- PLEASE HELP ME TO ANSWER THIS FOUR QUESTION FOR MY ACCOUNTING ASSIGNMENT

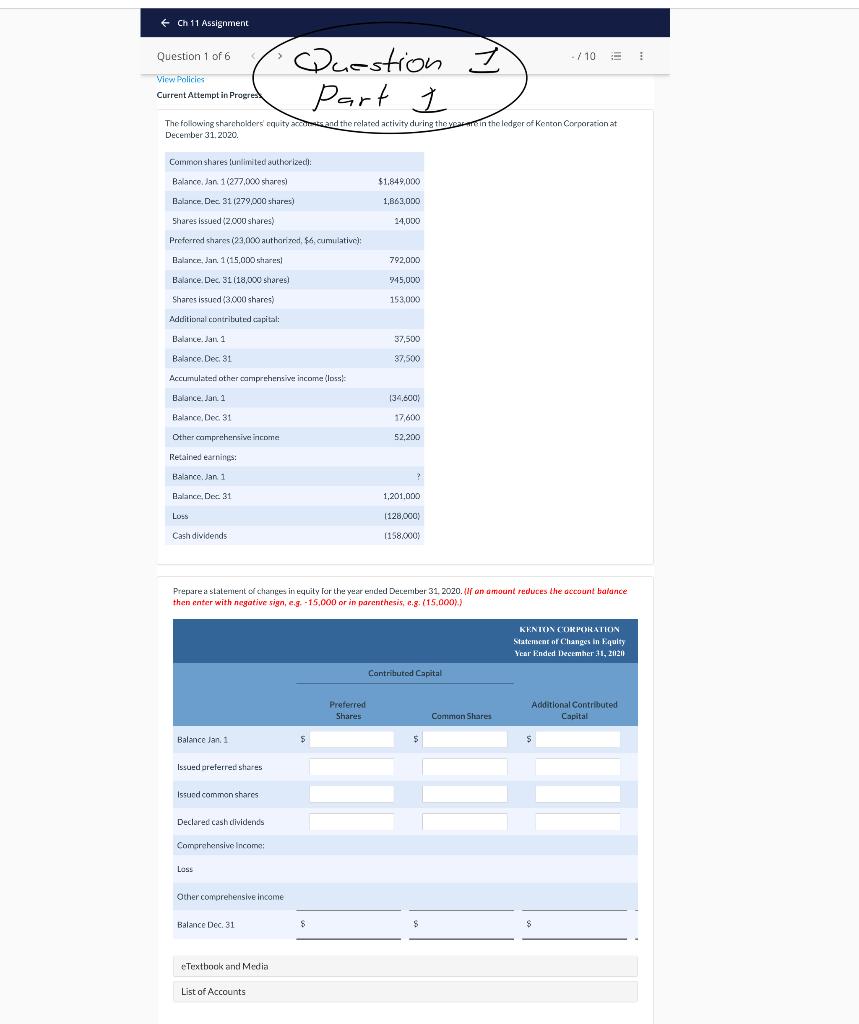

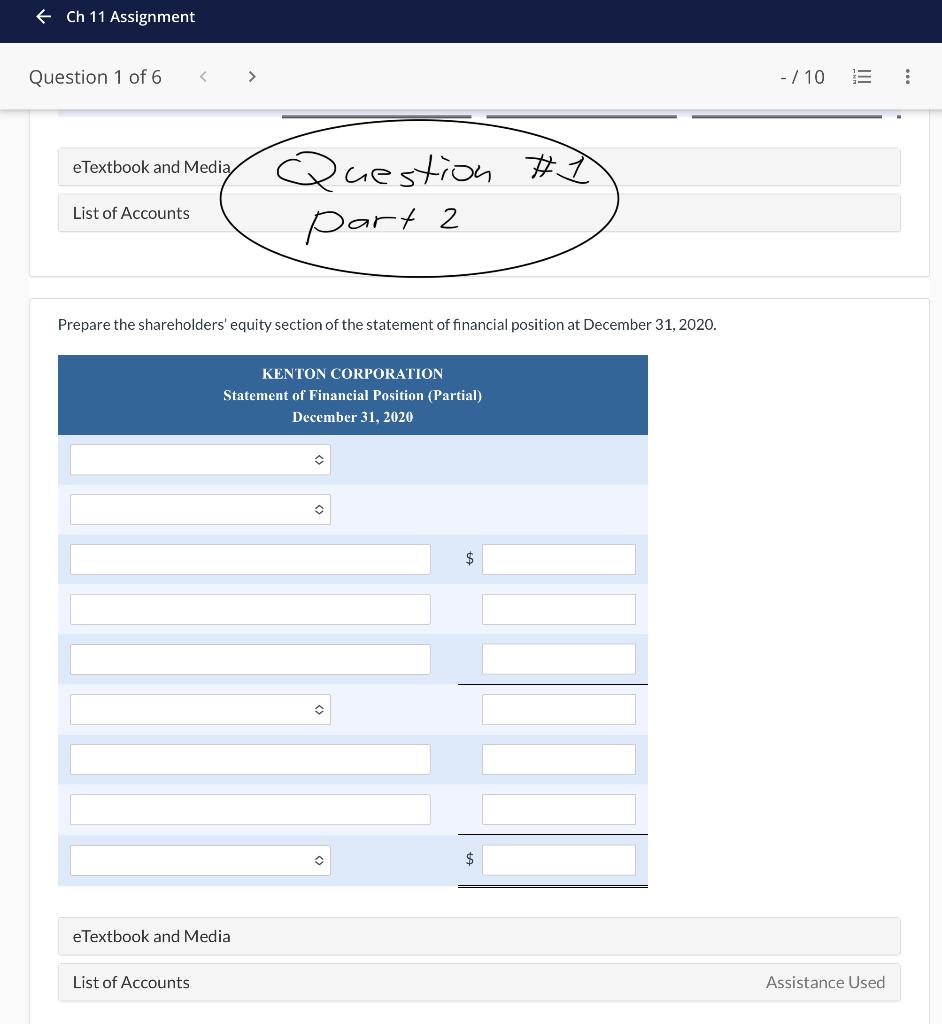

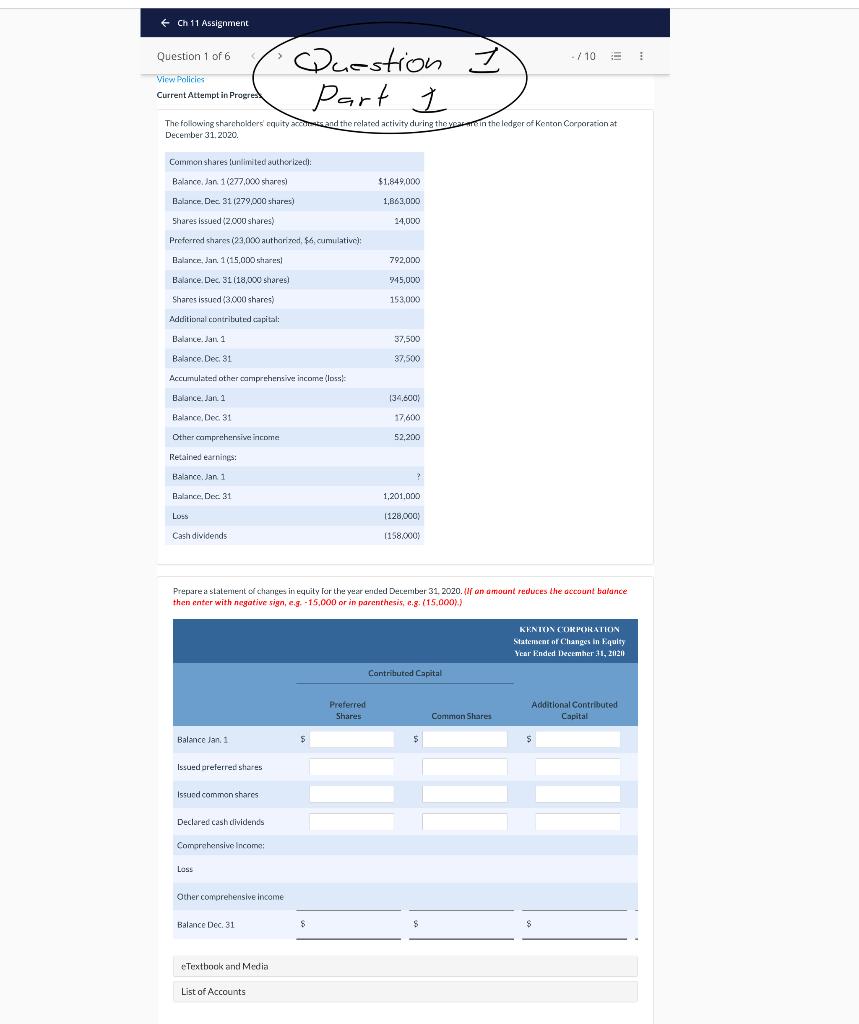

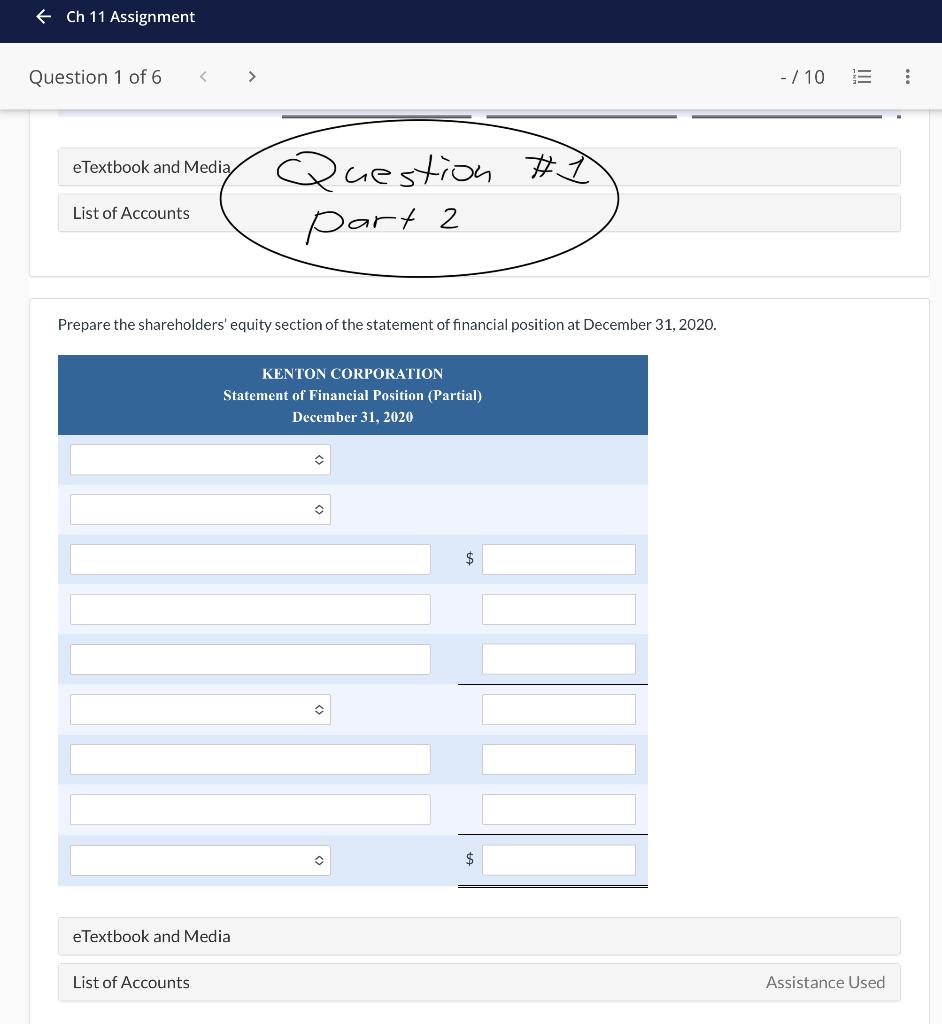

Question 1 OUT OF 6

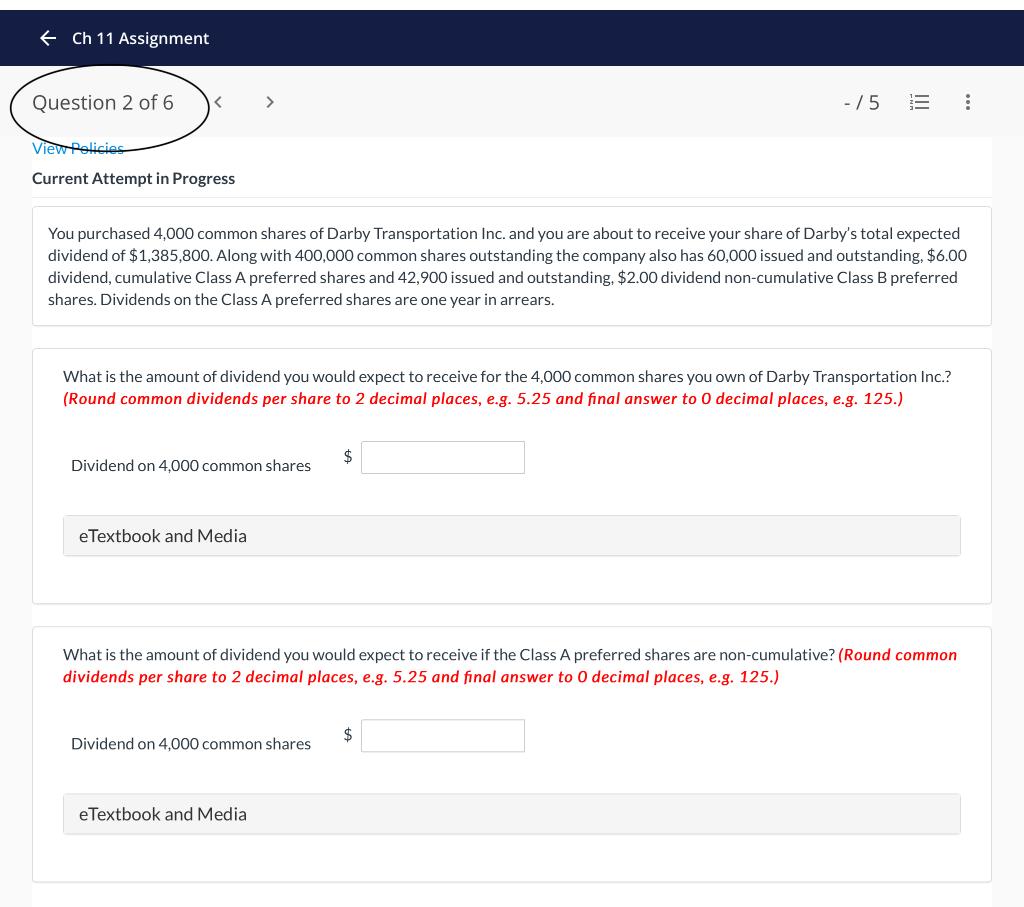

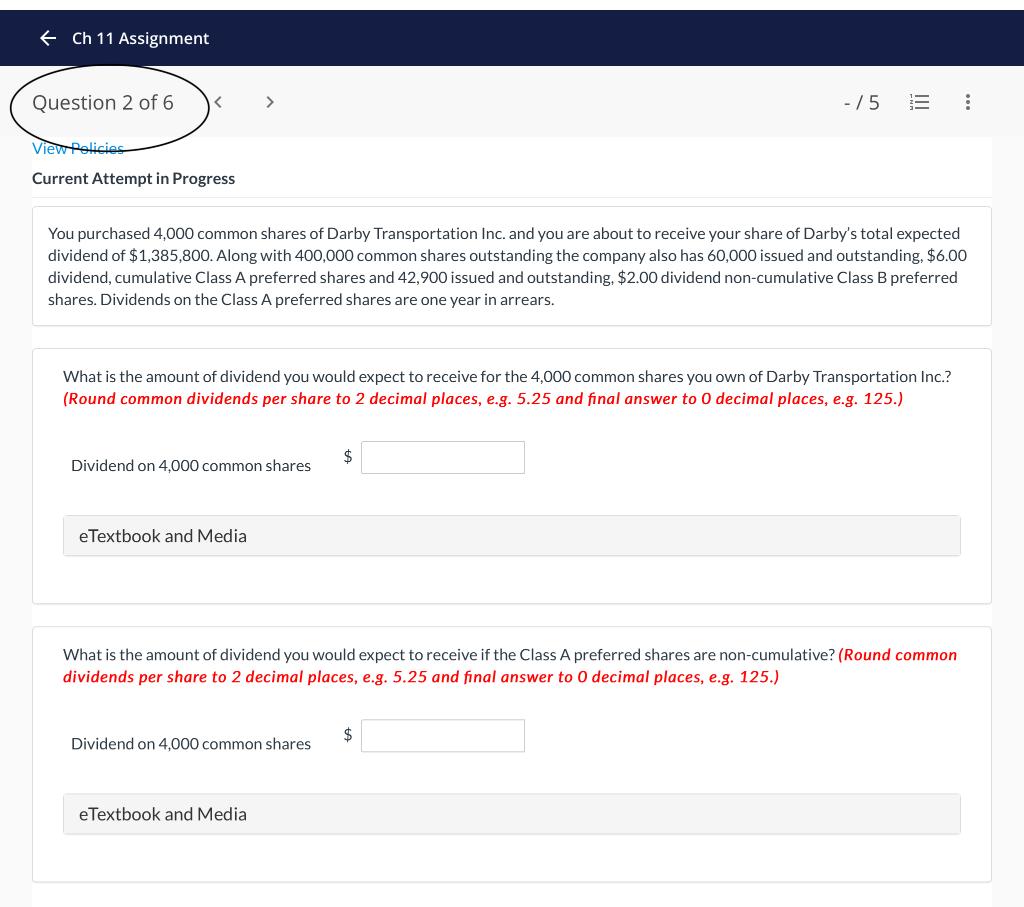

Question 2 OUT OF 6

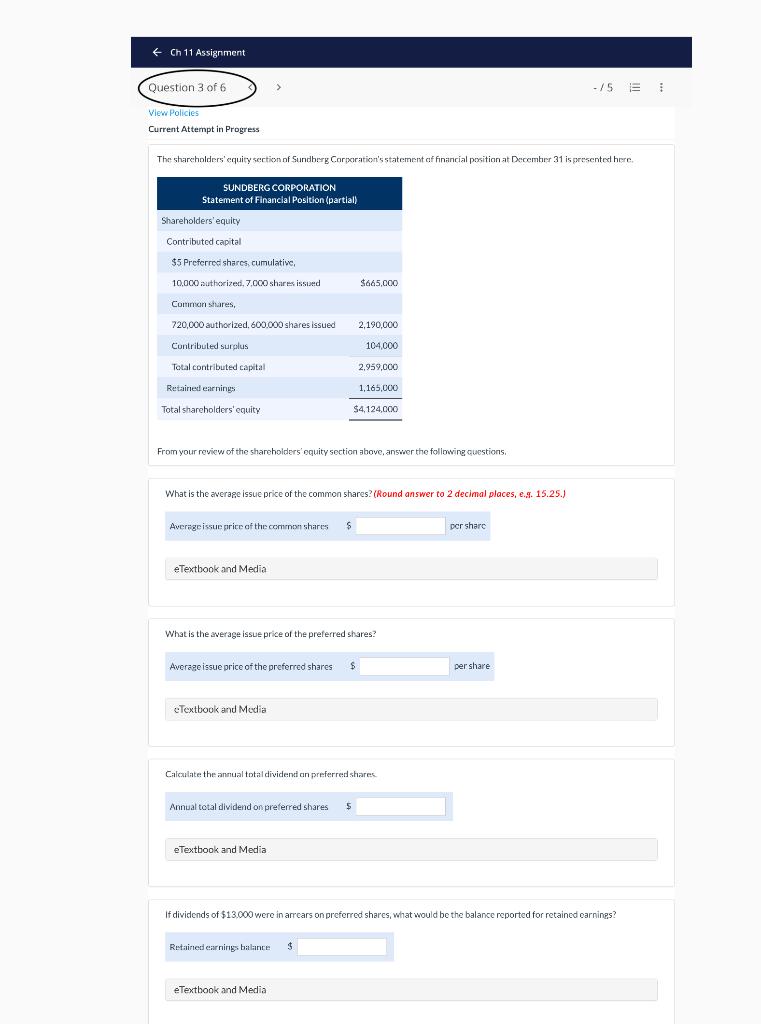

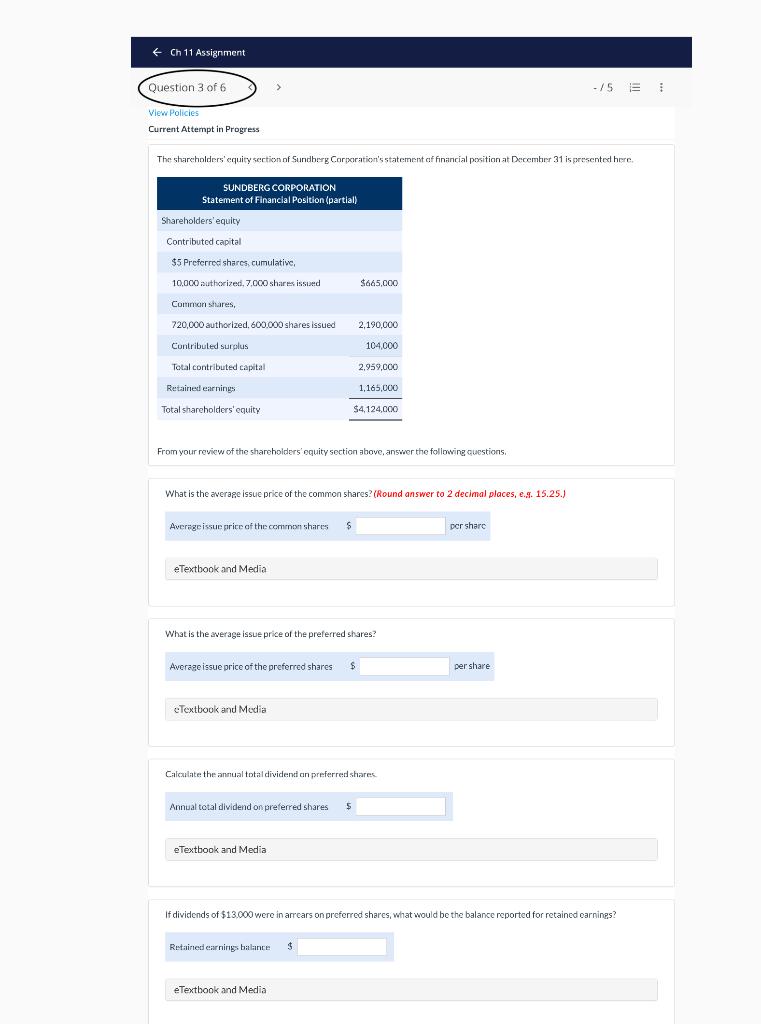

QUESTION 3 OUT OF 6

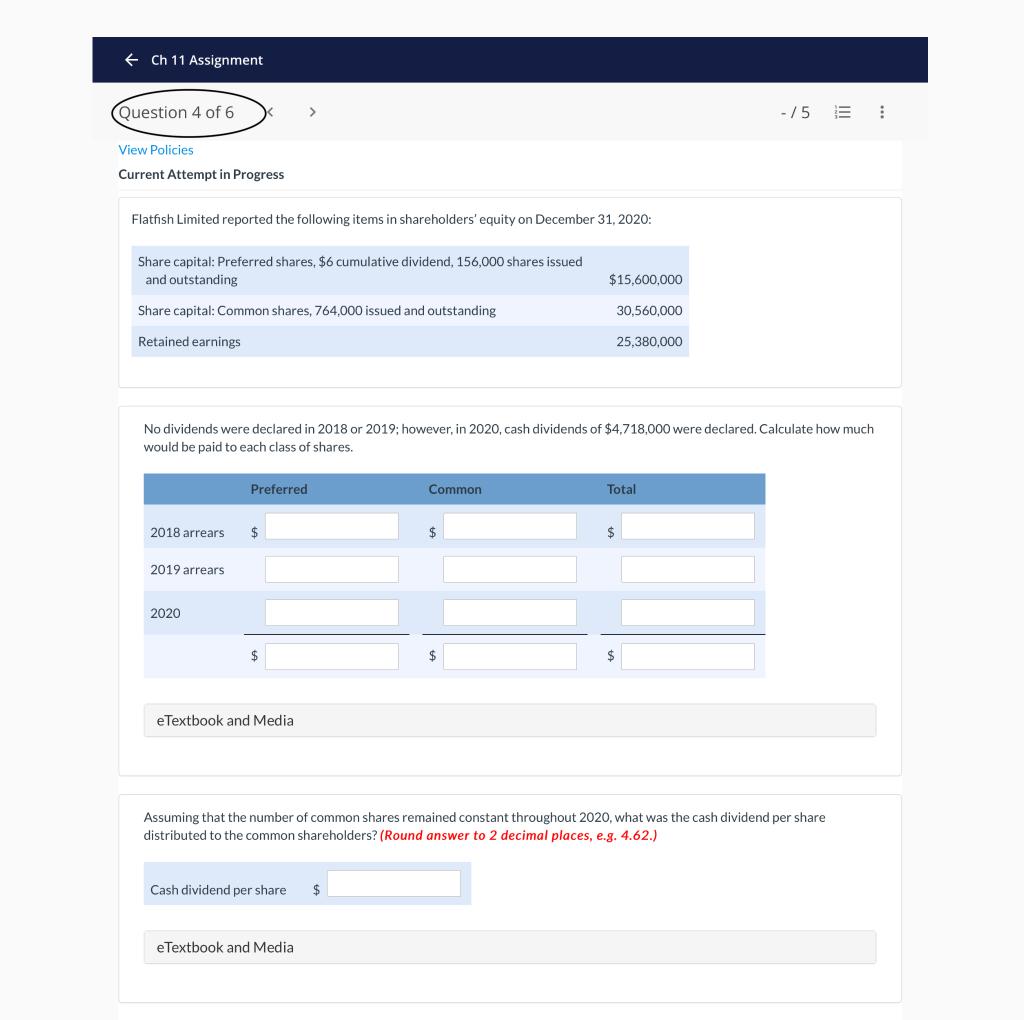

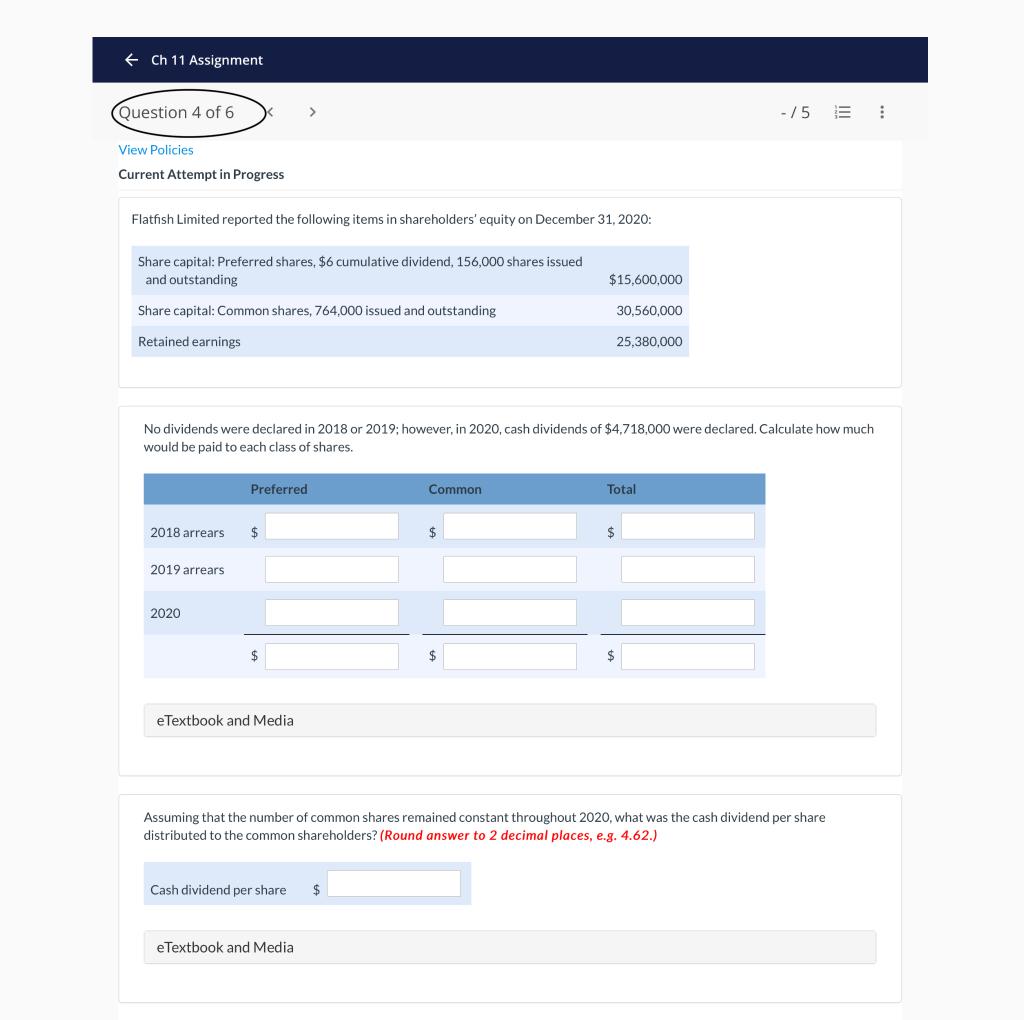

QUESTION 4 OUT OF 6

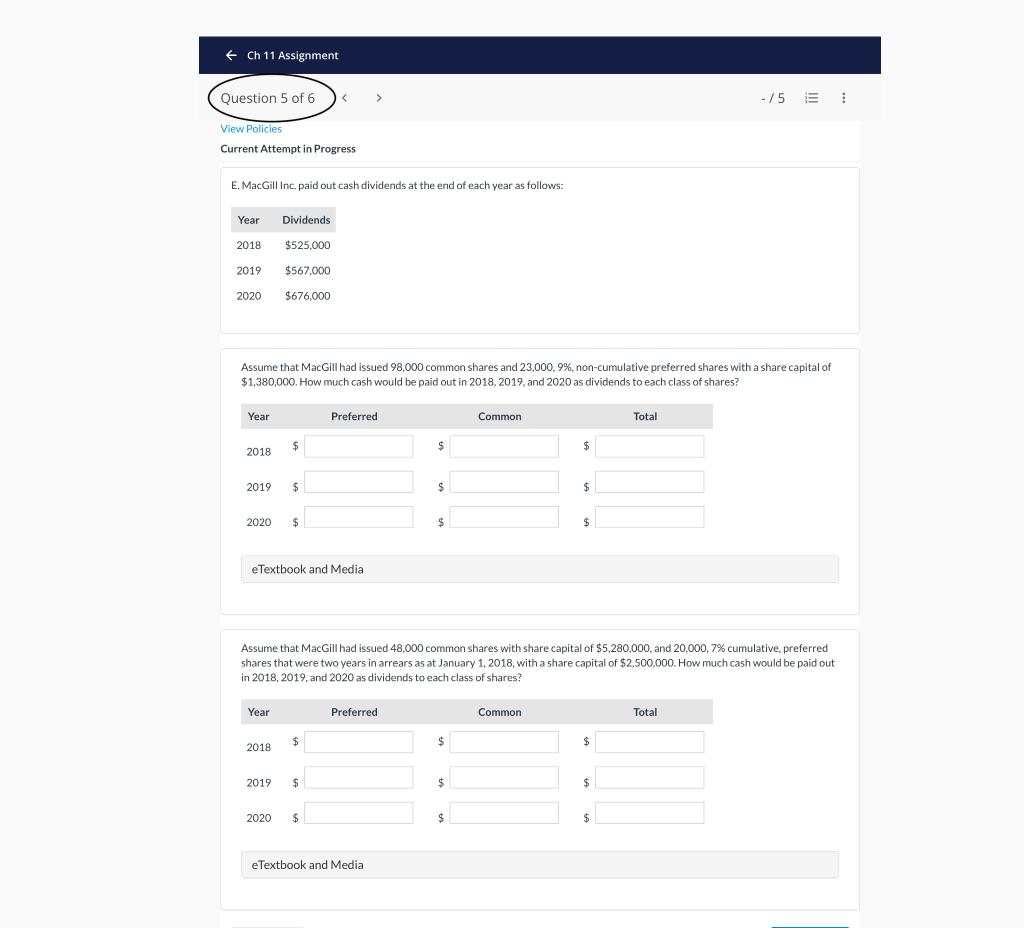

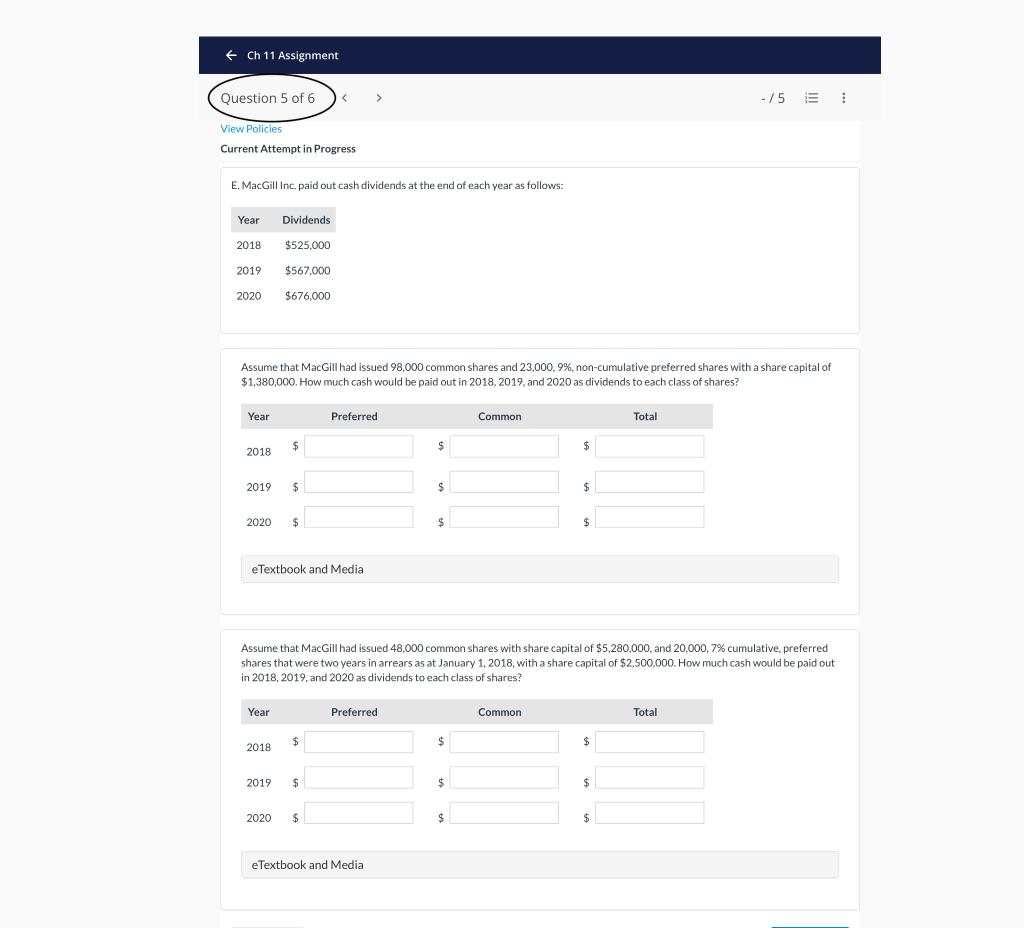

QUESTION 5 OUT OF 6

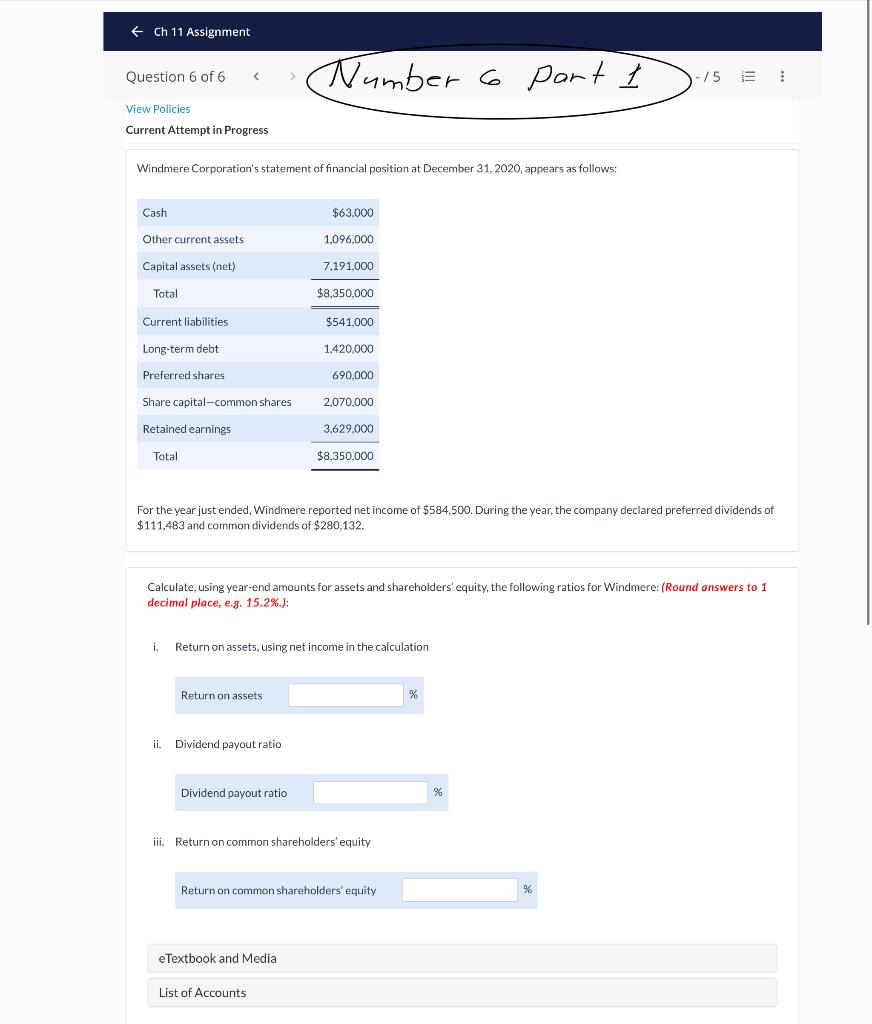

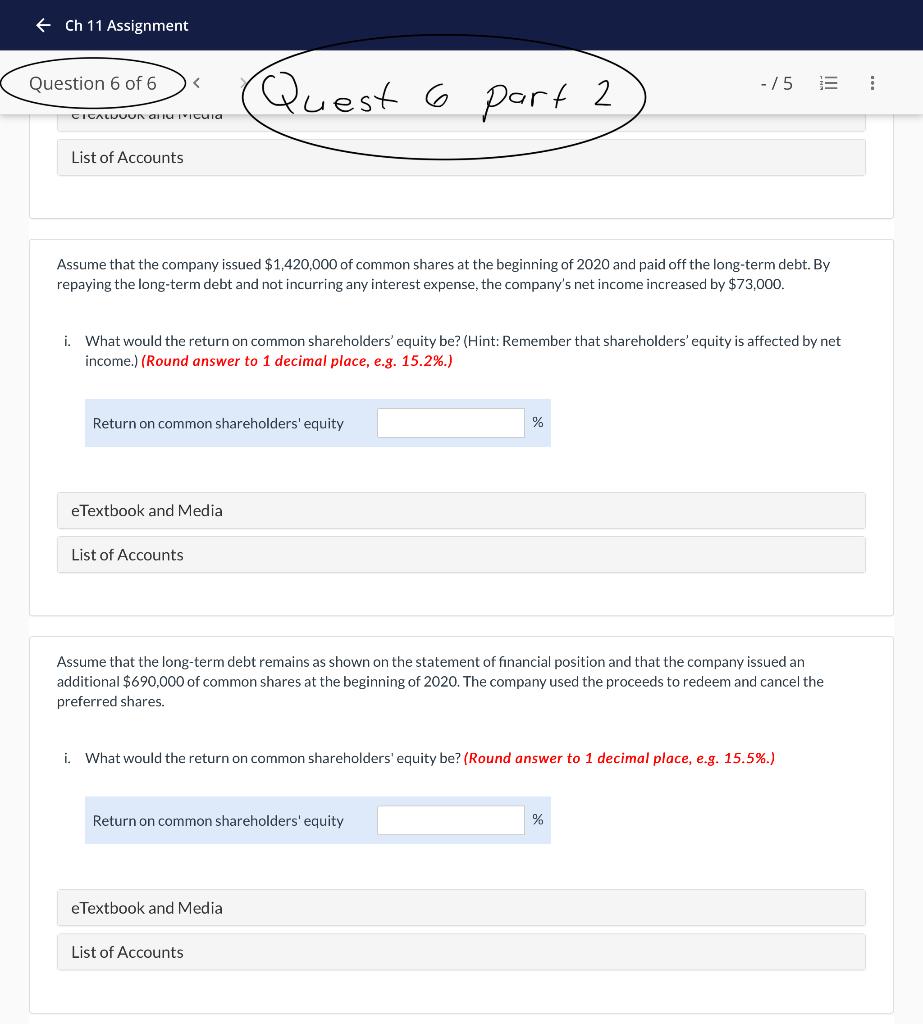

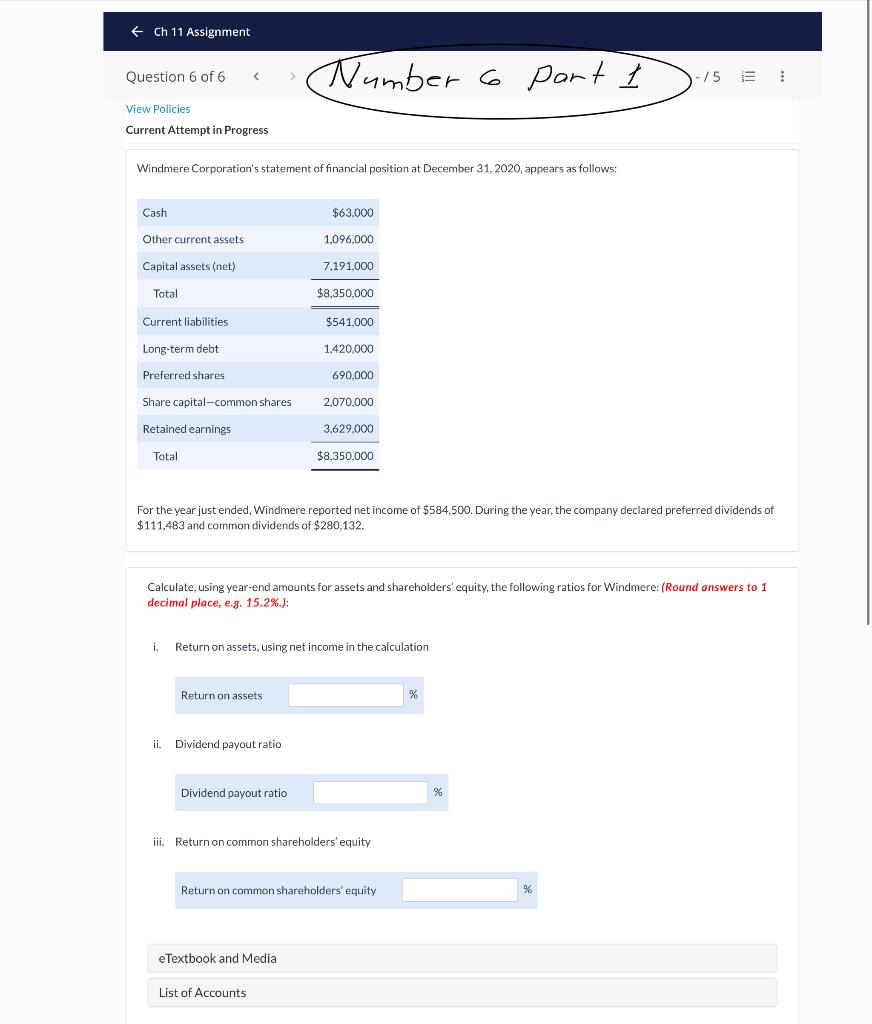

