please help me someone i cant figure this out

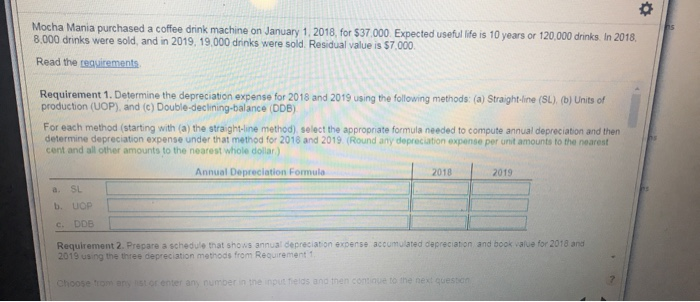

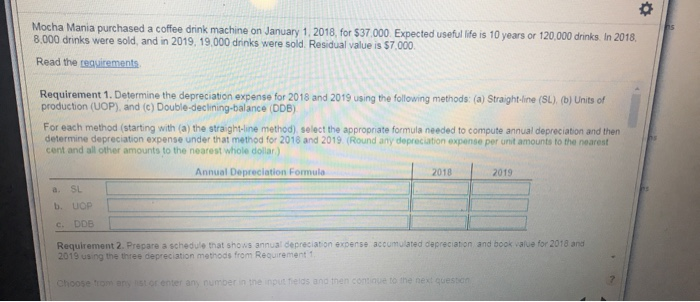

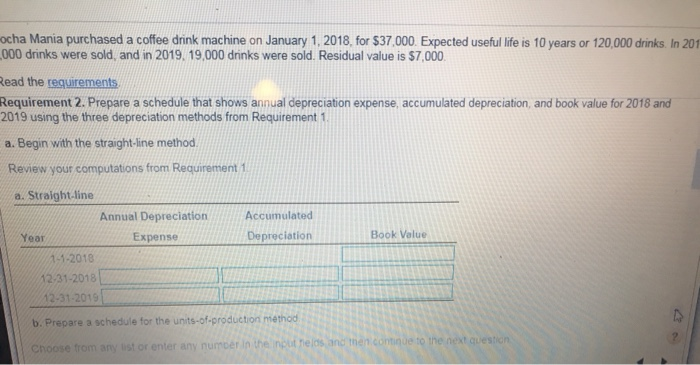

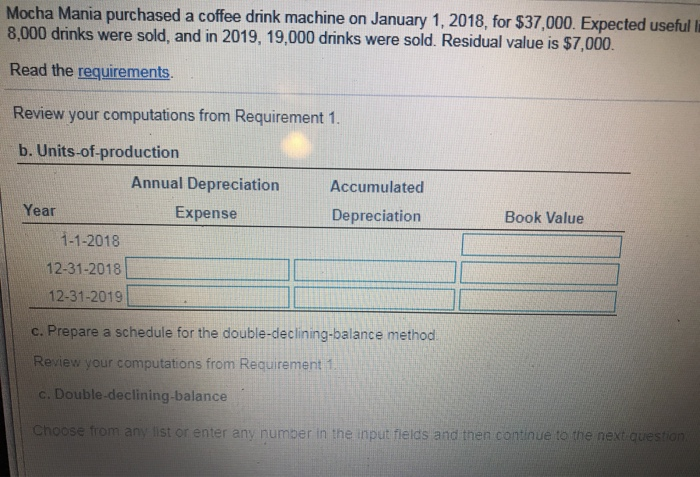

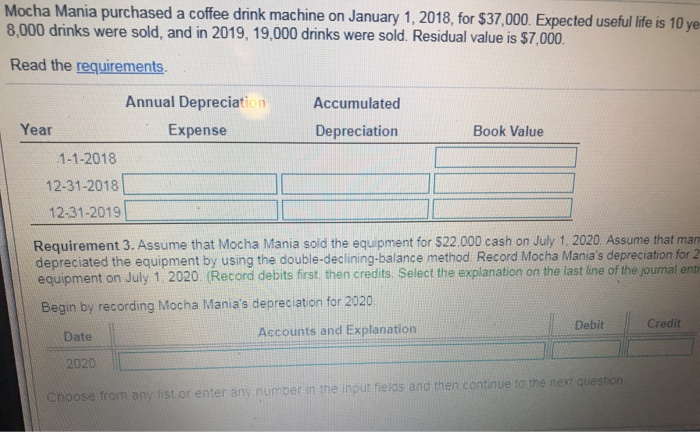

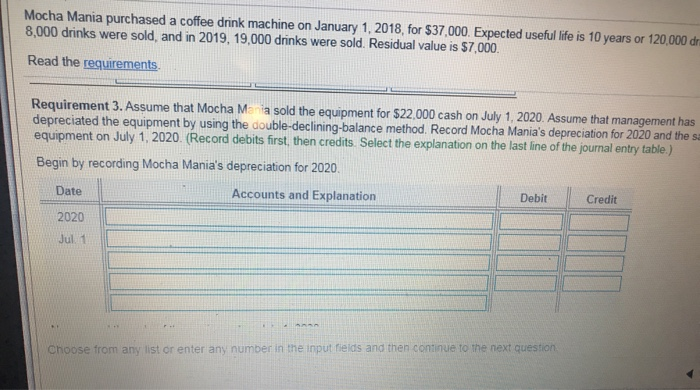

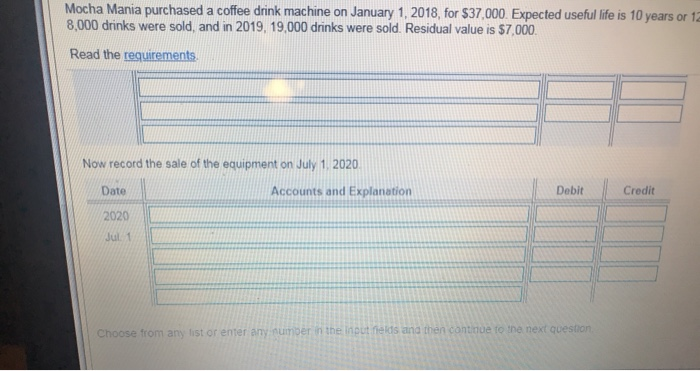

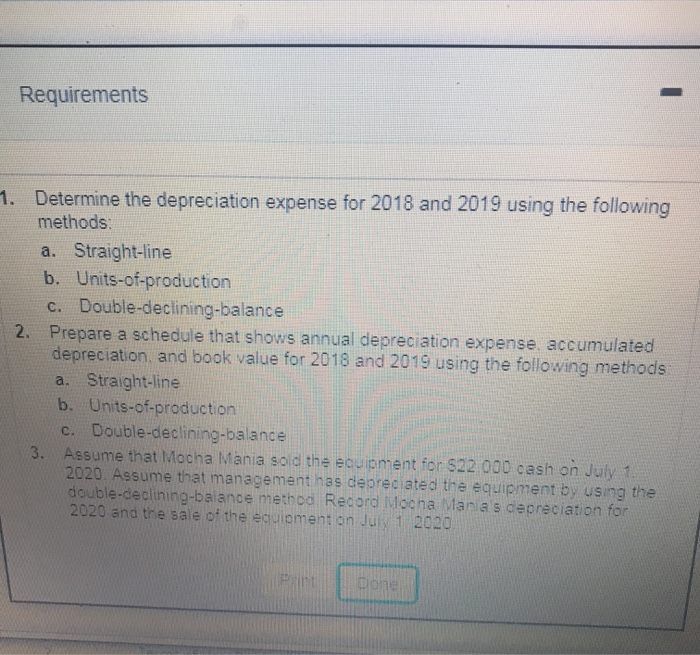

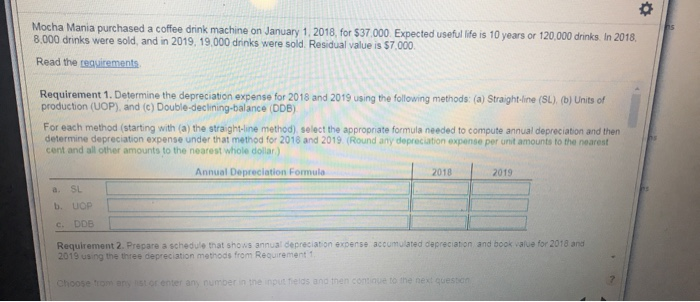

Mocha Mania purchased a coffee drink machine on January 1, 2018, for $37.000 Expected useful life is 10 years or 120.000 drinks. In 2018, 8.000 drinks were sold, and in 2019, 19.000 drinks were sold. Residual value is $7.000 Read the requirements Requirement 1. Determine the depreciation expense for 2018 and 2019 using the following methods: (a) Straight-line (SL). (b) Units of production (UOP), and (c) Double-declining-balance (DDB) For each method (starting with (a) the straight-line method) select the appropriate formula needed to compute annual depreciation and then determine depreciation expense under that method for 2016 and 2019. (Round any depreciation expense per unit amounts to the nearest cent and all other amounts to the nearest whole dollar) Annual Depreciation Formula a. SL b. UP CDDB Requirement 2. Prepare a schedule that shows annual depreciation expense accumulated depreciation and book value for 2018 and 2019 using the three depreciation methods from Requirement1 Choose fron t of enter any number the nuttelos and then continue to the next question ocha Mania purchased a coffee drink machine on January 1, 2018, for $37.000. Expected useful life is 10 years or 120,000 drinks. In 201 2000 drinks were sold, and in 2019. 