Question

- Please help me to complete my assignment Womens Summer Hockey Ltd. (WSHL) organizes and operates a womens hockey league between April and September. Teams

- Please help me to complete my assignment

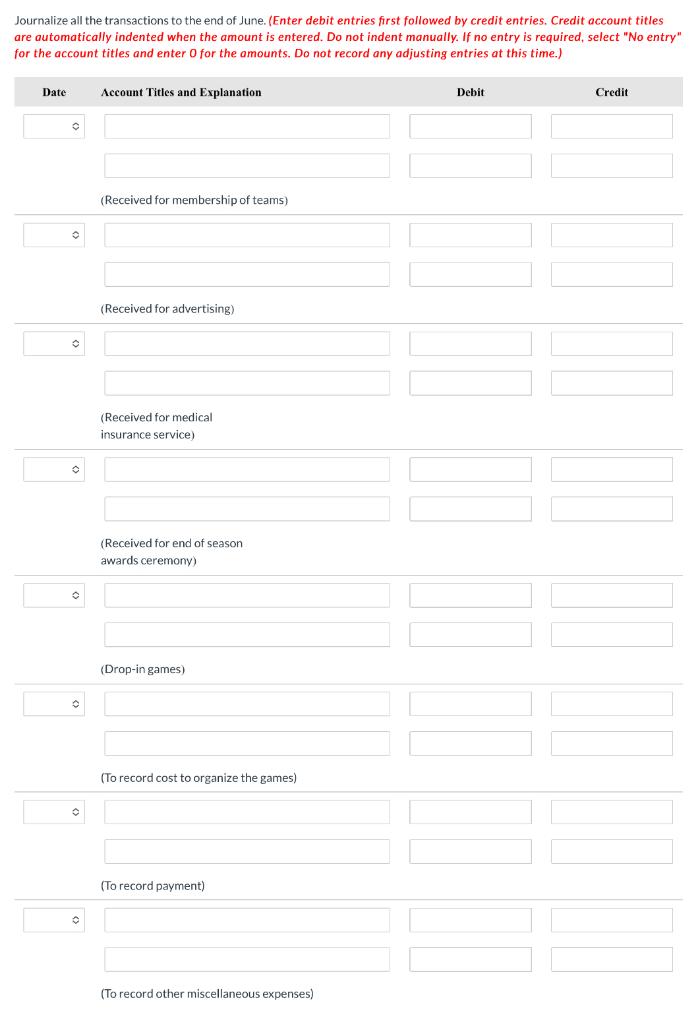

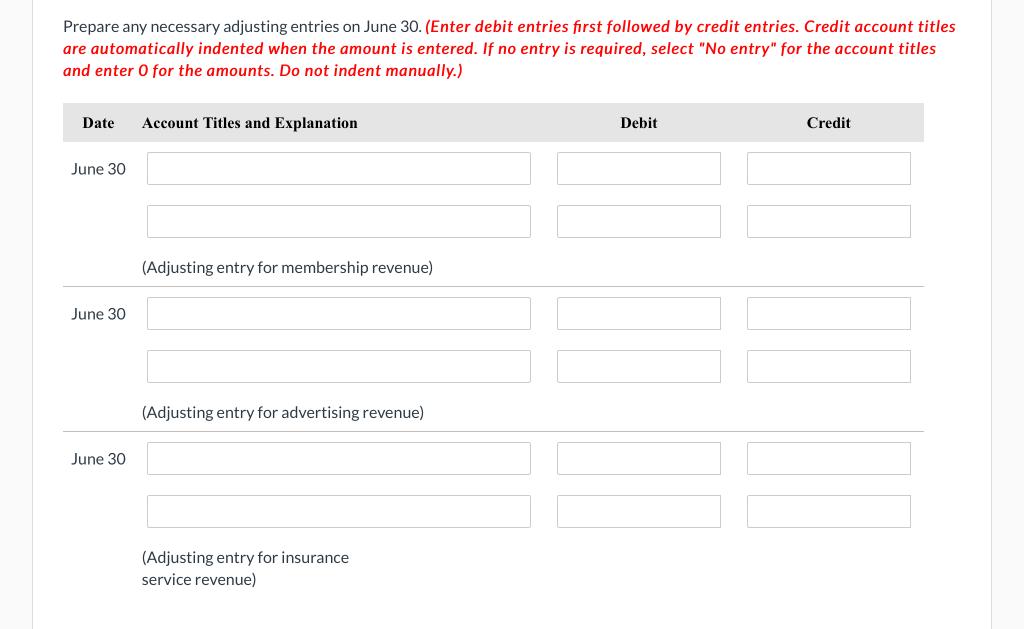

Womens Summer Hockey Ltd. (WSHL) organizes and operates a womens hockey league between April and September. Teams may register starting in January and by the end of March must prepay the registration fee in full. The registration fee of $6,280 entitles each team to four games a month from April to September inclusive. Every player receives a jersey on which the WSHL sells advertising space to local businesses. Players who prefer not to commit for the entire summer may play on a drop-in basis and only pay for individual games in which they play. For an additional fee, WSHL also offers medical insurance during the season as well as an end-of-season awards ceremony and party. At the close of registration, 12 teams had committed to the league. Once the season began, the league generated so much interest that between April and June, 330 women decided to play on a drop-in basis and paid $15 per game to participate. WSHL signed up several businesses that bought advertising space on the jerseys, and it collected $14,500 in advertising revenues. WSHL also pre-sold medical insurance and collected $1,410. Between April and June WSHL collected a total of $5,500 from individuals interested in attending the end-of-season awards ceremony. The cost to organize the games between April and June was $6,100 per month, of which $12,300 was paid by the end of June. Other miscellaneous expenses totalling $8,400 were incurred and paid in cash.

Prepare a simple statement of income for WSHL for the period from January to June. (Enter loss using either a negative sign preceding the number e.g. -14,674 or parentheses e.g. (14,674).)

| Womens Summer Hockey Ltd. Statement of Income Choose the accounting period. June 30 or 20XXFor the six months ended June 30, 20XX or For the year ended June 30, 20XX | ||

|---|---|---|

| Select an opening name for section one. Dividends or Expenses or Net Income / (Loss) or Retained Earnings, January 1 or Retained Earnings June 30 or Revenues or Total Expenses or Total Revenues: | ||

| Enter an income statement item. | $Enter a dollar amount. | |

| Enter an income statement item. | Enter a dollar amount. | |

| Enter an income statement item. | Enter a dollar amount. | |

| Select an opening name for section one. Dividends or Expenses or Net Income / (Loss) or Retained Earnings, January 1 or Retained Earnings June 30 or Revenues or Total Expenses or Total Revenues: | $Enter a total amount for section one. | |

| Select an opening name for section two. DividendsExpensesNet Income / (Loss)Retained Earnings, January 1Retained Earnings, June 30RevenuesTotal ExpensesTotal Revenues: | ||

| Enter an income statement item. | Enter a dollar amount. | |

| Enter an income statement item. | Enter a dollar amount. | |

| Select an opening name for section one. Dividends or Expenses or Net Income / (Loss) or Retained Earnings, January 1 or Retained Earnings June 30 or Revenues or Total Expenses or Total Revenues: | $Enter a total amount for section two. | |

| Select an opening name for section one. Dividends or Expenses or Net Income / (Loss) or Retained Earnings, January 1 or Retained Earnings June 30 or Revenues or Total Expenses or Total Revenues: | $Enter a total net income or loss amount. | |

eTextbook and Media

List of Accounts

Calculate the balance in WSHLs Cash account on June 30.

| Cash balance | $Enter cash balance in dollars. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started