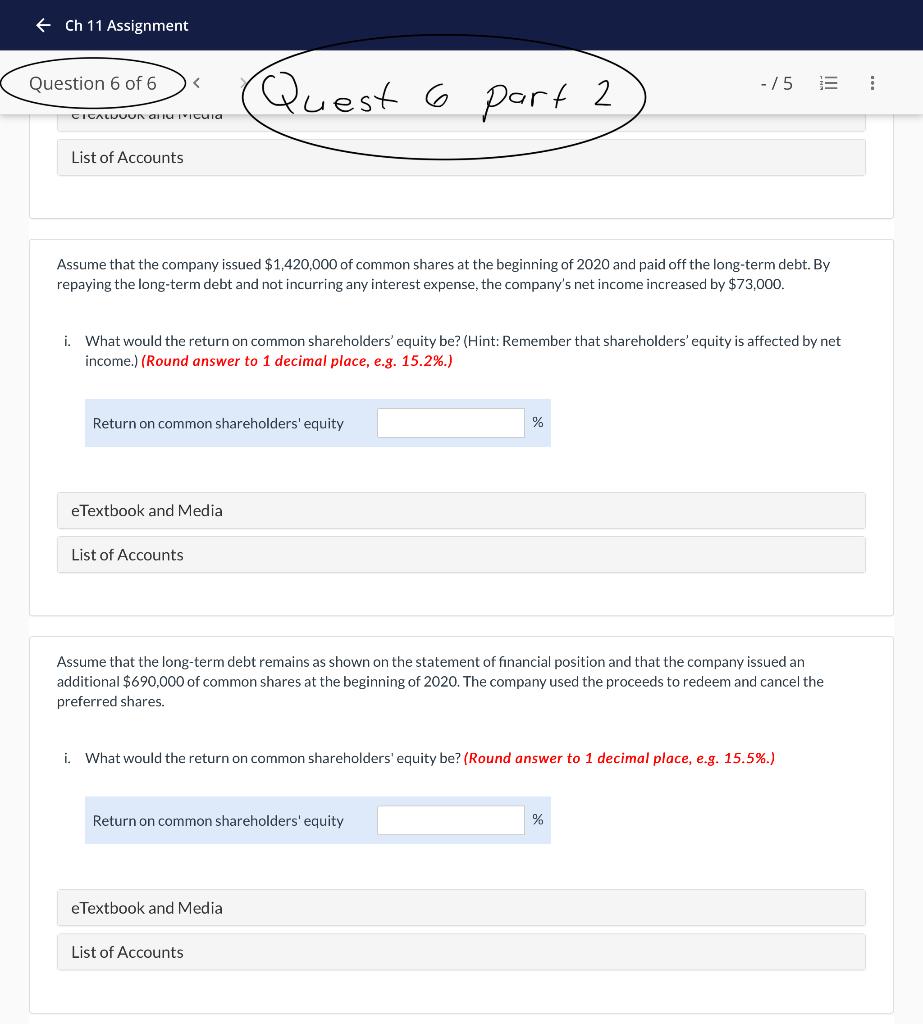

QUESTION 6 OUT OF 6

Ch 11 Assignment Question I Part I The following shareholders equity accosts and the related activity during the year are in the lodger of Kenton Corporation at December 31, 2020. Question 1 of 6 View Policies Current Attempt in Progres Common shares tunlimited authorized): Balance, Jan. 1(277,000 shares) Balance, Dec 31 (279,000 shares) Shares issued (2,000 shares) Preferred shares (23,000 authorized, $6,cumulative): Balance, Jan. 1(15,000 shares) Balance, Dec. 31 (18,000 shares) Shares issued (3,000 shares) Additional contributed capital: Balance, Jan 1 Balance. Dec. 31 Accumulated other comprehensive income (loss) Balance, Jan. 1 Balance, Dec. 31. Other comprehensive income Retained earnings: Balance, Jan 