Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me this question! Suppose you can purchase stock for $870,000 today. Your time series forecasting model predicts that you can sell this stock,

Please help me this question!

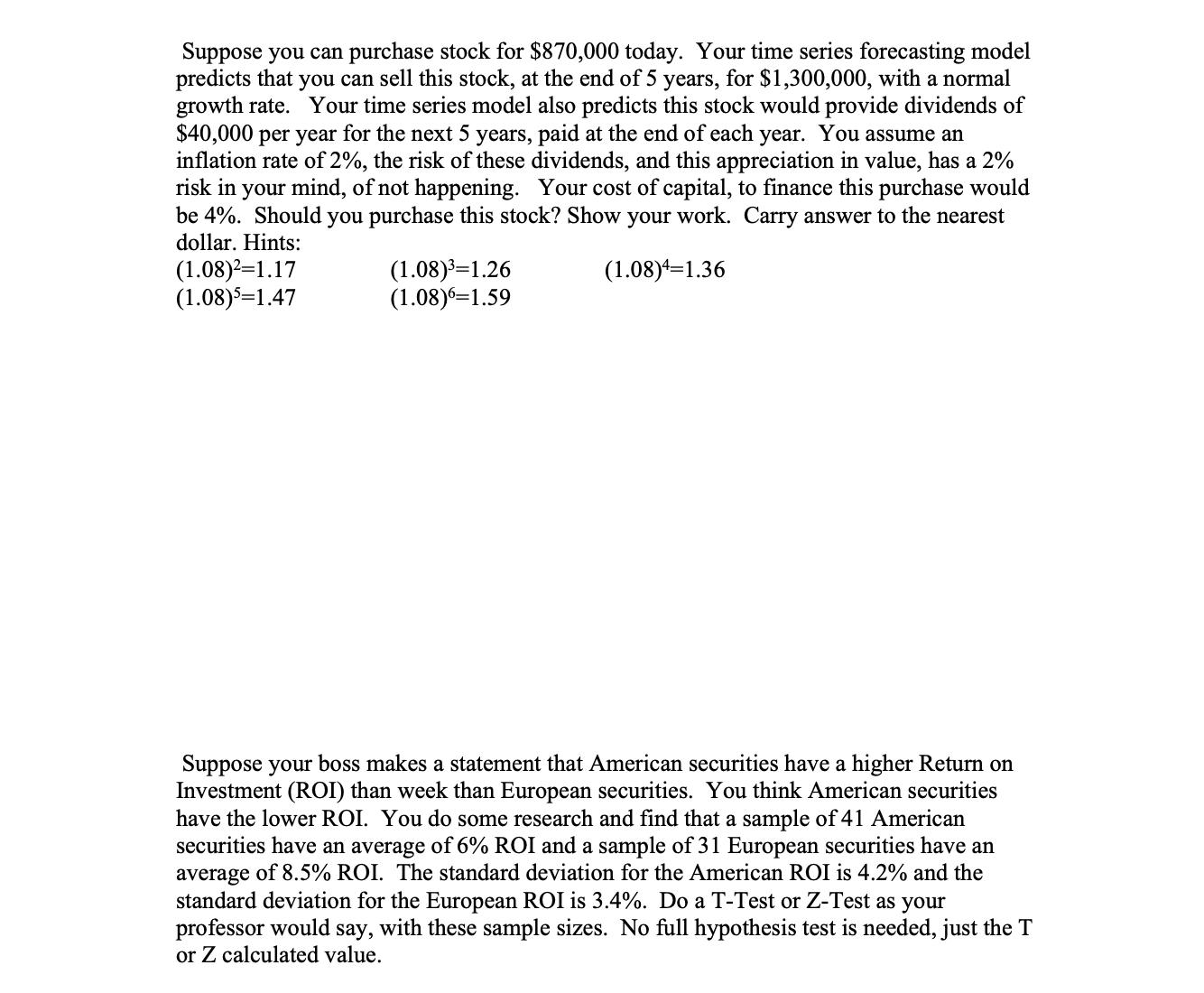

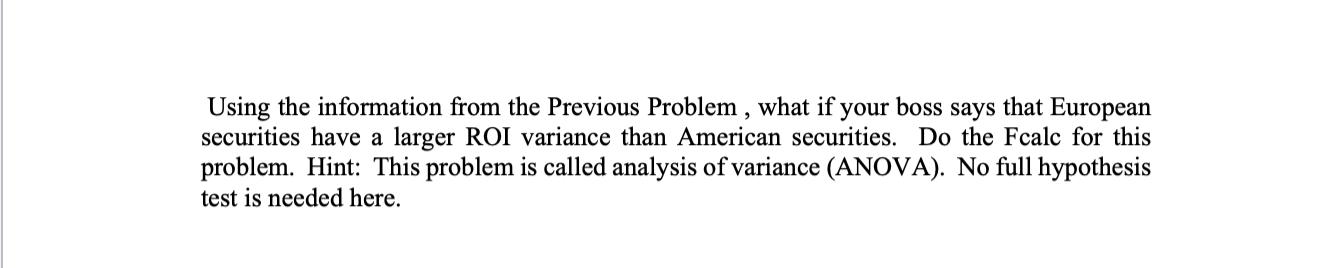

Suppose you can purchase stock for $870,000 today. Your time series forecasting model predicts that you can sell this stock, at the end of 5 years, for $1,300,000, with a normal growth rate. Your time series model also predicts this stock would provide dividends of $40,000 per year for the next 5 years, paid at the end of each year. You assume an inflation rate of 2%, the risk of these dividends, and this appreciation in value, has a 2% risk in your mind, of not happening. Your cost of capital, to finance this purchase would be 4%. Should you purchase this stock? Show your work. Carry answer to the nearest dollar. Hints: (1.08)=1.17 (1.08)5=1.47 (1.08)=1.26 (1.08)6=1.59 (1.08)4=1.36 Suppose your boss makes a statement that American securities have a higher Return on Investment (ROI) than week than European securities. You think American securities have the lower ROI. You do some research and find that a sample of 41 American securities have an average of 6% ROI and a sample of 31 European securities have an average of 8.5% ROI. The standard deviation for the American ROI is 4.2% and the standard deviation for the European ROI is 3.4%. Do a T-Test or Z-Test as your professor would say, with these sample sizes. No full hypothesis test is needed, just the T or Z calculated value.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started