Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE HELP ME THE QUESTION 3 AND THE LAST ONE. THANK YOU SO MUCH Mortgages and other amortized loans (meaning equal or blended payments) involve

PLEASE HELP ME THE QUESTION 3 AND THE LAST ONE. THANK YOU SO MUCH

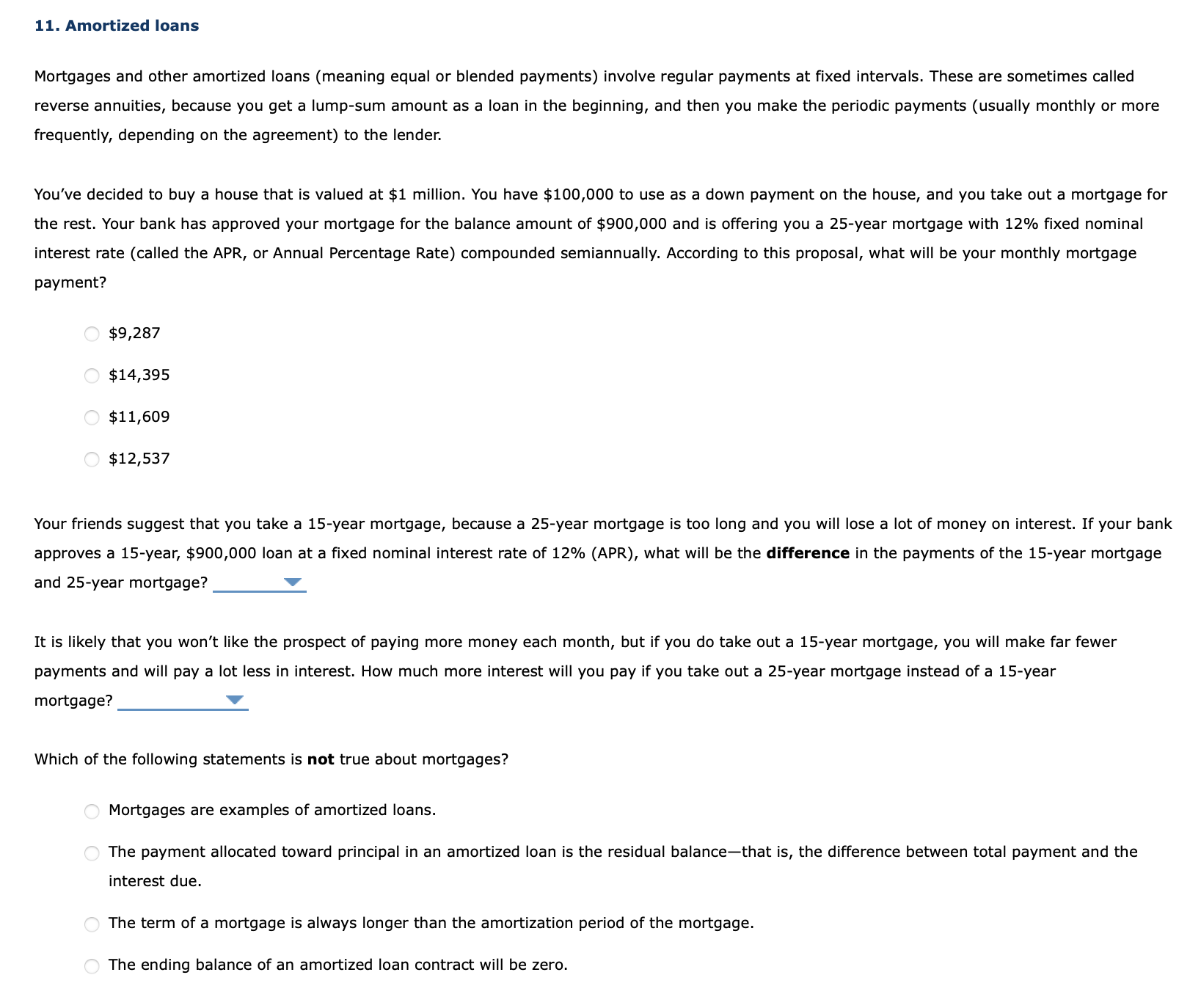

Mortgages and other amortized loans (meaning equal or blended payments) involve regular payments at fixed intervals. These are sometimes called reverse annuities, because you get a lump-sum amount as a loan in the beginning, and then you make the periodic payments (usually monthly or more frequently, depending on the agreement) to the lender. You've decided to buy a house that is valued at $1 million. You have $100,000 to use as a down payment on the house, and you take out a mortgage for the rest. Your bank has approved your mortgage for the balance amount of $900,000 and is offering you a 25 -year mortgage with 12% fixed nominal interest rate (called the APR, or Annual Percentage Rate) compounded semiannually. According to this proposal, what will be your monthly mortgage payment? $9,287 $14,395 $11,609 $12,537 Your friends suggest that you take a 15-year mortgage, because a 25 -year mortgage is too long and you will lose a lot of money on interest. If your bank approves a 15 -year, $900,000 loan at a fixed nominal interest rate of 12% (APR), what will be the difference in the payments of the 15 -year mortgage and 25 -year mortgage? It is likely that you won't like the prospect of paying more money each month, but if you do take out a 15-year mortgage, you will make far fewer payments and will pay a lot less in interest. How much more interest will you pay if you take out a 25-year mortgage instead of a 15 -year mortgage? Which of the following statements is not true about mortgages? Mortgages are examples of amortized loans. The payment allocated toward principal in an amortized loan is the residual balance-that is, the difference between total payment and the interest due. The term of a mortgage is always longer than the amortization period of the mortgage. The ending balance of an amortized loan contract will be zeroStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started