1. Balance, Dec. 31 Loss Cash dividends Balance Jan. 1. Issued preferred shares Issued common shares Declared cash dividends > Comprehensive Income: Lass Prepare a statement of changes in equity for the year ended December 31, 2020. (If an amount reduces the account balance then enter with negative sign, e.g. -15,000 or in parenthesis, e.g. (15,000).) Other comprehensive income Balance Dec. 31 eTextbook and Media. List of Accounts $ $ $1,849,000 1,863,000 14,000 Preferred Shares 792,000 945,000 153,000 37,500 37,500 134,600) 17,600 52,200 1,201,000 (128,000) (158,000) Contributed Capital $ $ Common Shares -/10 KENTON CORPORATION Statement of Changes in Equity Year Ended December 31, 2020 Additional Contributed $ $ Capital I Ch 11 Assignment Question 1 of 6 eTextbook and Media, List of Accounts Prepare the shareholders' equity section of the statement of financial position at December 31, 2020. eTextbook and Media Question #1 part 2 KENTON CORPORATION Statement of Financial Position (Partial) December 31, 2020 $ -/10 E Assistance Used Ch 11 Assignment Question 2 of 6 View Policies Current Attempt in Progress > You purchased 4,000 common shares of Darby Transportation Inc. and you are about to receive your share of Darby's total expected dividend of $1,385,800. Along with 400,000 common shares outstanding the company also has 60,000 issued and outstanding, $6.00 dividend, cumulative Class A preferred shares and 42,900 issued and outstanding, $2.00 dividend non-cumulative Class B preferred shares. Dividends on the Class A preferred shares are one year in arrears. What is the