Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me this problem, I got confuse about it Connor Ltd. is a large private company owned by the Connor family. It operates a

Please help me this problem, I got confuse about it

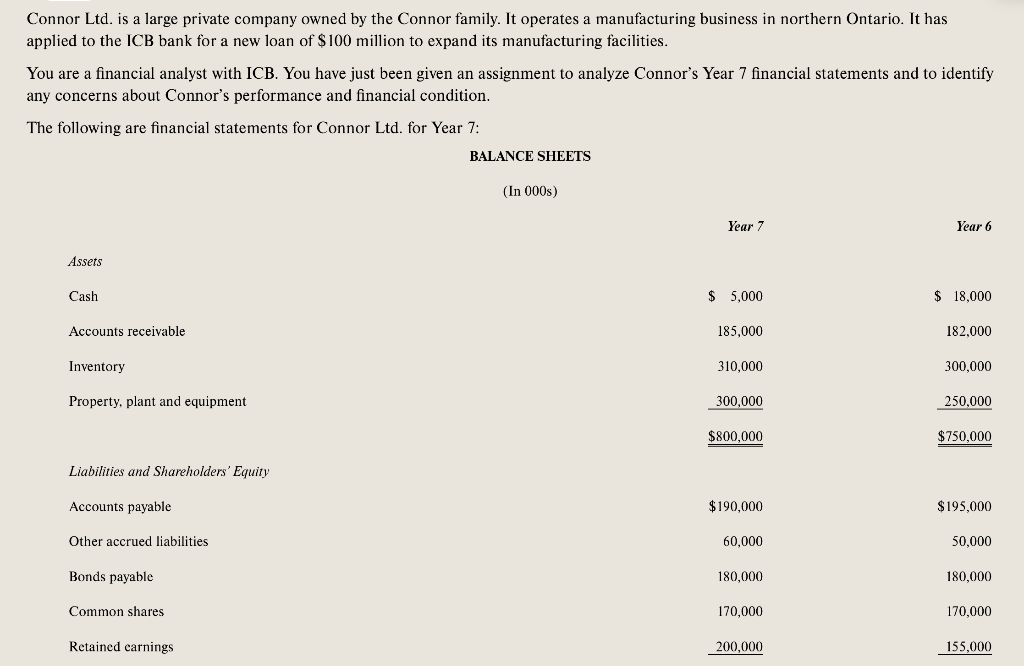

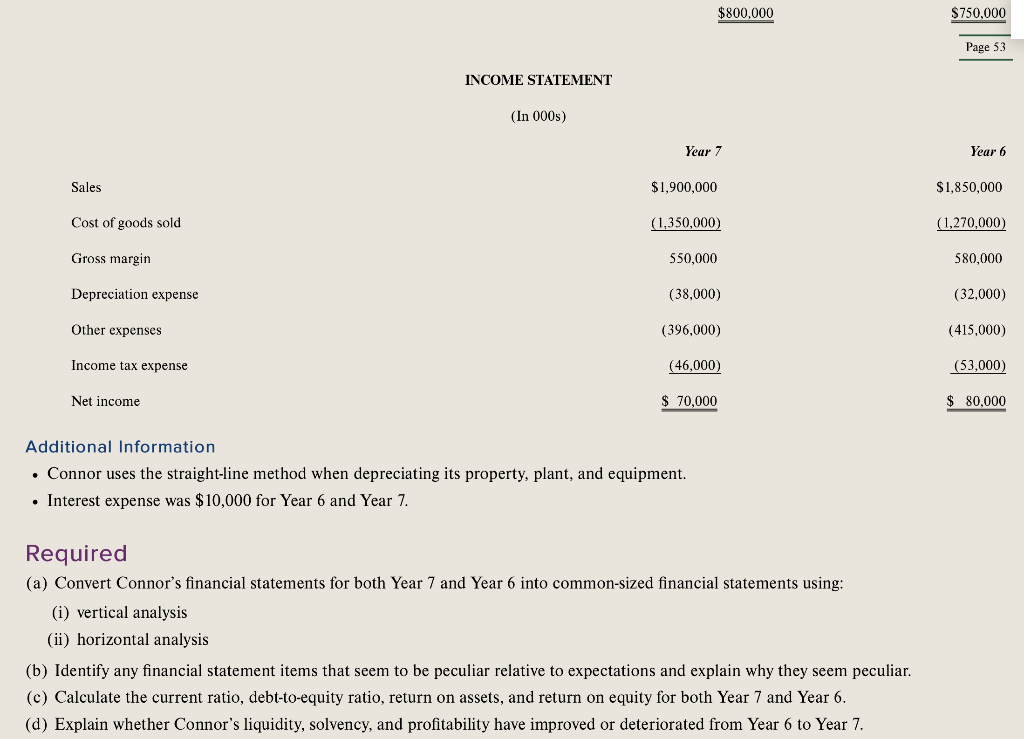

Connor Ltd. is a large private company owned by the Connor family. It operates a manufacturing business in northern Ontario. It has applied to the ICB bank for a new loan of $100 million to expand its manufacturing facilities. You are a financial analyst with ICB. You have just been given an assignment to analyze Connor's Year 7 financial statements and to identify any concerns about Connor's performance and financial condition. The following are financial statements for Connor Ltd. for Year 7: BALANCE SHEETS (In 000s) Year 7 Year 6 Assets Cash $ 5,000 $ 18,000 Accounts receivable 185,000 182,000 Inventory 310,000 300,000 Property, plant and equipment 300,000 250,000 $800,000 $750,000 Liabilities and Shareholders' Equity Accounts payable $190,000 $195,000 Other accrued liabilities 60,000 50,000 Bonds payable 180,000 180,000 Common shares 170,000 170,000 Retained earnings 200,000 155,000 $800,000 $750,000 Page 53 INCOME STATEMENT (In 000) Year 7 Year 6 Sales $1,900,000 $1,850,000 Cost of goods sold (1,350,000) (1,270,000) Gross margin 550,000 580,000 Depreciation expense (38,000) (32,000) Other expenses (396,000) (415,000) Income tax expense (46,000) (53,000) Net income $ 70,000 $ 80,000 Additional Information . Connor uses the straight-line method when depreciating its property, plant, and equipment. Interest expense was $10,000 for Year 6 and Year 7. Required (a) Convert Connor's financial statements for both Year 7 and Year 6 into common-sized financial statements using: (i) vertical analysis (ii) horizontal analysis (b) Identify any financial statement items that seem to be peculiar relative to expectations and explain why they seem peculiar. (c) Calculate the current ratio, debt-to-equity ratio, return on assets, and return on equity for both Year 7 and Year 6. (d) Explain whether Connor's liquidity, solvency, and profitability have improved or deteriorated from Year 6 to Year 7

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started