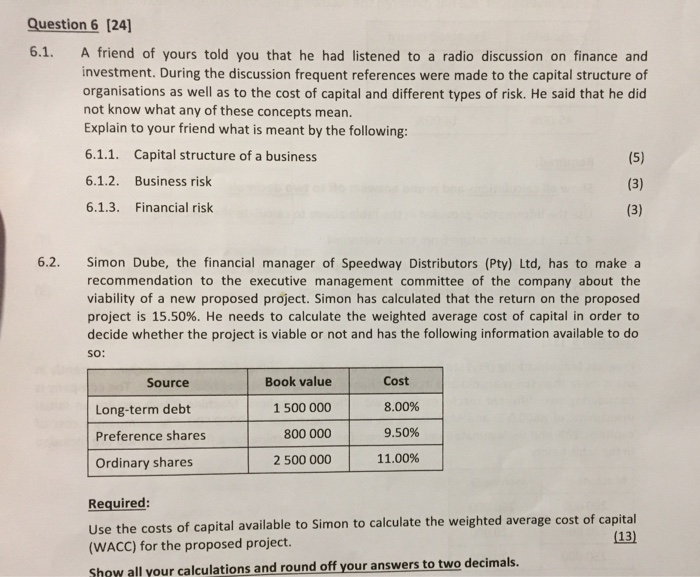

Please help me solve this. thank you Question 6 [24] 6.1. A friend of yours told you that he had listened to a radio discussion

Please help me solve this. thank you

Question 6 [24] 6.1. A friend of yours told you that he had listened to a radio discussion on finance and investment. During the discussion frequent references were made to the capital structure of organisations as well as to the cost of capital and different types of risk. He said that he did not know what any of these concepts mean. Explain to your friend what is meant by the following: 6.1.1. Capital structure of a business 6.1.2. Business risk 6.1.3. Financial risk 6.2. Simon Dube, the financial manager of Speedway Distributors (Pty) Ltd, has to make a recommendation to the executive management committee of the company about the viability of a new proposed project. Simon has calculated that the return on the proposed project is 15.50%. He needs to calculate the weighted average cost of capital in order to decide whether the project is viable or not and has the following information available to do SO: Book value Cost 8.00% Source Long-term debt Preference shares Ordinary shares 1 500 000 800 000 2 500 000 9.50% 11.00% Required: Use the costs of capital available to Simon to calculate the weighted average cost of capital (WACC) for the proposed project. Show all your calculations and round off your answers to two decimals. (13)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started