amount of dividend you would expect to receive for the 4,000 common shares you own of Darby Transportation Inc.? (Round common dividends per share to 2 decimal places, e.g. 5.25 and final answer to 0 decimal places, e.g. 125.) Dividend on 4,000 common shares eTextbook and Media Dividend on 4,000 common shares eTextbook and Media -/5 = : $ What is the amount of dividend you would expect to receive if the Class A preferred shares are non-cumulative? (Round common dividends per share to 2 decimal places, e.g. 5.25 and final answer to 0 decimal places, e.g. 125.) $ Ch 11 Assignment Question 3 of 6 View Policies Current Attempt in Progress The shareholders' equity section of Sundberg Corporation's statement of financial position at December 31 is presented here. SUNDBERG CORPORATION Statement of Financial Position (partial) Shareholders' equity Contributed capital $5 Preferred shares, cumulative, 10,000 authorized, 7.000 shares issued Common shares, 720,000 authorized, 600,000 shares issued Contributed surplus Total contributed capital Retained earnings Total shareholders' equity Average issue price of the common shares $ eTextbook and Media From your review of the shareholders equity section above, answer the following questions. What is the average issue price of the common shares? (Round answer to 2 decimal places, e.g. 15.25.) Average issue price of the preferred shares $ eTextbook and Media $665,000 What is the average issue price of the preferred shares? Annual total dividend on preferred shares $ 2,190,000 104,000 $4,124,000 eTextbook and Media 2,959,000 1,165,000 