Answered step by step

Verified Expert Solution

Question

1 Approved Answer

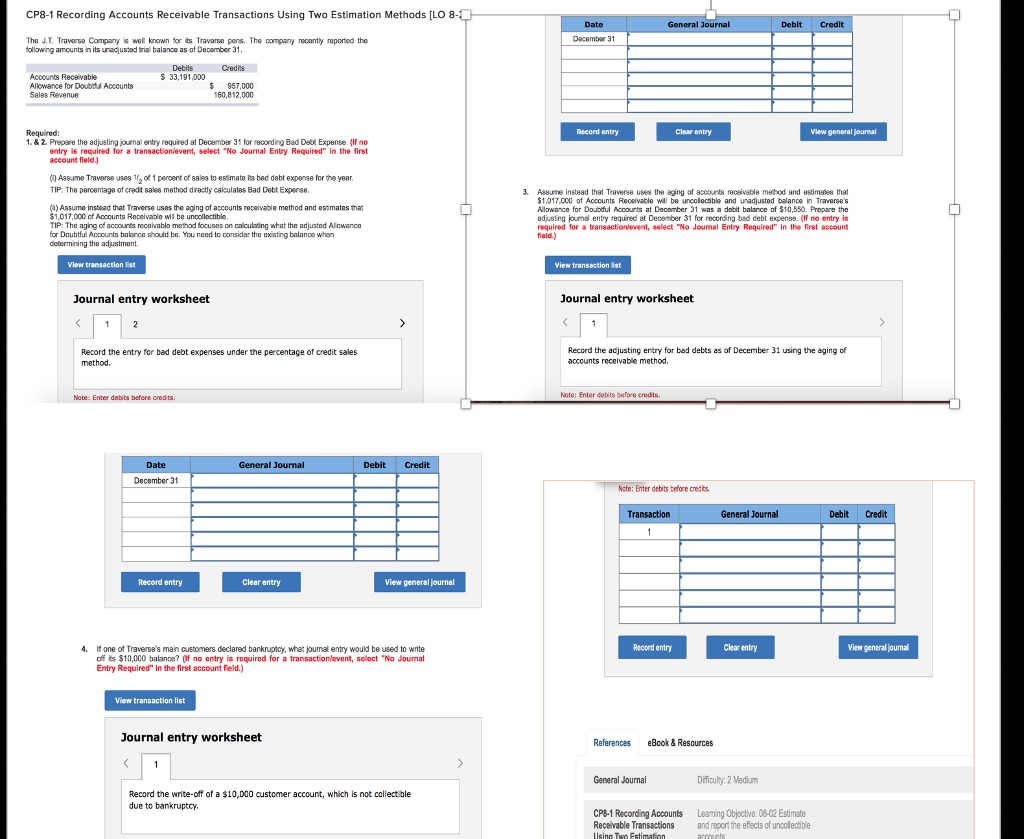

please help me this reads from left to right top to bottom like a z formaion thank you! CP8-1 Recording Accounts Receivable Transactions Using Two

please help me this reads from left to right top to bottom like a z formaion thank you!

CP8-1 Recording Accounts Receivable Transactions Using Two Estimation Methods [LO 8- Date General Journal Debit Credit The J.T. Traverse Company is well known for its Travarse pens. The company rocontly reported the ollowing amcunts in its unacjusted trial balance as of Decomber 31 Debits S 33,191,000 Credins Accounts Receivable Allowance for Doubau Accounts Seles Revenue uocounts $ $ 957,000 160,812,000 Record entry Clear entry View general journal Required: 1. & 2. Prepare the adjusting journal entry required at December 31 for reconding Bad Det Expense. (If no entry is required for a transaction/event, select "N Journal Entry Required" in the first account field.) Assume Traverse uses of 1 percent of sales to estimate its bad debt expense for the year. TIP: The percentage of credt sales method drecty calculales Bad Dett Expense. 3 Assume instead that Traverse uses the aging of accounts recaivable method and estimales that ()Assume instead that Traverse uses the aging of accounts recelvable method and esimates tha $1,017,000 cf Accounts Recelvable wil be uncollectible. TIP: The aging of accounts recalvable method focuses on calculating what the adjusted Alcwance for Doubtful Accounts balance should be. You need to considar the existing balanoe when 1,017000 of Accounts Recelvable wll be uncolecible and unadjustad balance in Traverse's Nlowance for Doubtful Accounts at December 31 was a debit balance of $10,550. Prepare the adjusing jounal entry required at December 31 for recording bed debt expense. (If no entry is required for a transactionievent, select "No Joumal Entry Required" in the first account field.) View transaction list View transaction list Journal entry worksheet Journal entry worksheet Record the entry for bad debt expenses under the percentage of credit sales method. Record the adjusting entry for bad debts as of December 31 using the aging of acccunts receivable method. Enter debits Date General Journal Debit Credit Ncte: Enter debits before credits General Journal Debit Credit Record entry Clear entry View general journal 4 Record entry Clear entry View general journal one of Traverses man customers declared bankruptcy, what joumal entry would be used to write off its $10,000 balanoe ( no entry is required for a transaction/event, select "No Journal Entry Required" in the first account Field.) View transaction list Journal entry worksheet References eBcok&Resources General Journal Dculty:2 Medium Record the write-off of a $10,000 customer account, which is not collectible due to bankruptcy. CP81 Recording Accounts Leaming Objective: 08-02 Estimate Receivable Transactions and report the efects of uncolectible

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started