19,000 drinks were sold, Residual value is $7,000 Read the requirements Requirement 2. Prepare a schedule that shows annual depreciation expense, accumulated depreciation, and book value for 2018 and 2019 using the three depreciation methods from Requirement1 a. Begin with the straight-line method. Review your computations from Requirement 1 Book Value a. Straight-line Annual Depreciation Accumulated Year Expense Depreciation 1-1-2018 12.31-2018 12-31-2019 b. Prepare a schedule for the units-of-production method then continue to the next question Choose from any ust or enter any number in the input nelas Mocha Mania purchased a coffee drink machine on January 1, 2018, for $37.000. Expected useful 8,000 drinks were sold, and in 2019, 19,000 drinks were sold. Residual value is $7,000. Read the requirements. Review your computations from Requirement 1. Accumulated Depreciation Book Value b. Units-of-production Annual Depreciation Year Expense 1-1-2018 12-31-2018 12-31-2019 c. Prepare a schedule for the double-declining-balance method. Review your computations from Requirement 1 c. Double-declining balance Choose from any list or enter any number in the input fields and then continue to the next question Mocha Mania purchased a coffee drink machine on January 1, 2018, for $37,000. Expected useful life is 10 ve 8,000 drinks were sold, and in 2019, 19,000 drinks were sold. Residual value is $7.000. Read the requirements Accumulated Depreciation Year Book Value Annual Depreciation Expense 1-1-2018 12-31-2018 12-31-2019 Requirement 3. Assume that Mocha Mania sold the equipment for $22.000 cash on July 1, 2020. Assume that man depreciated the equipment by using the double-declining-balance method. Record Mocha Mania's depreciation for 2 equipment on July 1, 2020. (Record debits first, then credits. Select the explanation on the last line of the joumal entr Begin by recording Mocha Mania's depreciation for 2020 Date Accounts and Explanation Debit Credit 2020 Choose from any list or enter any number in the input fields and then