Calculate the annual total dividend an preferred shares Retained earnings balance. $ eTextbook and Media per share -/5 = 1 per share If dividends of $13,000 were in arrears on preferred shares, what would be the balance reported for retained earnings? Ch 11 Assignment Question 4 of 6 View Policies Current Attempt in Progress Flatfish Limited reported the following items in shareholders' equity on December 31, 2020: Share capital: Preferred shares, $6 cumulative dividend, 156,000 shares issued and outstanding Share capital: Common shares, 764,000 issued and outstanding Retained earnings 2018 arrears 2019 arrears 2020 No dividends were declared in 2018 or 2019; however, in 2020, cash dividends of $4,718,000 were declared. Calculate how much would be paid to each class of shares. Preferred $ $ eTextbook and Media Cash dividend per share $ $15,600,000 Common eTextbook and Media 30.560,000 25,380,000 Total $ -/5 = : Assuming that the number of common shares remained constant throughout 2020, what was the cash dividend per share distributed to the common shareholders? (Round answer to 2 decimal places, e.g. 4.62.) Ch 11 Assignment Question 5 of 6 View Policies Current Attempt in Progress E. MacGill Inc. paid out cash dividends at the end of each year as follows: Year 2018 2019 $567,000 2020 $676,000 Year 2018 Assume that MacGill had issued 98,000 common shares and 23,000, 9%, non-cumulative preferred shares with a share capital of $1,380,000, How much cash would be paid out in 2018, 2019, and 2020 as dividends to each class of shares? 2019 2020 Dividends $525,000 Year $ 2018 $ $