Please help me solve this. There are 2 questions please answer; 1a,1b,2a,and 2b Thanks a million!

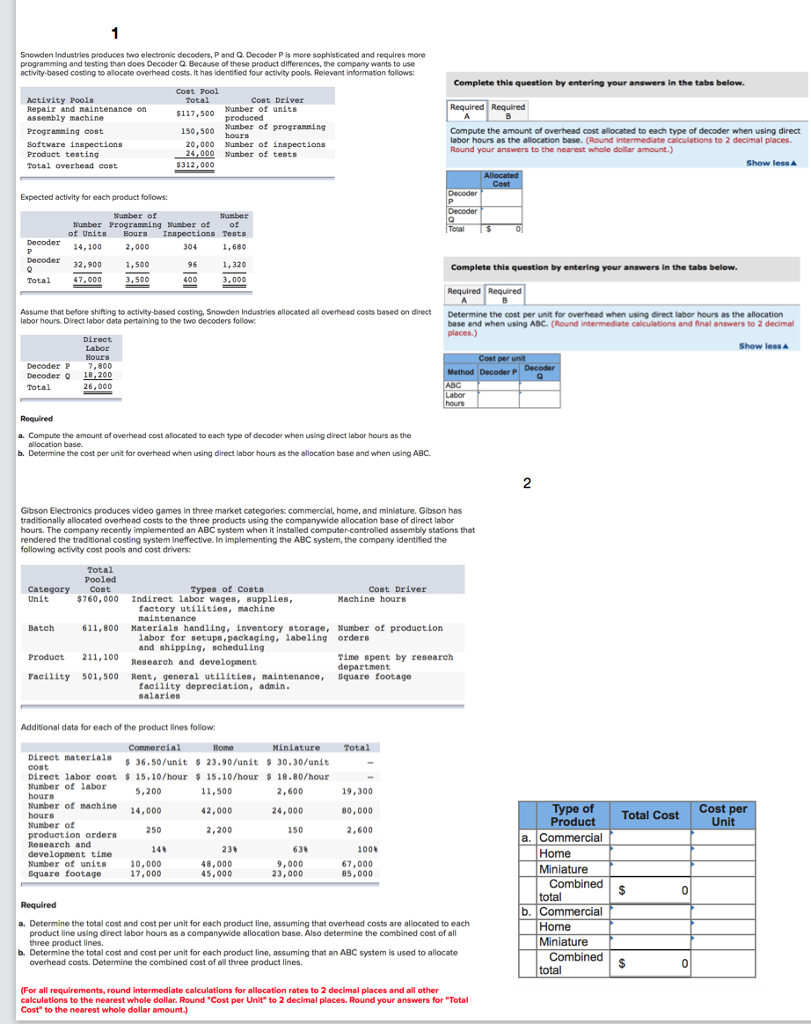

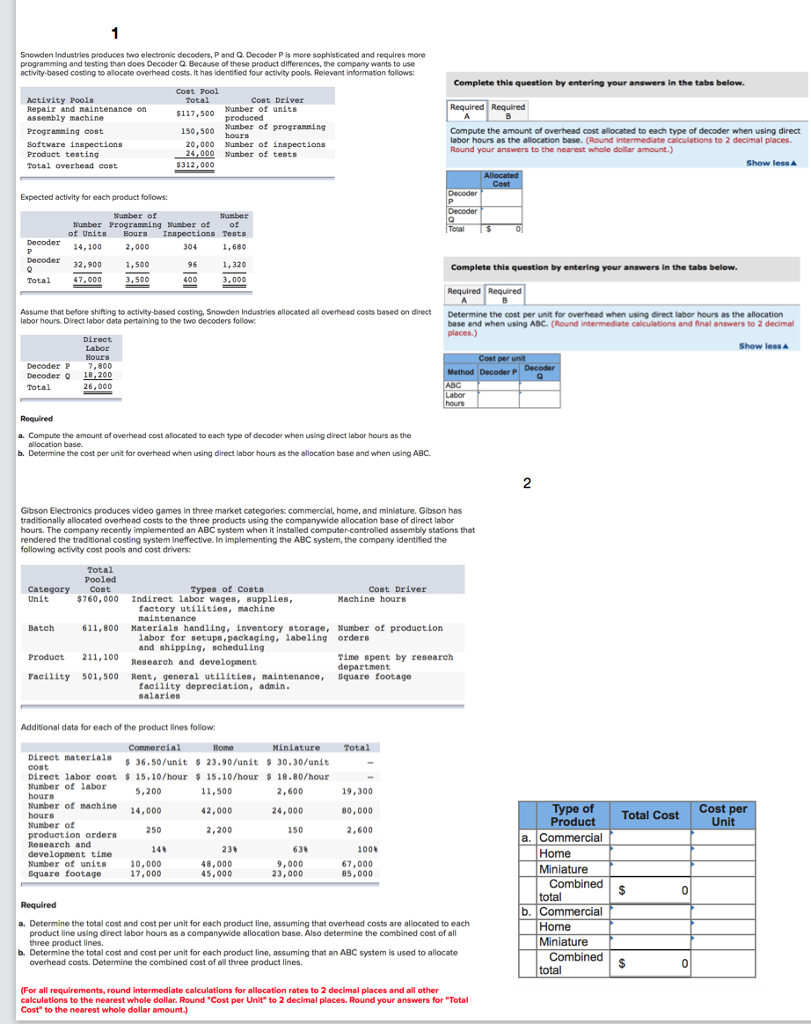

Snowden Industries produces two electronic decoders, P and Q. Decoder P is more sophisticated and requires more programming and testing than does Decoder Q. Because of these product differences, the company wants to use activity-based costing to alocate overhead costs. It has identified four activity pools. Relevant information follows Complete this question by entering your answers in the tabs below. Cost Pool Activity Pools Repair and maintenance on assembly machine Cost Driver 117,500 Number of 150,500 Sunber of units Required Required progranning Compute the amount of overhead cost allocated to each type of decoder when using direct labor hours as the allocation base. (Round intermediate calculations to 2 decimal places. Round your answers to the nearest whole dollar amount. 20,000 Sunber of inspections 24,000 Nunber of tests Product testing total overhead c Show lessA Expected activity for each product follows: unber of Nunber Programaing Number of of of Units Bours Inspections Tests Decodor pecoder 32,900 Complete this question by entering your answers in the tabs below. Required Required Determine the cost per unit for overhead when using direct labor hours as the allocation Total Assume that before shifting to activity-based costing, Snowden Industries allocated all overhead costs based on direct labor hours. Direct labor data pertaining to the two decoders follow base and when using ADC. (Round intermediate calculations and final answers to 2 decimal Show less 7,800 Decoder 18,200 a. Compute the amount of overhead cost alocated to each type of decoder when using direct labor hours as the b. Determine the cost per unit for overhead when using direct labor hours as the allocation base and when using ABC 2 Gibson Electronics produces video games in three market categories: commercial, home, and miniature, Gibson has