continue to the next question Mocha Mania purchased a coffee drink machine on January 1, 2018, for $37.000. Expected useful life is 10 years or 120.000 de 8,000 drinks were sold, and in 2019, 19,000 drinks were sold. Residual value is $7,000. Read the requirements Requirement 3. Assume that Mocha M a sold the equipment for $22,000 cash on July 1, 2020. Assume that management has depreciated the equipment by using the double-declining-balance method. Record Mocha Mania's depreciation for 2020 and the s equipment on July 1, 2020. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Begin by recording Mocha Mania's depreciation for 2020. Date Accounts and Explanation Debit Credit 2020 Jul 1 Choose from any list or enter any number in the input fields and then continue to the next question Mocha Mania purchased a coffee drink machine on January 1, 2018, for $37,000. Expected useful life is 10 years or 12 8,000 drinks were sold, and in 2019,19,000 drinks were sold. Residual value is $7,000. Read the requirements Now record the sale of the equipment on July 1, 2020 Date Accounts and Explanation Debit Credit 2020 JUL 1 Choose from any list or enter any number in the input melds and then continue to the next question Requirements Determine the depreciation expense for 2018 and 2019 using the following methods a. Straight-line b. Units-of-production C. Double-declining-balance Prepare a schedule that shows annual depreciation expense accumulated depreciation, and book value for 2018 and 2019 using the following methods a. Straight-line b. Units-of-production c. Double-declining-balance Assume that Mocha Mania sold the equipment for $22.000 cash on July 1 2020. Assume that management has depreciated the equipment by using the double-declining-balance method Record vocha Mania's depreciation for 2020 and the sale of the equipment on July 1 2020