Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me thank you so much On January 1, 2022, Crane Corporation acquired machinery for $1710000. Crane adopted the straight-line method of depreciation for

please help me thank you so much

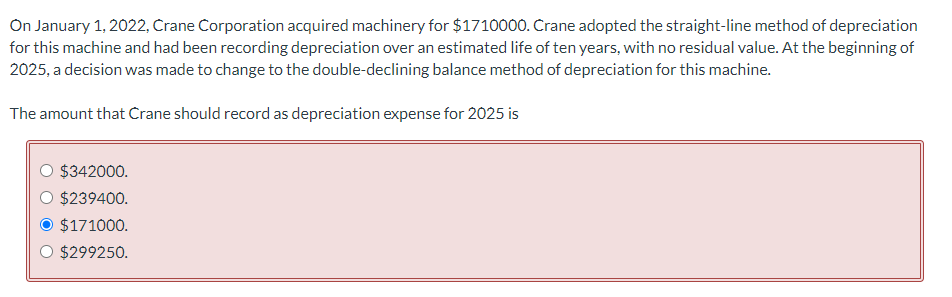

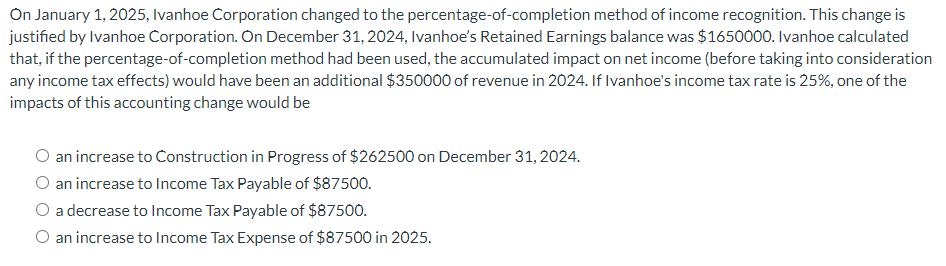

On January 1, 2022, Crane Corporation acquired machinery for $1710000. Crane adopted the straight-line method of depreciation for this machine and had been recording depreciation over an estimated life of ten years, with no residual value. At the beginning of 2025, a decision was made to change to the double-declining balance method of depreciation for this machine. The amount that Crane should record as depreciation expense for 2025 is $342000.$239400$171000$299250 On January 1,2025 , Ivanhoe Corporation changed to the percentage-of-completion method of income recognition. This change is justified by Ivanhoe Corporation. On December 31, 2024, Ivanhoe's Retained Earnings balance was $1650000. Ivanhoe calculated that, if the percentage-of-completion method had been used, the accumulated impact on net income (before taking into consideration any income tax effects) would have been an additional $350000 of revenue in 2024 . If Ivanhoe's income tax rate is 25%, one of the impacts of this accounting change would be an increase to Construction in Progress of $262500 on December 31, 2024. an increase to Income Tax Payable of $87500. a decrease to Income Tax Payable of $87500. an increase to Income Tax Expense of $87500 in 2025

On January 1, 2022, Crane Corporation acquired machinery for $1710000. Crane adopted the straight-line method of depreciation for this machine and had been recording depreciation over an estimated life of ten years, with no residual value. At the beginning of 2025, a decision was made to change to the double-declining balance method of depreciation for this machine. The amount that Crane should record as depreciation expense for 2025 is $342000.$239400$171000$299250 On January 1,2025 , Ivanhoe Corporation changed to the percentage-of-completion method of income recognition. This change is justified by Ivanhoe Corporation. On December 31, 2024, Ivanhoe's Retained Earnings balance was $1650000. Ivanhoe calculated that, if the percentage-of-completion method had been used, the accumulated impact on net income (before taking into consideration any income tax effects) would have been an additional $350000 of revenue in 2024 . If Ivanhoe's income tax rate is 25%, one of the impacts of this accounting change would be an increase to Construction in Progress of $262500 on December 31, 2024. an increase to Income Tax Payable of $87500. a decrease to Income Tax Payable of $87500. an increase to Income Tax Expense of $87500 in 2025 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started