traditionally allocated overhead costs to the three products using the companywide allocation base of direct labor hours. The company recently implemented an ABC system when it installed computer-controled assembly stations that rendered the traditional costing system ineffective. In implementing the ABC system, the company identified the following activity cost pools and cost drivers Total Pooled Category Cost Unit Types of Costs $760,000 Indirect labor wages, supplies, Machine hourB factory utilities, machine maintenance Batch 611,800 Naterials handling, inventory storage, Number of production labor for setups, packaging, label and shipping, scheduling ing orders Product 211,100 Research and development rime spent by research ososres Facility 501,500 Rent, general utiiities,maintenance, Square footage facility depreciation, admin Additional data for each of the product lines follow Direct materials cost Direct labor cost 15.10/hour 15.10/hour 18.80/hour Number of labor 36.50/unit 23.90/unit 30.30/unit 11,500 42,000 2,200 19,300 80,000 2,600 Number of machine pe Cost per 14,000 24,000 Total Cost roduct production orders Research and development time Number of units Square footage a. Commercial 14 23% 1008 10,000 17,000 9,000 23,000 67,000 85,000 Home Miniature 45,000 Combined b. Commercial a. Determine the total cost and cost per unit for each product line, assuming that overhead costs are allocated to each Home Miniature product line using direct labor hours as a companywide allocation base. Also determine the combined cost of all three product lines b. Determine the total cost and cost per unit for each product line, assuming that an ABC system is used to allocate Combined overhead costs. Determine the combined cost of all three product lines (For all requirements, round intermediate calculations for allocation rates to 2 decimal places and all other calculations to the nearest whole dollar. Round "Cost per Unit to 2 decimal places. Round your answers for Total Cost" to the nearest whole dollar amount.)